This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

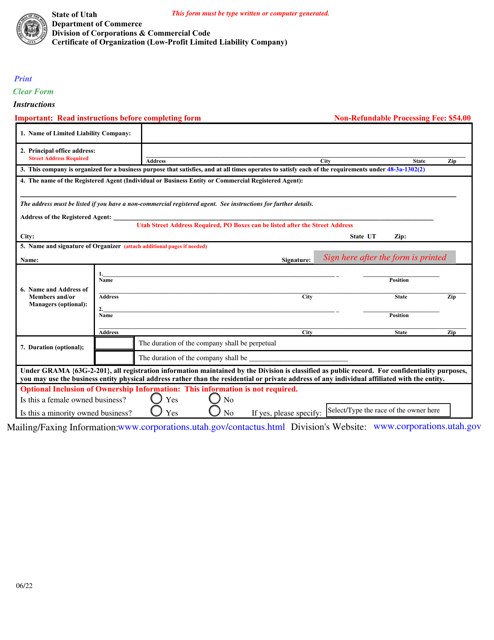

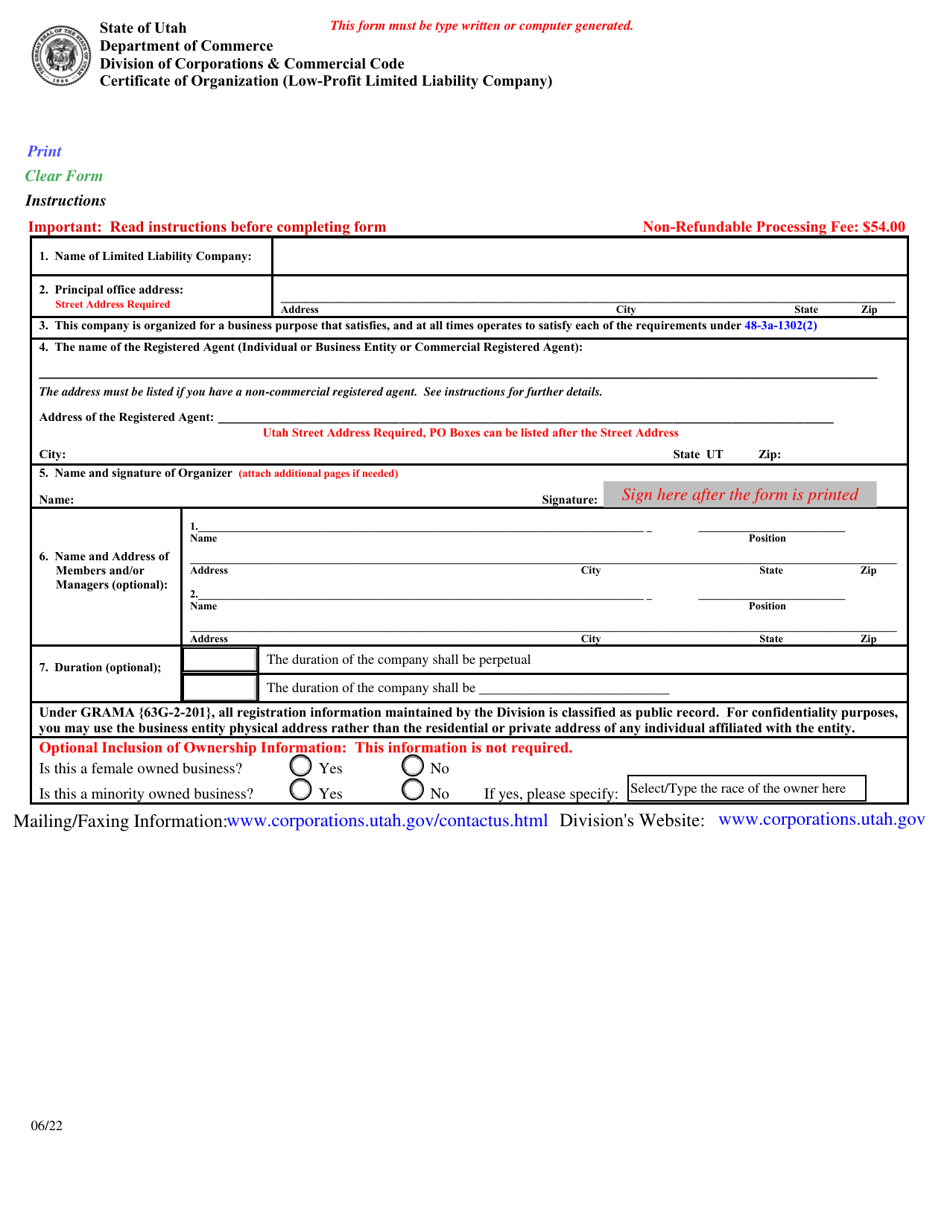

Certificate of Organization (Low-Profit Limited Liability Company) - Utah

Certificate of Organization (Low-Profit Limited Liability Company) is a legal document that was released by the Utah Department of Commerce - a government authority operating within Utah.

FAQ

Q: What is a Certificate of Organization?

A: A Certificate of Organization is a document that establishes the formation of a Low-Profit Limited Liability Company (LLC) in Utah.

Q: What is a Low-Profit Limited Liability Company?

A: A Low-Profit Limited Liability Company (LLC) is a type of business entity that combines aspects of a non-profit organization and a for-profit company.

Q: Who can file a Certificate of Organization for a Low-Profit LLC in Utah?

A: Any individual or group can file a Certificate of Organization for a Low-Profit LLC in Utah, as long as they meet the state's requirements.

Q: What are the requirements for filing a Certificate of Organization in Utah?

A: To file a Certificate of Organization in Utah, you need to provide the LLC's name, address, registered agent information, and a statement of purpose.

Q: Is there a fee for filing a Certificate of Organization in Utah?

A: Yes, there is a fee for filing a Certificate of Organization in Utah. The current fee is $70.

Q: Can a Low-Profit LLC be converted into a regular LLC in Utah?

A: Yes, a Low-Profit LLC can be converted into a regular LLC in Utah, but you'll need to follow the state's conversion process.

Q: What benefits does a Low-Profit LLC offer?

A: A Low-Profit LLC offers some benefits, such as the ability to pursue a social or charitable mission while still generating profits, and potentially receiving certain tax benefits.

Q: Are there any limitations to forming a Low-Profit LLC in Utah?

A: Yes, there are some limitations to forming a Low-Profit LLC in Utah, such as restrictions on distributions and the requirement that the LLC's primary purpose must be a charitable or educational one.

Q: Is legal assistance required to file a Certificate of Organization for a Low-Profit LLC in Utah?

A: Legal assistance is not required, but it can be helpful to consult with an attorney or legal professional to ensure you meet all the necessary requirements and understand the implications of forming a Low-Profit LLC.

Form Details:

- Released on June 1, 2022;

- The latest edition currently provided by the Utah Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Commerce.