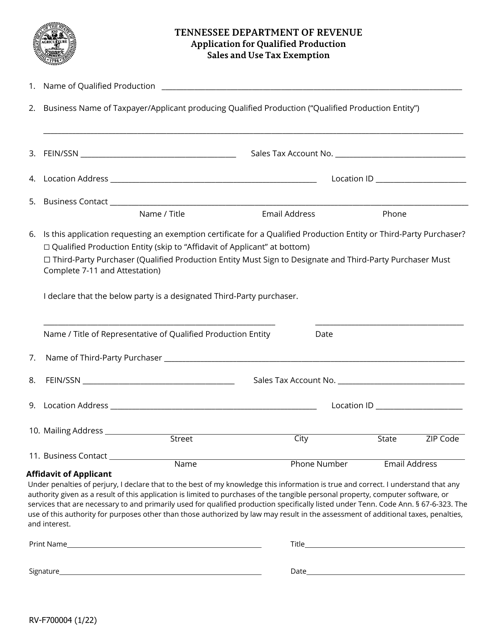

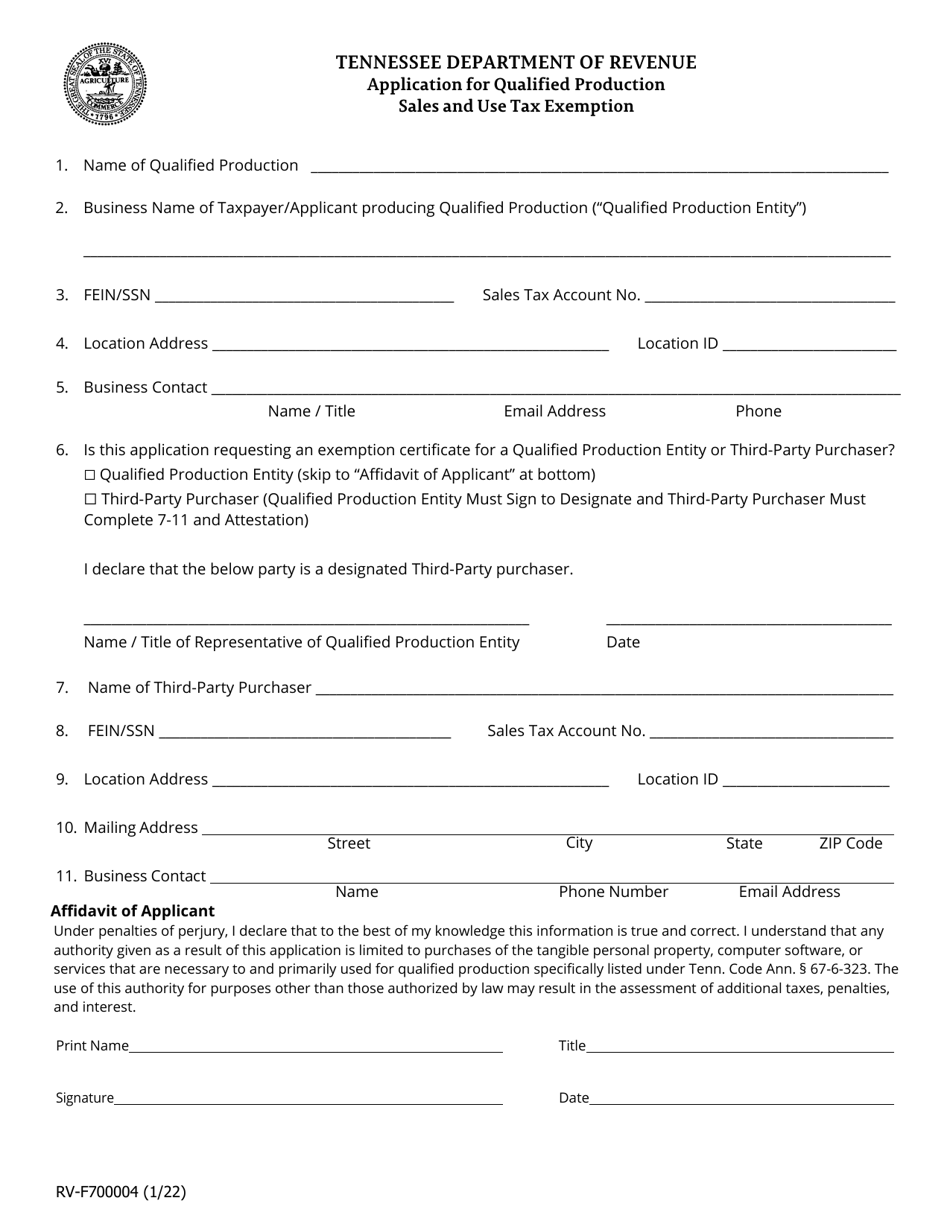

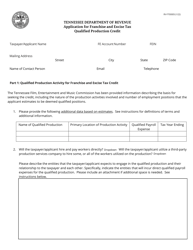

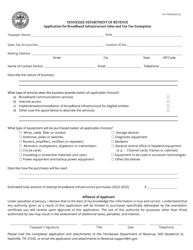

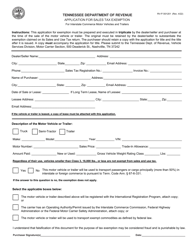

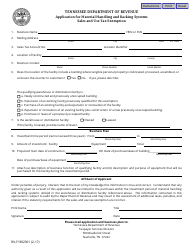

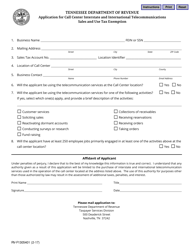

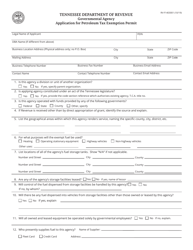

Form RV-F700004 Application for Qualified Production Sales and Use Tax Exemption - Tennessee

What Is Form RV-F700004?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F700004 Application?

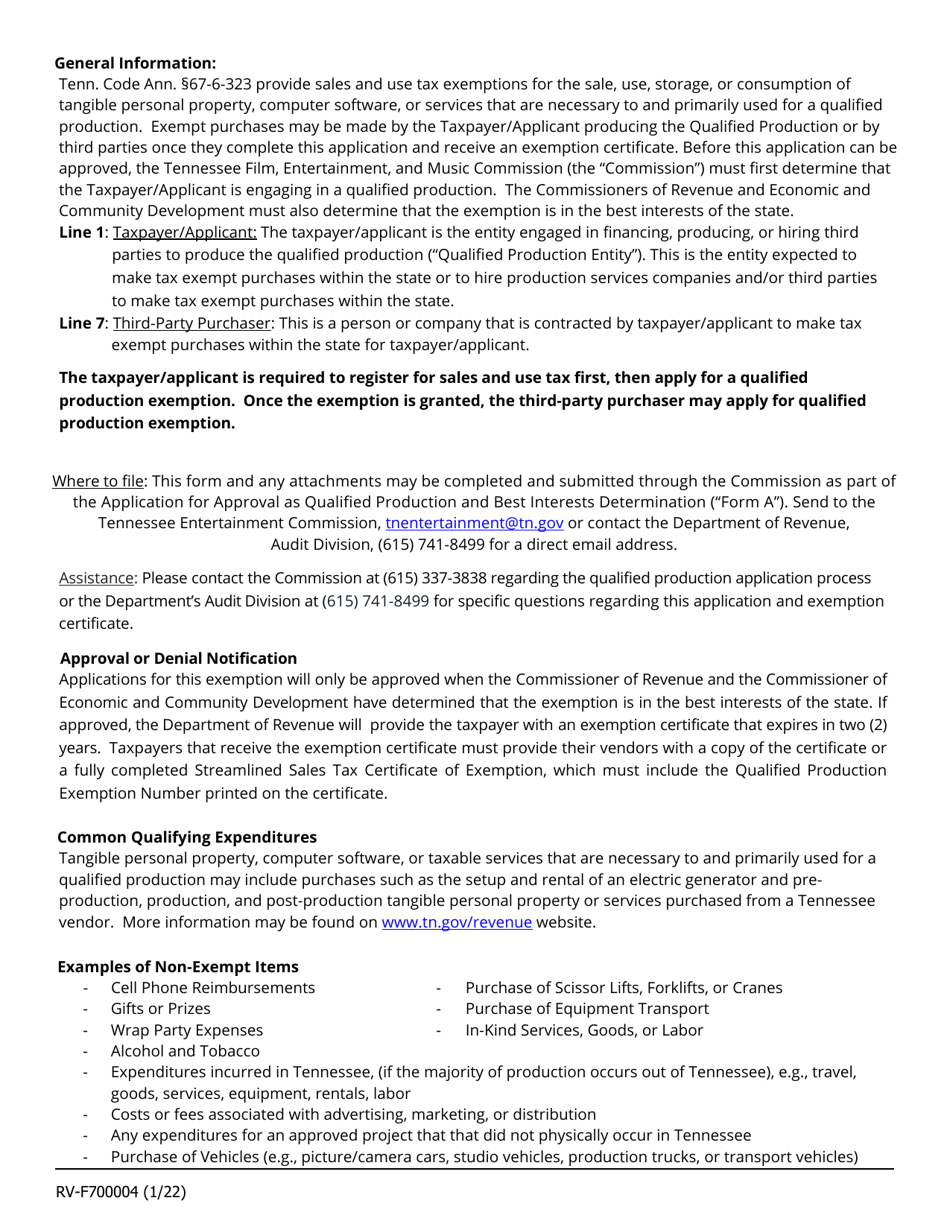

A: The RV-F700004 Application is a form used to apply for the Qualified Production Sales and Use Tax Exemption in Tennessee.

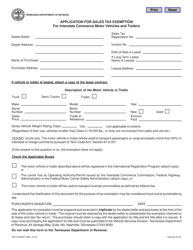

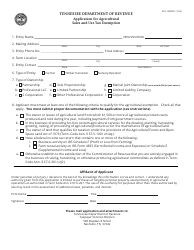

Q: What is the Qualified Production Sales and Use Tax Exemption?

A: The Qualified Production Sales and Use Tax Exemption is a tax exemption provided to qualifying production companies in Tennessee.

Q: Who is eligible for the Qualified Production Sales and Use Tax Exemption?

A: Qualifying production companies engaged in film, television, and music production are eligible for the exemption.

Q: What is the purpose of the exemption?

A: The purpose of the exemption is to attract and support production companies in Tennessee, promoting job creation and economic growth.

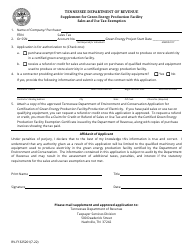

Q: What should be included in the application?

A: The application should include relevant information about the production company, project details, and supporting documentation.

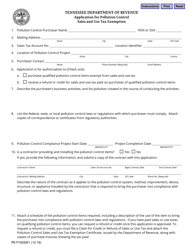

Q: Are there any fees associated with the application?

A: No, there are no fees associated with submitting the RV-F700004 Application for the Qualified Production Sales and Use Tax Exemption.

Q: How long does it take to process the application?

A: The processing time may vary, but generally it takes around 4 to 6 weeks for the Tennessee Department of Revenue to review and process the application.

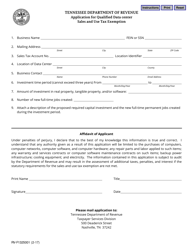

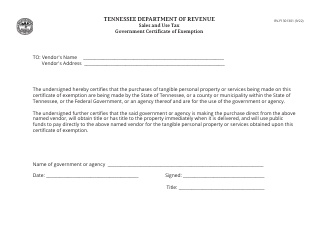

Q: What happens after the application is approved?

A: If the application is approved, the production company will receive a Certificate of Exemption, which can be used to claim the tax exemption on qualifying purchases.

Q: Are there any reporting requirements for companies receiving the exemption?

A: Yes, companies receiving the exemption are required to file an annual report with the Tennessee Department of Revenue providing financial and statistical information about the production.

Q: Is the exemption permanent?

A: The exemption is not permanent and must be renewed annually by filing a new application with the Tennessee Department of Revenue.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F700004 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.