This version of the form is not currently in use and is provided for reference only. Download this version of

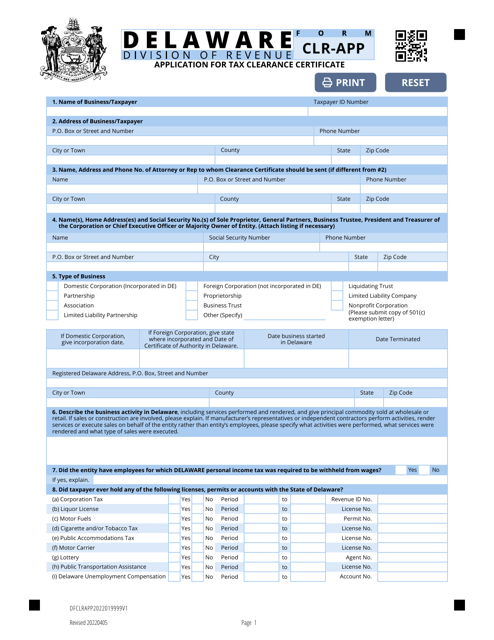

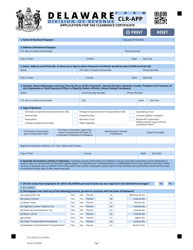

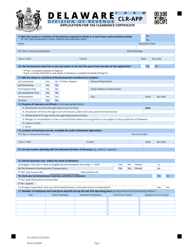

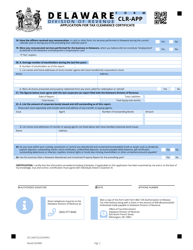

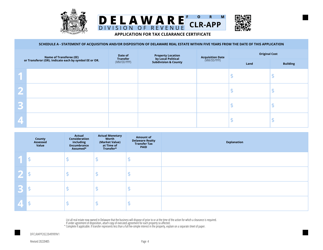

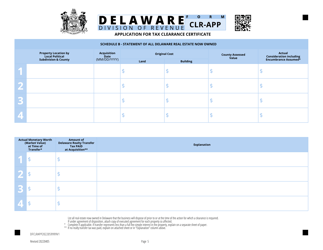

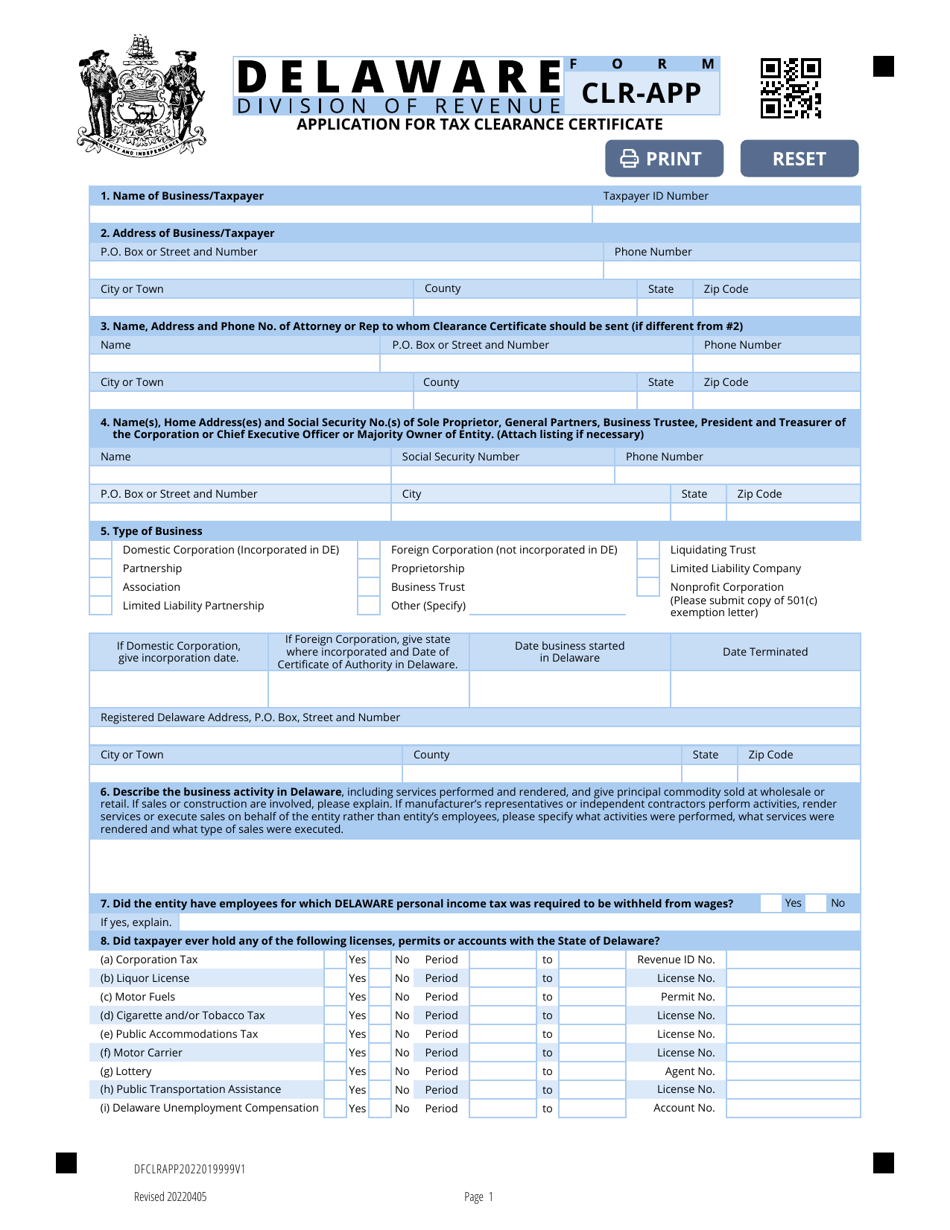

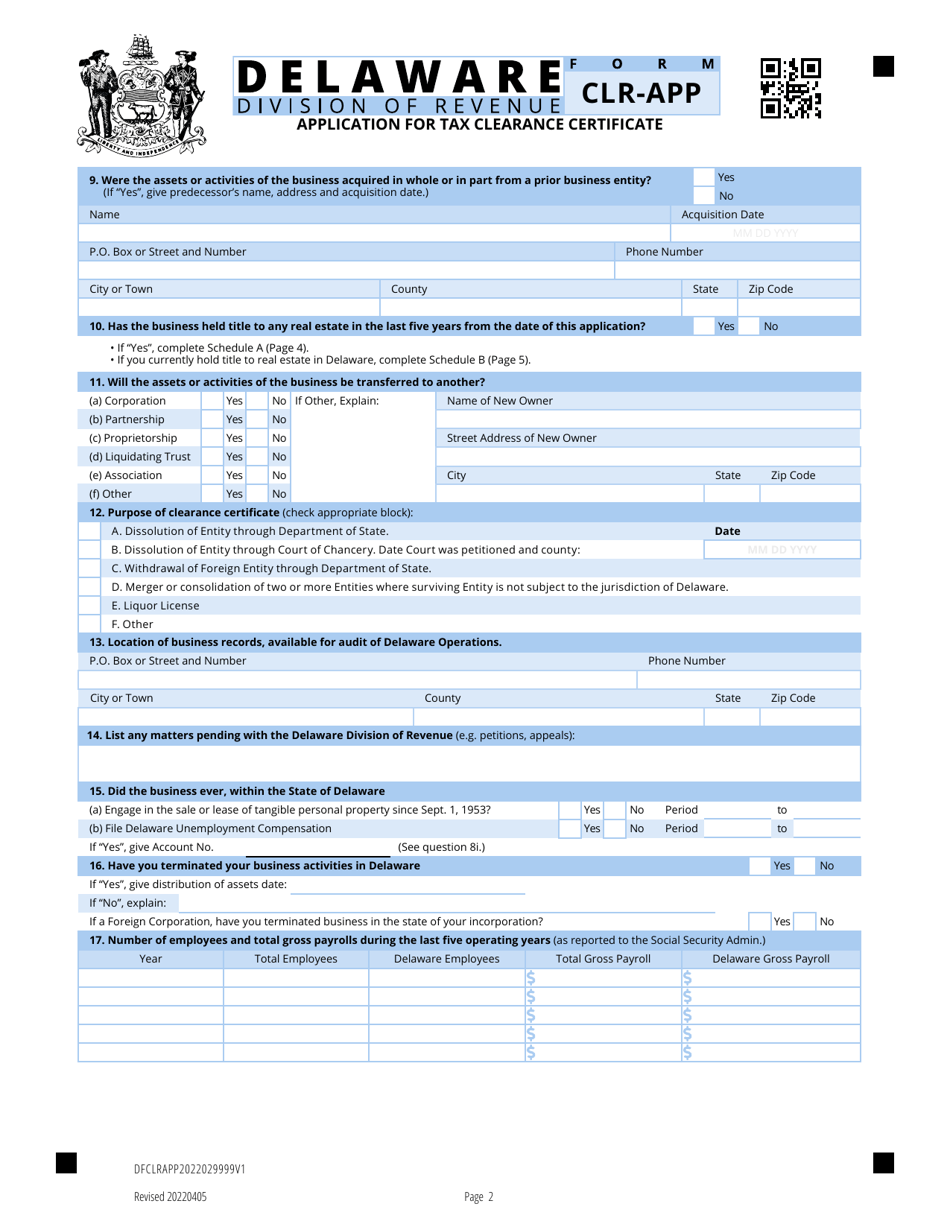

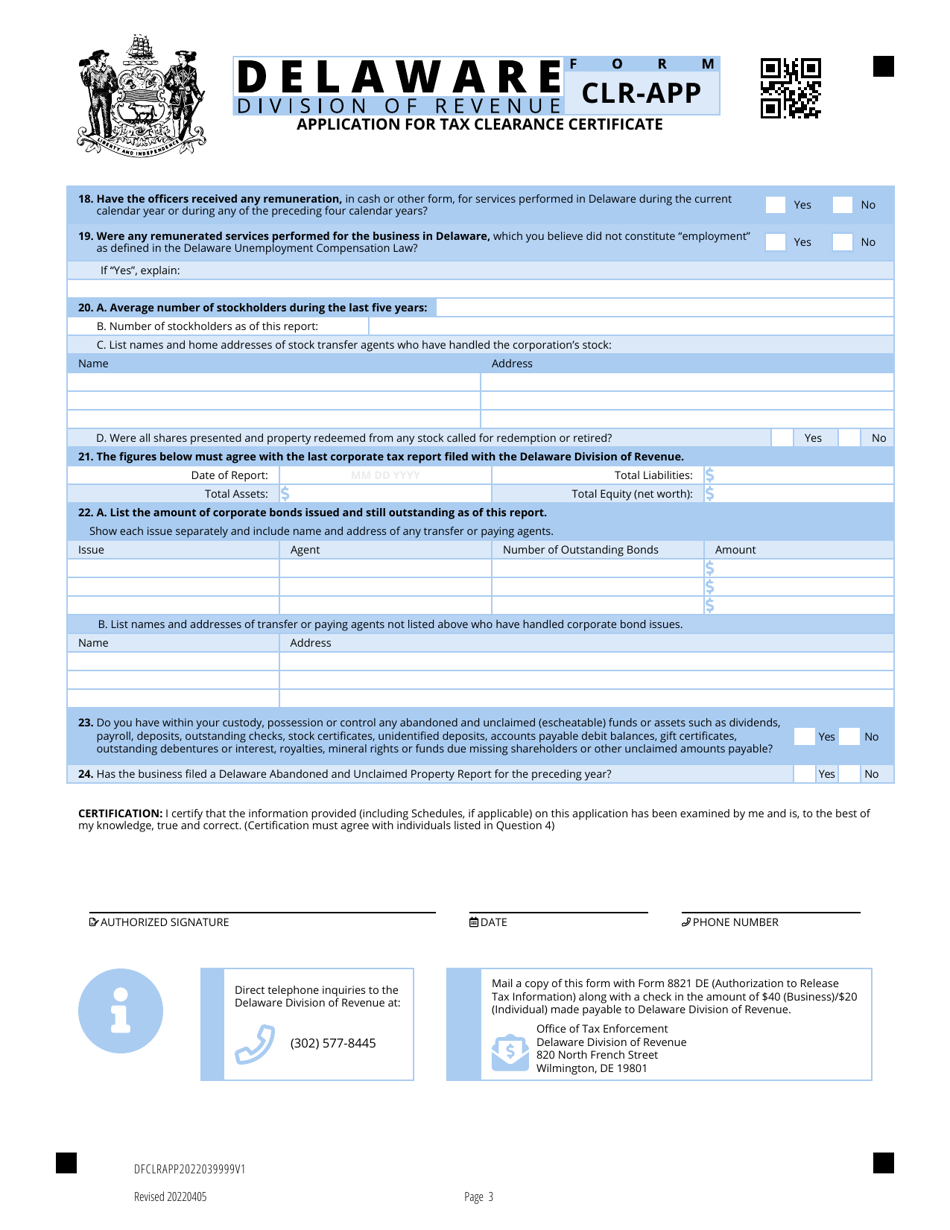

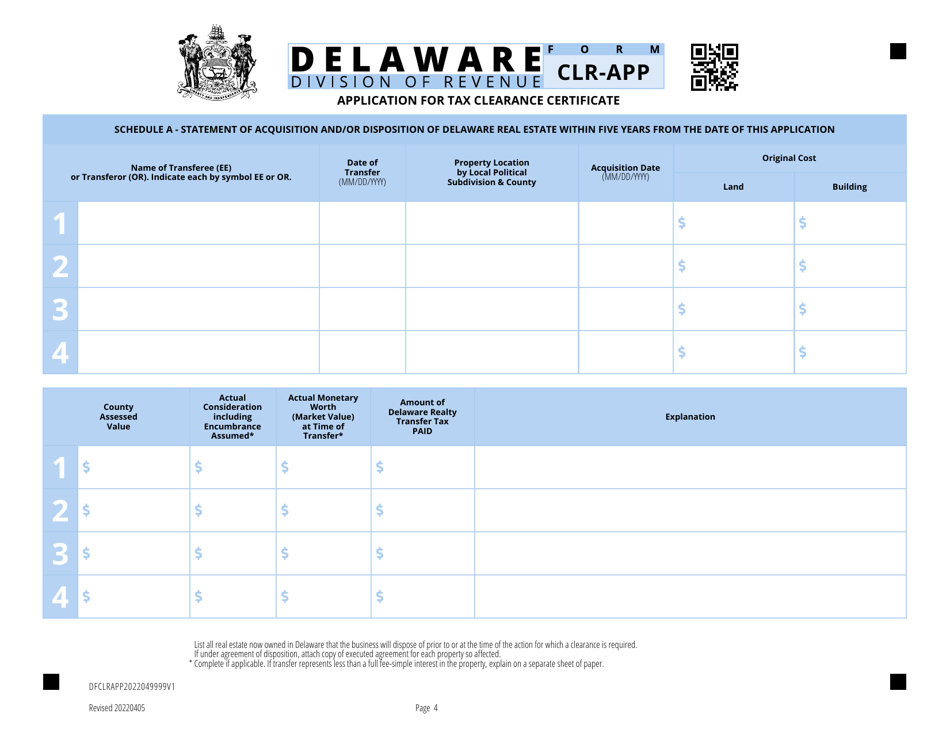

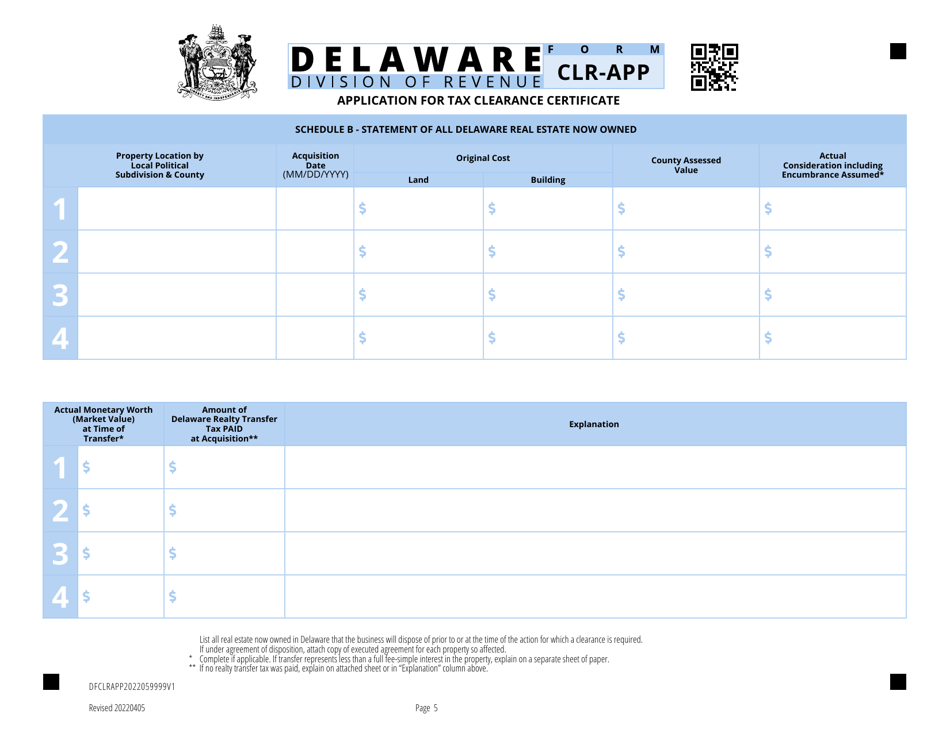

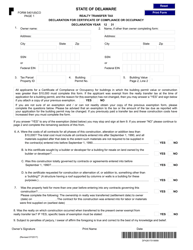

Form CLR-APP

for the current year.

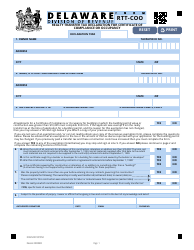

Form CLR-APP Application for Tax Clearance Certificate - Delaware

What Is Form CLR-APP?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CLR-APP?

A: Form CLR-APP is the Application for Tax Clearance Certificate in Delaware.

Q: What is a Tax Clearance Certificate?

A: A Tax Clearance Certificate is a document issued by the state of Delaware certifying that the applicant has no outstanding tax liabilities.

Q: Who needs to file Form CLR-APP?

A: Any business or individual that wants to obtain a Tax Clearance Certificate in Delaware needs to file Form CLR-APP.

Q: Why do I need a Tax Clearance Certificate?

A: A Tax Clearance Certificate may be required when you sell or transfer a business, apply for certain licenses or permits, or participate in government contracts or programs.

Q: How do I complete Form CLR-APP?

A: You need to provide your personal or business information, including tax identification numbers and details on any outstanding taxes or liabilities.

Q: When should I file Form CLR-APP?

A: You should file Form CLR-APP at least 10 days before you need the Tax Clearance Certificate.

Q: Is there a fee to file Form CLR-APP?

A: Yes, there is a $50 fee to file Form CLR-APP.

Q: How long does it take to process Form CLR-APP?

A: The processing time for Form CLR-APP is typically around 3-5 business days.

Form Details:

- Released on April 5, 2022;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CLR-APP by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.