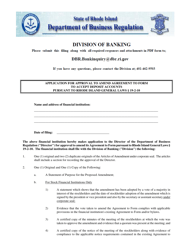

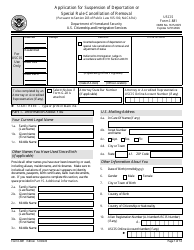

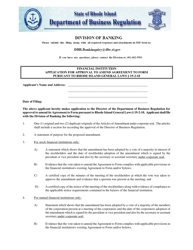

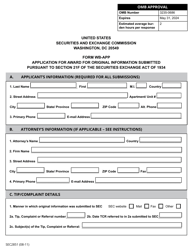

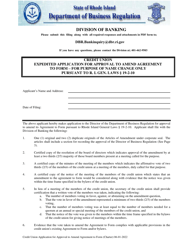

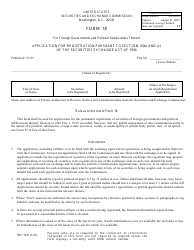

Application Pursuant to the Rhode Island Interstate Branching and Bank Holding Company Mergers and Acquisitions Act - Rhode Island

Application Pursuant to the Rhode Island Interstate Branching and Bank Holding Company Mergers and Acquisitions Act is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is the Rhode Island Interstate Branching and Bank Holding Company Mergers and Acquisitions Act?

A: The Rhode Island Interstate Branching and Bank Holding Company Mergers and Acquisitions Act is a state law that governs the process of interstate branching and bank holding company mergers and acquisitions in Rhode Island.

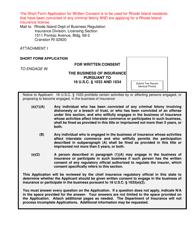

Q: What does the Act require?

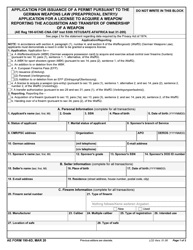

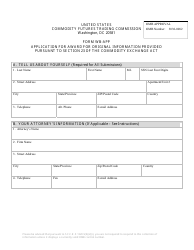

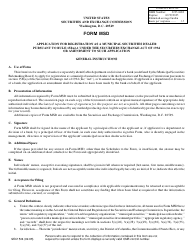

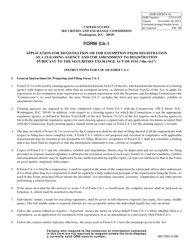

A: The Act requires financial institutions seeking to engage in interstate branching or bank holding company mergers and acquisitions in Rhode Island to file an application with the state's regulatory authorities.

Q: Who is responsible for reviewing and approving the applications?

A: The regulatory authorities in Rhode Island are responsible for reviewing and approving the applications filed under the Act.

Q: Why is this Act important?

A: This Act is important as it ensures proper oversight and regulation of interstate branching and bank holding company mergers and acquisitions in Rhode Island, safeguarding the interests of consumers and maintaining the stability of the banking system.

Q: Does this Act apply to all financial institutions operating in Rhode Island?

A: Yes, this Act applies to all financial institutions, including banks and credit unions, that wish to engage in interstate branching or bank holding company mergers and acquisitions in Rhode Island.

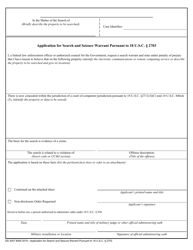

Q: What are the requirements for filing an application under the Act?

A: The requirements for filing an application under the Act may vary, but generally, financial institutions are required to provide detailed information about the proposed transaction, the parties involved, and the potential impact on consumers and the economy.

Q: How long does the review process usually take?

A: The review process can vary depending on the complexity of the transaction and the completeness of the application, but it typically takes several months.

Q: What happens after the application is approved?

A: After the application is approved, the financial institution can proceed with the interstate branching or bank holding company merger or acquisition, subject to any conditions or limitations imposed by the regulatory authorities.

Q: Can the application be rejected?

A: Yes, the application can be rejected if it does not meet the requirements of the Act or if it raises concerns about the safety and soundness of the financial institution or the potential risks to consumers.

Form Details:

- Released on June 1, 2022;

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.