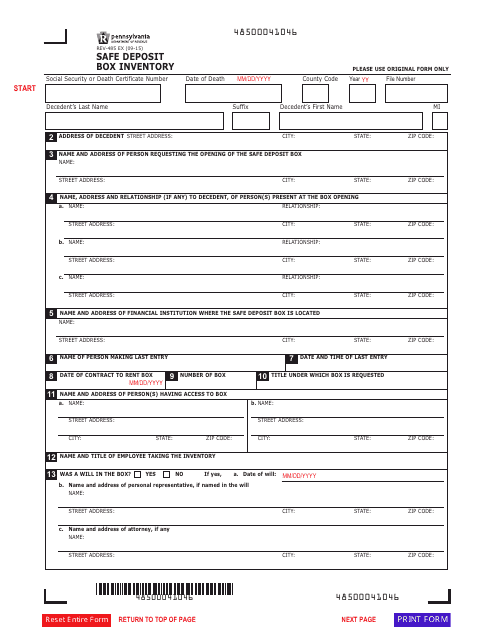

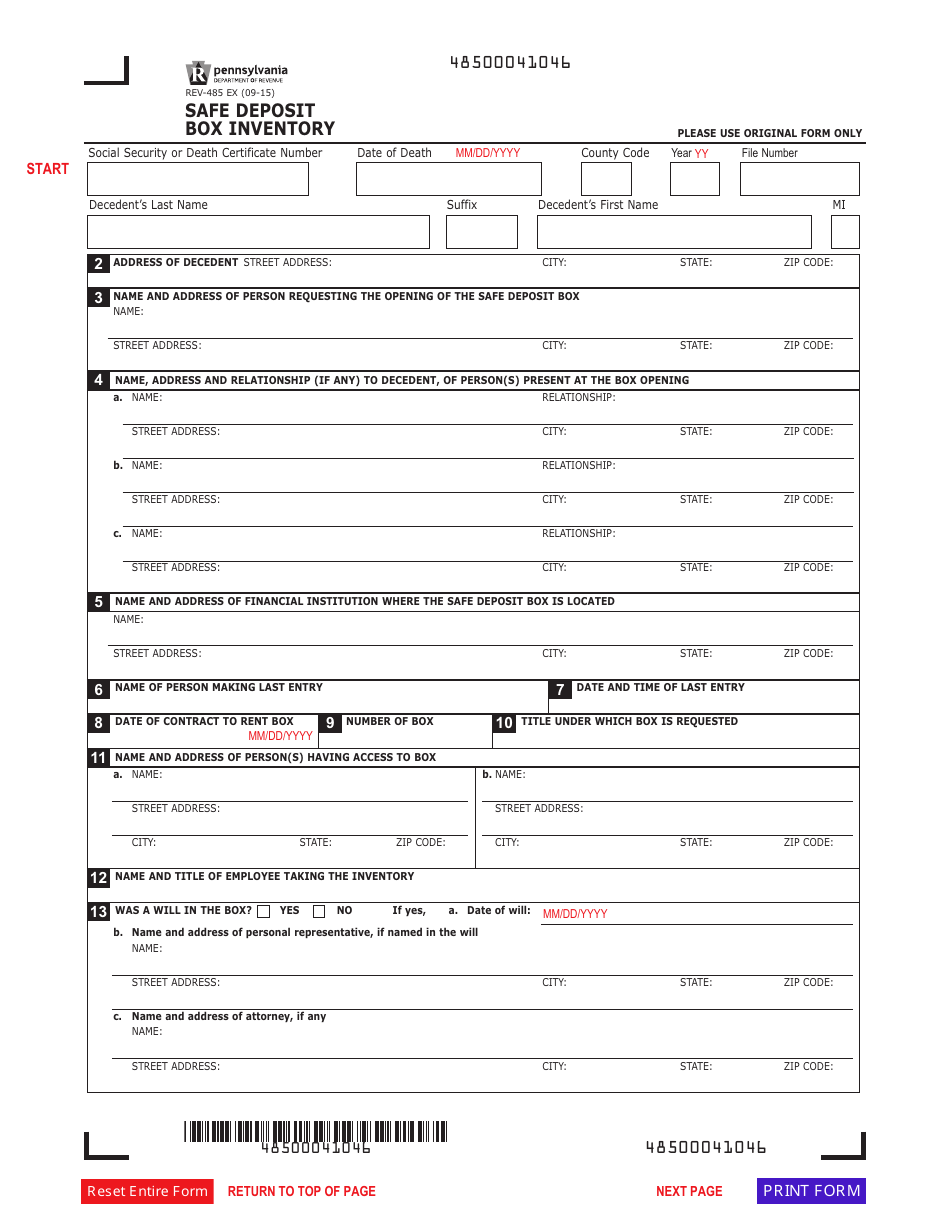

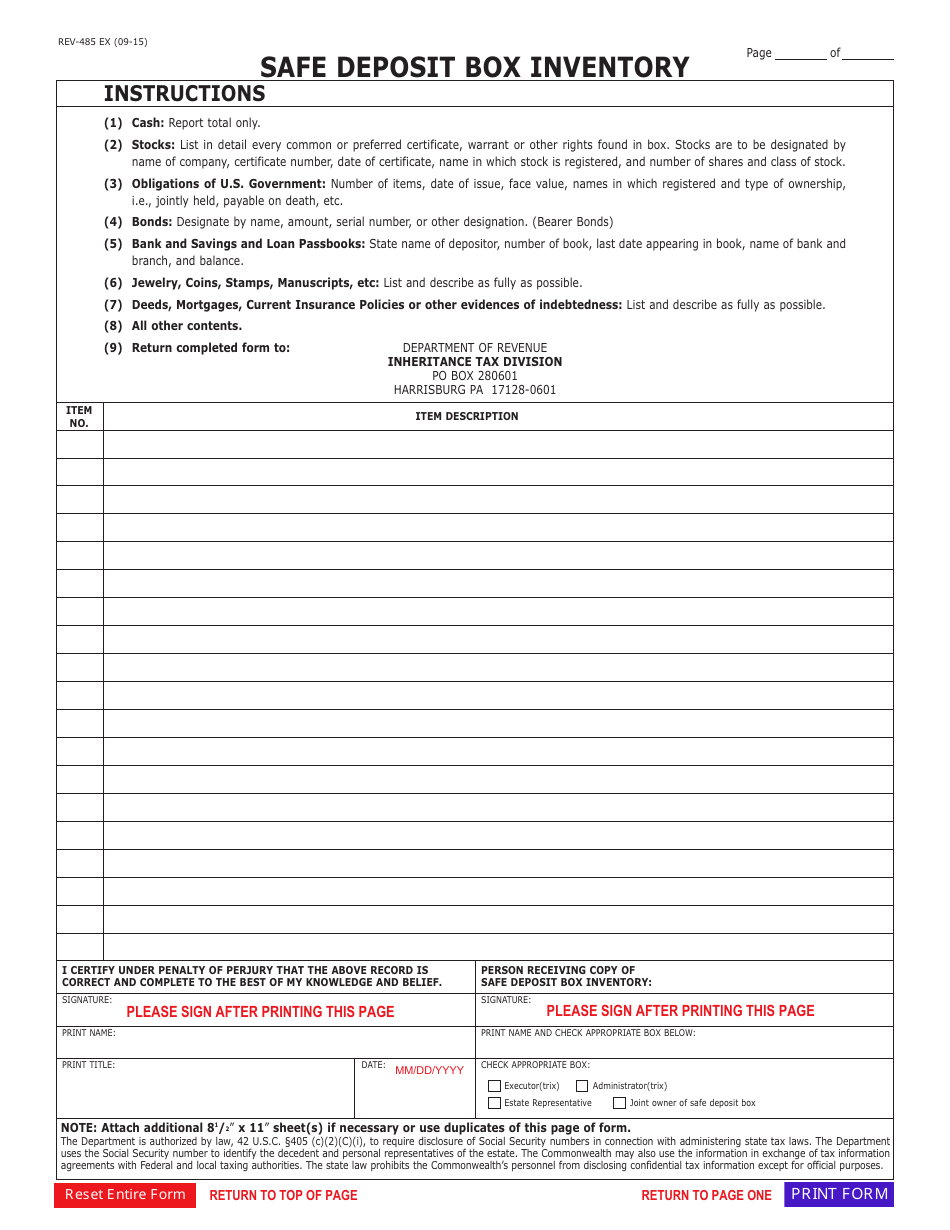

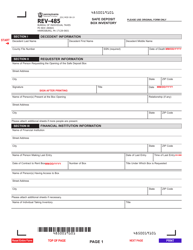

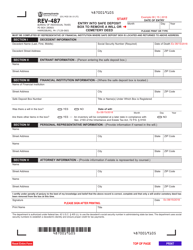

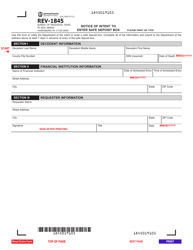

Form REV485 Safe Deposit Box Inventory - Pennsylvania

What Is Form REV485?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV485?

A: Form REV485 is the Safe Deposit Box Inventory form used in Pennsylvania.

Q: What is a safe deposit box?

A: A safe deposit box is a secure storage space provided by banks or other financial institutions to store valuable items.

Q: Who needs to complete Form REV485?

A: Individuals or estates that have a safe deposit box in Pennsylvania need to complete Form REV485.

Q: What is the purpose of Form REV485?

A: The purpose of Form REV485 is to provide a detailed inventory of the contents of a safe deposit box.

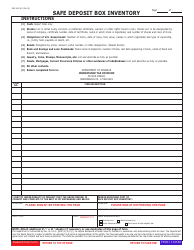

Q: How do I complete Form REV485?

A: You need to list each item in the safe deposit box along with its estimated value and provide other requested information on the form.

Q: Do I need to file Form REV485 every year?

A: No, Form REV485 needs to be filed only when there are changes to the items in the safe deposit box, or when opening or closing a safe deposit box.

Q: Is there a deadline to submit Form REV485?

A: Yes, Form REV485 needs to be submitted within 30 days of any changes or actions related to the safe deposit box.

Q: Are there any penalties for not filing Form REV485?

A: Yes, there may be penalties for failing to file Form REV485, including the assessment of tax on the estimated value of the safe deposit box contents.

Q: Can I claim a deduction for the value of the safe deposit box contents?

A: No, the value of the safe deposit box contents is not tax-deductible in Pennsylvania.

Form Details:

- Released on September 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV485 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.