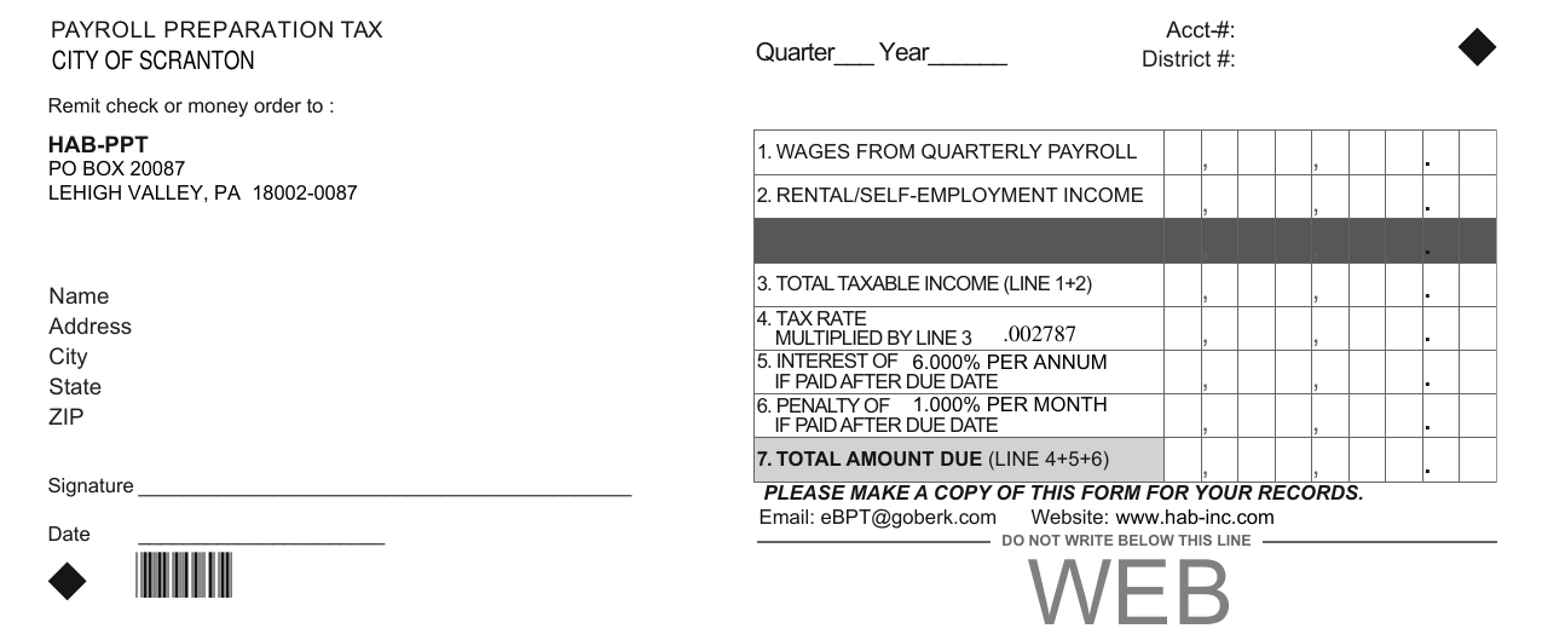

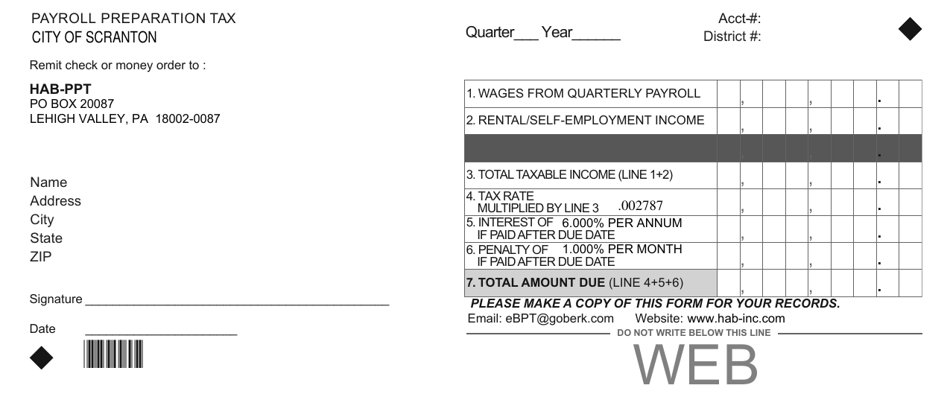

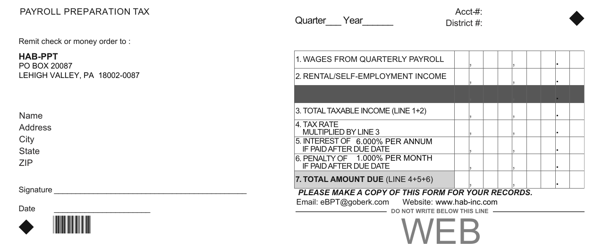

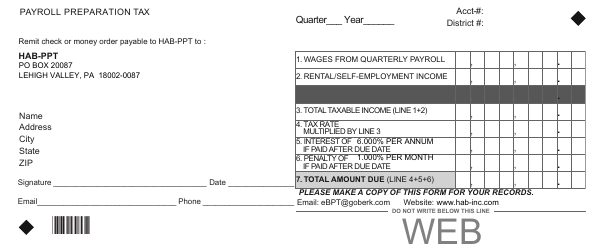

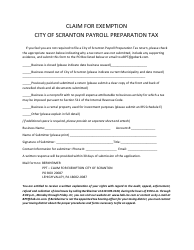

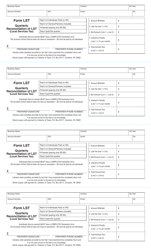

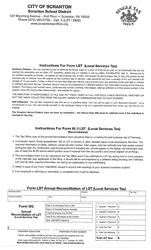

Form HAB-PPT Payroll Preparation Tax Form - City of Scranton - Pennsylvania

What Is Form HAB-PPT?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the HAB-PPT tax form?

A: The HAB-PPT tax form is the payroll preparation tax form.

Q: Who is required to file the HAB-PPT tax form?

A: Employers in the City of Scranton, Pennsylvania are required to file the HAB-PPT tax form.

Q: What is the purpose of the HAB-PPT tax form?

A: The purpose of the HAB-PPT tax form is to report and pay the payroll preparation tax to the City of Scranton.

Q: What is the payroll preparation tax?

A: The payroll preparation tax is a tax imposed on employers based on their payroll expenses.

Q: When is the HAB-PPT tax form due?

A: The HAB-PPT tax form is due on or before the 30th day of April each year.

Form Details:

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HAB-PPT by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.