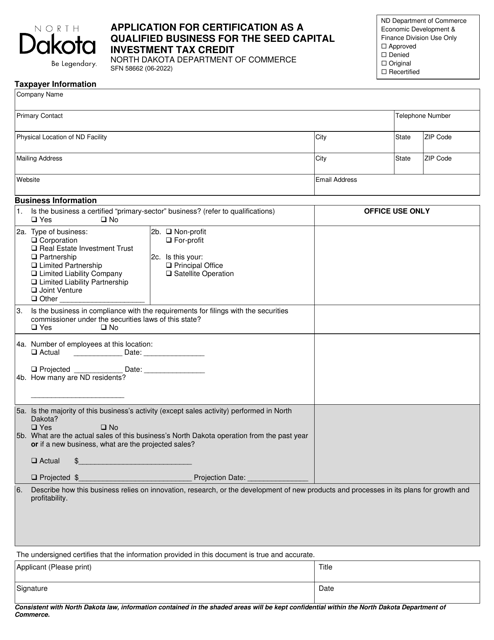

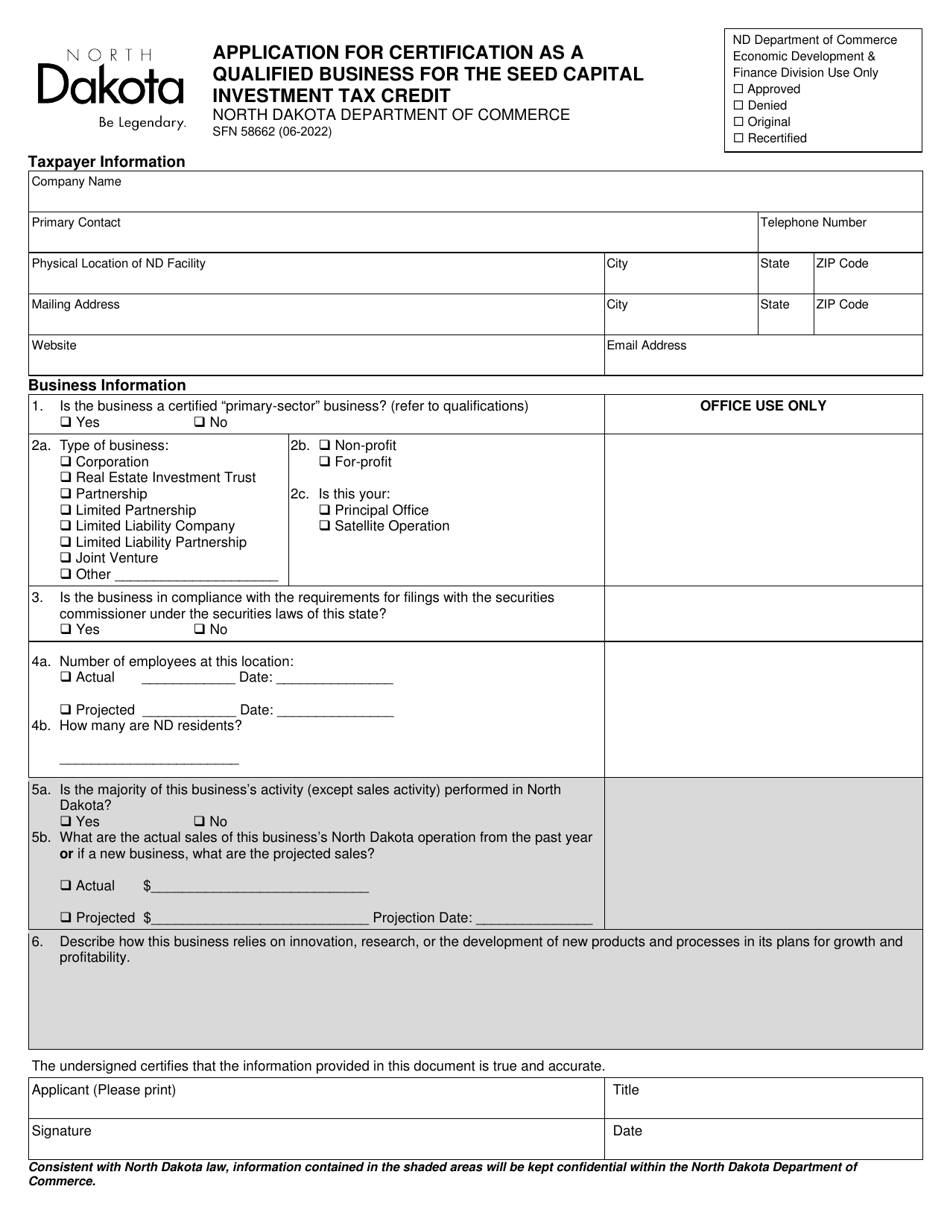

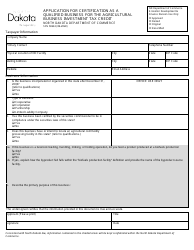

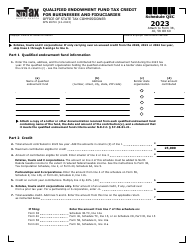

Form SFN58662 Application for Certification as a Qualified Business for the Seed Capital Investment Tax Credit - North Dakota

What Is Form SFN58662?

This is a legal form that was released by the North Dakota Department of Commerce - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form SFN58662?

A: Form SFN58662 is the application form for certification as a Qualified Business for the Seed Capital Investment Tax Credit in North Dakota.

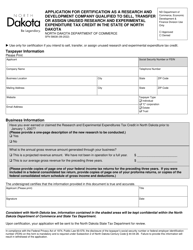

Q: What is the Seed Capital Investment Tax Credit?

A: The Seed Capital Investment Tax Credit is a tax incentive in North Dakota that provides a credit to qualified businesses that invest in eligible ventures.

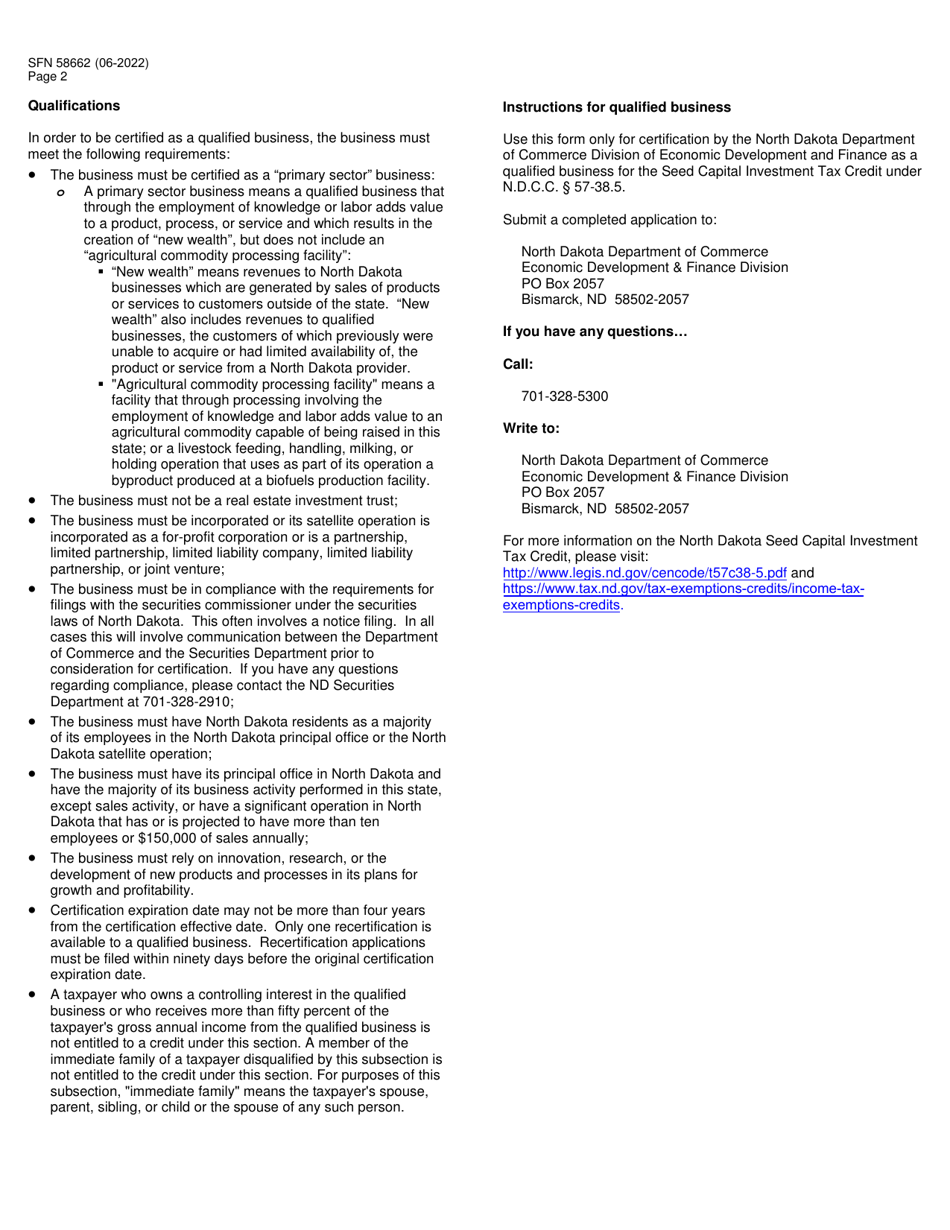

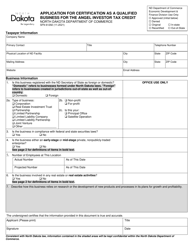

Q: Who can apply for certification as a Qualified Business?

A: Any business that meets the eligibility criteria outlined in the application form can apply for certification as a Qualified Business.

Q: What information do I need to provide in the application form?

A: The application form requires information about your business, details of the eligible venture, and supporting documentation as specified in the form.

Q: What are the benefits of becoming a Qualified Business for the Seed Capital Investment Tax Credit?

A: The benefits include eligibility for the tax credit, which can help offset a portion of the qualified investment made in eligible ventures.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted before the close of business on the last day of the calendar year in which the qualified investment is made.

Q: Can I apply for the Seed Capital Investment Tax Credit if my business is not located in North Dakota?

A: No, the Seed Capital Investment Tax Credit is specific to businesses operating in North Dakota.

Q: Are there any fees associated with the application?

A: No, there are no fees required for submitting the application for certification as a Qualified Business.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the North Dakota Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN58662 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Commerce.