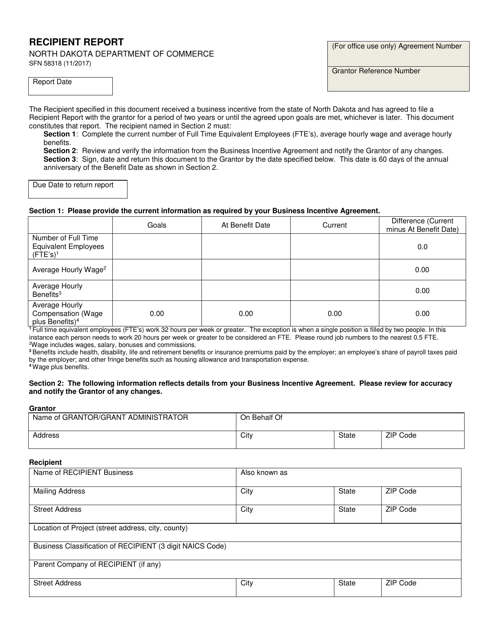

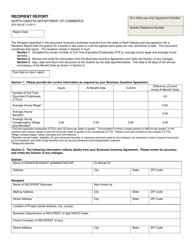

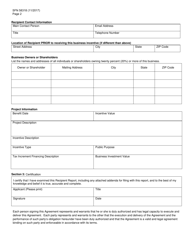

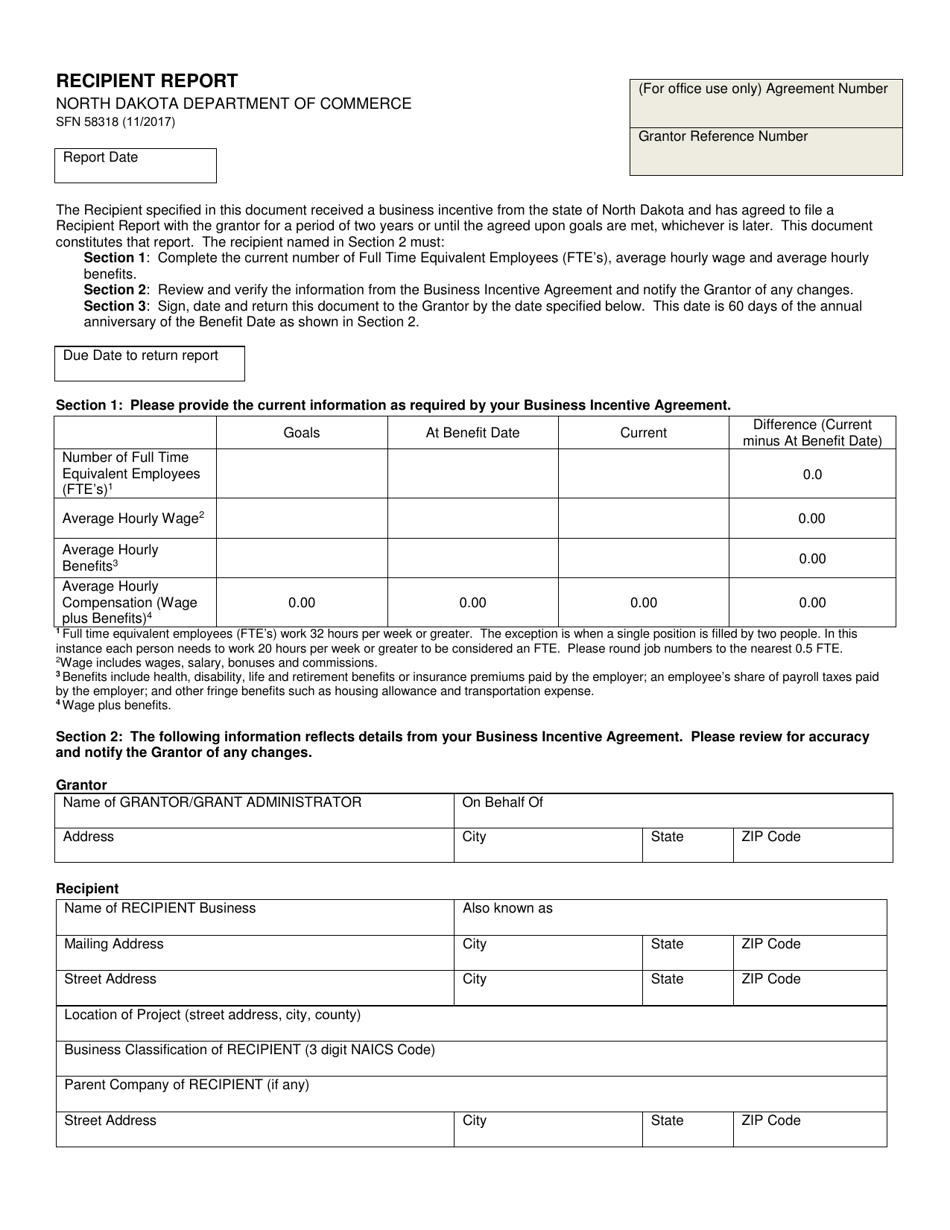

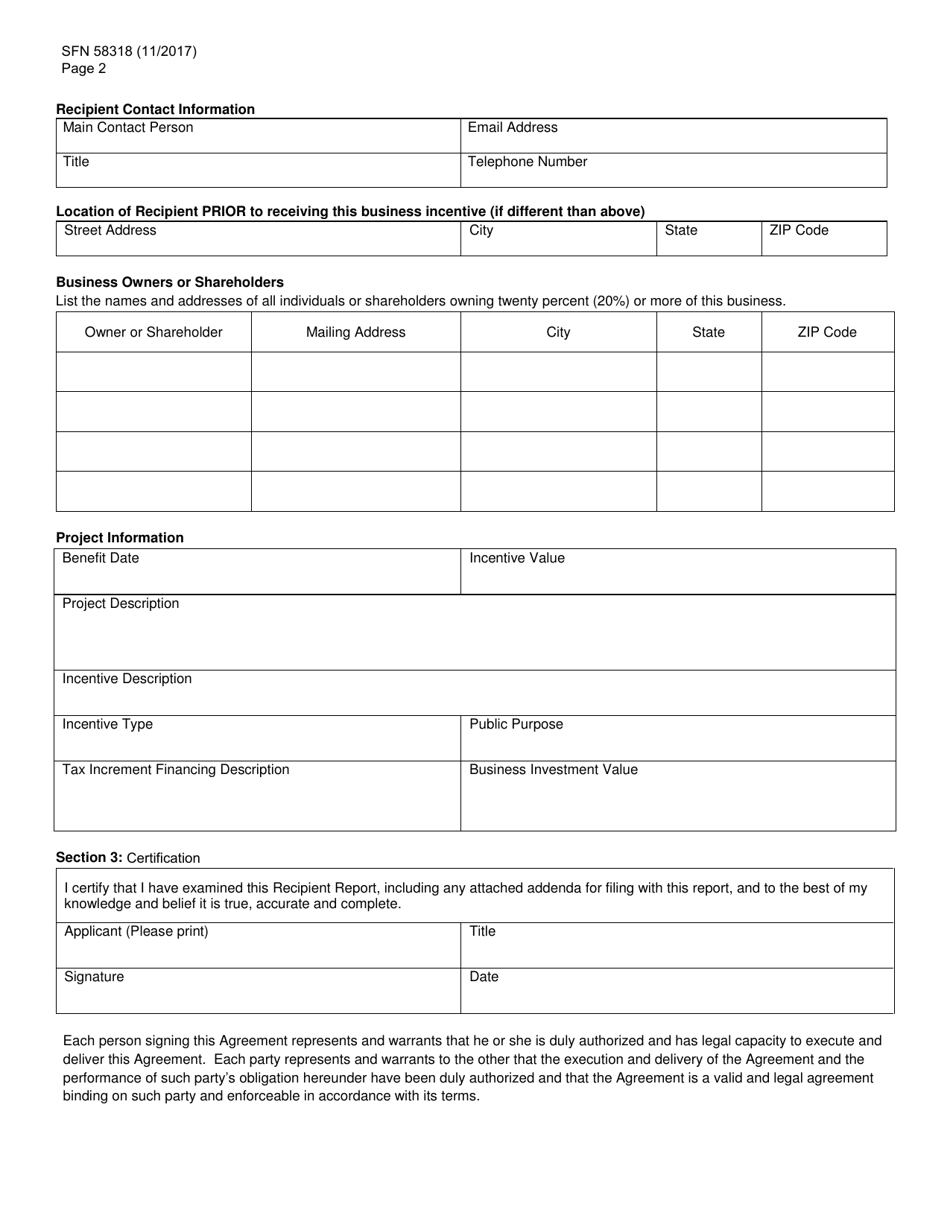

Form SFN58318 Recipient Report - North Dakota

What Is Form SFN58318?

This is a legal form that was released by the North Dakota Department of Commerce - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN58318?

A: Form SFN58318 is the Recipient Report form used in North Dakota.

Q: Who is required to fill out Form SFN58318?

A: Individuals or entities that receive payments from the State of North Dakota are required to fill out Form SFN58318.

Q: What information is required on Form SFN58318?

A: Form SFN58318 requires the recipient's name, address, taxpayer identification number (TIN), and the amount received.

Q: How often do I need to file Form SFN58318?

A: Form SFN58318 needs to be filed annually.

Q: Is there a deadline for filing Form SFN58318?

A: Yes, the deadline for filing Form SFN58318 is January 31 of the year following the calendar year in which the payments were received.

Q: What happens if I fail to file Form SFN58318?

A: Failing to file Form SFN58318 may result in penalties or interest charges.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the North Dakota Department of Commerce;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN58318 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Commerce.