This version of the form is not currently in use and is provided for reference only. Download this version of

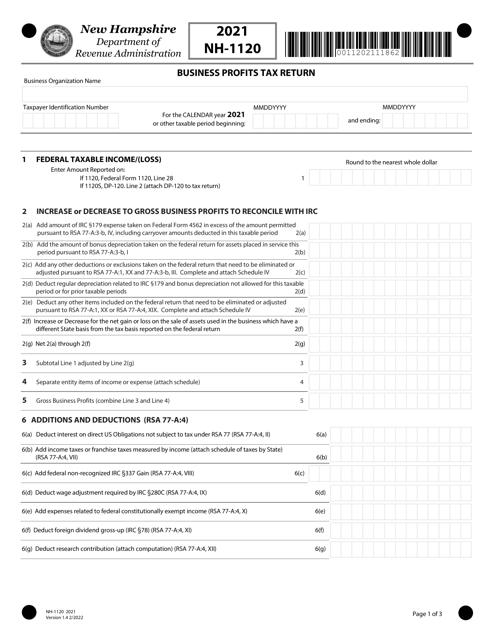

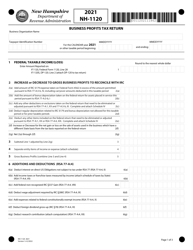

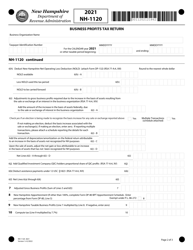

Form NH-1120

for the current year.

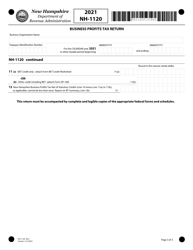

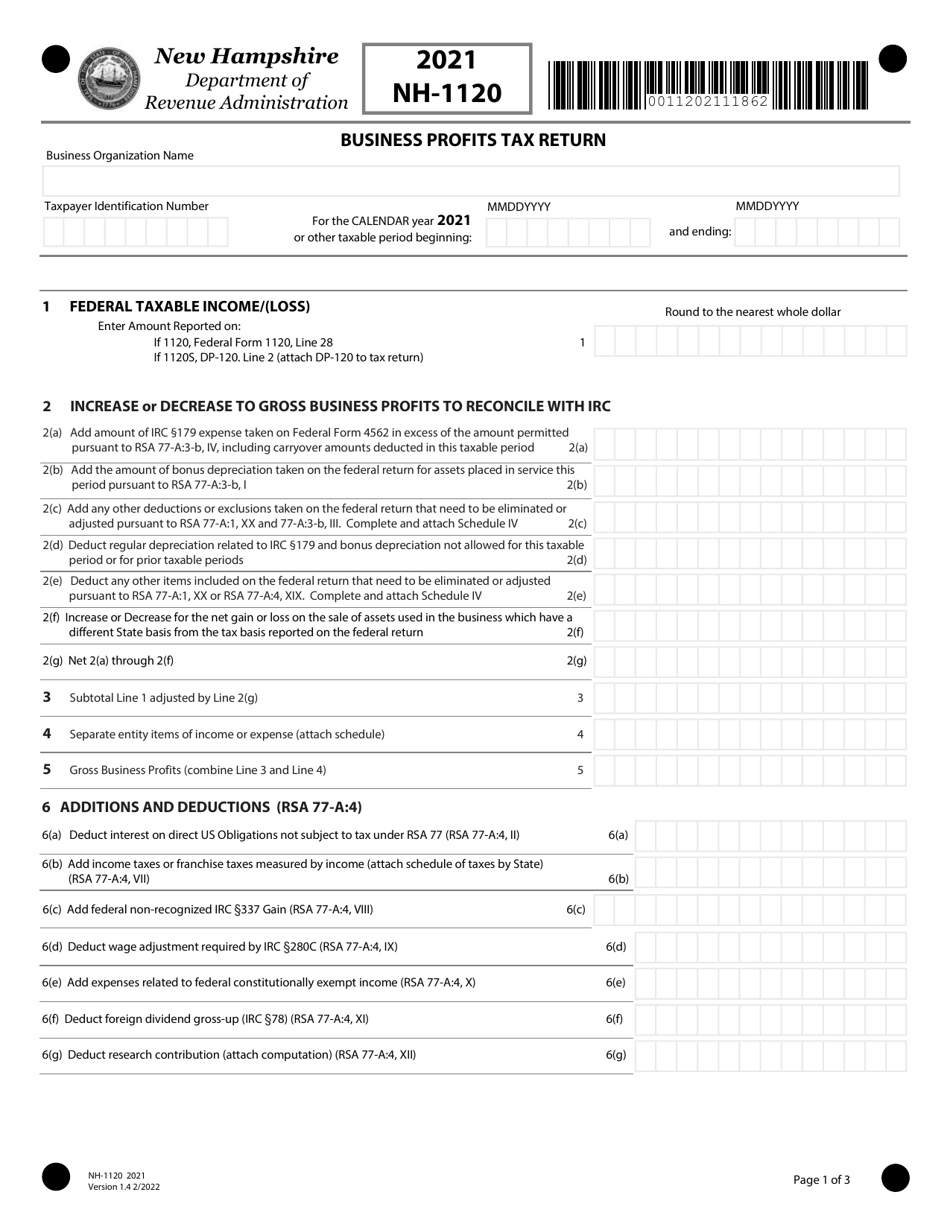

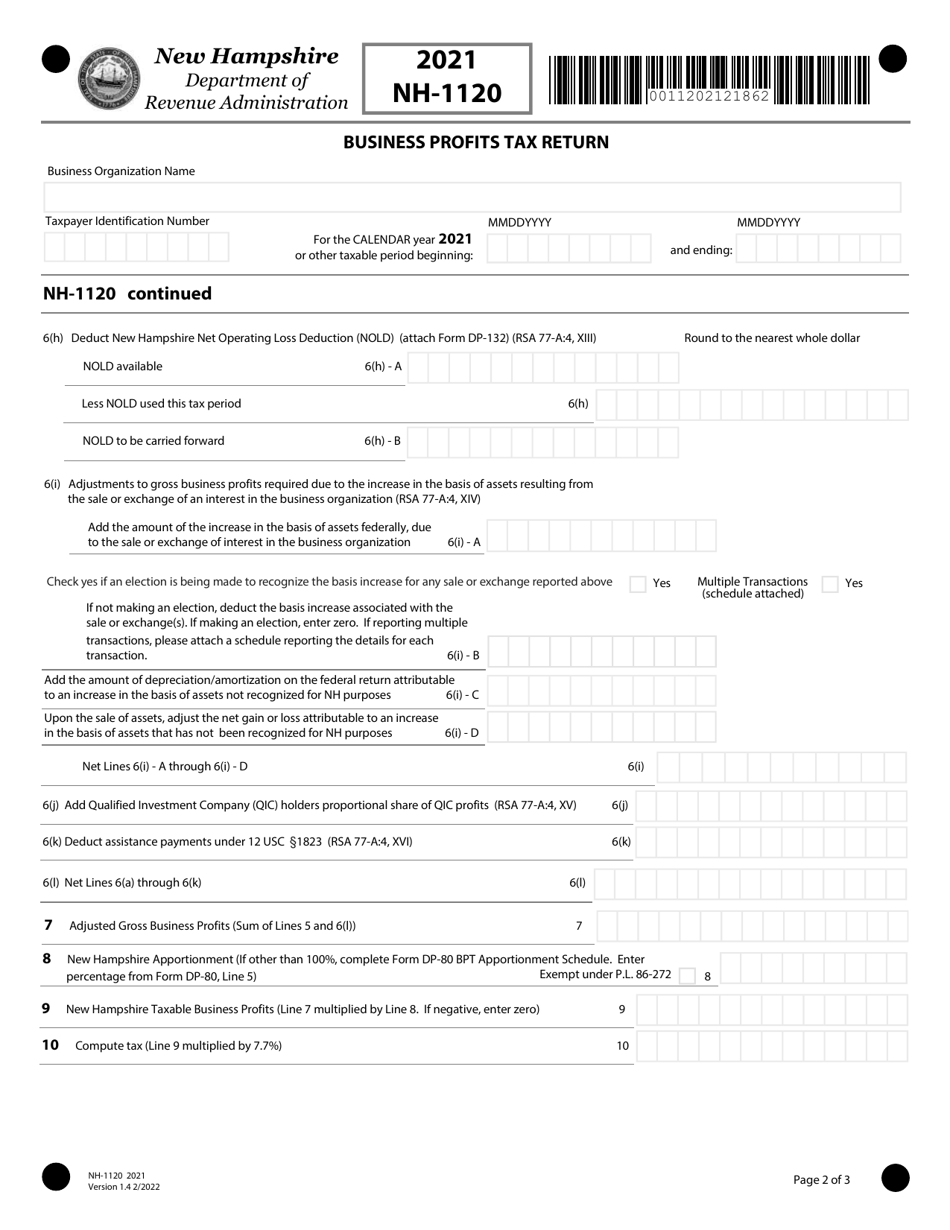

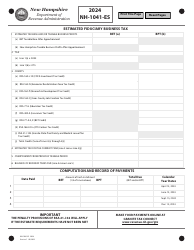

Form NH-1120 Business Profits Tax Return - New Hampshire

What Is Form NH-1120?

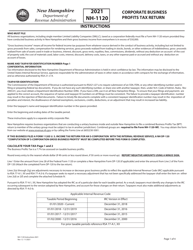

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NH-1120?

A: Form NH-1120 is the Business Profits Tax Return for businesses in New Hampshire.

Q: Who needs to file Form NH-1120?

A: Businesses located in New Hampshire that have income from business activities are required to file Form NH-1120.

Q: What is the deadline to file Form NH-1120?

A: The deadline to file Form NH-1120 is the 15th day of the third month following the close of the tax year.

Q: Are there any extensions available for filing Form NH-1120?

A: Yes, businesses can request an extension to file Form NH-1120, but the tax payment is still due by the original deadline.

Q: What information is required to complete Form NH-1120?

A: Some of the information required to complete Form NH-1120 includes the company's income and deductions, apportionment factors, and tax credits.

Q: Can I file Form NH-1120 electronically?

A: Yes, businesses can file Form NH-1120 electronically through the New Hampshire Department of Revenue Administration's e-file system.

Q: What are the penalties for late filing of Form NH-1120?

A: The penalties for late filing of Form NH-1120 include monetary fines and interest on any unpaid tax amount.

Q: Can I amend Form NH-1120 if I made a mistake?

A: Yes, businesses can file an amended Form NH-1120 using Form NH-1120-X if they discover an error or omission after the original filing.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1120 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.