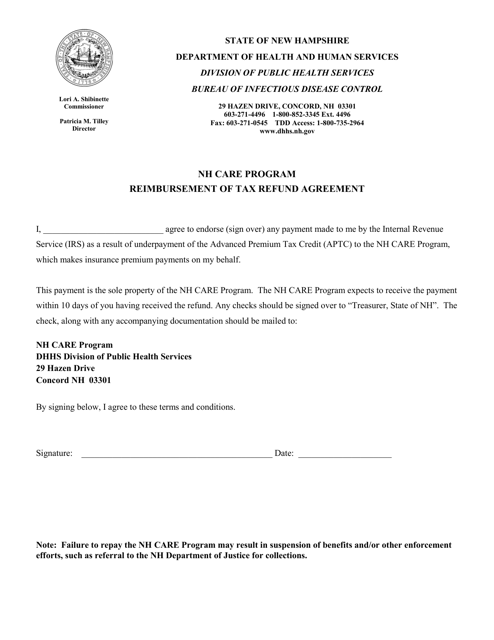

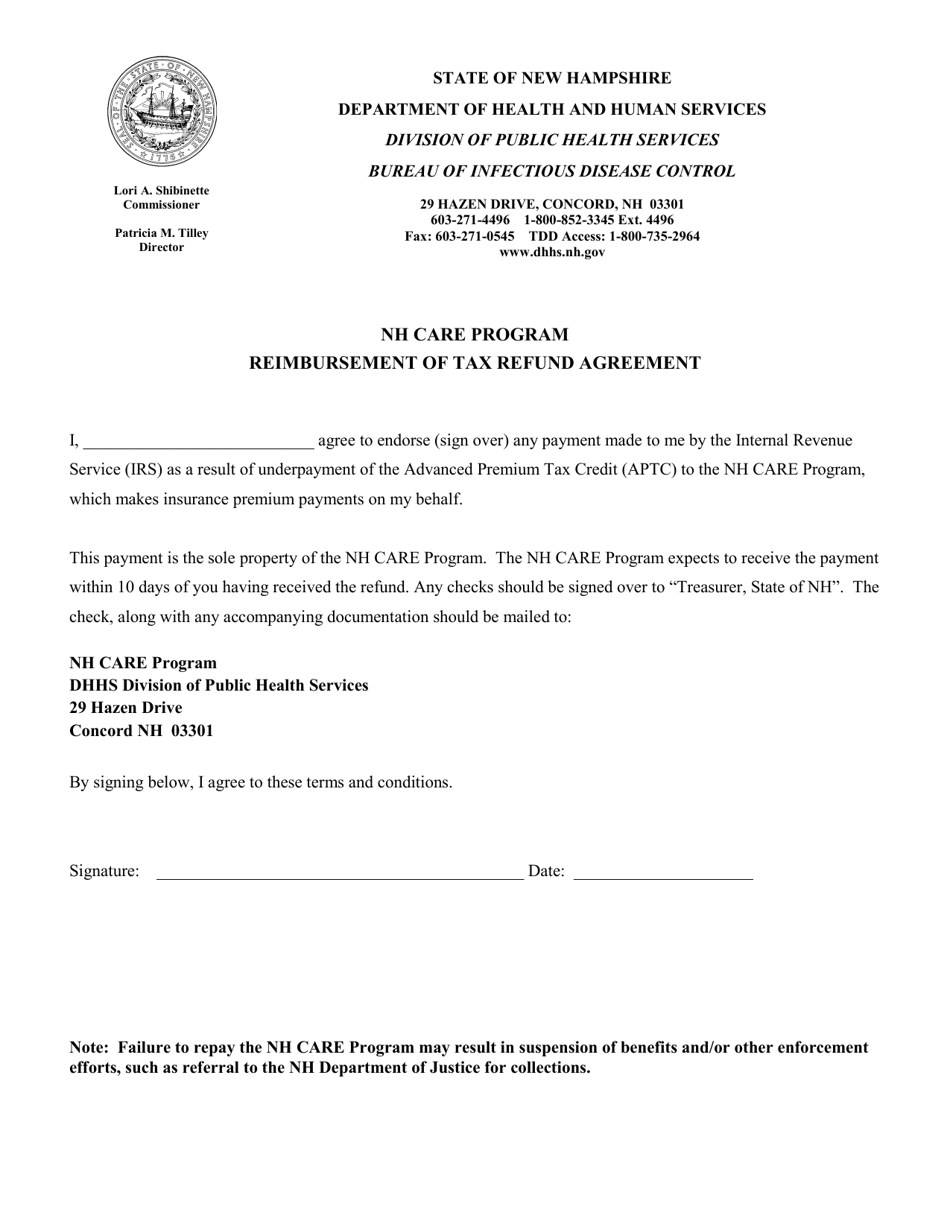

Reimbursement of Tax Refund Agreement - Nh Care Program - New Hampshire

Reimbursement of Tax Refund Agreement - Nh Care Program is a legal document that was released by the New Hampshire Department of Health and Human Services - a government authority operating within New Hampshire.

FAQ

Q: What is the Reimbursement of Tax Refund Agreement?

A: The Reimbursement of Tax Refund Agreement is a program within the NH Care Program in New Hampshire.

Q: What is the NH Care Program?

A: The NH Care Program is a state healthcare assistance program in New Hampshire.

Q: How does the Reimbursement of Tax Refund Agreement work?

A: The Reimbursement of Tax Refund Agreement allows eligible NH Care Program participants to receive reimbursement for their tax refunds.

Q: Who is eligible for the Reimbursement of Tax Refund Agreement?

A: Eligibility for the Reimbursement of Tax Refund Agreement is determined by the NH Care Program.

Q: Is the reimbursement taxable income?

A: It is recommended to consult a tax professional to determine if the reimbursement is taxable income.

Q: How can I apply for the Reimbursement of Tax Refund Agreement?

A: You can apply for the Reimbursement of Tax Refund Agreement through the NH Care Program.

Form Details:

- The latest edition currently provided by the New Hampshire Department of Health and Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Health and Human Services.