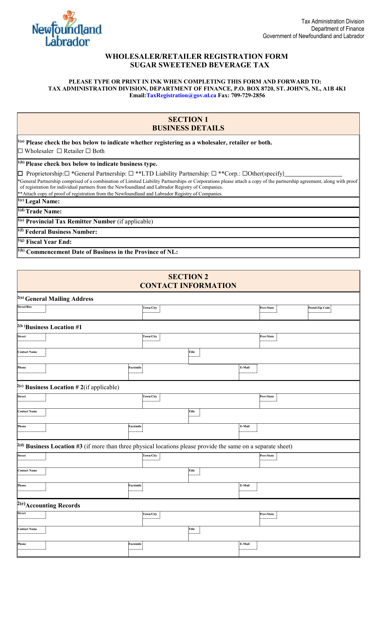

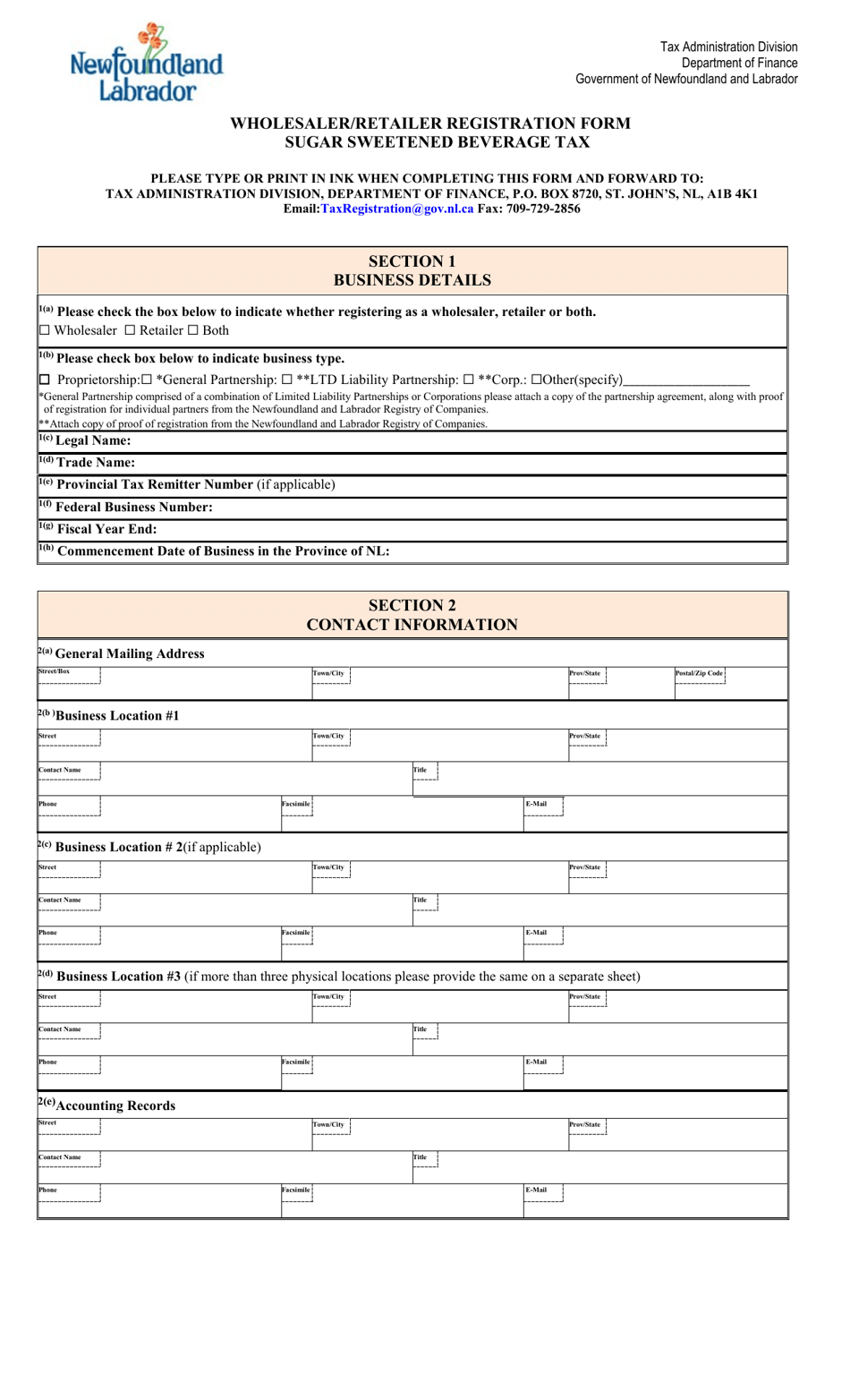

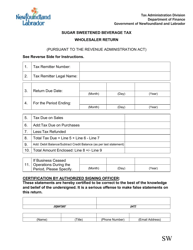

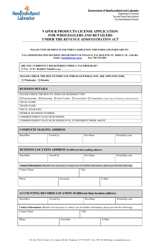

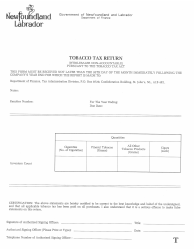

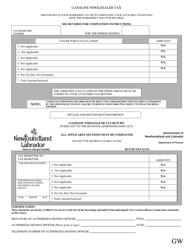

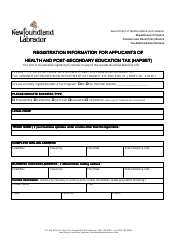

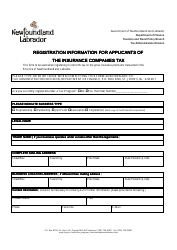

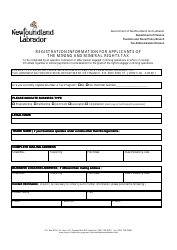

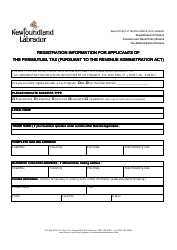

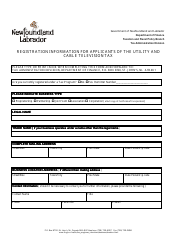

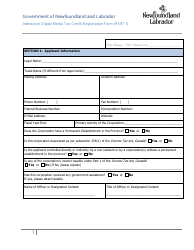

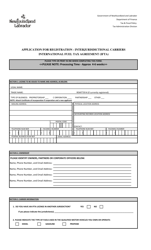

Wholesaler / Retailer Registration Form - Sugar Sweetened Beverage Tax - Newfoundland and Labrador, Canada

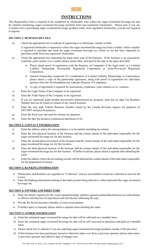

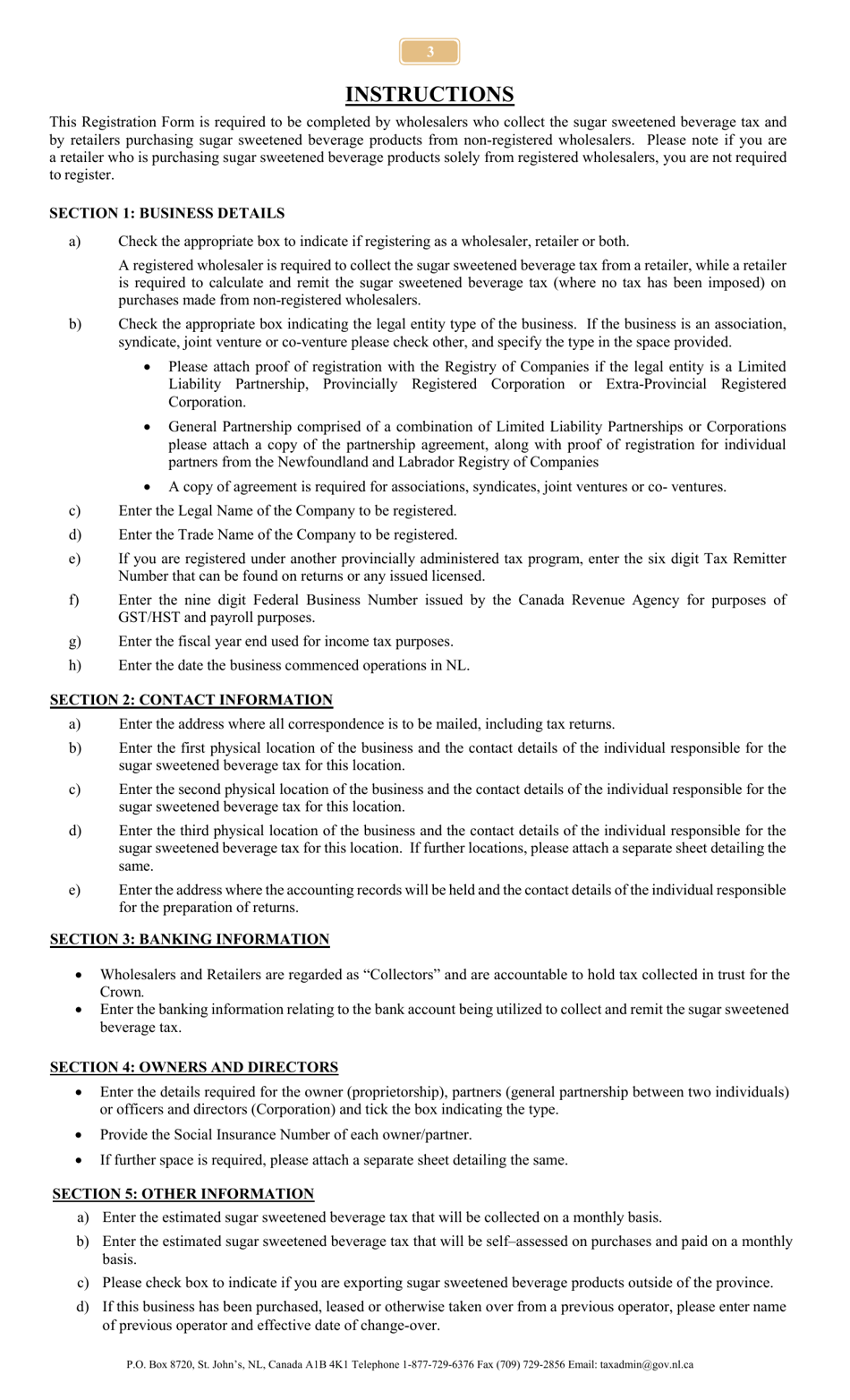

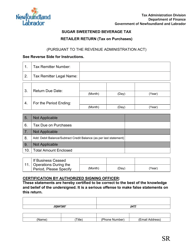

The Wholesaler/Retailer Registration Form for the Sugar Sweetened Beverage Tax in Newfoundland and Labrador, Canada is used for wholesalers and retailers to register for the tax. This form allows them to comply with the regulations and requirements related to the tax on sugar-sweetened beverages in the province.

The wholesaler or retailer files the Wholesaler/Retailer Registration Form for the Sugar Sweetened Beverage Tax in Newfoundland and Labrador, Canada.

FAQ

Q: What is the Wholesaler/Retailer Registration Form for Sugar Sweetened Beverage Tax in Newfoundland and Labrador?

A: The Wholesaler/Retailer Registration Form is a document required for businesses to register for the Sugar Sweetened Beverage Tax in Newfoundland and Labrador, Canada.

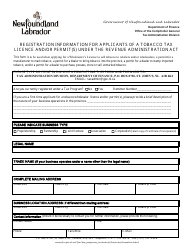

Q: Who needs to fill out the Wholesaler/Retailer Registration Form?

A: Any wholesaler or retailer selling sugar-sweetened beverages in Newfoundland and Labrador needs to fill out the form.

Q: Why do businesses need to register for the Sugar Sweetened Beverage Tax?

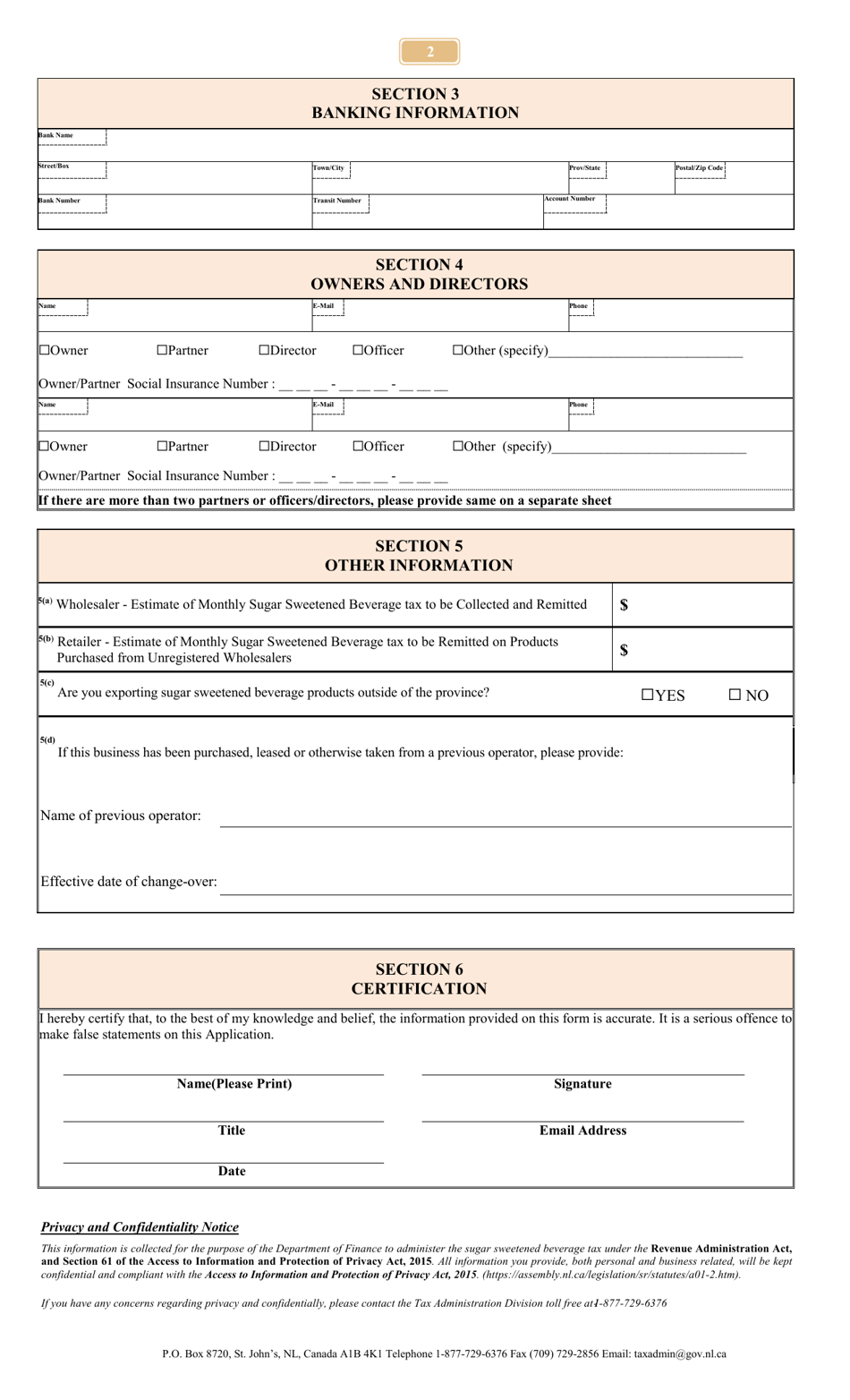

A: Businesses need to register for the tax to comply with the regulations and ensure proper collection and remittance of the tax.

Q: Are there any fees for registering as a wholesaler or retailer for the Sugar Sweetened Beverage Tax?

A: No, there are no fees associated with registering as a wholesaler or retailer for the tax.

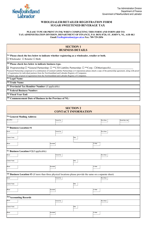

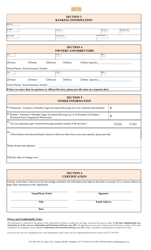

Q: What information is required on the Wholesaler/Retailer Registration Form?

A: The form requires information such as business details, contact information, and estimated monthly sales of sugar-sweetened beverages.

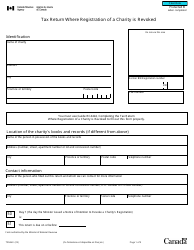

Q: What are the consequences of not registering for the Sugar Sweetened Beverage Tax?

A: Failure to register for the tax can result in penalties and legal consequences for businesses in Newfoundland and Labrador.

Q: Can businesses be exempt from the Sugar Sweetened Beverage Tax?

A: Certain businesses may qualify for exemptions from the tax. Additional information can be found in the guidelines provided by the Newfoundland and Labrador Revenue Administration.