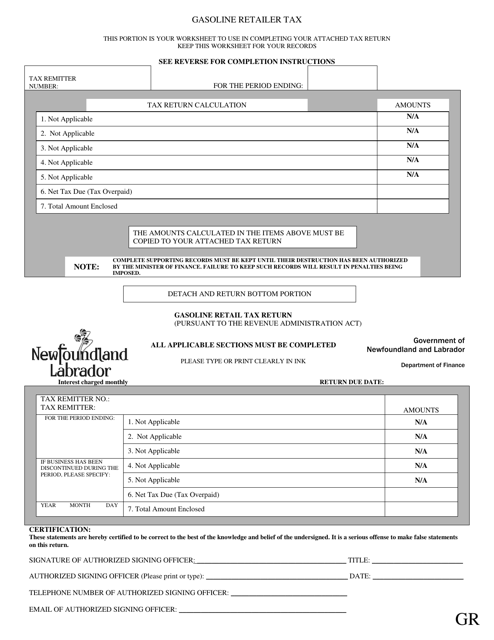

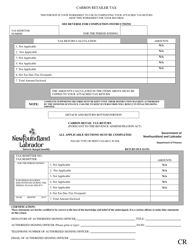

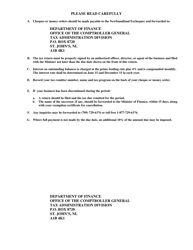

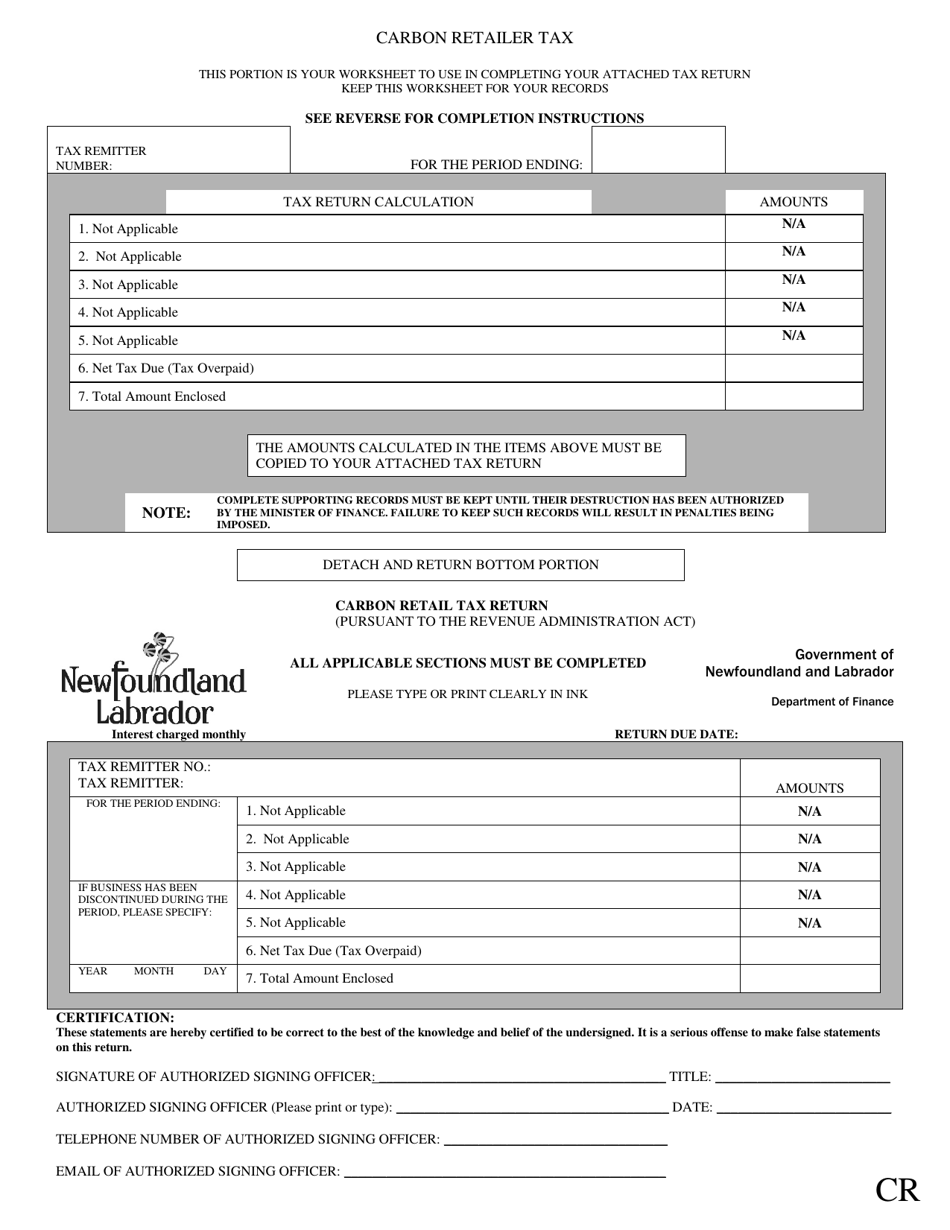

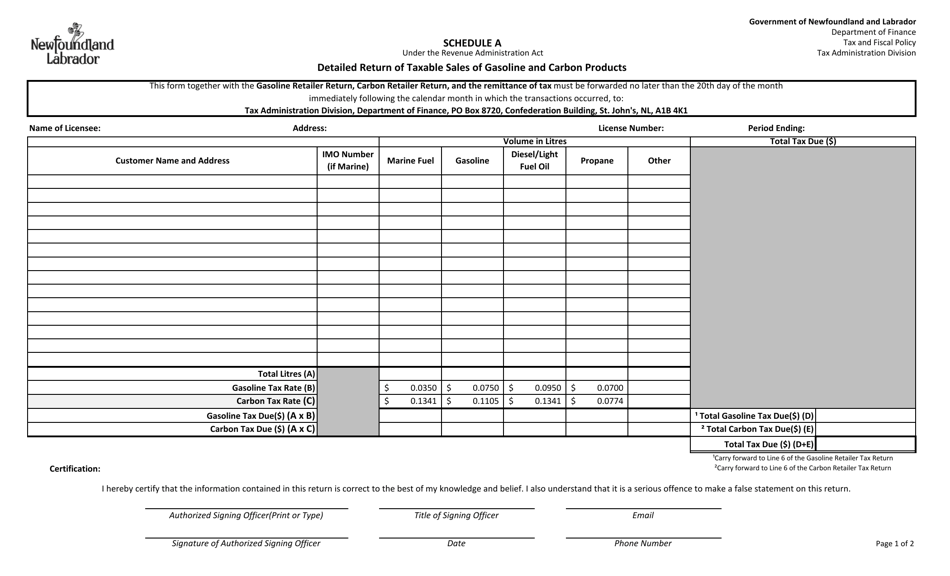

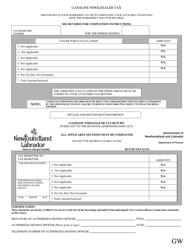

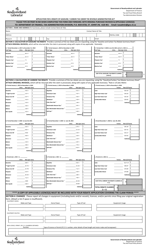

Schedule A Gasoline Retailer Tax - Newfoundland and Labrador, Canada

Schedule A Gasoline Retailer Tax in Newfoundland and Labrador, Canada is a tax specifically imposed on gasoline retailers in the province. It is used to generate revenue for the government and support various public services and infrastructure projects.

The Schedule A Gasoline Retailer Tax in Newfoundland and Labrador, Canada is filed by gasoline retailers in that province.

FAQ

Q: What is Schedule A Gasoline Retailer Tax?

A: Schedule A Gasoline Retailer Tax is a tax imposed on gasoline retailers in Newfoundland and Labrador, Canada.

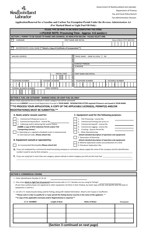

Q: Who is required to pay Schedule A Gasoline Retailer Tax?

A: Gasoline retailers are required to pay Schedule A Gasoline Retailer Tax.

Q: What is the purpose of Schedule A Gasoline Retailer Tax?

A: The purpose of Schedule A Gasoline Retailer Tax is to generate revenue for the government and help fund infrastructure projects.

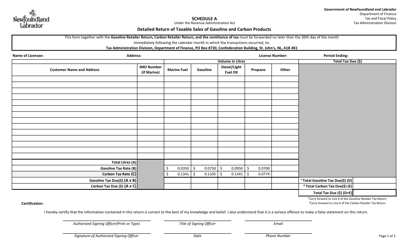

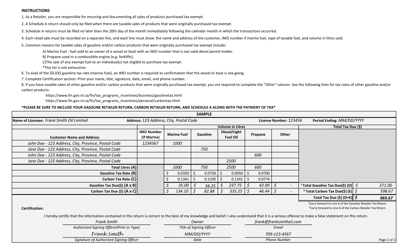

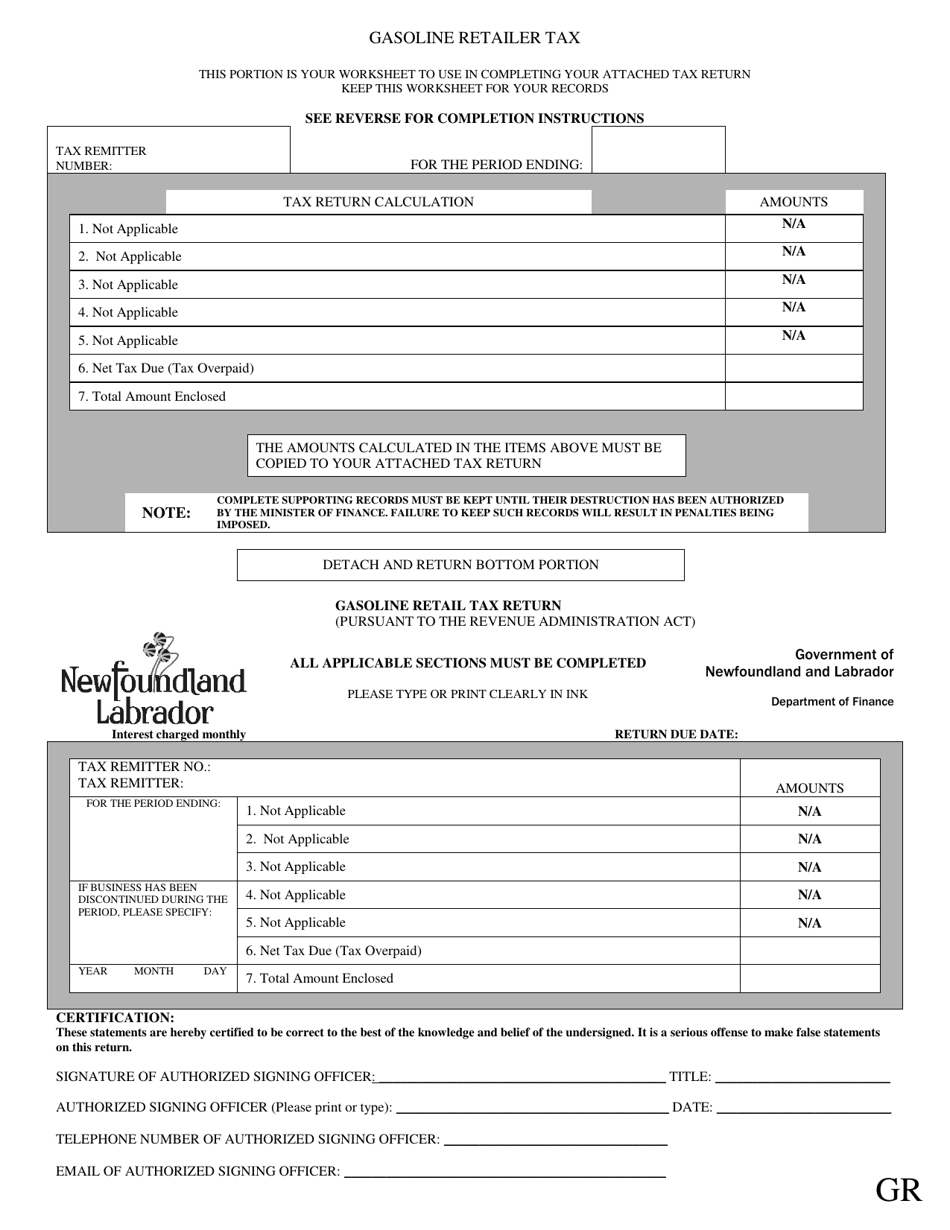

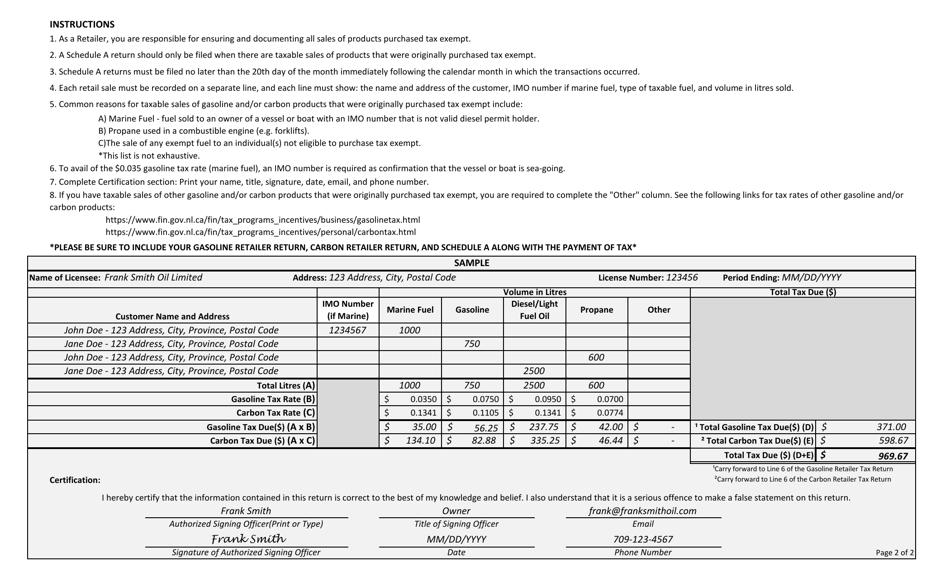

Q: How is Schedule A Gasoline Retailer Tax calculated?

A: Schedule A Gasoline Retailer Tax is calculated based on the volume of gasoline sold by retailers.

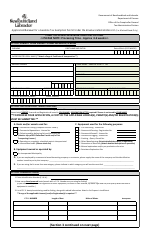

Q: Are there any exemptions or deductions for Schedule A Gasoline Retailer Tax?

A: There are no specific exemptions or deductions available for Schedule A Gasoline Retailer Tax.

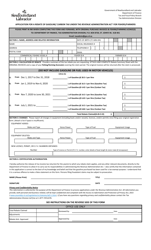

Q: Is Schedule A Gasoline Retailer Tax the same across all provinces in Canada?

A: No, Schedule A Gasoline Retailer Tax may vary across different provinces in Canada. This information specifically pertains to Newfoundland and Labrador.