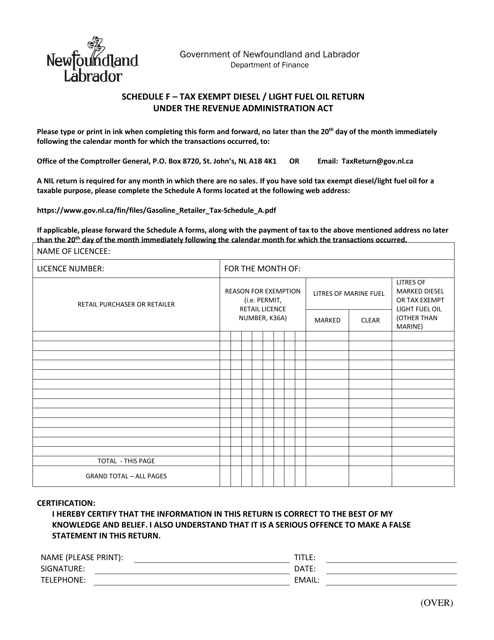

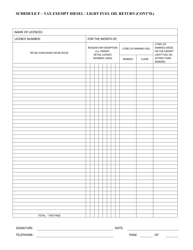

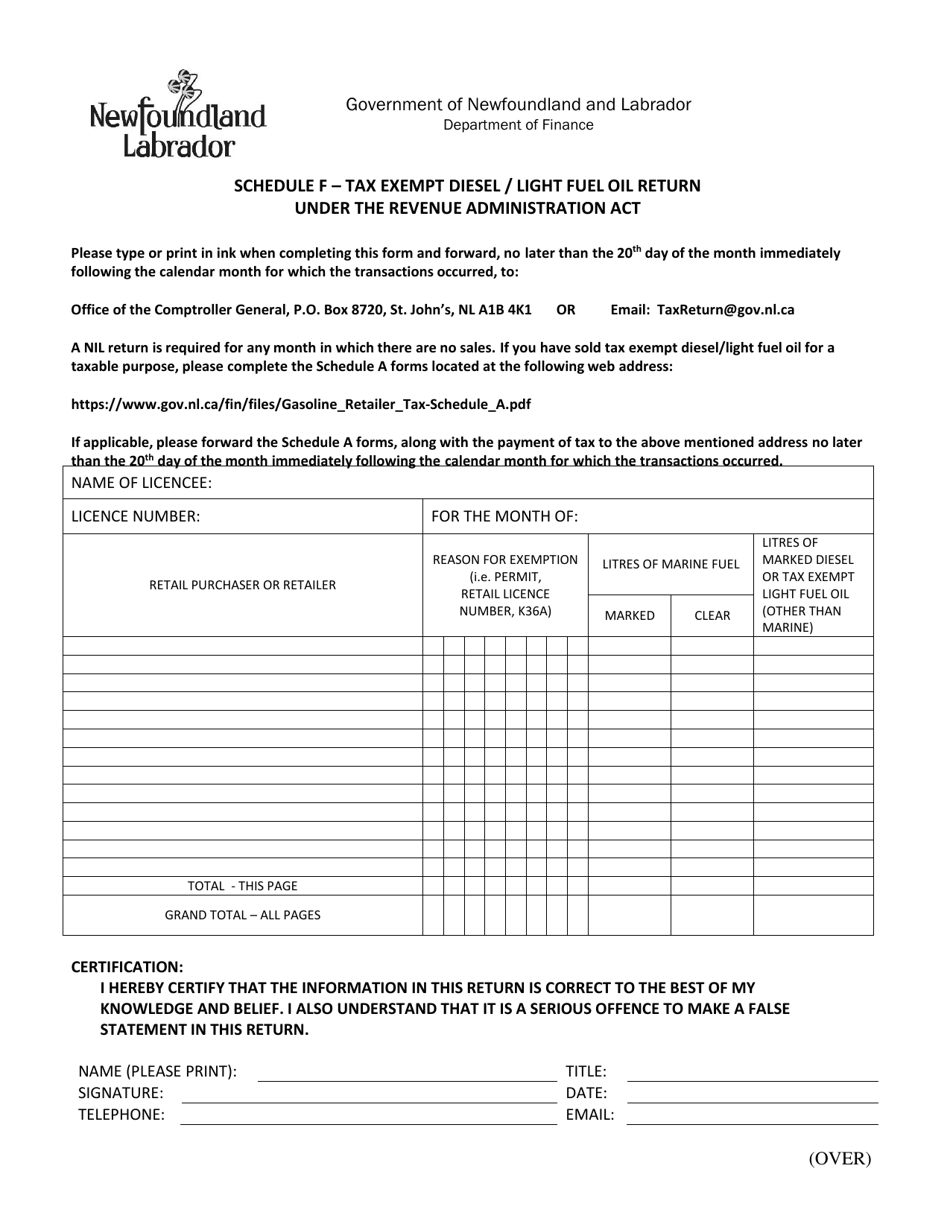

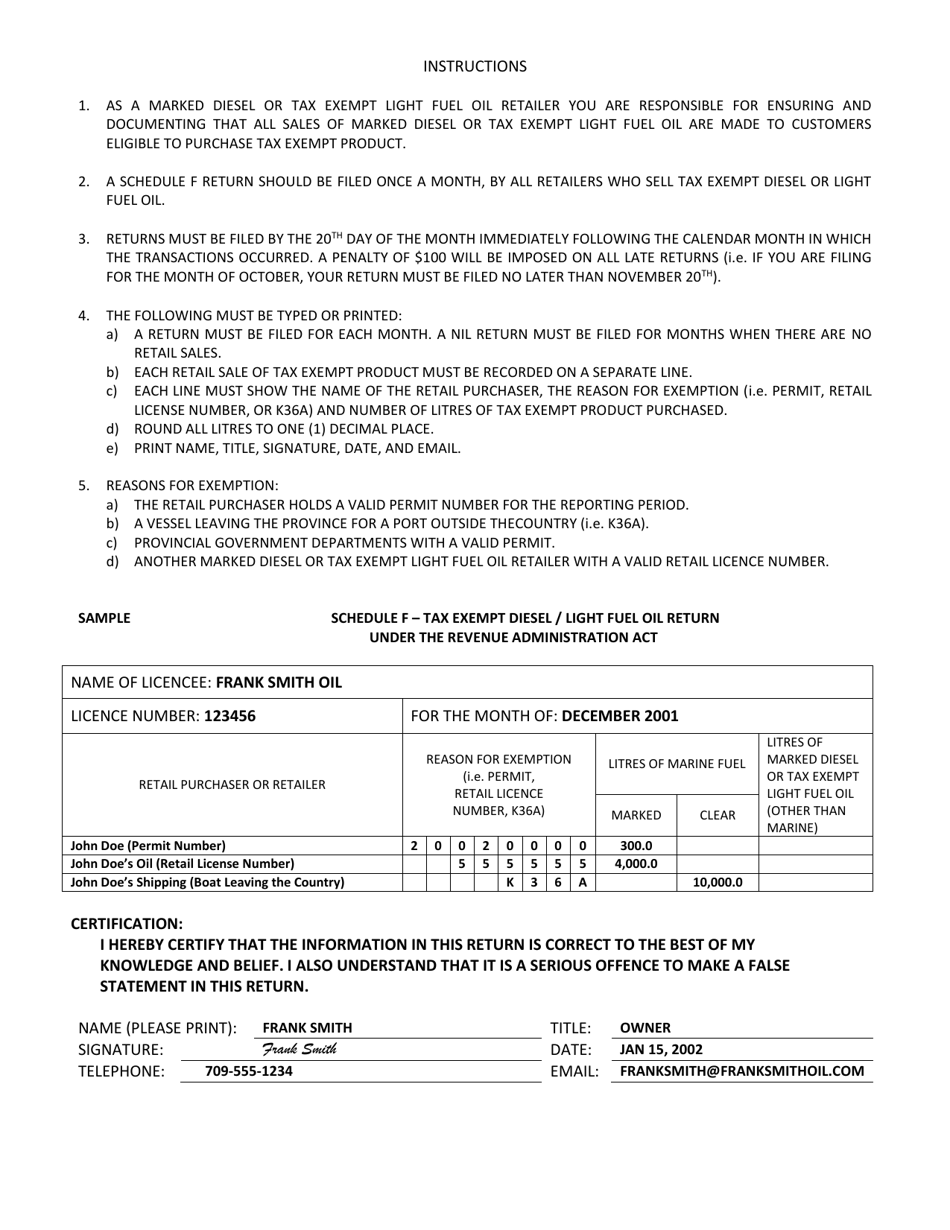

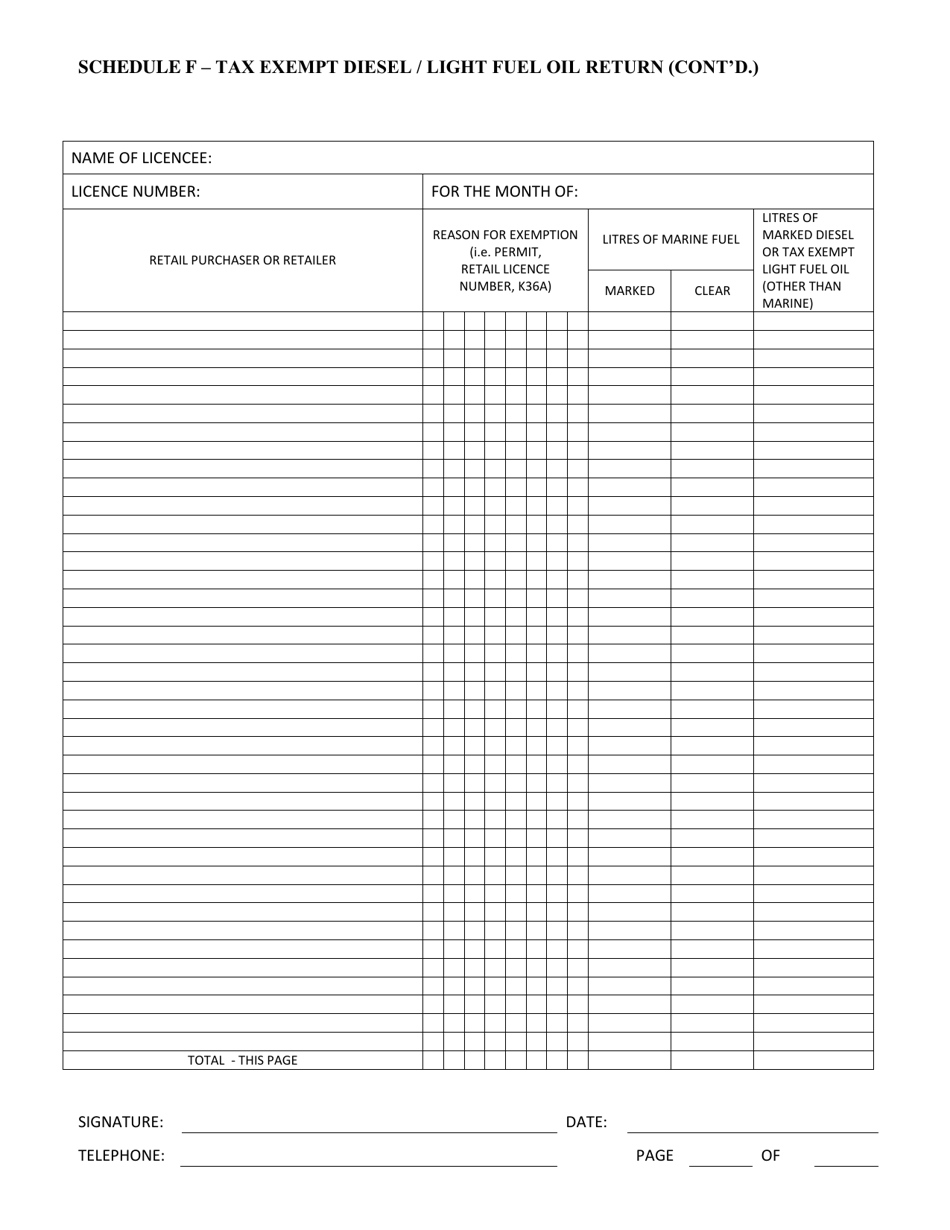

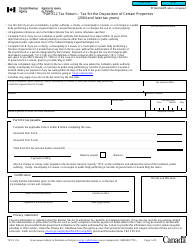

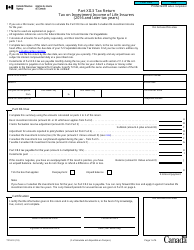

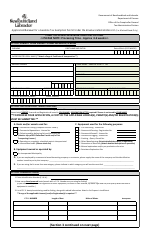

Schedule F Tax Exempt Diesel / Light Fuel Oil Return - Newfoundland and Labrador, Canada

The Schedule F Tax Exempt Diesel/Light Fuel Oil Return in Newfoundland and Labrador, Canada is for reporting and claiming exemptions on the consumption of diesel or light fuel oil for eligible purposes, such as farming or fishing activities.

FAQ

Q: What is the Schedule F Tax Exempt Diesel/Light Fuel Oil Return?

A: The Schedule F Tax Exempt Diesel/Light Fuel Oil Return is a form used in Newfoundland and Labrador, Canada to report and claim exemption for the use of diesel or light fuel oil in certain types of vehicles.

Q: Who needs to file the Schedule F tax return?

A: Any individual or business that uses diesel or light fuel oil in tax-exempt vehicles in Newfoundland and Labrador must file this return.

Q: What is considered a tax-exempt vehicle?

A: Tax-exempt vehicles include certain farm machinery, forestry equipment, and commercial fishing boats.

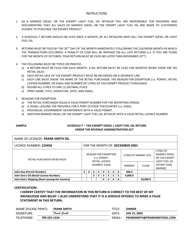

Q: When is the deadline to file the Schedule F tax return?

A: The deadline to file the Schedule F tax return is usually on or before the last day of the month following the end of the reporting period.