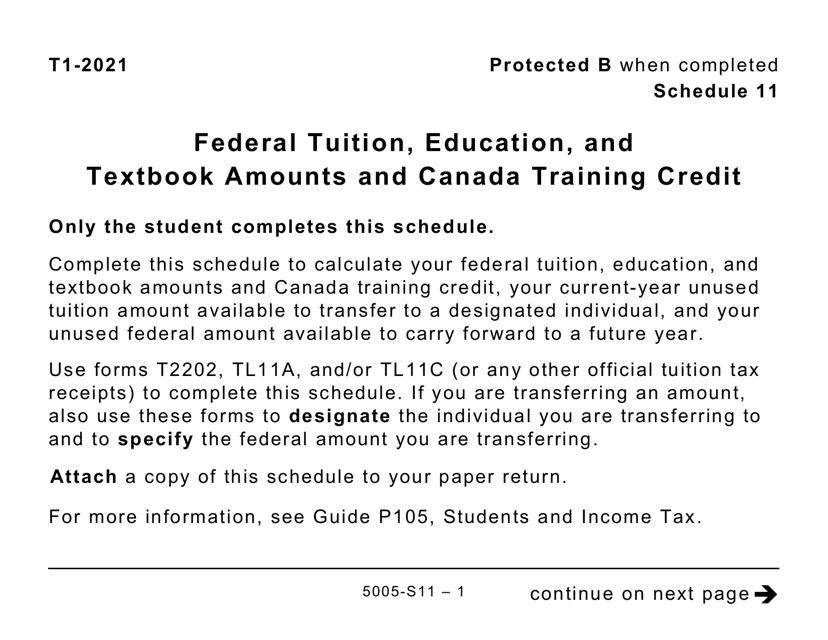

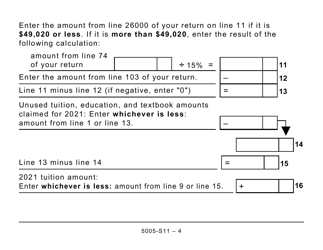

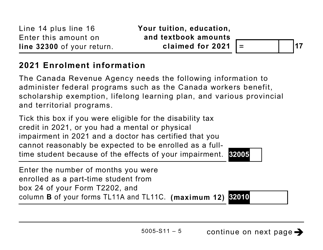

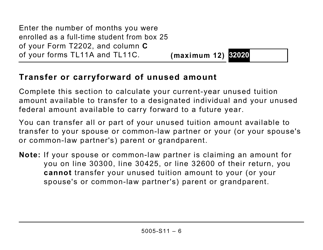

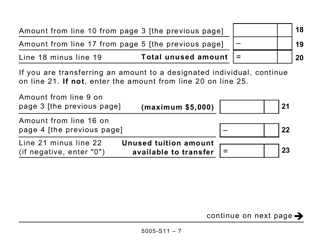

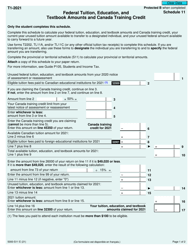

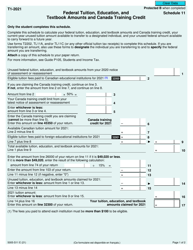

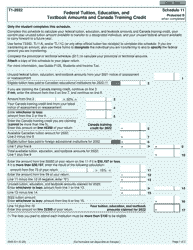

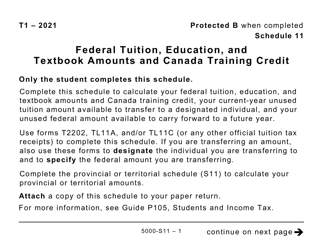

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (Large Print) - Canada

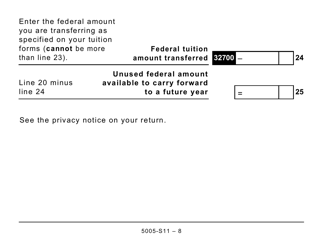

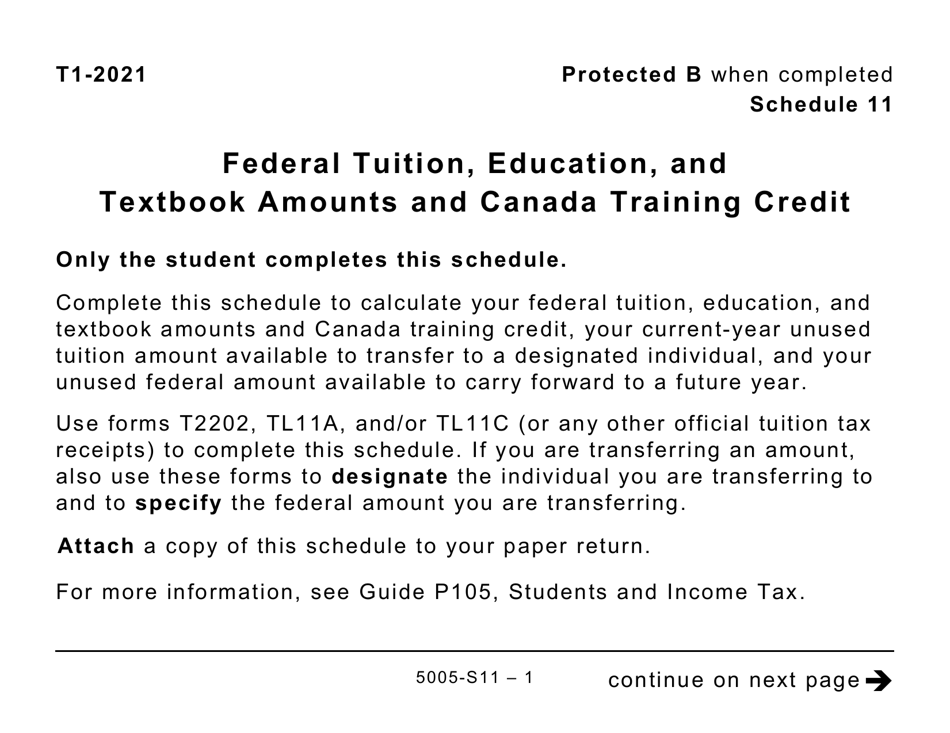

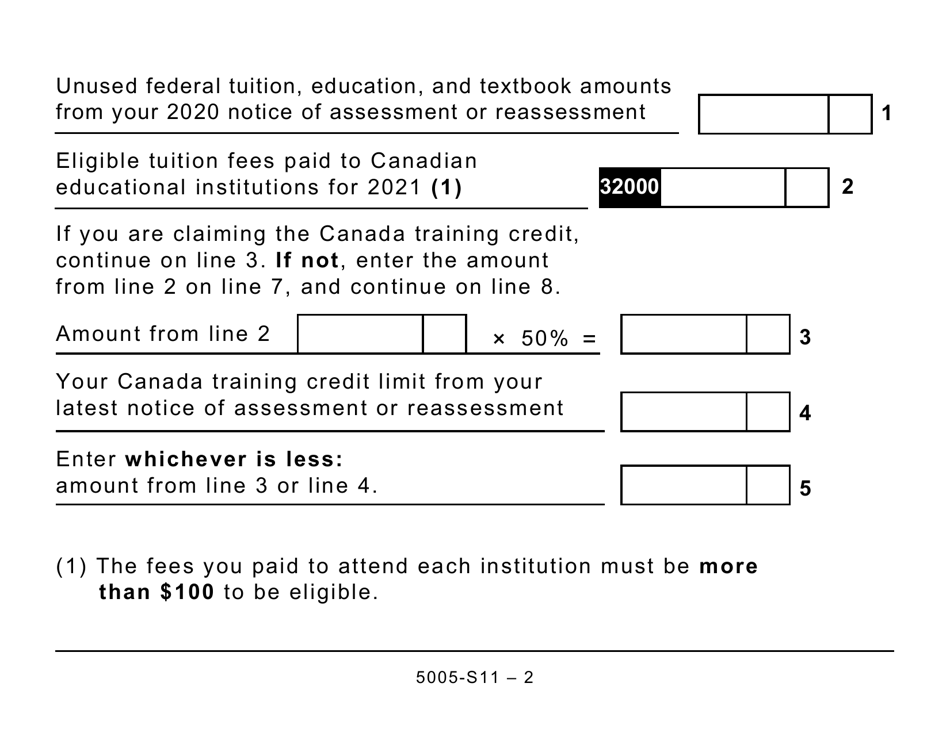

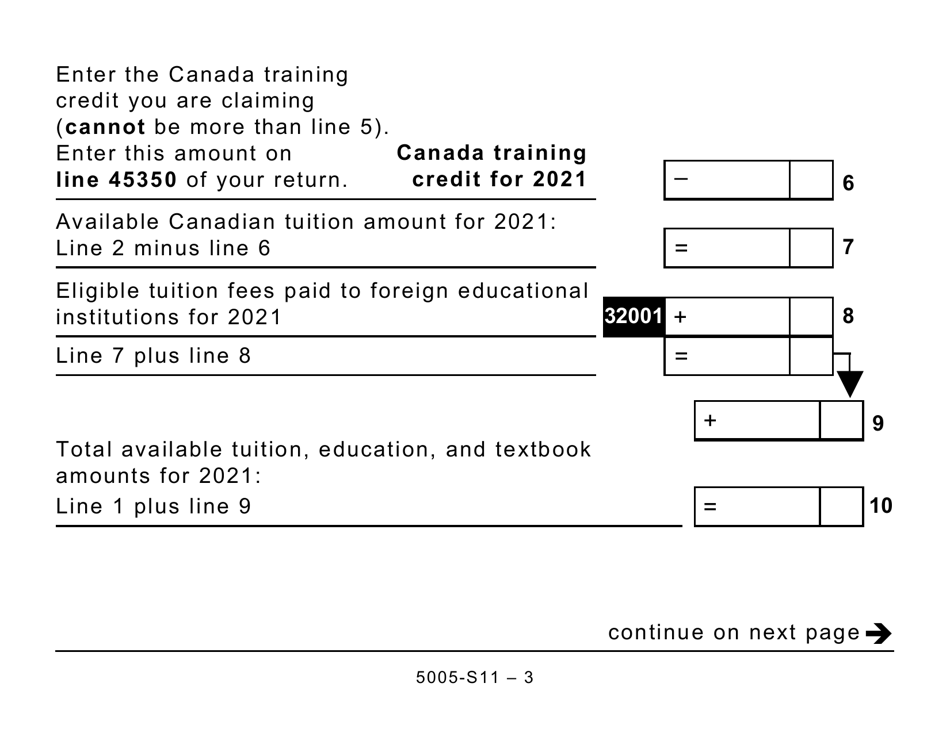

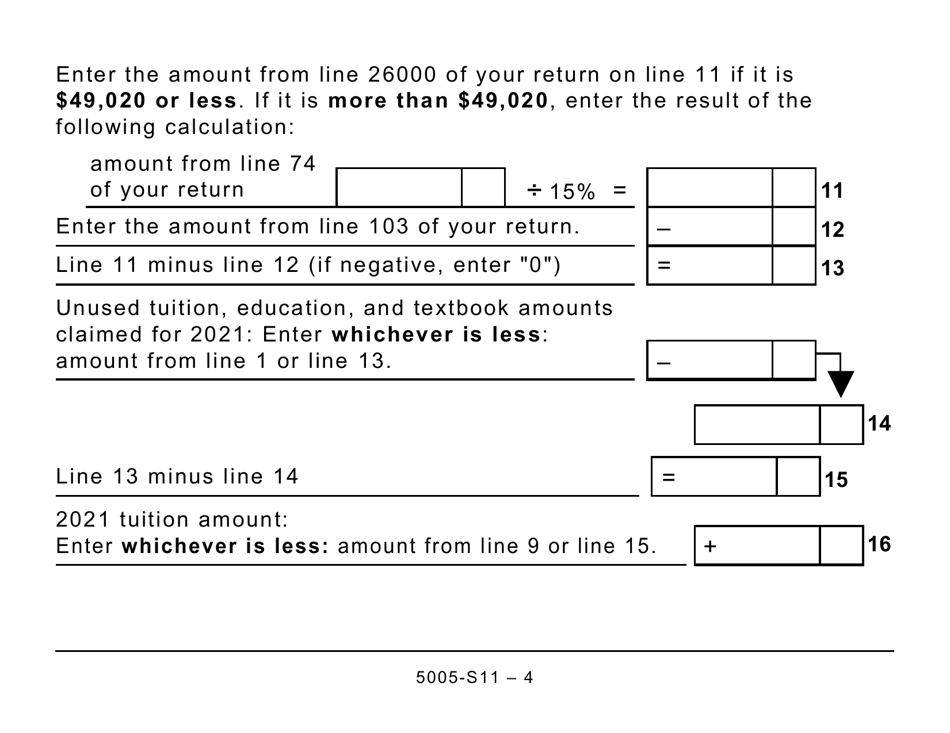

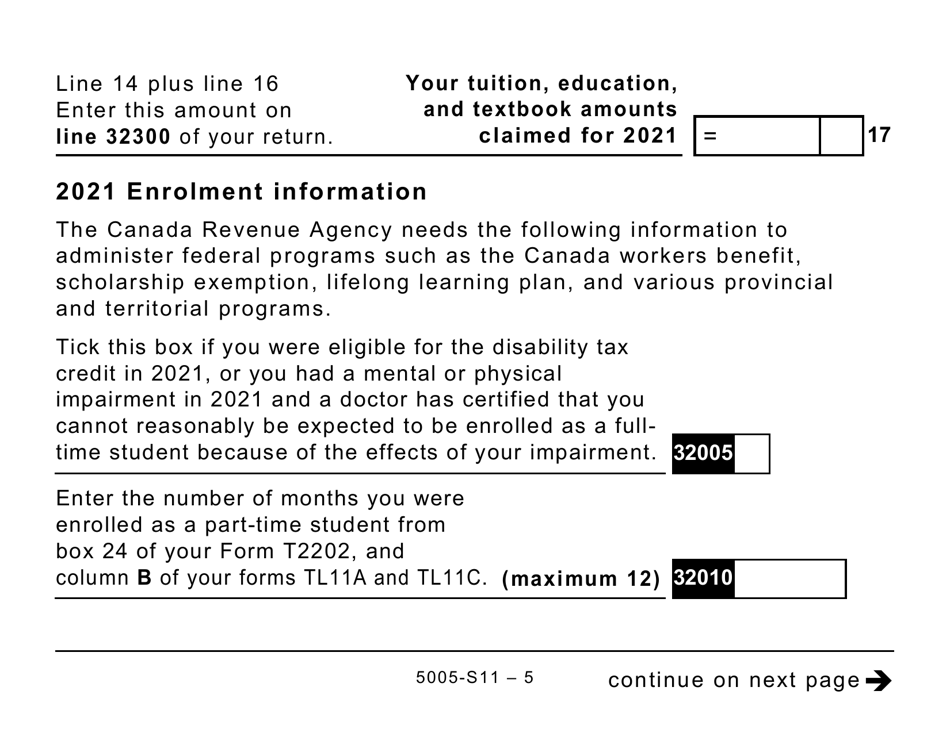

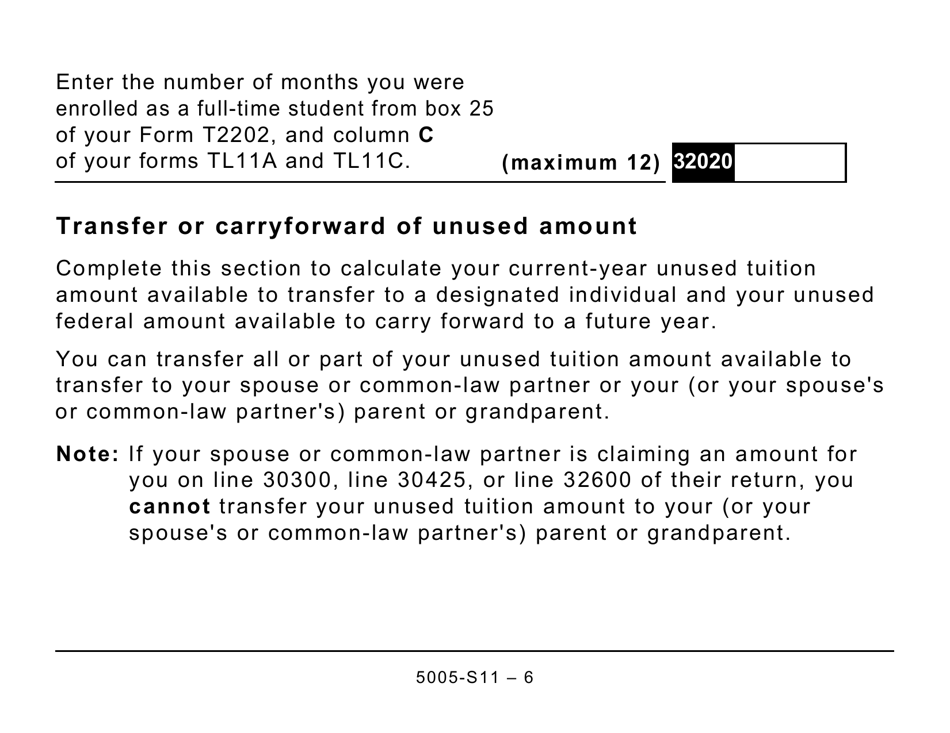

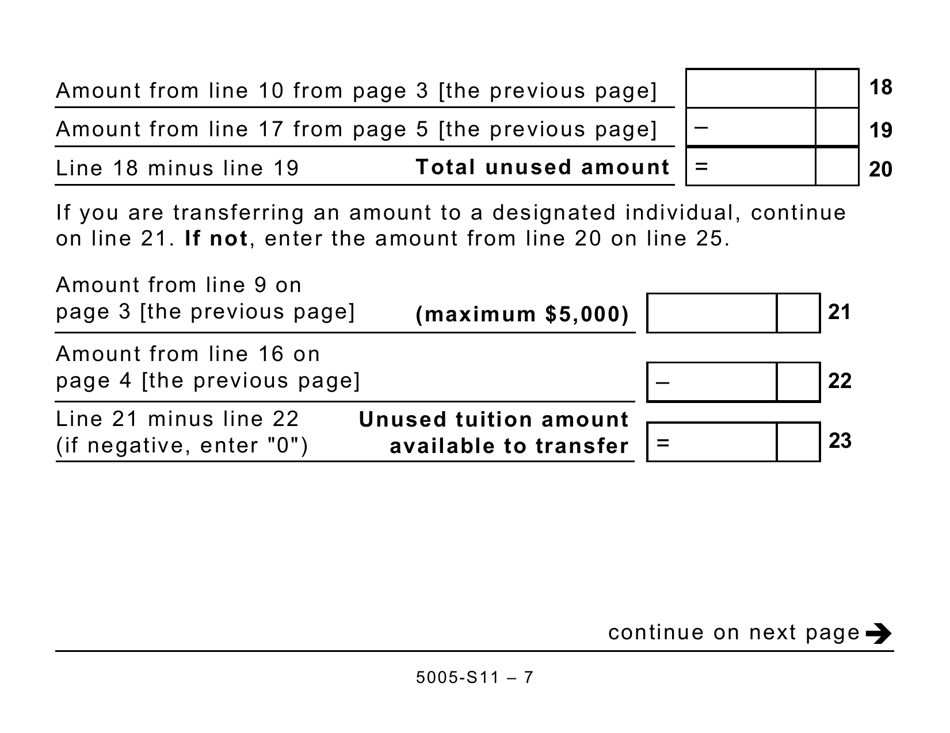

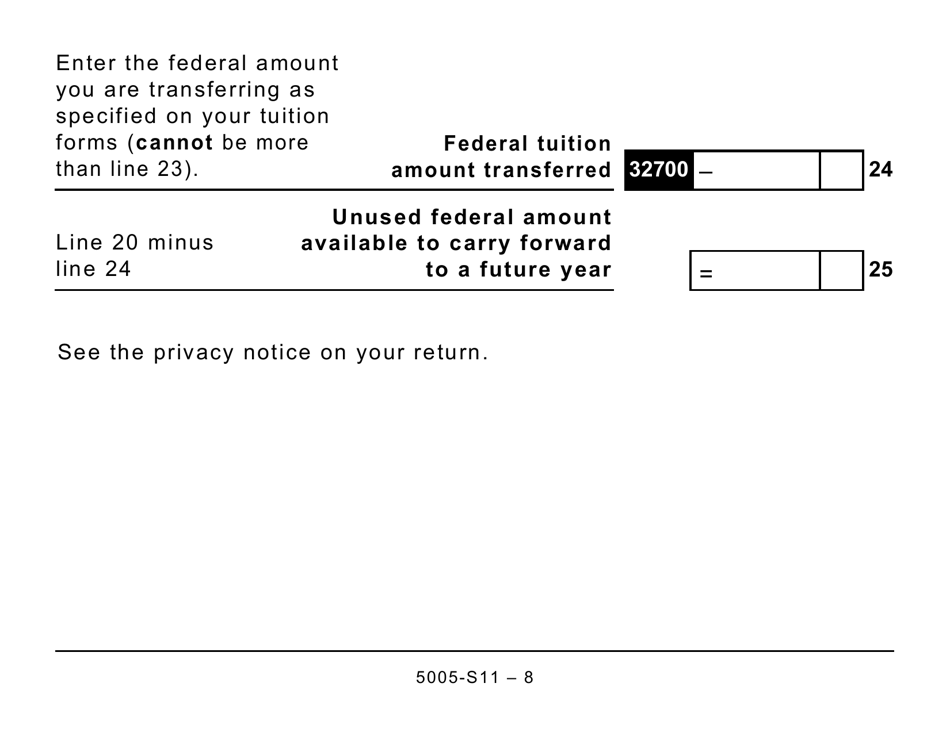

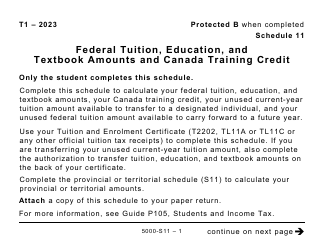

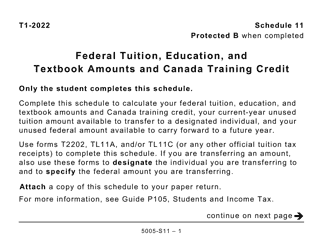

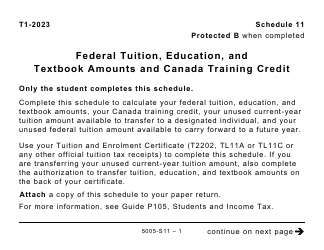

Form 5005-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (Large Print) is used in Canada for claiming tuition, education, textbook amounts, and the Canada Training Credit.

The form 5005-S11 Schedule 11 is filed by individual taxpayers in Canada to claim federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

FAQ

Q: What is Form 5005-S11?

A: Form 5005-S11 is a schedule used in Canada for reporting federal tuition, education, and textbook amounts as well as the Canada Training Credit.

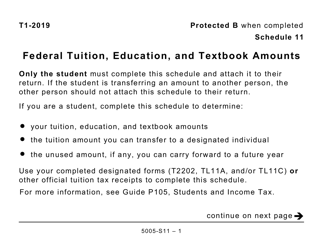

Q: Who needs to use Form 5005-S11?

A: Individuals in Canada who want to claim tuition, education, or textbook amounts, or the Canada Training Credit need to use Form 5005-S11.

Q: What are federal tuition, education, and textbook amounts?

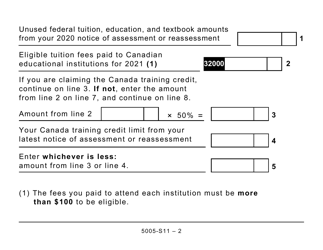

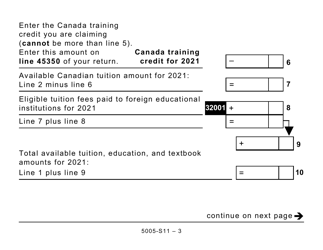

A: Federal tuition, education, and textbook amounts are tax credits that can be claimed by individuals to reduce their income tax payable.

Q: How do I claim the Canada Training Credit?

A: You can claim the Canada Training Credit by completing Schedule 11 on Form 5005-S11 and including it with your income tax return.

Q: Is Form 5005-S11 available in large print?

A: Yes, Form 5005-S11 is available in a large print format for individuals who require it.