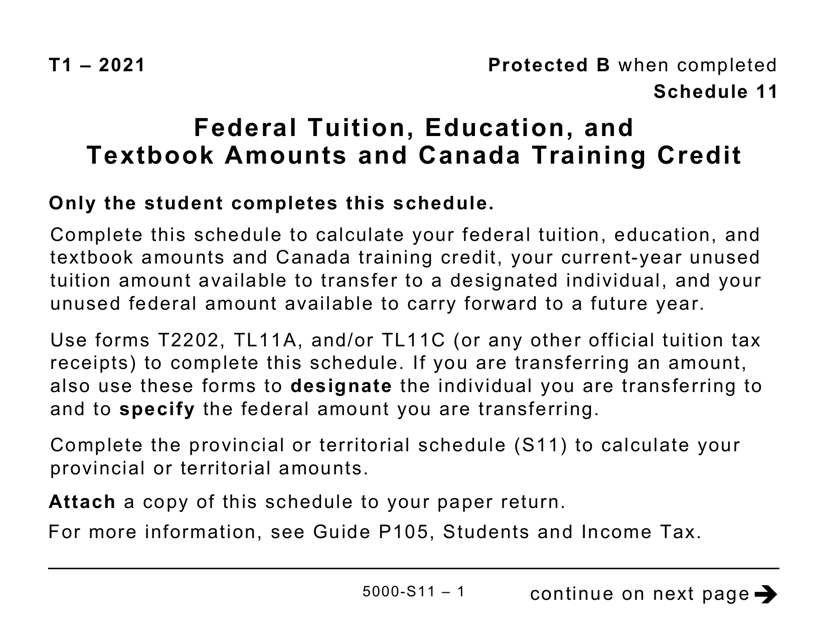

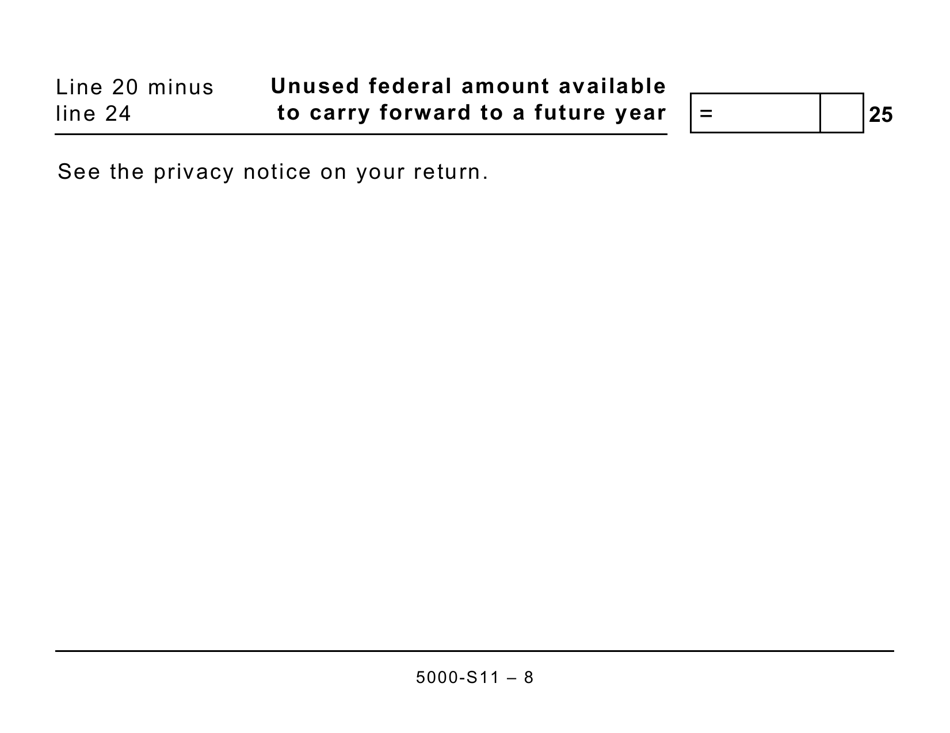

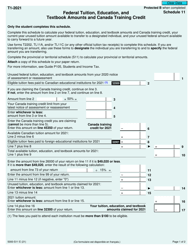

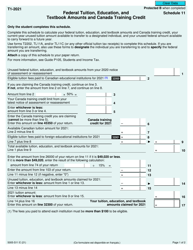

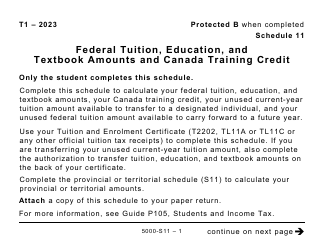

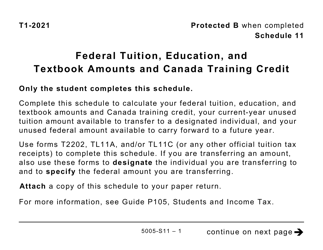

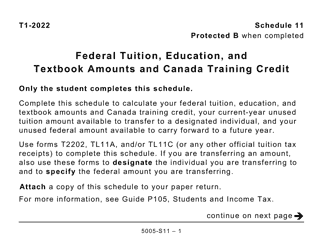

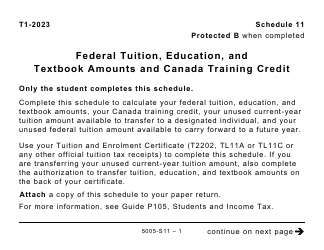

Form 5000-S11 (T1) Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (Large Print) - Canada

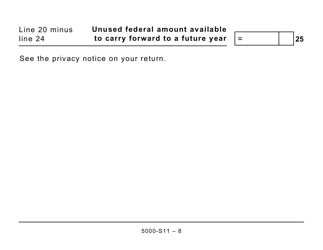

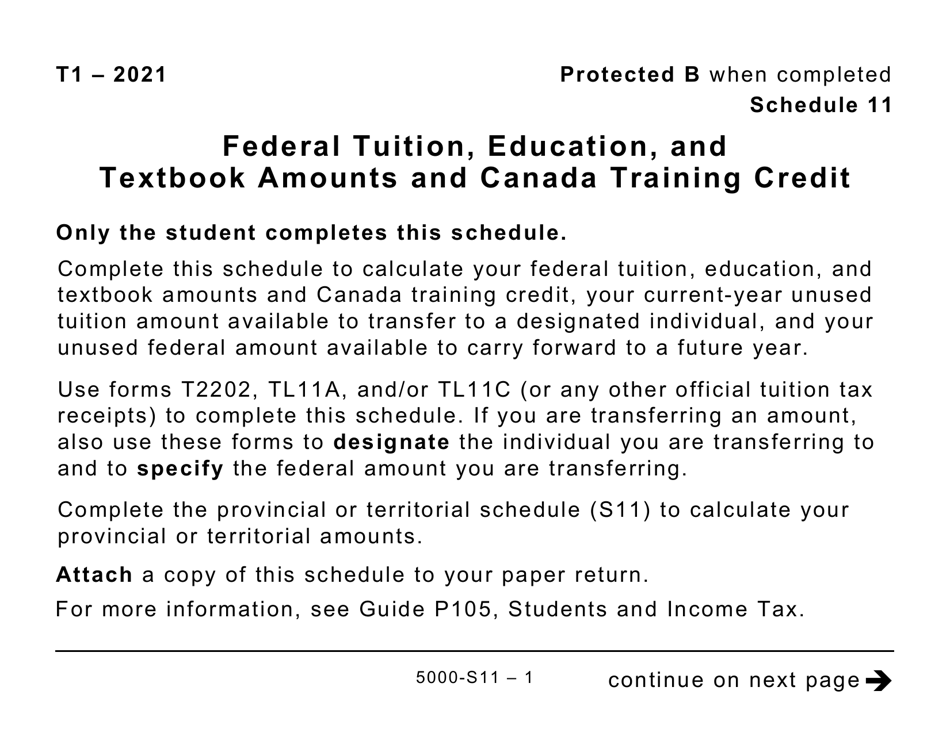

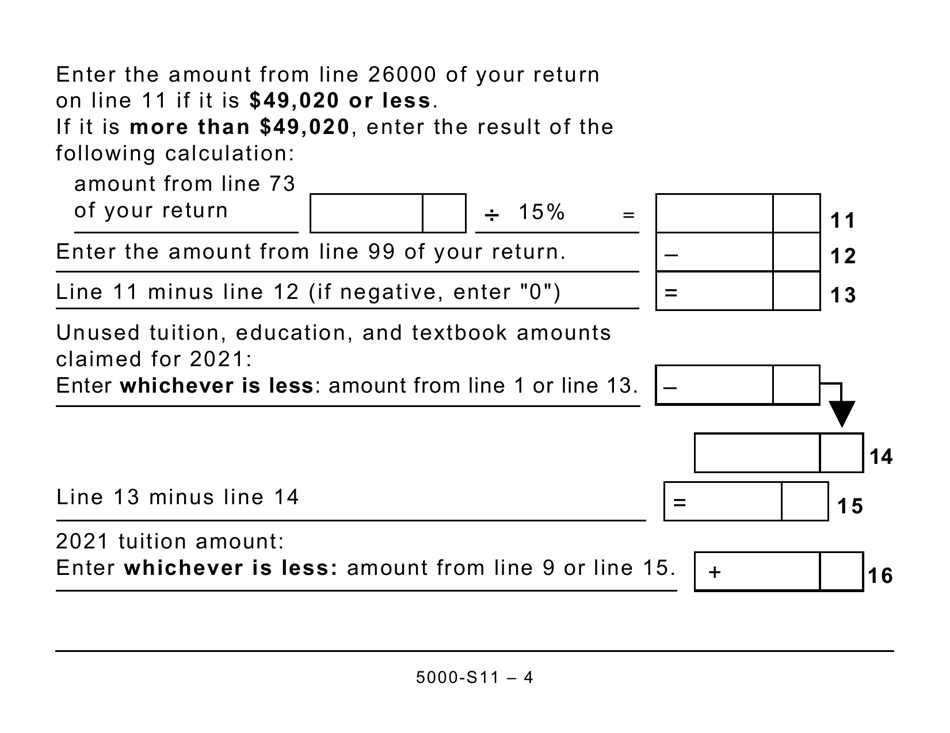

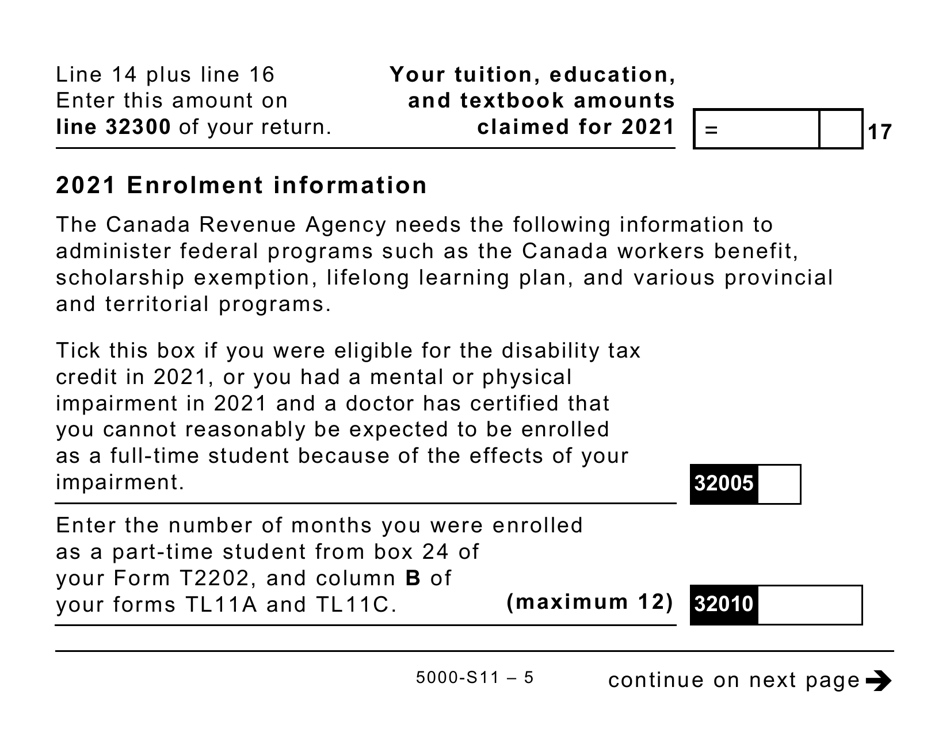

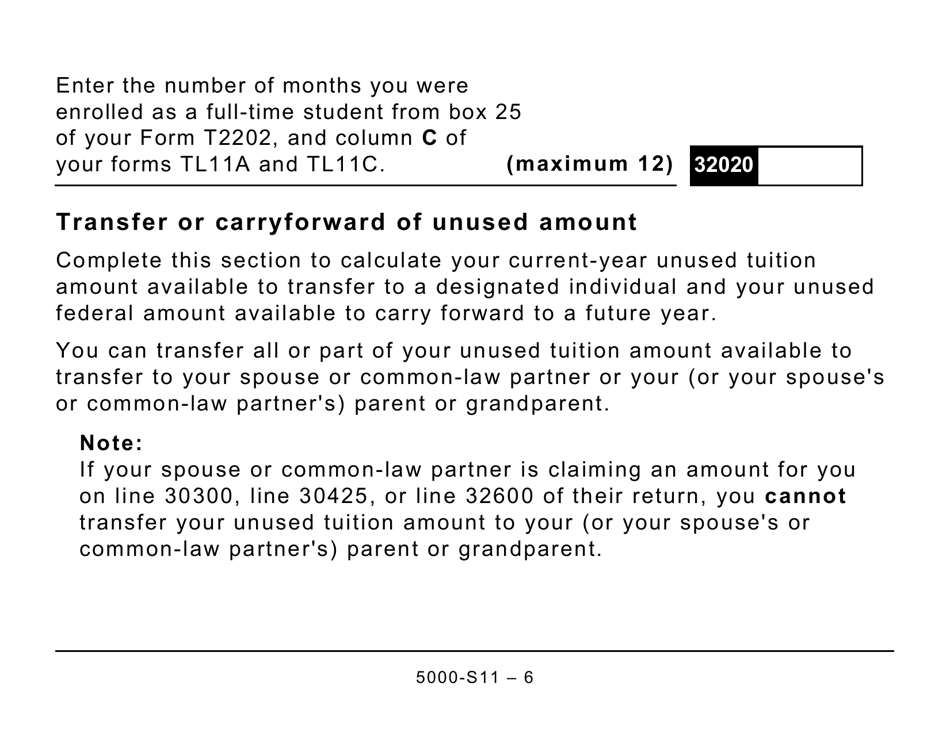

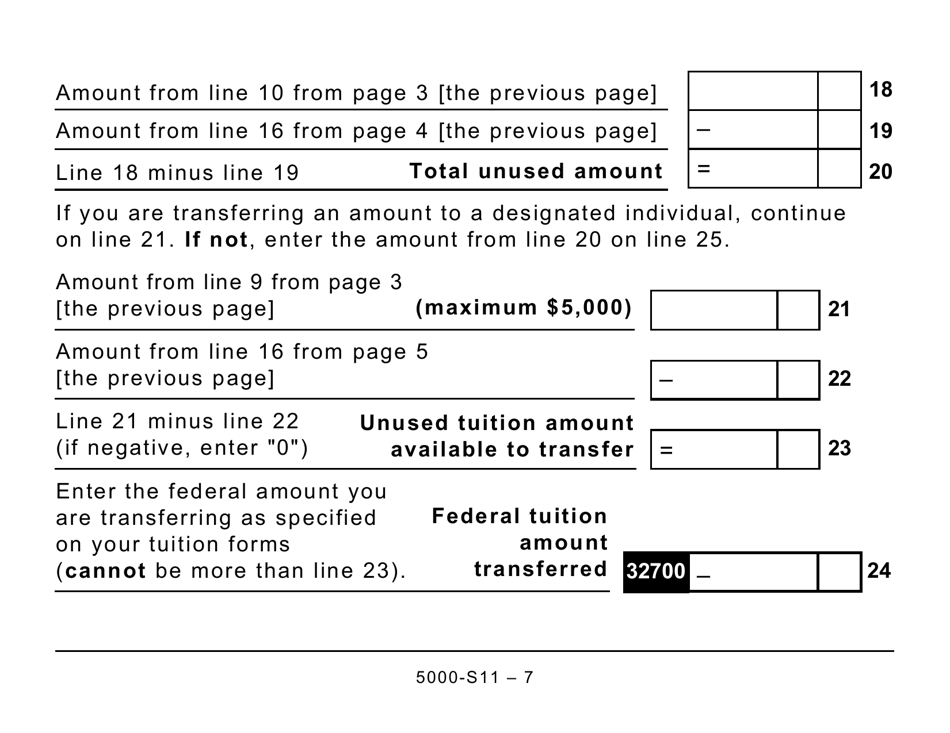

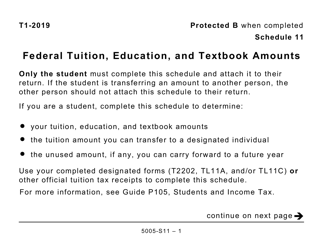

Form 5000-S11 (T1) Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (Large Print) is used in Canada to claim tax credits related to tuition, education, and textbooks, as well as the Canada Training Credit.

Individual taxpayers in Canada file the Form 5000-S11 (T1) Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit.

FAQ

Q: What is Form 5000-S11?

A: Form 5000-S11 is the T1 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit form in Canada.

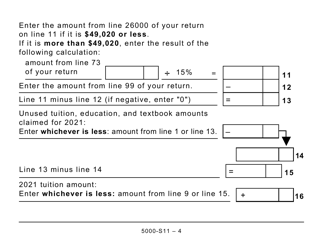

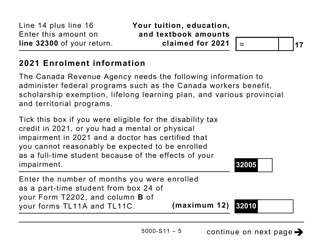

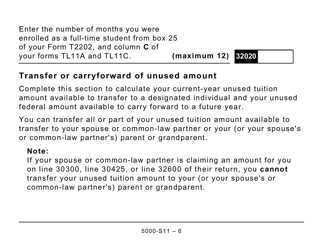

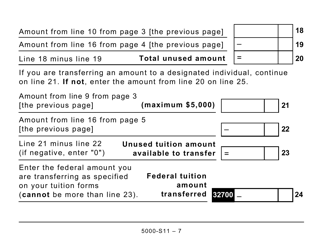

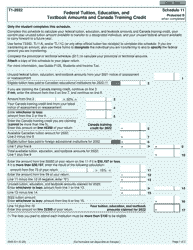

Q: What does Form 5000-S11 calculate?

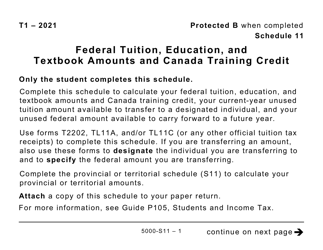

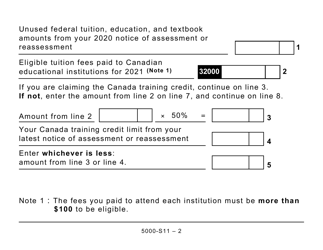

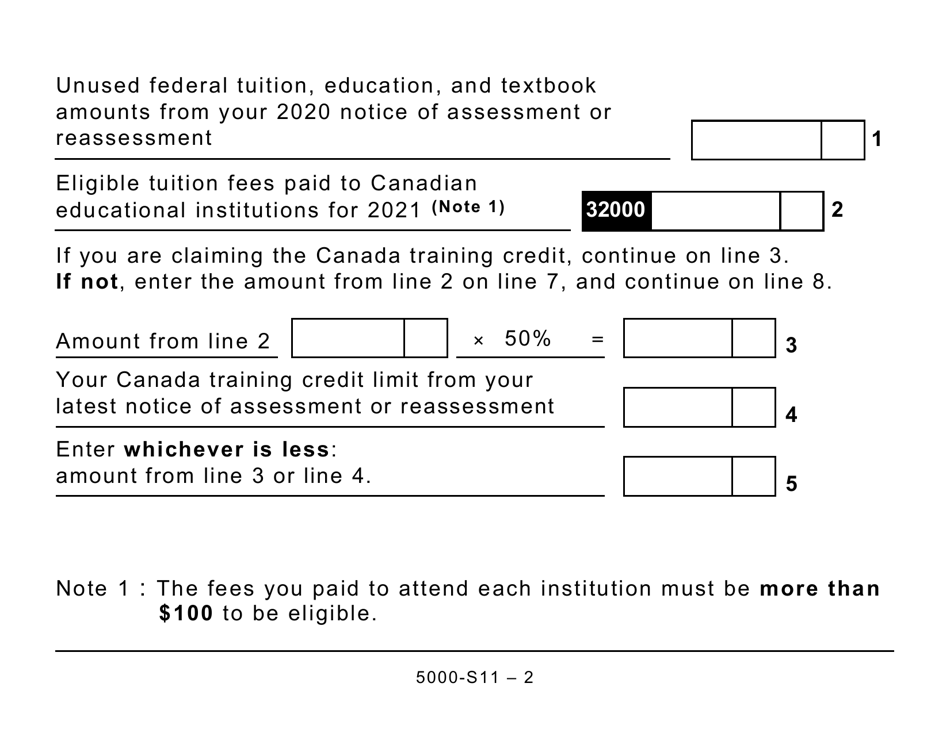

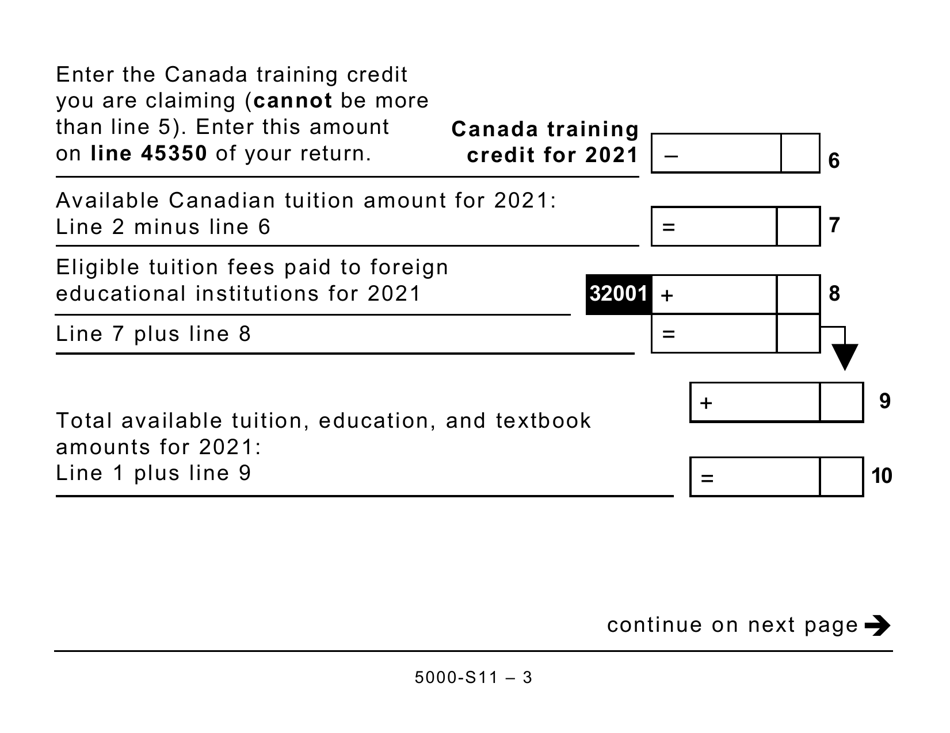

A: Form 5000-S11 is used to calculate the federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

Q: Who should use Form 5000-S11?

A: Form 5000-S11 should be used by individuals who have eligible tuition, education, and textbook amounts, as well as those who qualify for the Canada Training Credit.

Q: What is the Canada Training Credit?

A: The Canada Training Credit is a refundable tax credit designed to help individuals cover the cost of eligible training expenses.

Q: What are the eligibility criteria for the Canada Training Credit?

A: To be eligible for the Canada Training Credit, an individual must be between the ages of 25 and 64, have earned income in the previous year, and have a cumulative limit of $10,000 in eligible tuition and fees.

Q: Is Form 5000-S11 applicable to residents of the United States?

A: No, Form 5000-S11 is specific to residents of Canada.

Q: What should I do if I need help with Form 5000-S11?

A: If you need assistance with Form 5000-S11, you can contact the Canada Revenue Agency directly or consult with a tax professional.