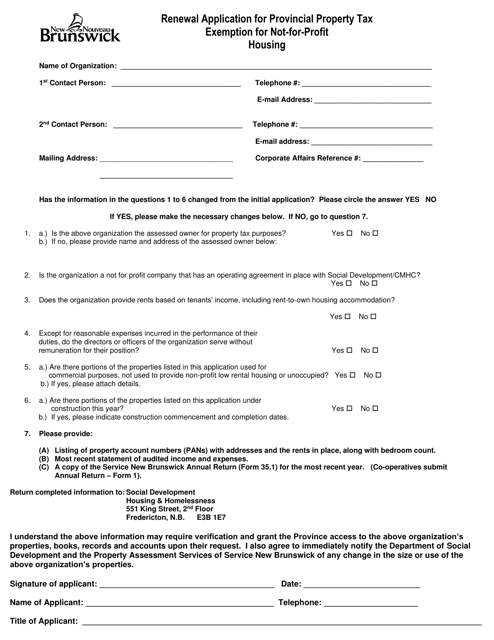

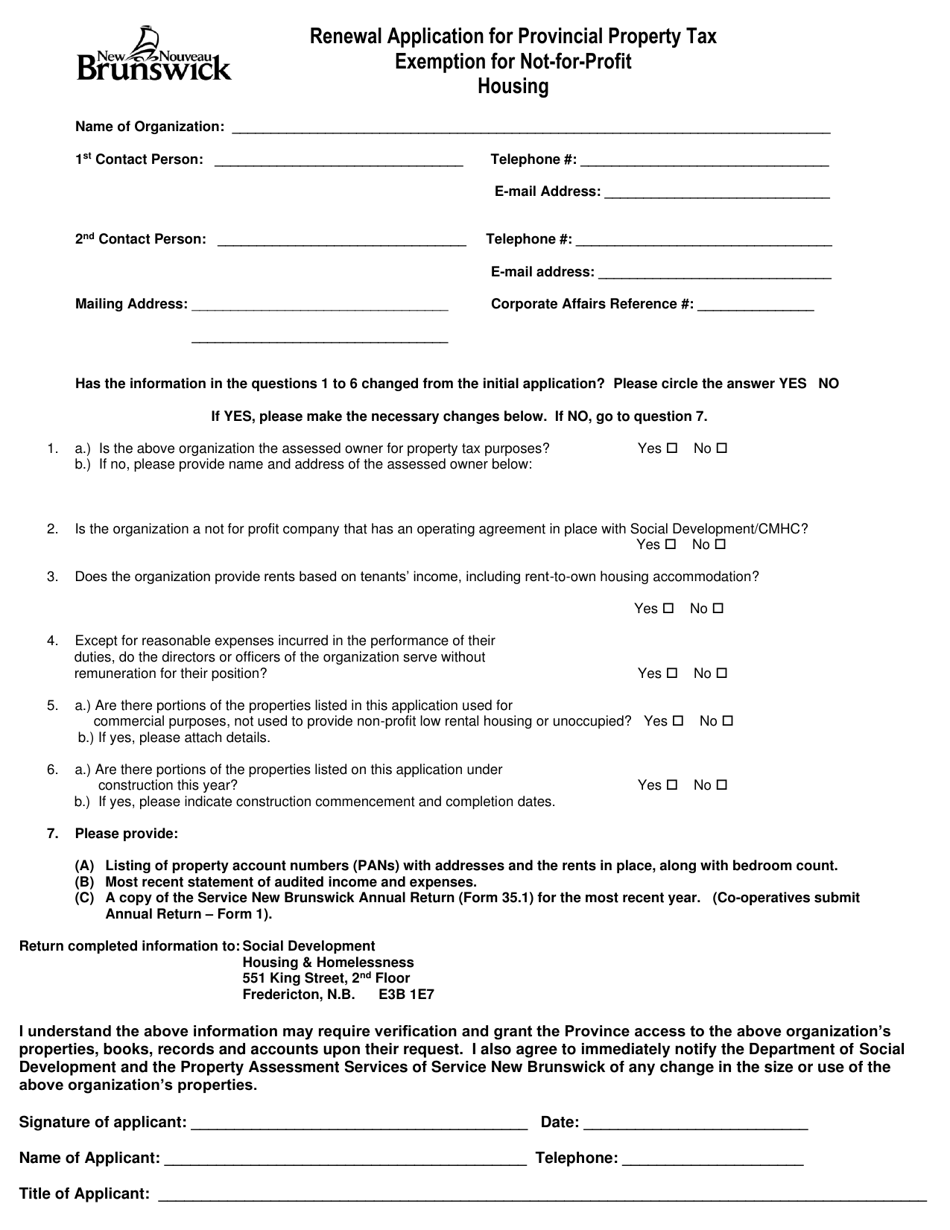

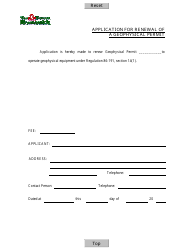

Renewal Application for Provincial Property Tax Exemption for Not-For-Profit Housing - New Brunswick, Canada

The Renewal Application for Provincial Property Tax Exemption for Not-For-Profit Housing in New Brunswick, Canada is used by not-for-profit housing organizations to request a renewal of their property tax exemption for eligible properties. It allows these organizations to continue receiving exemptions from property taxes as long as they meet the required criteria.

FAQ

Q: What is the Renewal Application for Provincial Property Tax Exemption for Not-For-Profit Housing?

A: The Renewal Application is a form that not-for-profit housing organizations in New Brunswick need to complete to request a property tax exemption.

Q: Who is eligible for the Provincial Property Tax Exemption?

A: Not-for-profit housing organizations in New Brunswick are eligible for the Provincial Property Tax Exemption.

Q: What is the purpose of the Provincial Property Tax Exemption?

A: The purpose of the Provincial Property Tax Exemption is to provide financial relief to not-for-profit housing organizations by exempting them from paying property taxes.

Q: How can I get the Renewal Application form?

A: You can obtain the Renewal Application form for the Provincial Property Tax Exemption for Not-For-Profit Housing in New Brunswick by contacting the appropriate government office or department.

Q: What information do I need to provide on the Renewal Application?

A: The Renewal Application form will ask for details about your organization, the properties you own, and any changes that have occurred since your last application.