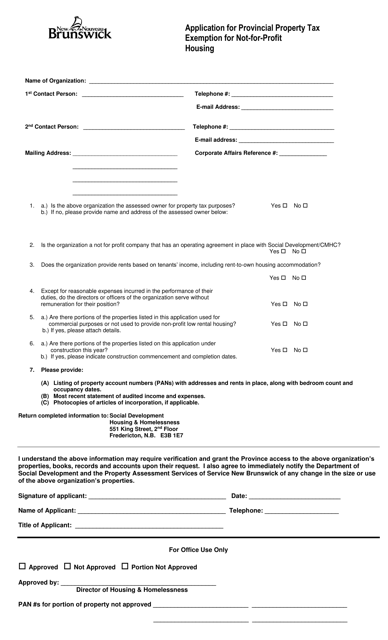

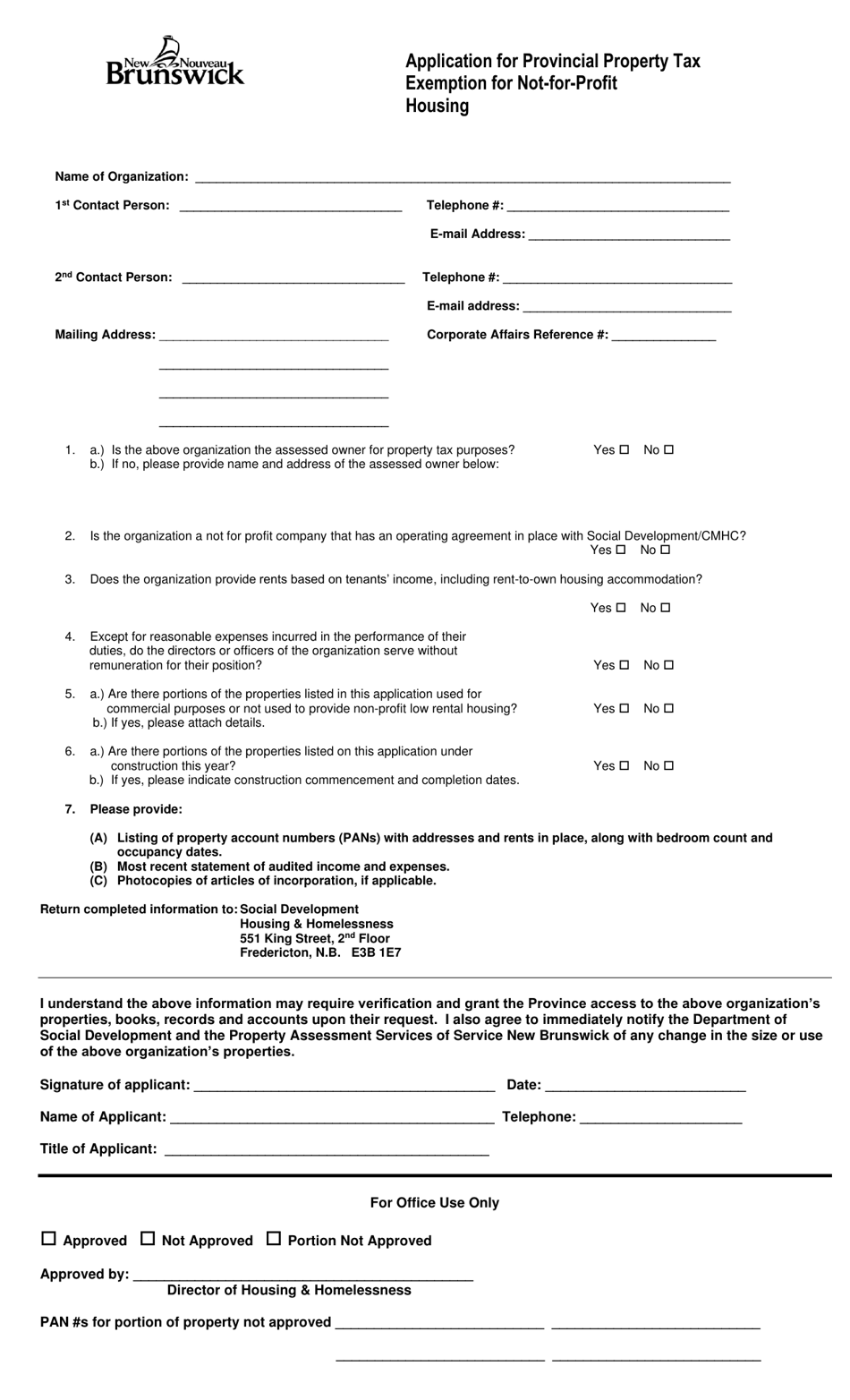

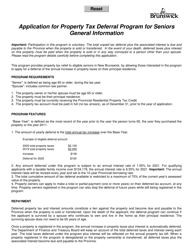

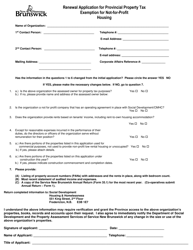

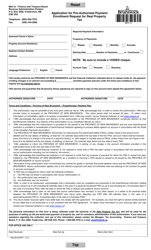

Application for Provincial Property Tax Exemption for Not-For-Profit Housing - New Brunswick, Canada

The Application for Provincial Property Tax Exemption for Not-For-Profit Housing in New Brunswick, Canada, is used to apply for a tax exemption on property owned by not-for-profit housing organizations. It allows these organizations to potentially lower their property tax obligations.

In New Brunswick, Canada, the application for provincial property tax exemption for not-for-profit housing is typically filed by the organization or entity that owns the housing property.

FAQ

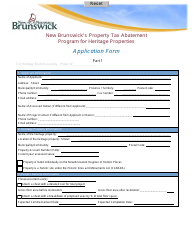

Q: What is the Provincial Property Tax Exemption for Not-For-Profit Housing?

A: The Provincial Property Tax Exemption for Not-For-Profit Housing is a program in New Brunswick, Canada that provides tax relief for eligible non-profit housing organizations.

Q: Who is eligible for the Provincial Property Tax Exemption?

A: Non-profit housing organizations in New Brunswick are typically eligible for the Provincial Property Tax Exemption.

Q: What is the purpose of the tax exemption?

A: The purpose of the tax exemption is to support the development and operation of affordable housing for low-income individuals and families in New Brunswick.

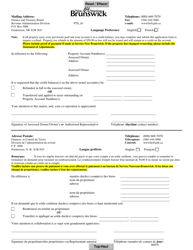

Q: How can a non-profit housing organization apply for the tax exemption?

A: Non-profit housing organizations can apply for the tax exemption by submitting an application to the provincial government in New Brunswick.

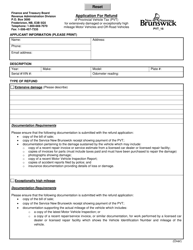

Q: What documents are required for the application?

A: The application for the tax exemption may require various documents, such as financial statements, property assessments, and proof of non-profit status.

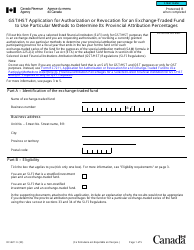

Q: Is there a deadline for applying?

A: There may be a specific deadline for submitting the application, so it's important to check with the provincial government for the current deadline.

Q: Are there any fees associated with the application process?

A: There may be fees associated with the application process, such as an application fee or administrative fees. These fees can vary, so it's important to review the application guidelines.

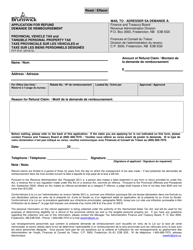

Q: What happens after the application is submitted?

A: After the application is submitted, it will be reviewed by the provincial government. If approved, the non-profit housing organization may receive a property tax exemption for eligible properties.

Q: How long does the tax exemption last?

A: The tax exemption typically lasts for a specific period of time, such as a certain number of years, and may need to be renewed.

Q: Are there any conditions or requirements for maintaining the tax exemption?

A: There may be conditions or requirements for maintaining the tax exemption, such as ongoing reporting or compliance with certain regulations. Non-profit housing organizations should review the terms of the tax exemption carefully.