This version of the form is not currently in use and is provided for reference only. Download this version of

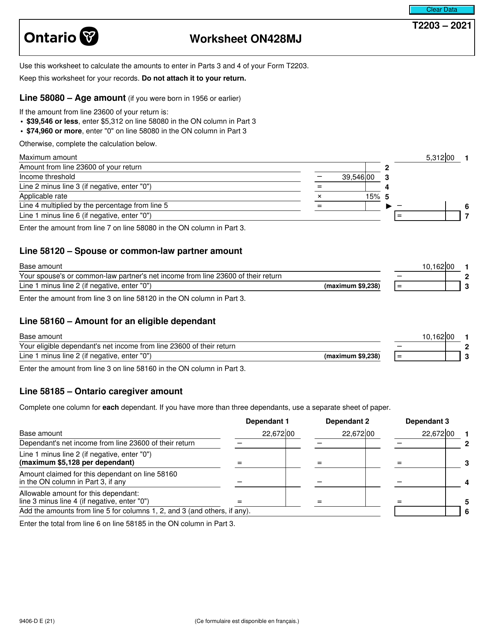

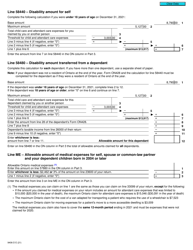

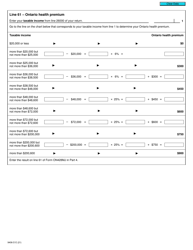

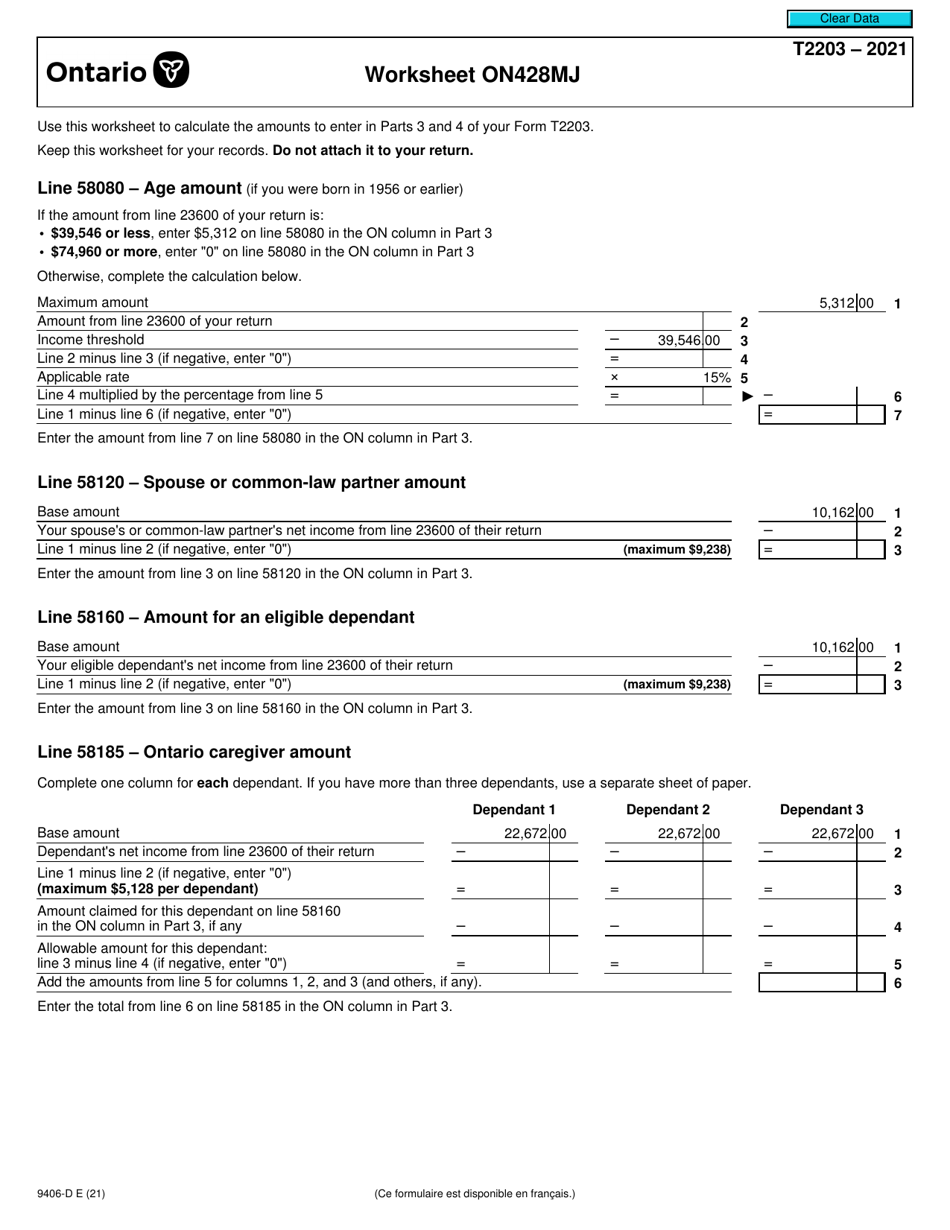

Form T2203 (9406-D) Worksheet ON428MJ

for the current year.

Form T2203 (9406-D) Worksheet ON428MJ Ontario - Canada

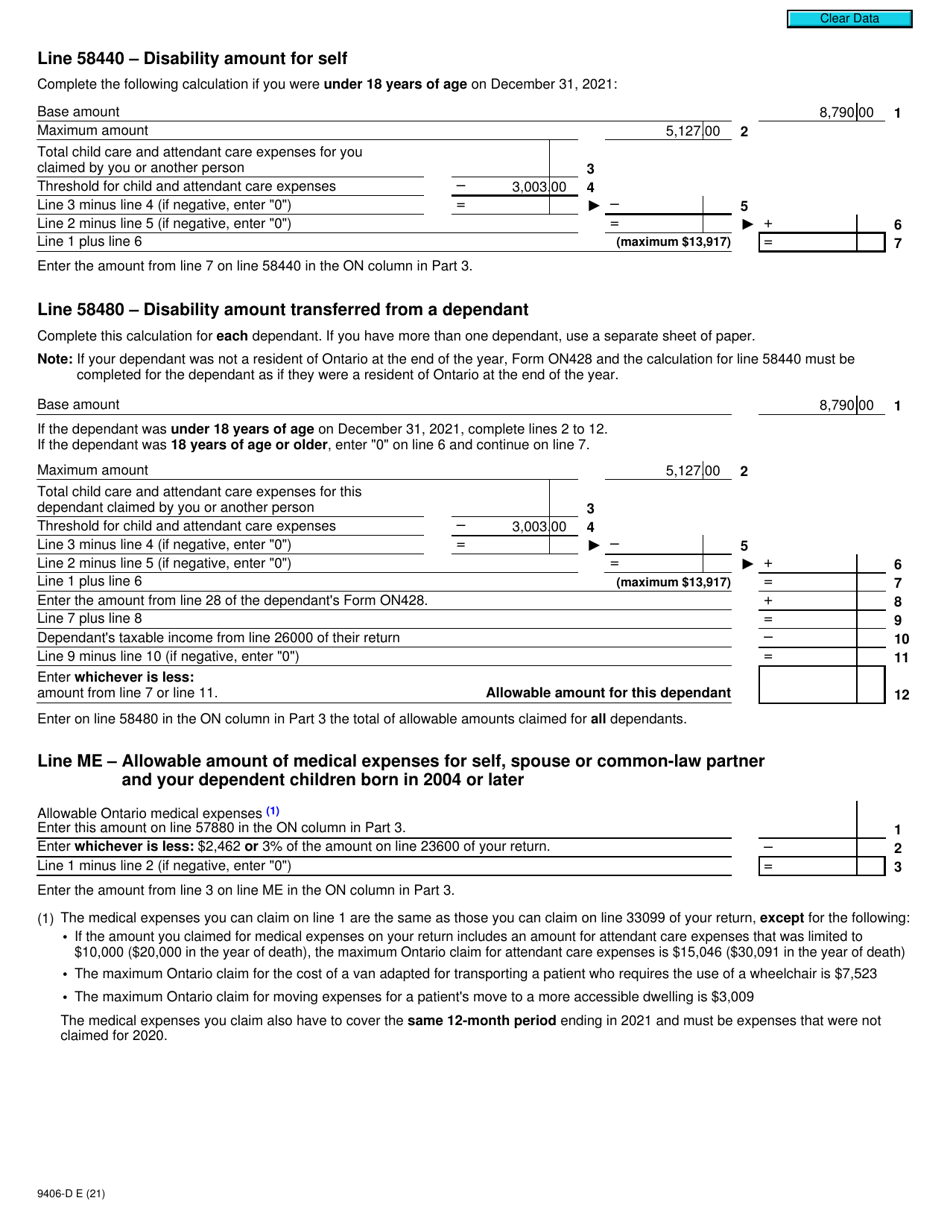

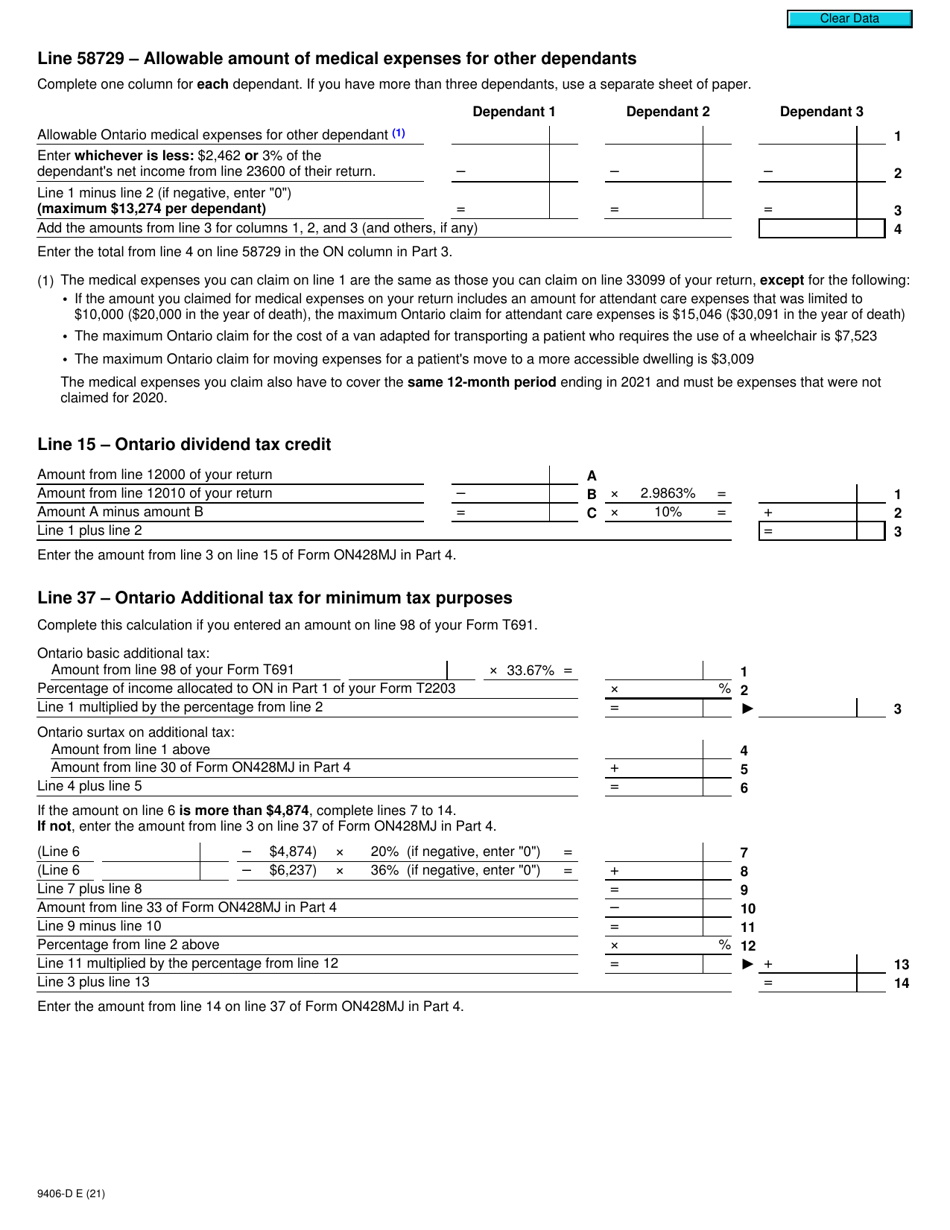

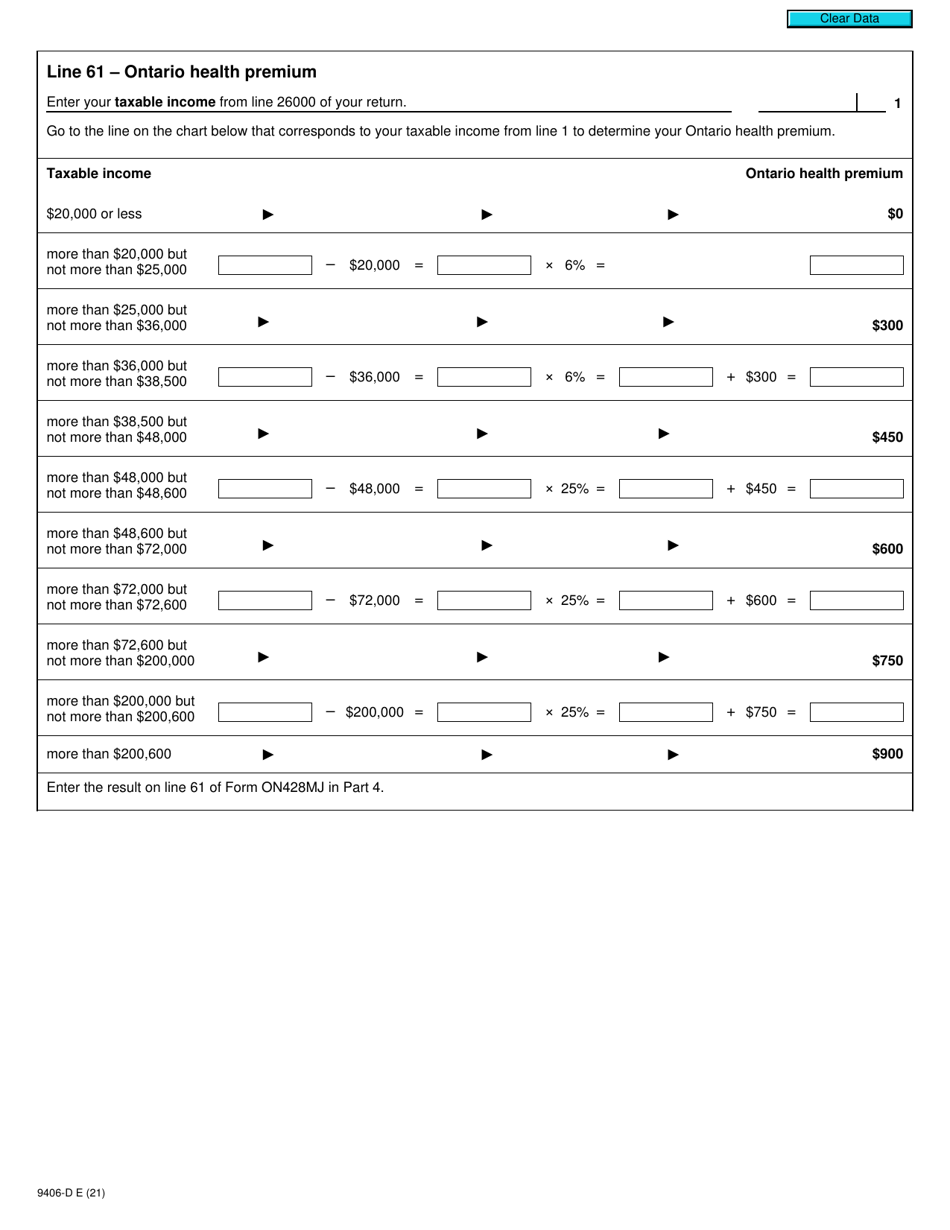

Form T2203 (formerly known as Form 9406-D) is a worksheet in Canada specifically for residents of Ontario. This form is used to calculate your provincial tax credits and deductions when completing your income tax return for Ontario. It helps you determine the amount of provincial tax payable or refundable.

The Form T2203 (9406-D) Worksheet ON428MJ in Ontario, Canada is filed by individuals who need to calculate their Ontario tax credits.

FAQ

Q: What is Form T2203 (9406-D) Worksheet ON428MJ?

A: Form T2203 (9406-D) Worksheet ON428MJ is a tax form used in Ontario, Canada to calculate provincial tax credits and deductions.

Q: What is the purpose of Form T2203 (9406-D) Worksheet ON428MJ?

A: The purpose of this form is to assist residents of Ontario in calculating their provincial tax credits and deductions to be reported on their income tax return.

Q: Can I use Form T2203 (9406-D) Worksheet ON428MJ if I live in the United States?

A: No, Form T2203 (9406-D) Worksheet ON428MJ is specifically for residents of Ontario, Canada. If you live in the United States, you would need to file your taxes with the appropriate U.S. tax forms.

Q: What information do I need to complete Form T2203 (9406-D) Worksheet ON428MJ?

A: To complete this form, you will need information about your income, deductions, and credits relevant to Ontario, such as tuition fees, medical expenses, and child care expenses.

Q: When is the deadline to file Form T2203 (9406-D) Worksheet ON428MJ?

A: The deadline to file Form T2203 (9406-D) Worksheet ON428MJ is usually April 30th of each year for most individuals. However, it is important to check with the CRA or a tax professional for any specific deadlines or extensions that may apply.

Q: Can I e-file Form T2203 (9406-D) Worksheet ON428MJ?

A: Yes, you can electronically file Form T2203 (9406-D) Worksheet ON428MJ using netfile, a service provided by the CRA.