This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243 Schedule A

for the current year.

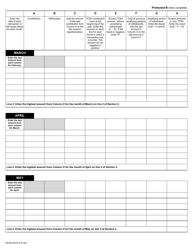

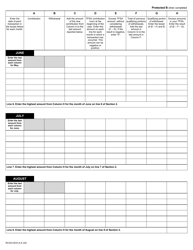

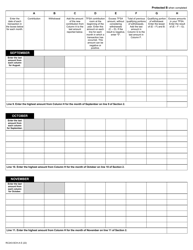

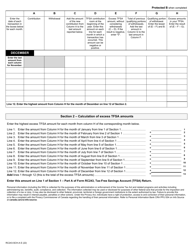

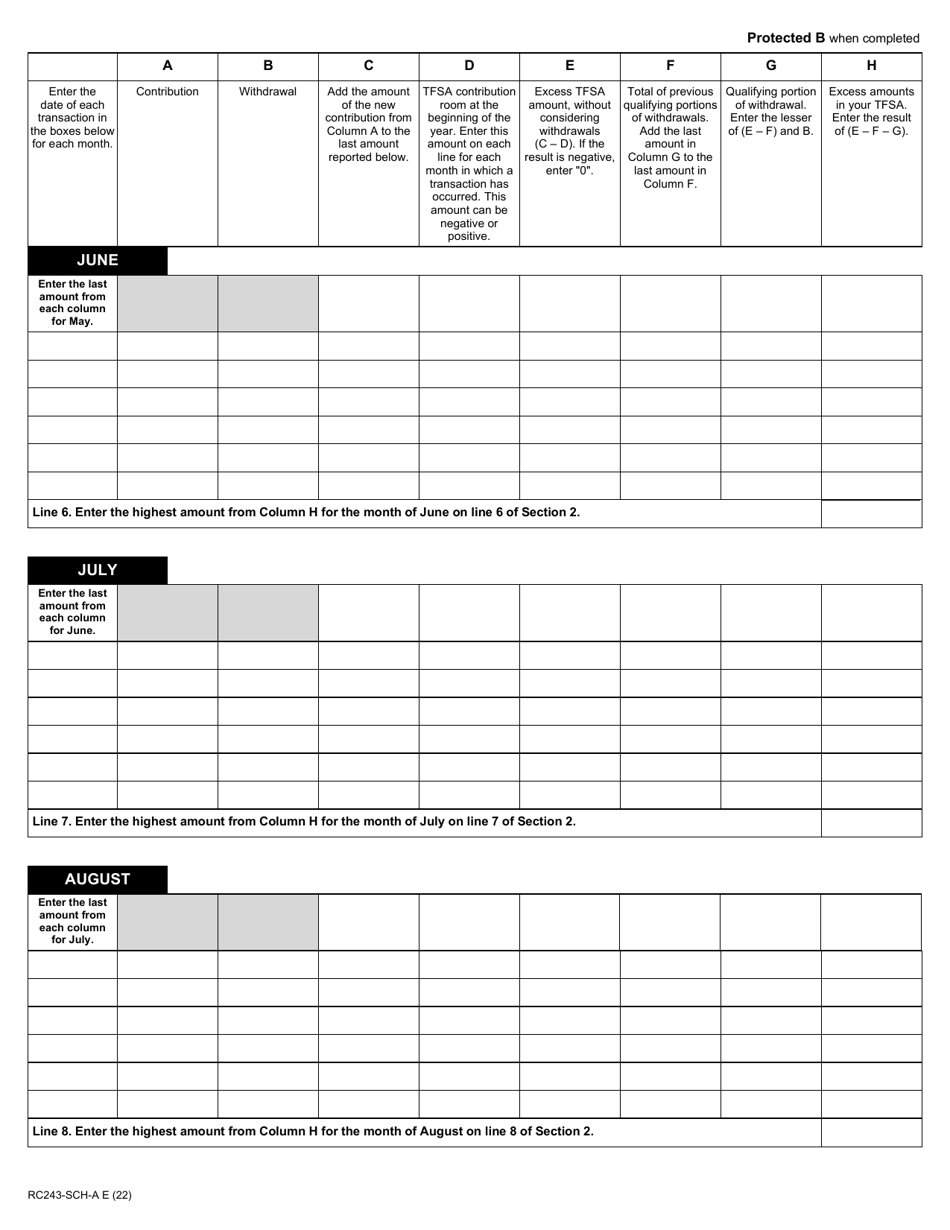

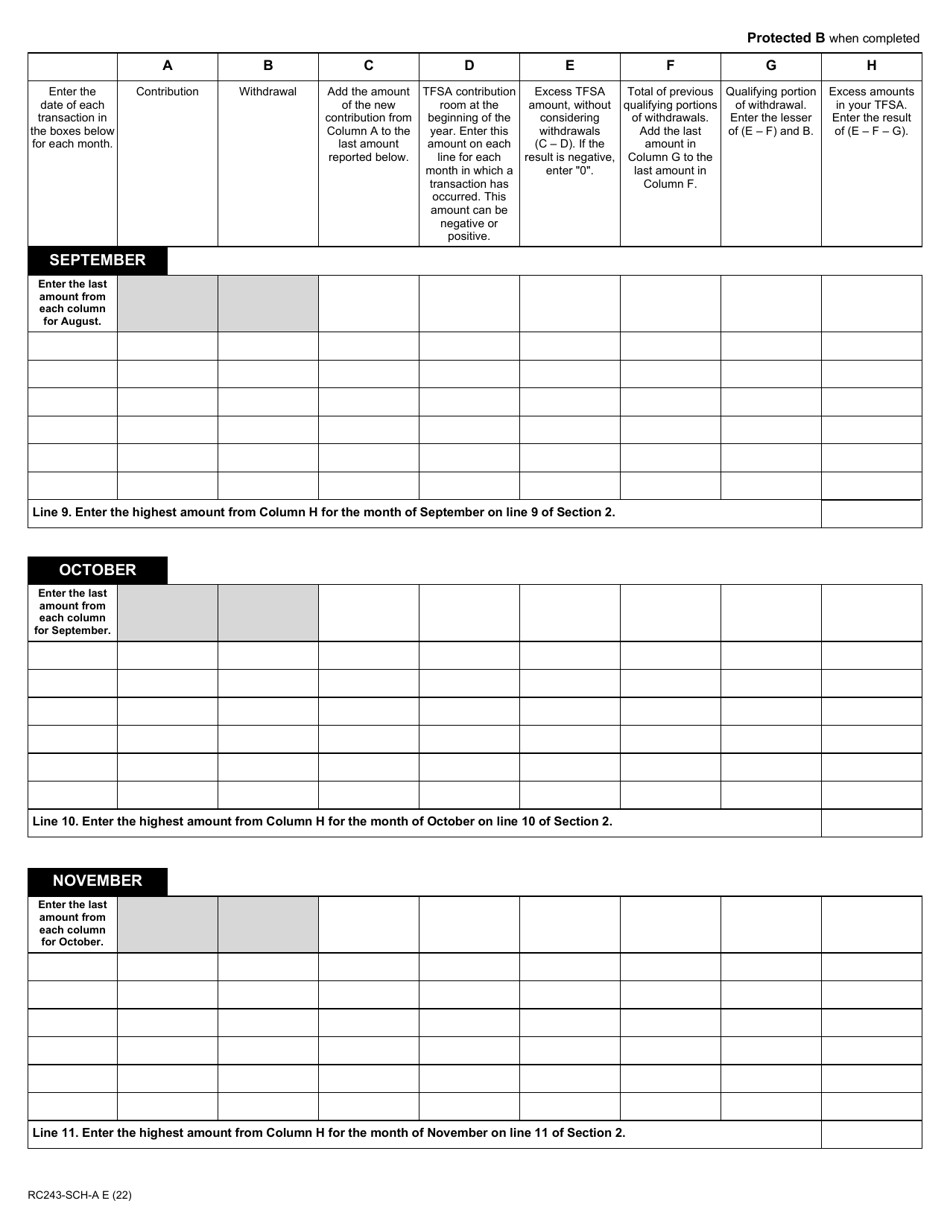

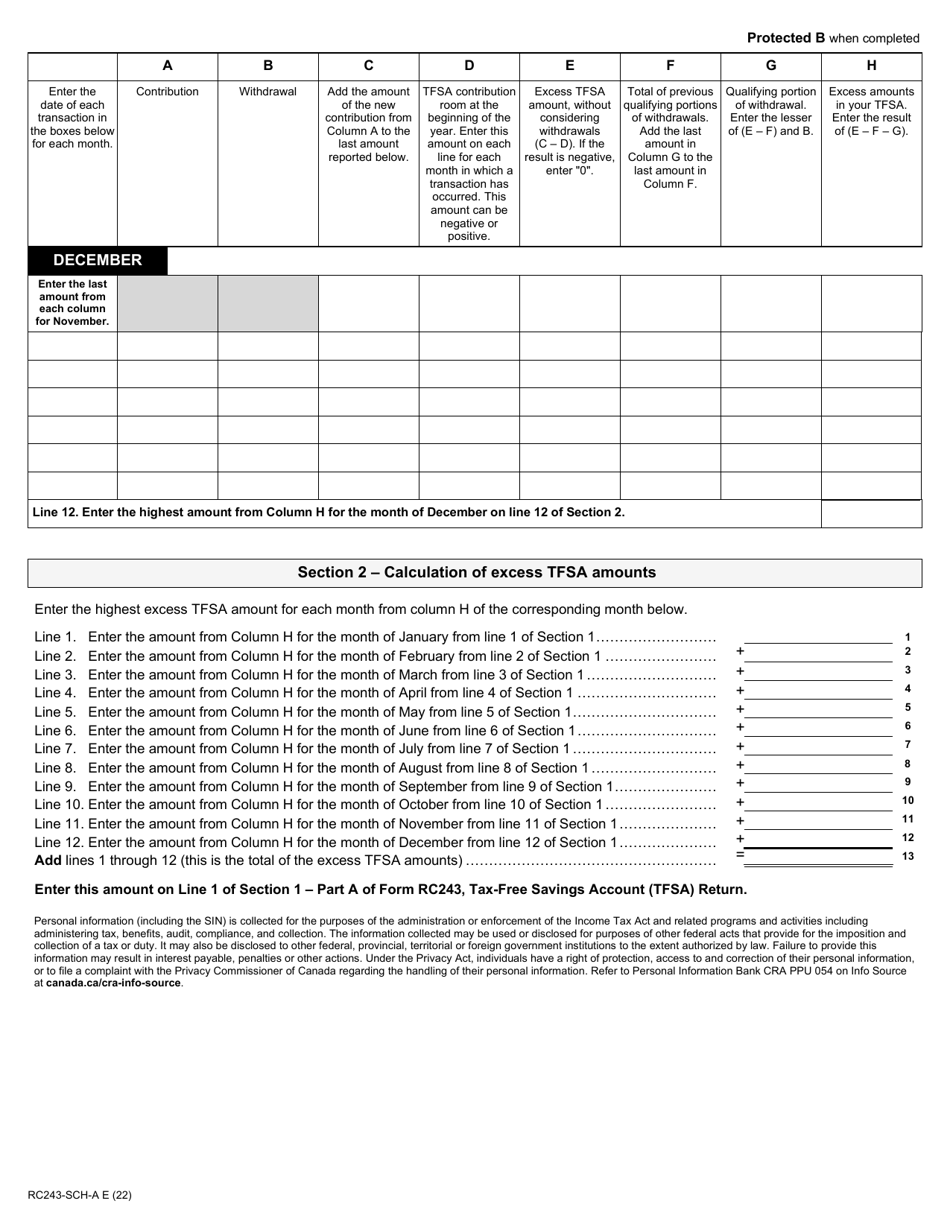

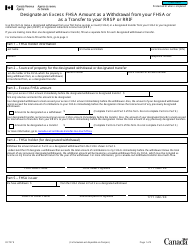

Form RC243 Schedule A Excess Tfsa Amounts - Canada

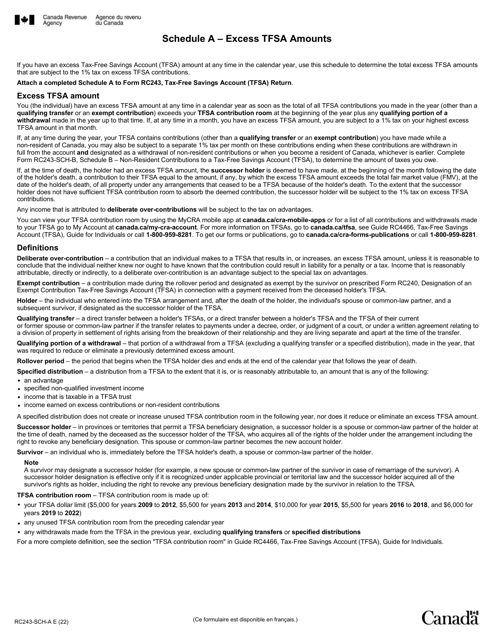

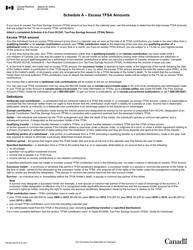

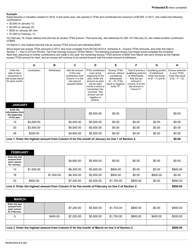

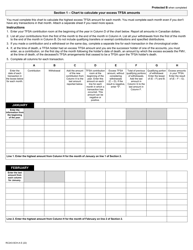

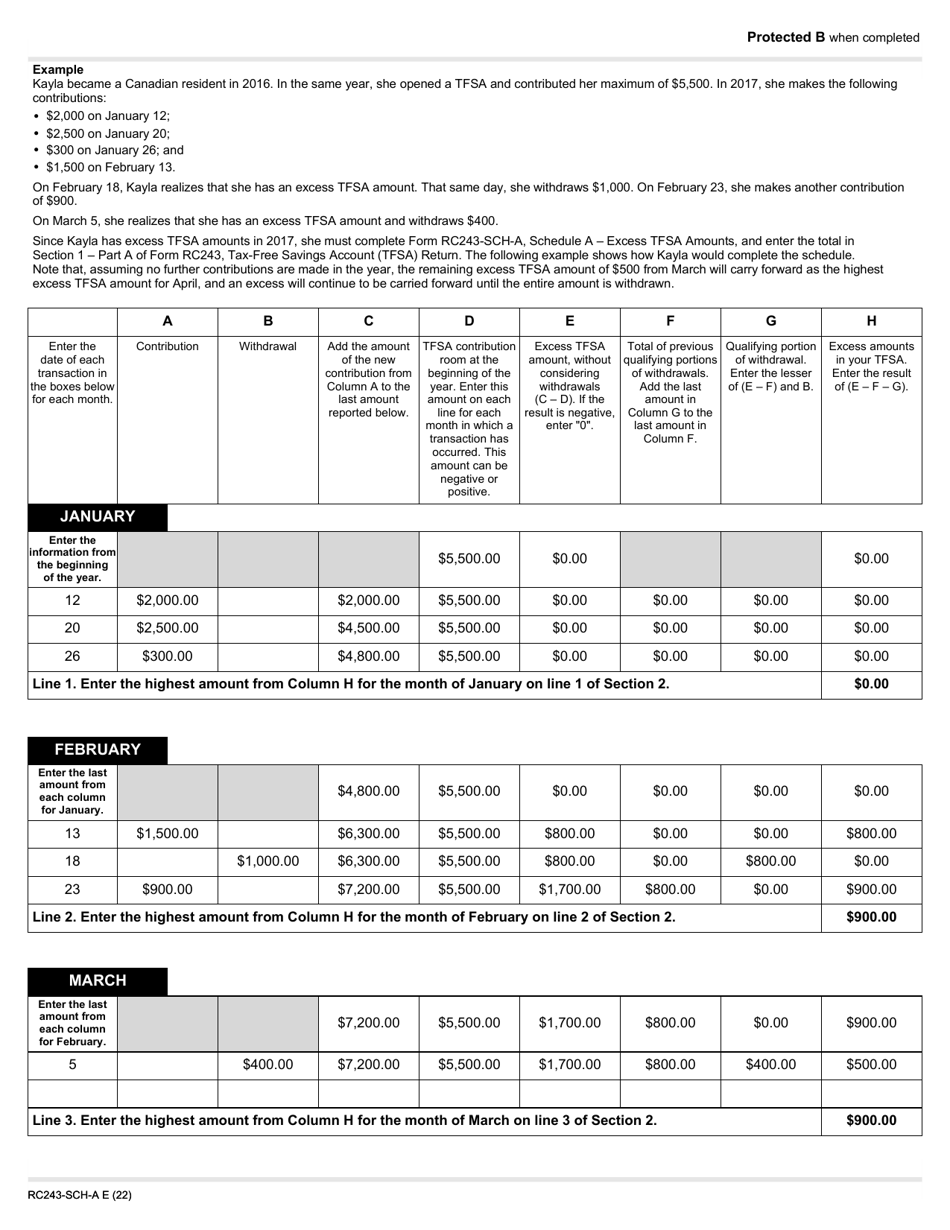

Form RC243 Schedule A Excess TFSA Amounts in Canada is used to report any excess contributions made to a tax-free savings account (TFSA). TFSA is an account where individuals can save and invest money without paying taxes on the investment income or withdrawals made from the account. However, there are certain contribution limits set by the government, and if someone contributes more than the allowed amount, they may face penalties. Form RC243 Schedule A helps individuals declare and calculate the excess TFSA contributions they have made, ensuring compliance with the tax regulations.

The Form RC243 Schedule A Excess TFSA Amounts in Canada is filed by individuals who have contributed more than their allowable limit to their Tax-Free Savings Account (TFSA) and need to report this excess amount to the Canada Revenue Agency (CRA). This form helps individuals calculate and declare their overcontribution, which may result in penalties or tax consequences. It is important to consult with a tax professional or refer to the official CRA guidelines for detailed instructions on how to complete and file this form.

FAQ

Q: What is Form RC243 Schedule A?

A: Form RC243 Schedule A is a tax form used in Canada to report excess Tax-Free Savings Account (TFSA) amounts.

Q: What are excess TFSA amounts?

A: Excess TFSA amounts refer to contributions that exceed the TFSA contribution limit set by the Canadian government.

Q: When should I use Form RC243 Schedule A?

A: You should use Form RC243 Schedule A if you have made excess contributions to your Tax-Free Savings Account.

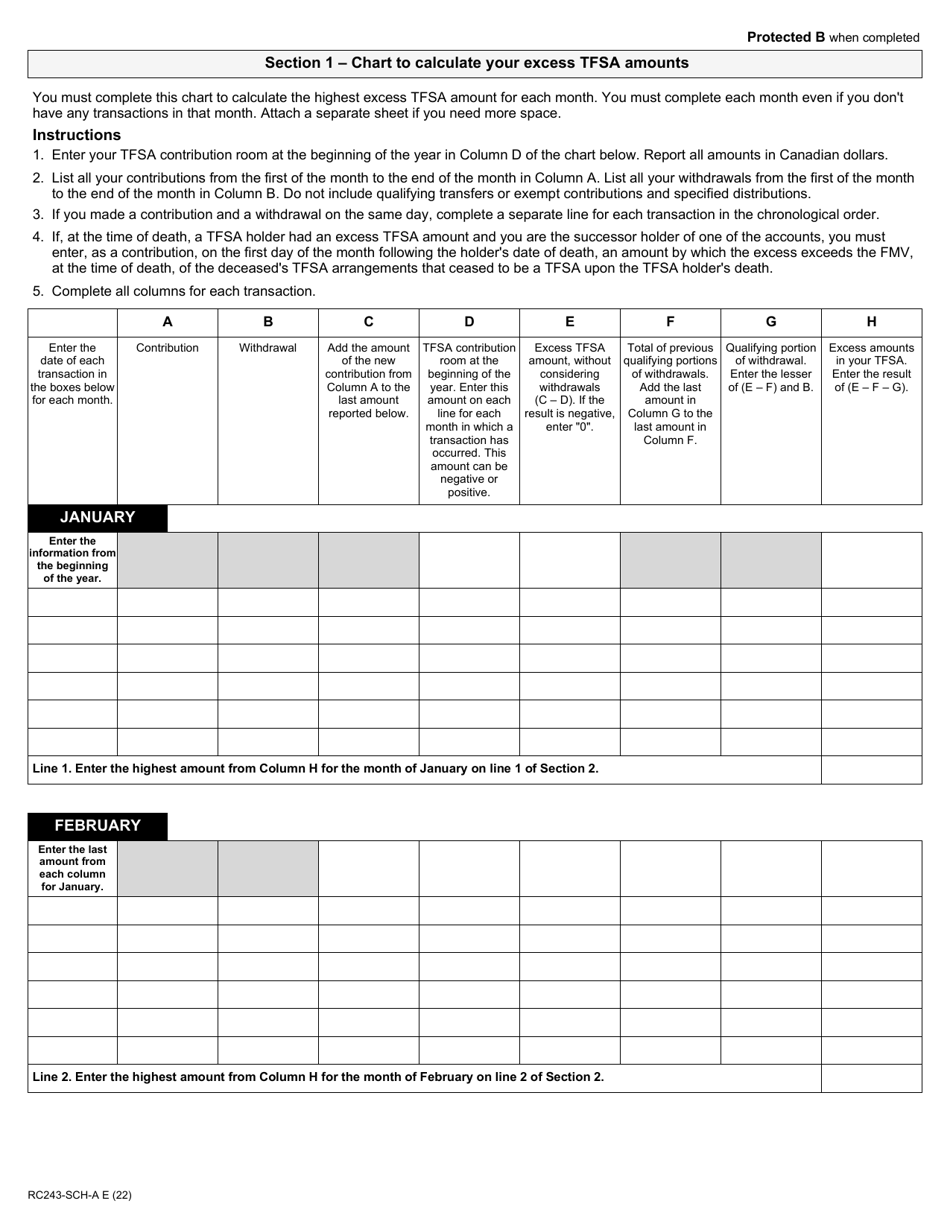

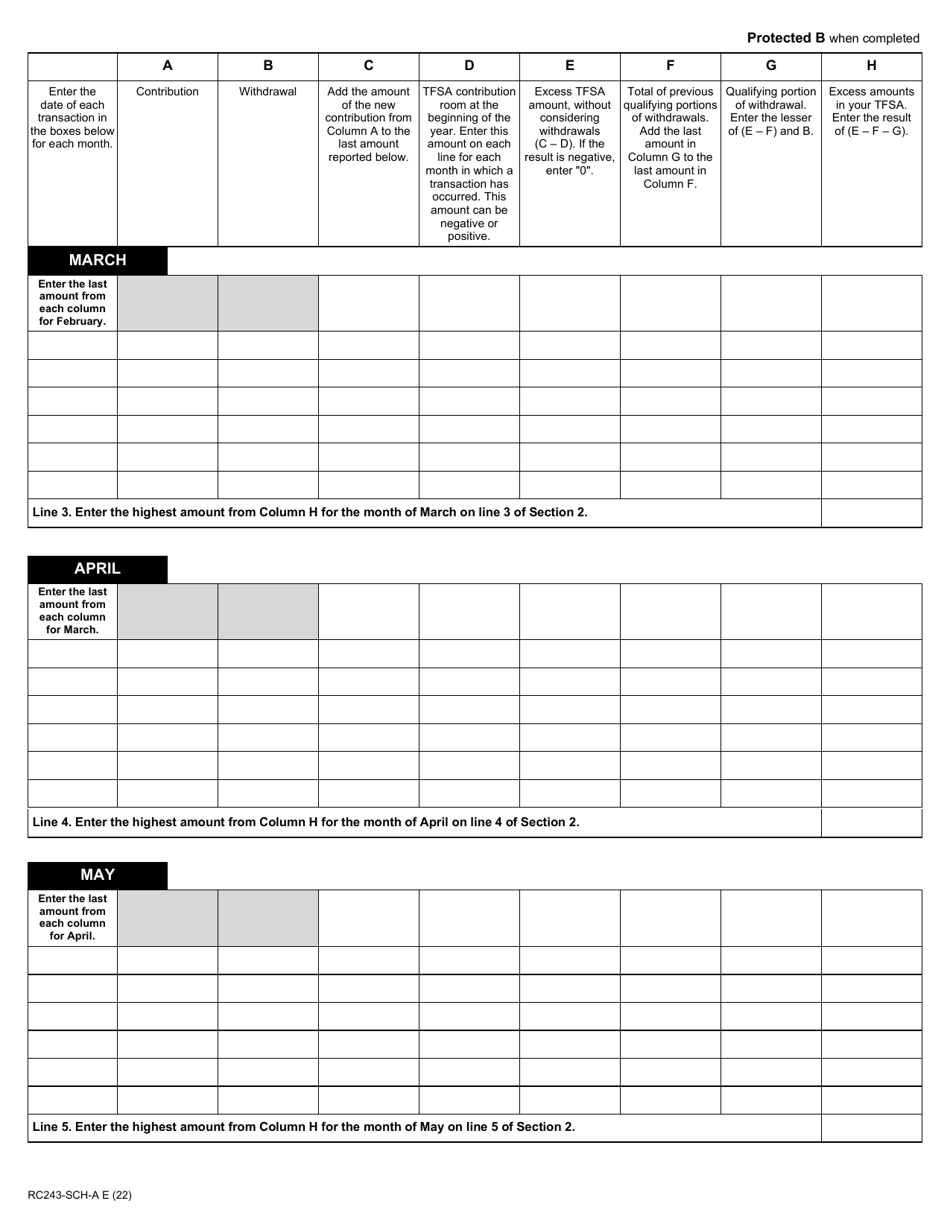

Q: How do I complete Form RC243 Schedule A?

A: To complete Form RC243 Schedule A, you need to provide your personal information, details of your excess TFSA contributions, and calculate the applicable tax.

Q: What happens if I don't report excess TFSA amounts?

A: If you fail to report excess TFSA amounts, you may incur penalties and have to pay tax on the excess contributions.

Q: Is there a deadline for filing Form RC243 Schedule A?

A: Yes, Form RC243 Schedule A should be filed on or before the deadline for filing your income tax return, which is generally April 30th of the following year.

Q: Can I amend my Form RC243 Schedule A?

A: Yes, if you discover errors or need to make changes to your Form RC243 Schedule A, you can file an amendment using Form T1-ADJ.

Q: Do I need to include supporting documents with Form RC243 Schedule A?

A: You do not need to include supporting documents when you initially file Form RC243 Schedule A, but you should keep them in case the Canada Revenue Agency requests them for verification.