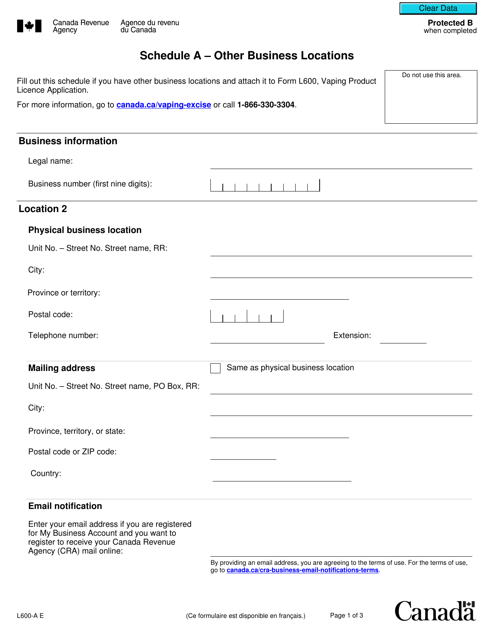

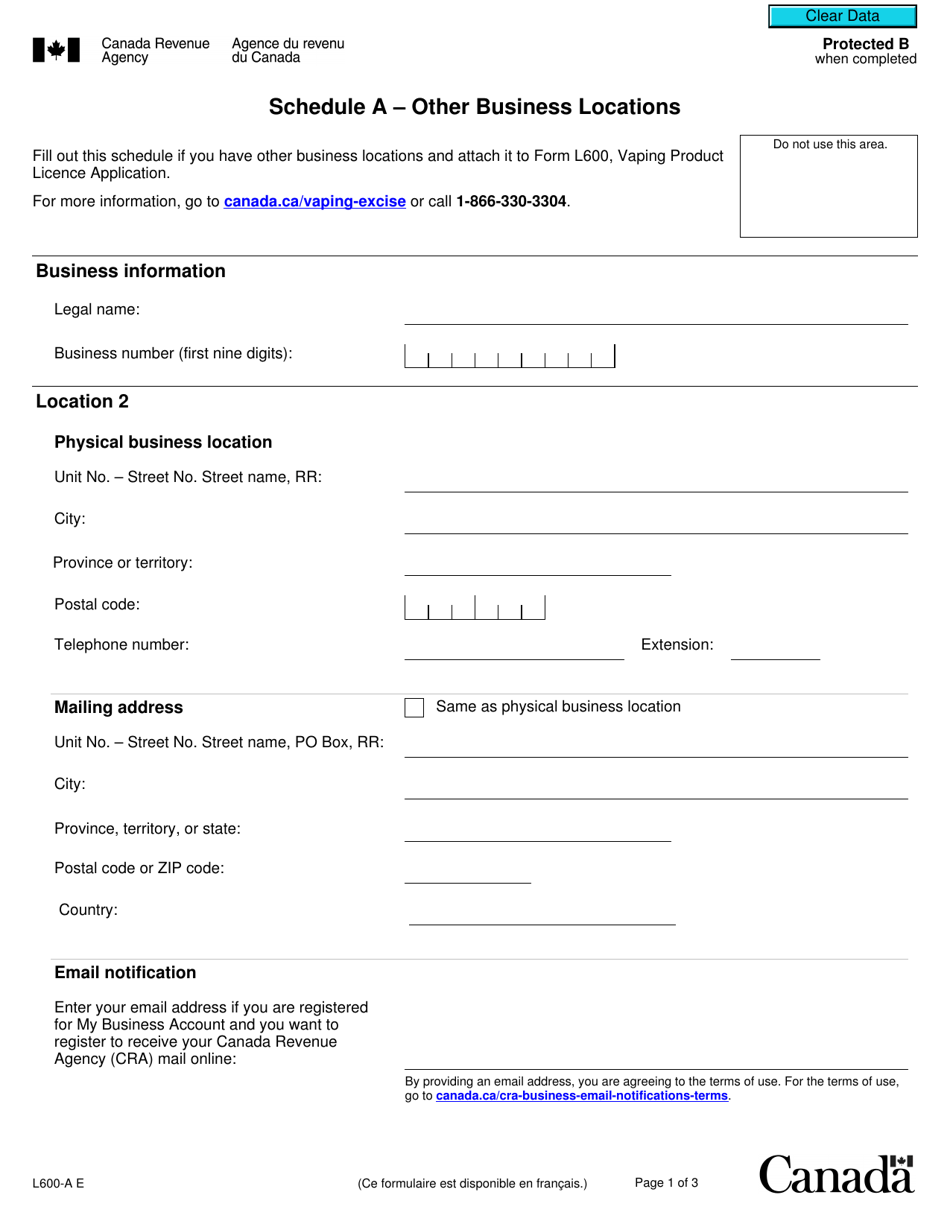

Form L600-A Schedule A Other Business Locations - Canada

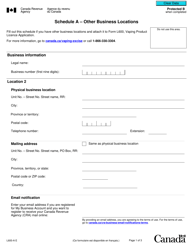

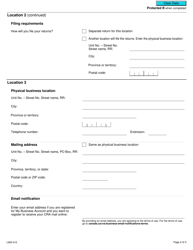

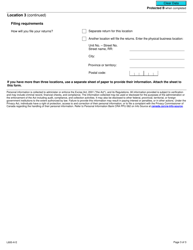

Form L600-A Schedule A Other Business Locations - Canada is used to report additional business locations in Canada for a taxpayer who operates in multiple locations. The purpose of this form is to provide the relevant information about these additional locations for tax filing and compliance purposes.

FAQ

Q: What is Form L600-A Schedule A?

A: Form L600-A Schedule A is a tax form used to report other business locations in Canada.

Q: Who needs to file Form L600-A Schedule A?

A: Companies that have business locations in Canada need to file Form L600-A Schedule A.

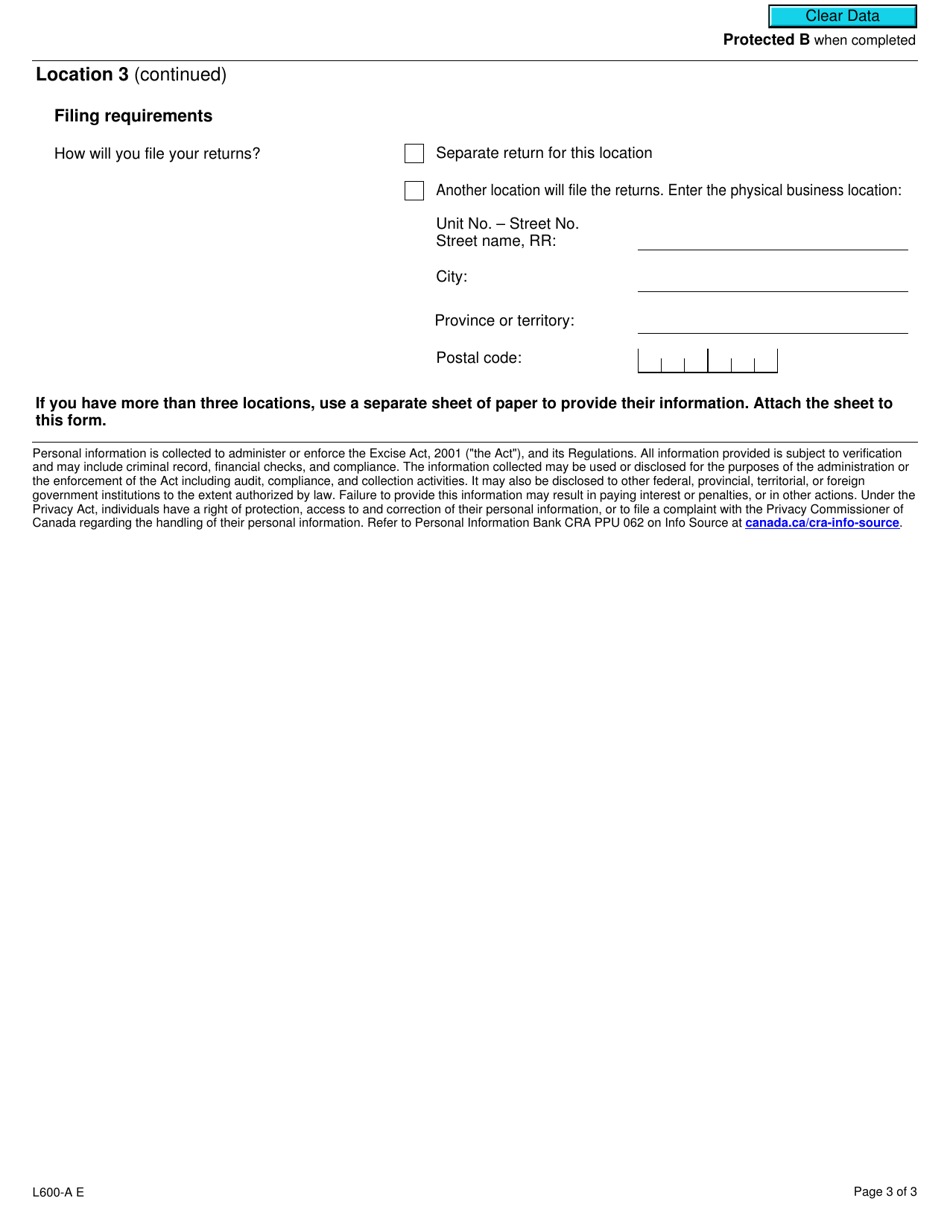

Q: What information should be provided in Form L600-A Schedule A?

A: Form L600-A Schedule A requires detailed information about each business location in Canada, such as the address, activities conducted, and the amount of sales or revenue generated.

Q: When is the deadline to file Form L600-A Schedule A?

A: The deadline to file Form L600-A Schedule A is usually aligned with the company's tax return filing deadline, which varies depending on the fiscal year-end of the company.