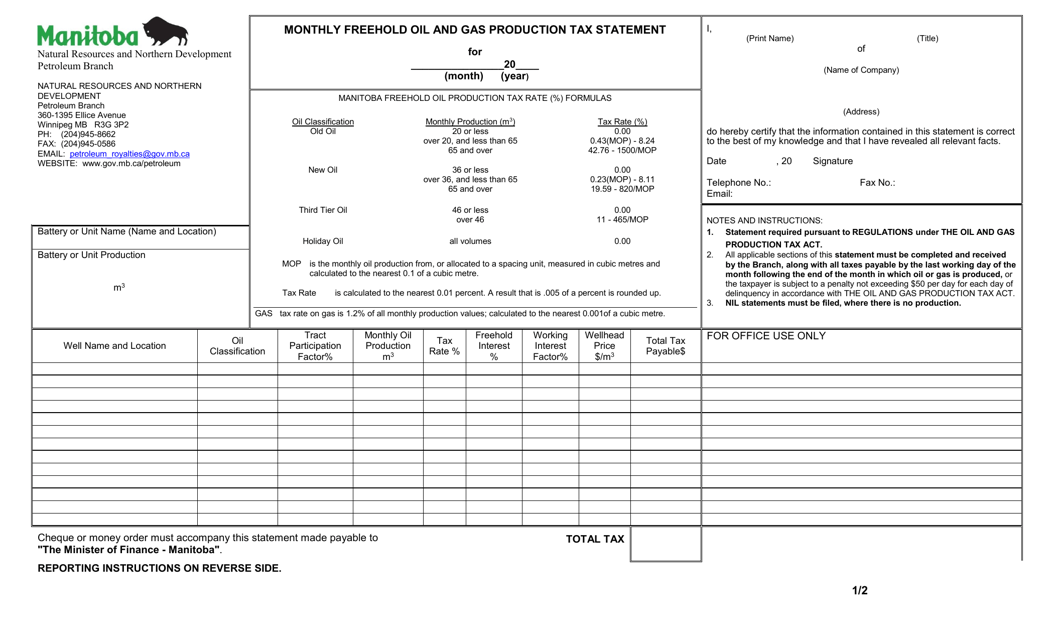

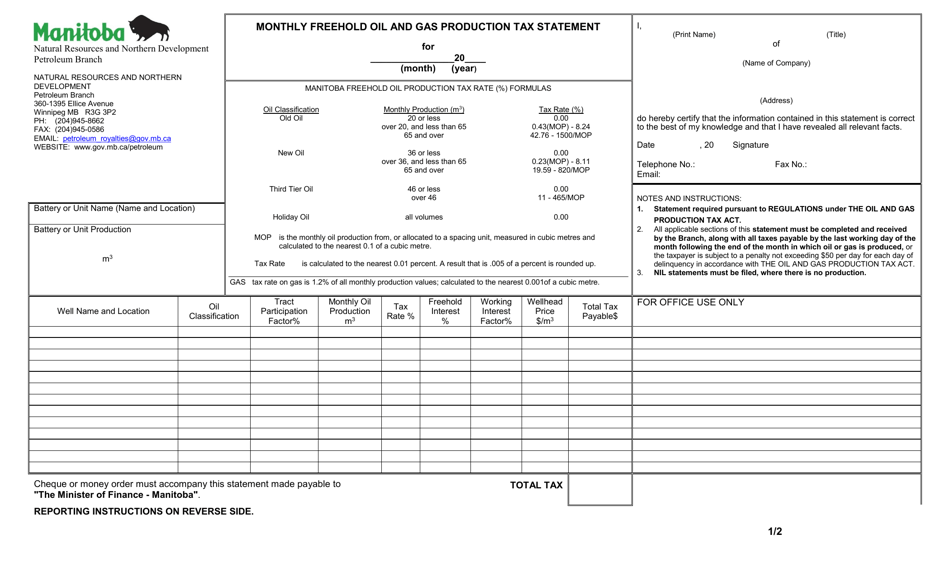

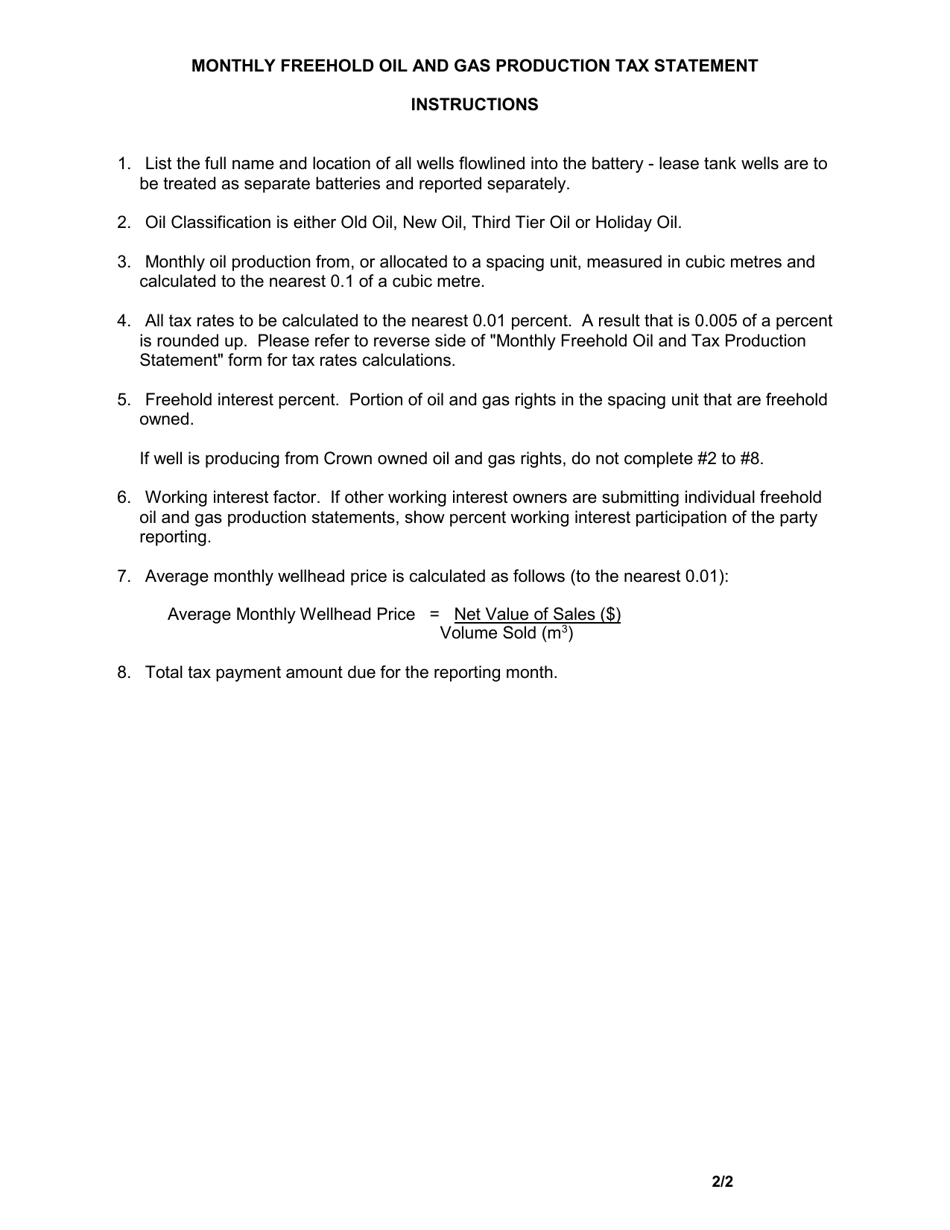

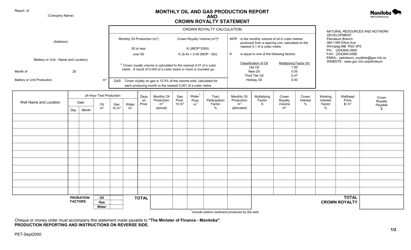

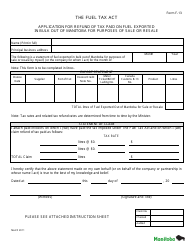

Monthly Freehold Oil and Gas Production Tax Statement - Manitoba, Canada

The Monthly Freehold Oil and Gas ProductionTax Statement in Manitoba, Canada is used to report and pay taxes on the production of oil and gas from freehold lands. It helps ensure that the appropriate taxes are collected from oil and gas producers in the province.

The monthly Freehold Oil and Gas Production Tax Statement in Manitoba, Canada is filed by the oil and gas production companies.

FAQ

Q: What is the Monthly Freehold Oil and Gas Production Tax Statement?

A: The Monthly Freehold Oil and Gas Production Tax Statement is a form used in Manitoba, Canada to report production and calculate the tax owed by freehold oil and gas operators.

Q: Who needs to file the Monthly Freehold Oil and Gas Production Tax Statement?

A: Freehold oil and gas operators in Manitoba, Canada are required to file this statement.

Q: What information should be included in the Monthly Freehold Oil and Gas Production Tax Statement?

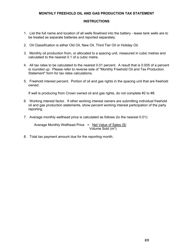

A: The statement should include details of oil and gas production, sales, and expenses incurred.

Q: When is the Monthly Freehold Oil and Gas Production Tax Statement due?

A: The statement is due on the 25th of each month following the month in which the production occurred.