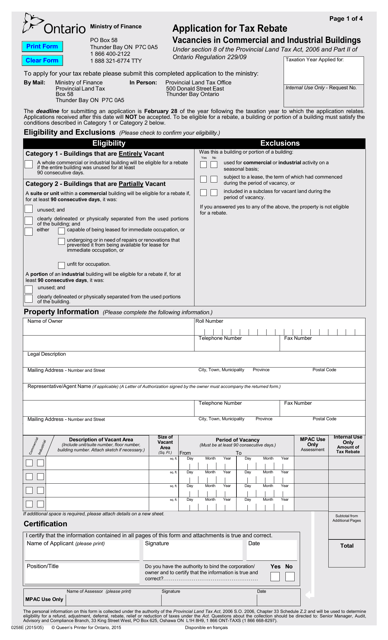

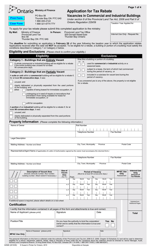

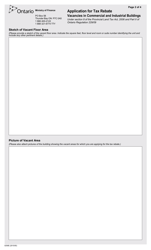

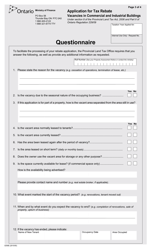

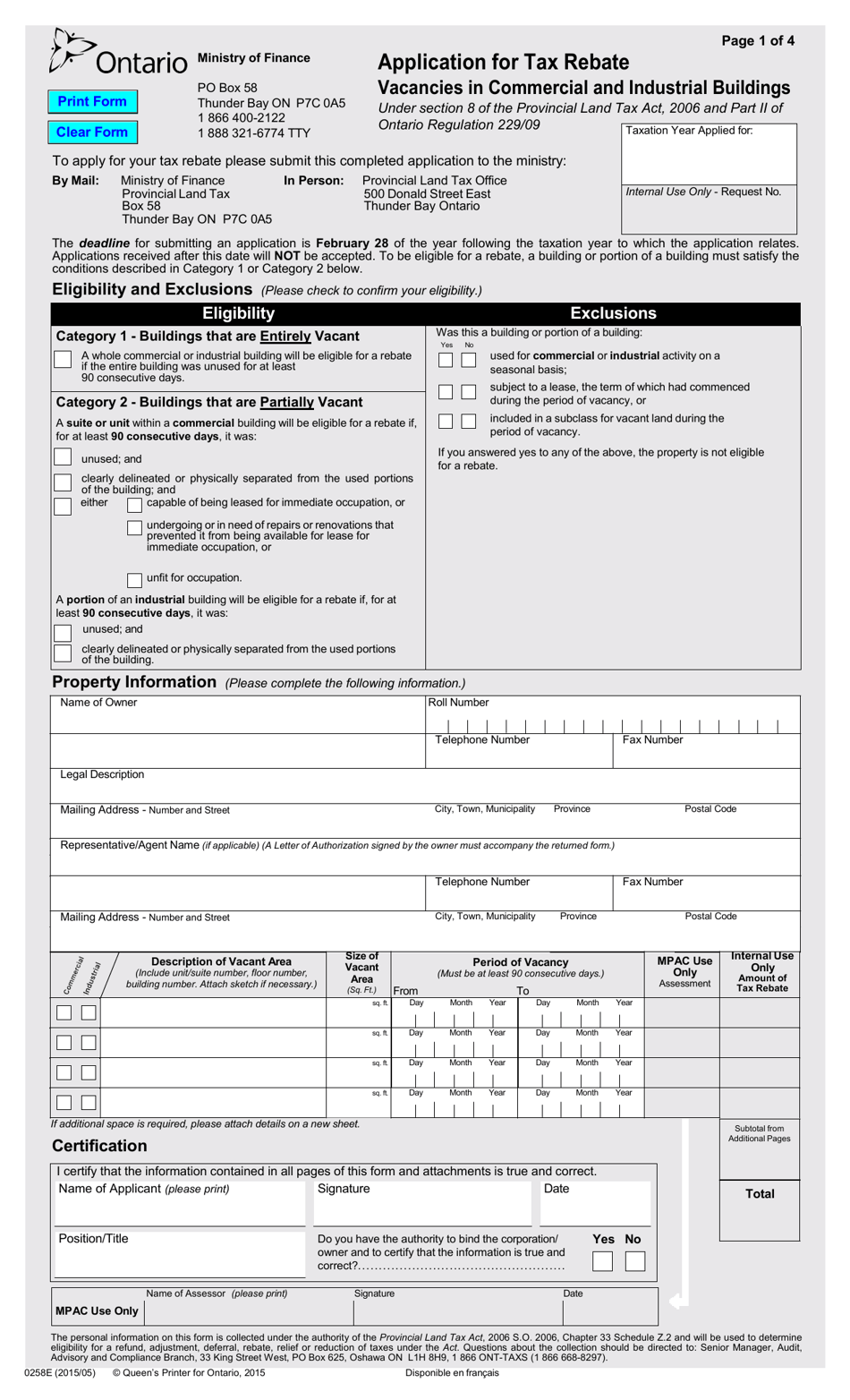

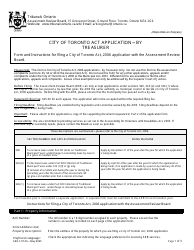

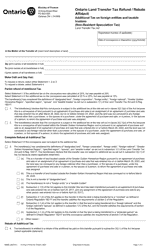

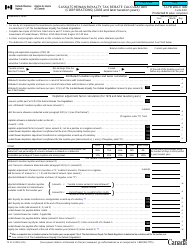

Form 0258E Application for Tax Rebate Vacancies in Commercial and Industrial Buildings - Ontario, Canada

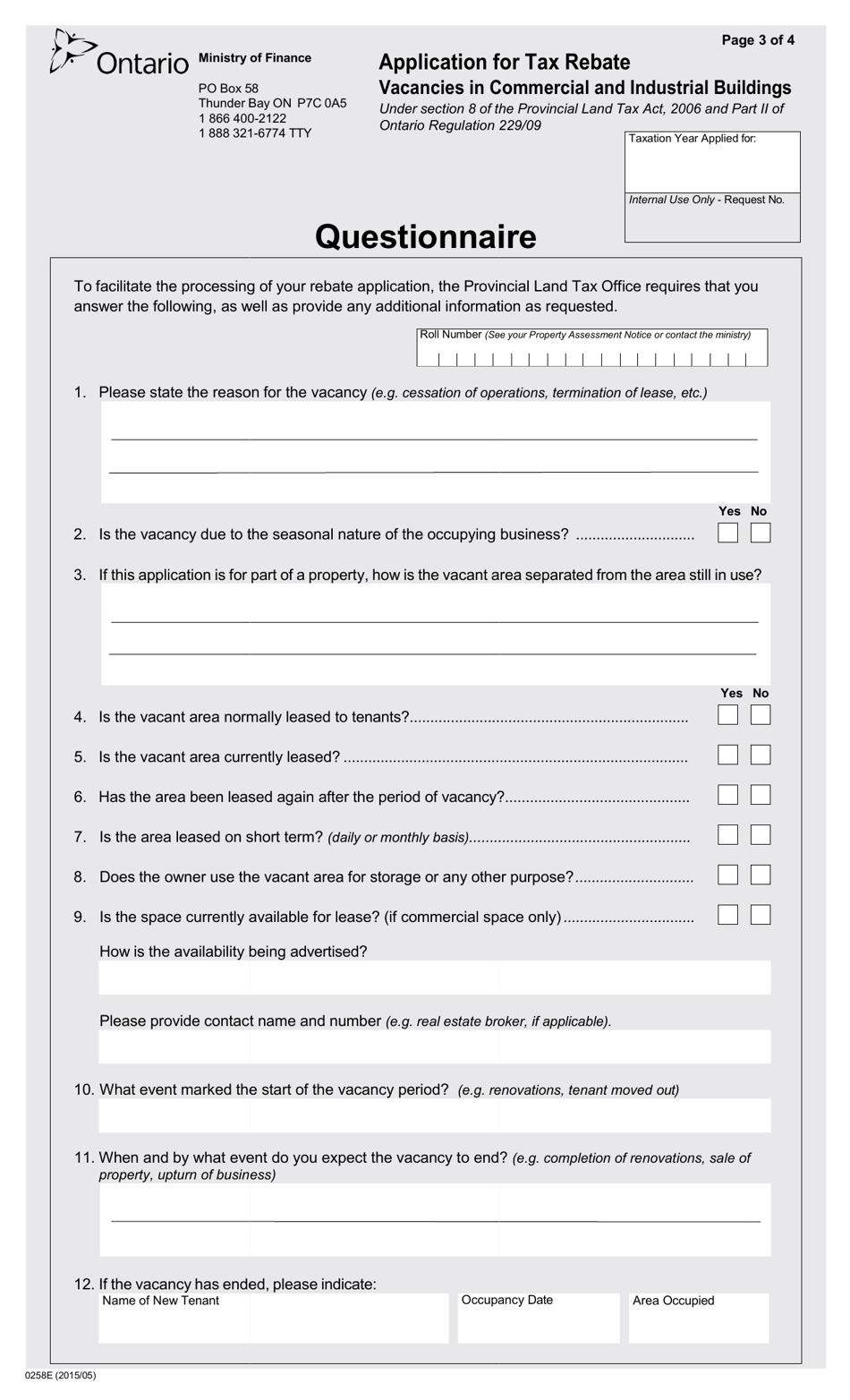

Form 0258E Application for Tax Rebate Vacancies in Commercial and Industrial Buildings in Ontario, Canada is used to apply for a tax rebate for vacancies in commercial and industrial buildings in the province of Ontario. This form allows property owners to request a refund on a portion of their property taxes if the building is vacant for a specified period of time.

The Form 0258E Application for Tax Rebate Vacancies in Commercial and Industrial Buildings in Ontario, Canada is filed by the property owner.

FAQ

Q: What is Form 0258E?

A: Form 0258E is the application for tax rebate vacancies in commercial and industrial buildings in Ontario, Canada.

Q: What is the purpose of Form 0258E?

A: The purpose of Form 0258E is to apply for a tax rebate for vacancies in commercial and industrial buildings in Ontario, Canada.

Q: Who can use Form 0258E?

A: Owners of commercial and industrial buildings in Ontario, Canada can use Form 0258E to apply for a tax rebate for vacancies.

Q: What is the eligibility criteria for the tax rebate?

A: To be eligible for the tax rebate, the building must be located in Ontario, have been vacant for at least 90 consecutive days, and meet certain conditions.

Q: What documents should be included with Form 0258E?

A: When submitting Form 0258E, owners should include supporting documents such as proof of ownership, lease agreements, and property assessment notices.

Q: When is the deadline to submit Form 0258E?

A: The deadline to submit Form 0258E varies by municipality, so owners should check with their local municipal office for the specific deadline.

Q: How long does it take to process the tax rebate application?

A: The processing time for the tax rebate application varies, but it typically takes several weeks to a few months.

Q: Is there an application fee for Form 0258E?

A: No, there is no application fee for Form 0258E.

Q: Can I apply for the tax rebate for multiple vacancies?

A: Yes, you can apply for the tax rebate for multiple vacancies in the same building or in different buildings, as long as they meet the eligibility criteria.