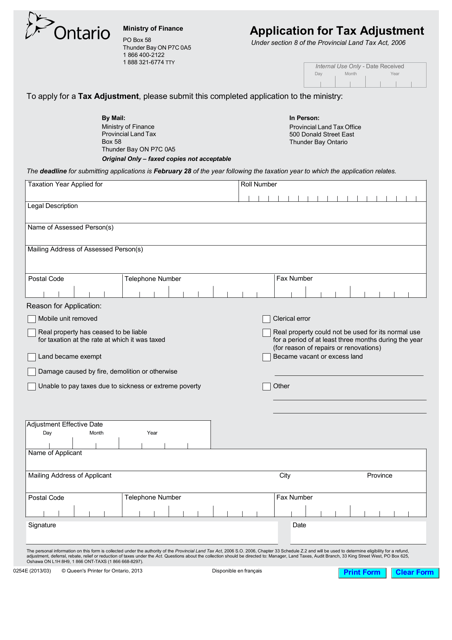

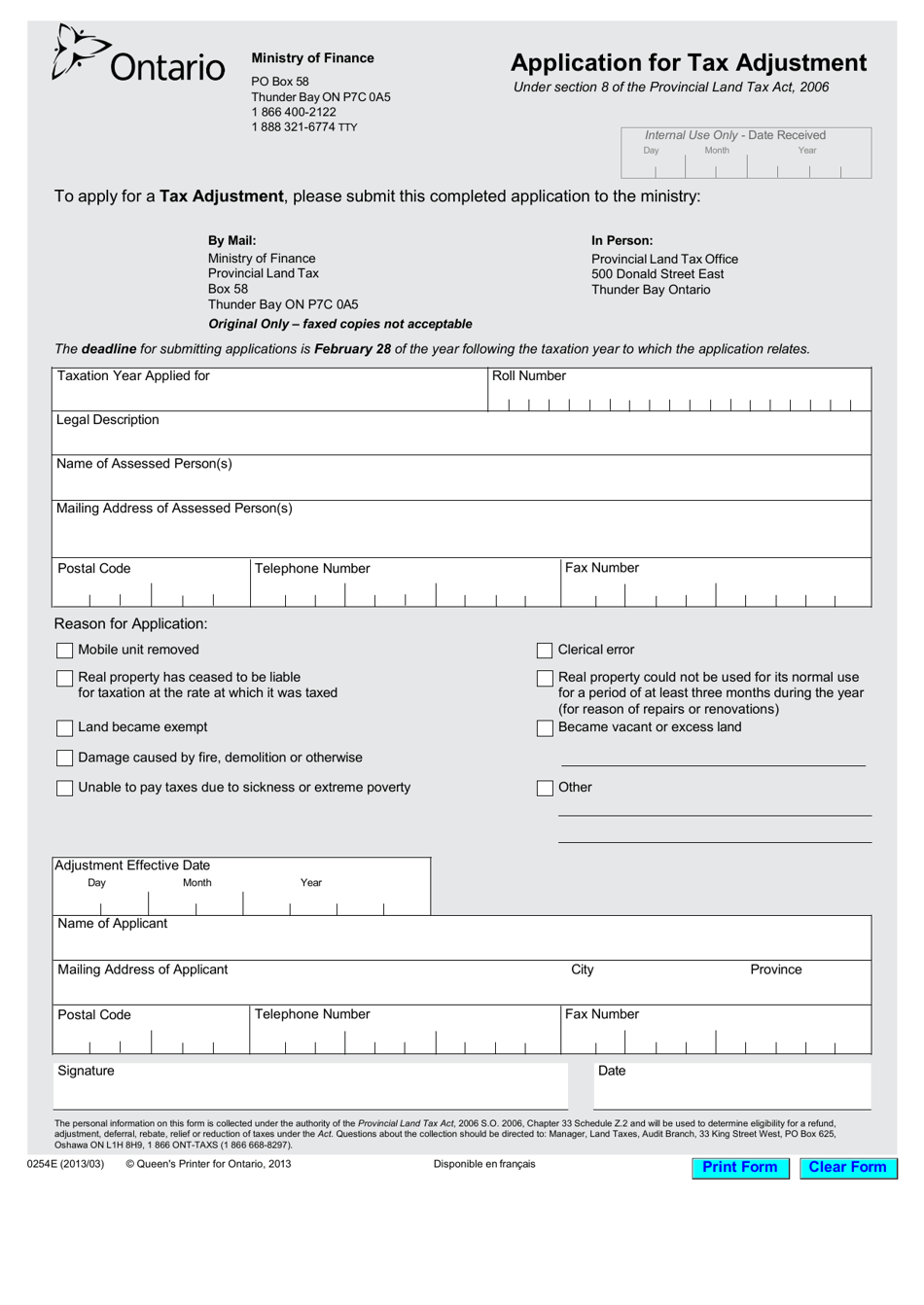

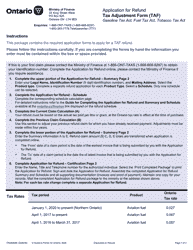

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 0254E

for the current year.

Form 0254E Application for Tax Adjustment - Ontario, Canada

Form 0254E, Application for Tax Adjustment in Ontario, Canada, is used to request adjustments or changes to your tax liability or assessment in the province of Ontario.

The Form 0254E Application for Tax Adjustment in Ontario, Canada is filed by individual taxpayers or their authorized representatives.

FAQ

Q: What is Form 0254E?

A: Form 0254E is an application for tax adjustment in Ontario, Canada.

Q: What is the purpose of Form 0254E?

A: The purpose of Form 0254E is to request an adjustment to your taxes in Ontario.

Q: Who can use Form 0254E?

A: Form 0254E can be used by individuals in Ontario who want to adjust their taxes.

Q: What information do I need to provide on Form 0254E?

A: You will need to provide your personal information, details about your taxes, and the reason for requesting the adjustment.

Q: Is there a fee to submit Form 0254E?

A: No, there is no fee to submit Form 0254E.

Q: How can I submit Form 0254E?

A: You can submit Form 0254E by mail or in person at a ServiceOntario location.

Q: What should I do after submitting Form 0254E?

A: After submitting Form 0254E, you should wait for a response from the Ontario Ministry of Finance regarding your request.

Q: How long does it take to process Form 0254E?

A: The processing time for Form 0254E can vary, but it typically takes several weeks.