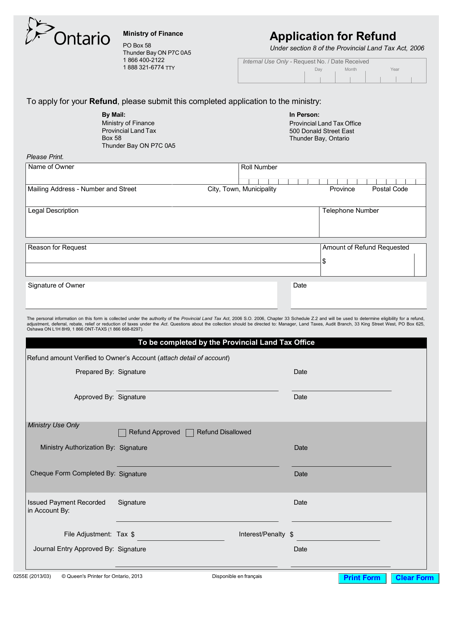

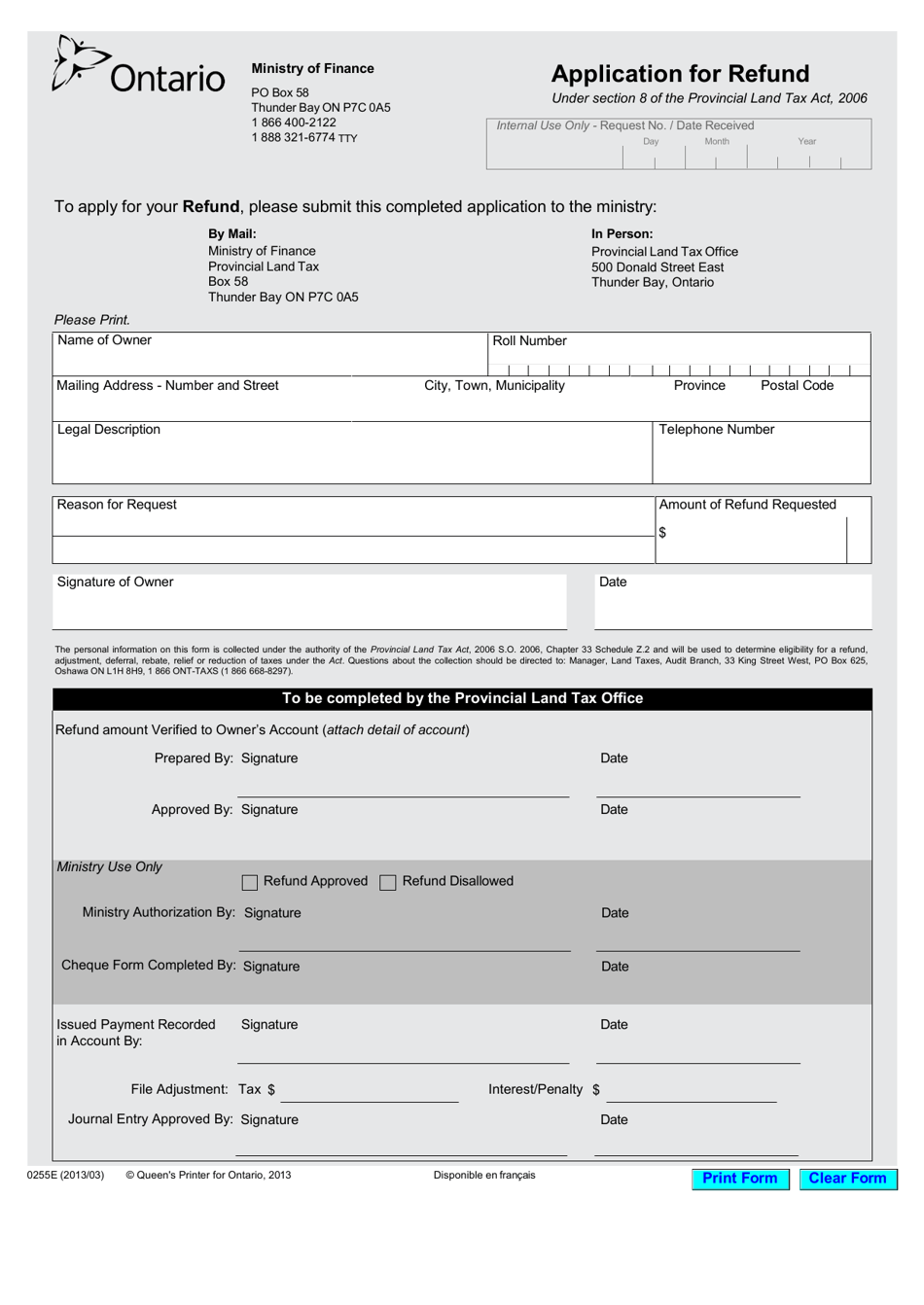

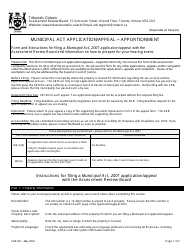

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 0255E

for the current year.

Form 0255E Application for Refund - Ontario, Canada

Form 0255E Application for Refund in Ontario, Canada is used to apply for a refund of certain taxes or fees paid to the government.

The Form 0255E Application for Refund in Ontario, Canada is filed by individuals who are seeking a refund for various reasons such as overpayment of taxes or a credit balance.

FAQ

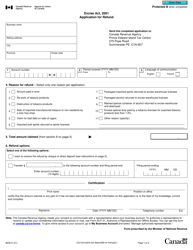

Q: What is Form 0255E?

A: Form 0255E is an Application for Refund specific to Ontario, Canada.

Q: Who can use Form 0255E?

A: Form 0255E can be used by individuals and businesses in Ontario, Canada to apply for a refund.

Q: What is this form used for?

A: Form 0255E is used to apply for a refund for various reasons, such as overpayment of taxes.

Q: Are there any fees associated with filing this form?

A: No, there are no fees associated with filing Form 0255E.

Q: What documents should I include with Form 0255E?

A: You may need to include supporting documents such as receipts or invoices, depending on the reason for your refund application.

Q: How long does it take to process the refund application?

A: The processing time for a refund application can vary, but it typically takes several weeks to receive a response.

Q: What should I do if I have questions or need assistance with this form?

A: If you have questions or need assistance with Form 0255E, you can contact the Ontario Ministry of Finance for guidance.