This version of the form is not currently in use and is provided for reference only. Download this version of

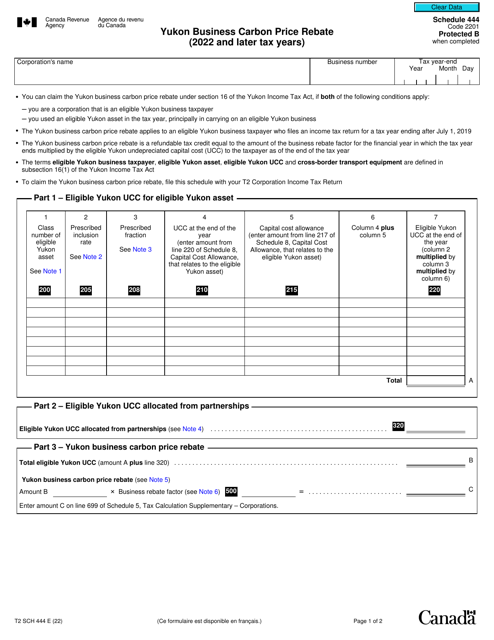

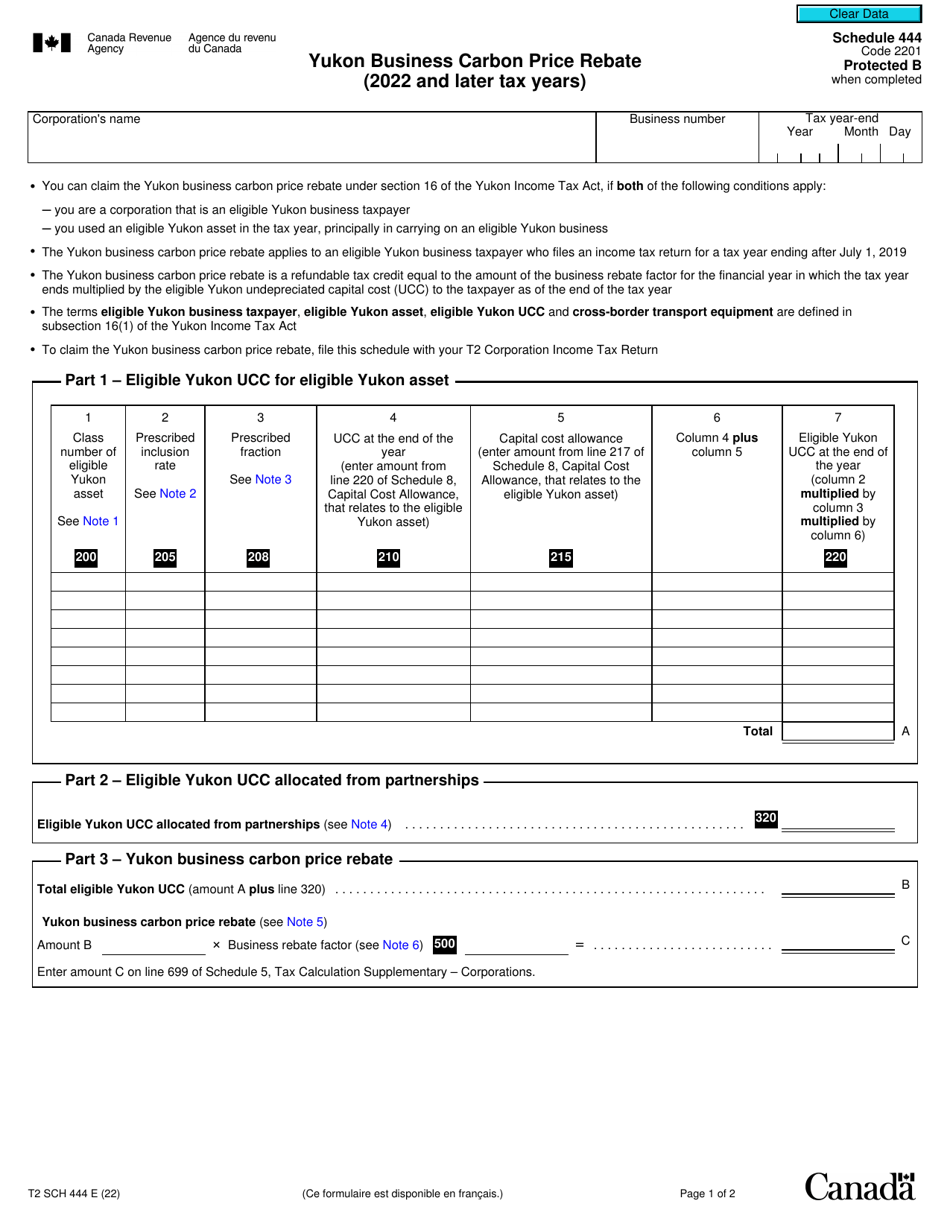

Form T2 Schedule 444

for the current year.

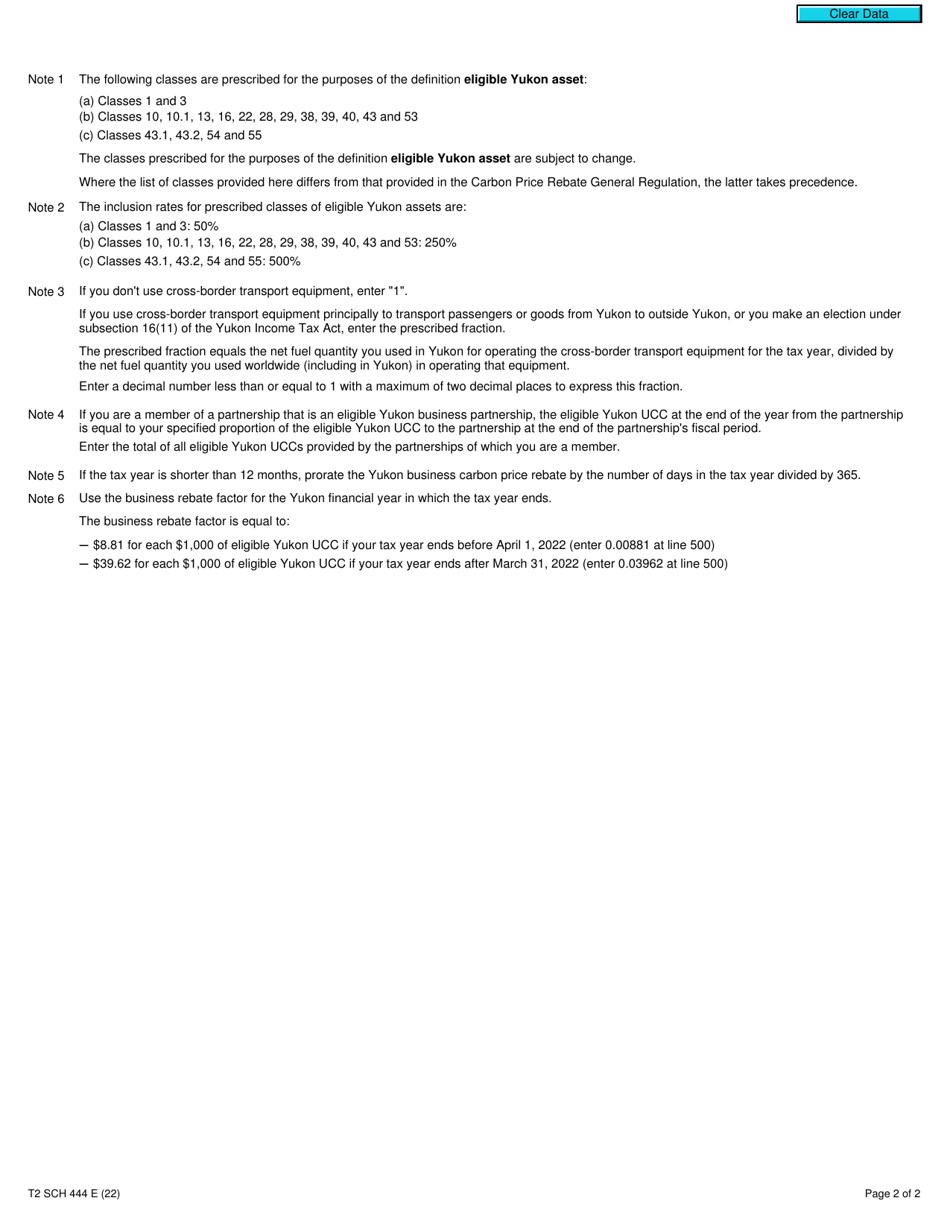

Form T2 Schedule 444 Yukon Business Carbon Price Rebate (2022 and Later Tax Years) - Canada

Form T2 Schedule 444 Yukon Business Carbon Price Rebate (2022 and Later Tax Years) is used by businesses in Yukon, Canada, to claim a rebate for the carbon price paid on eligible carbon-based fuels.

The business in Yukon files the Form T2 Schedule 444 Yukon Business Carbon Price Rebate in Canada.

FAQ

Q: What is Form T2 Schedule 444?

A: Form T2 Schedule 444 is a tax form in Canada.

Q: What is the purpose of Form T2 Schedule 444?

A: The purpose of Form T2 Schedule 444 is to claim a business carbon price rebate for the Yukon region.

Q: When can Form T2 Schedule 444 be used?

A: Form T2 Schedule 444 can be used for tax years starting in 2022 and later.

Q: Who is eligible to use Form T2 Schedule 444?

A: Businesses operating in the Yukon region are eligible to use Form T2 Schedule 444.

Q: What is a business carbon price rebate?

A: A business carbon price rebate is a refund or reduction in taxes paid by businesses to offset the cost of carbon pricing.