This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT1

for the current year.

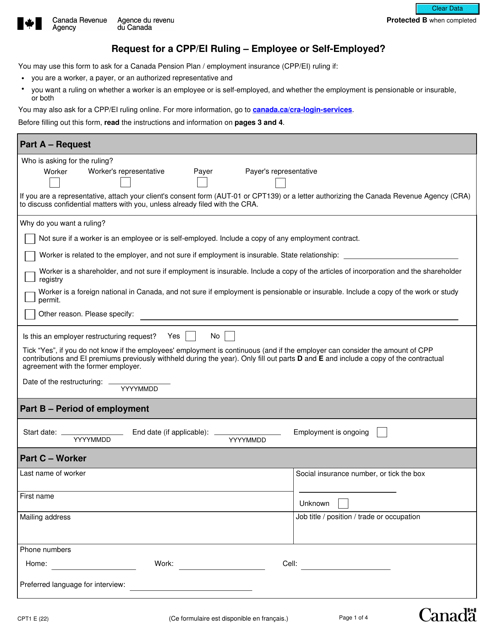

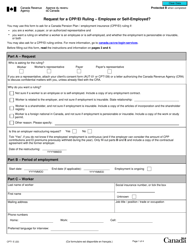

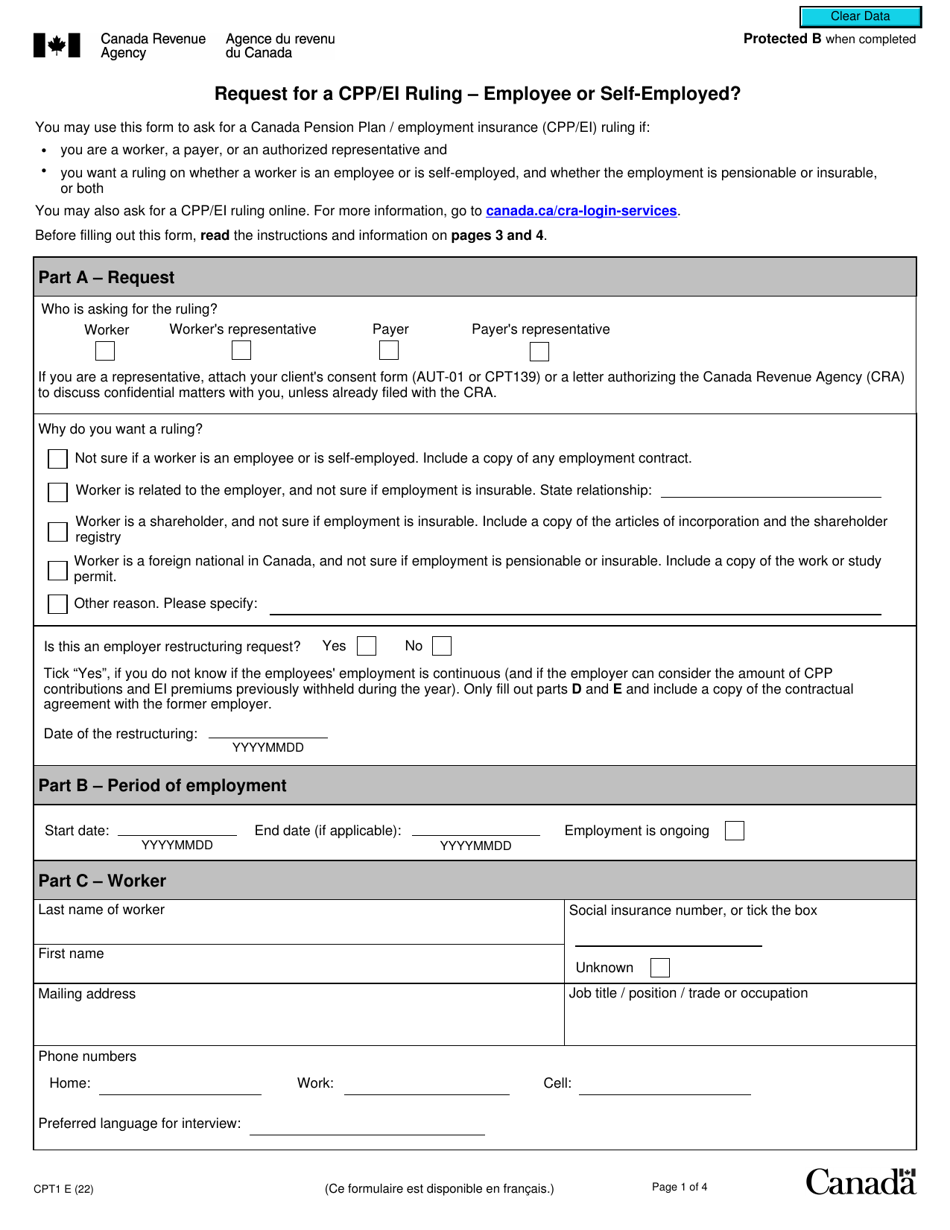

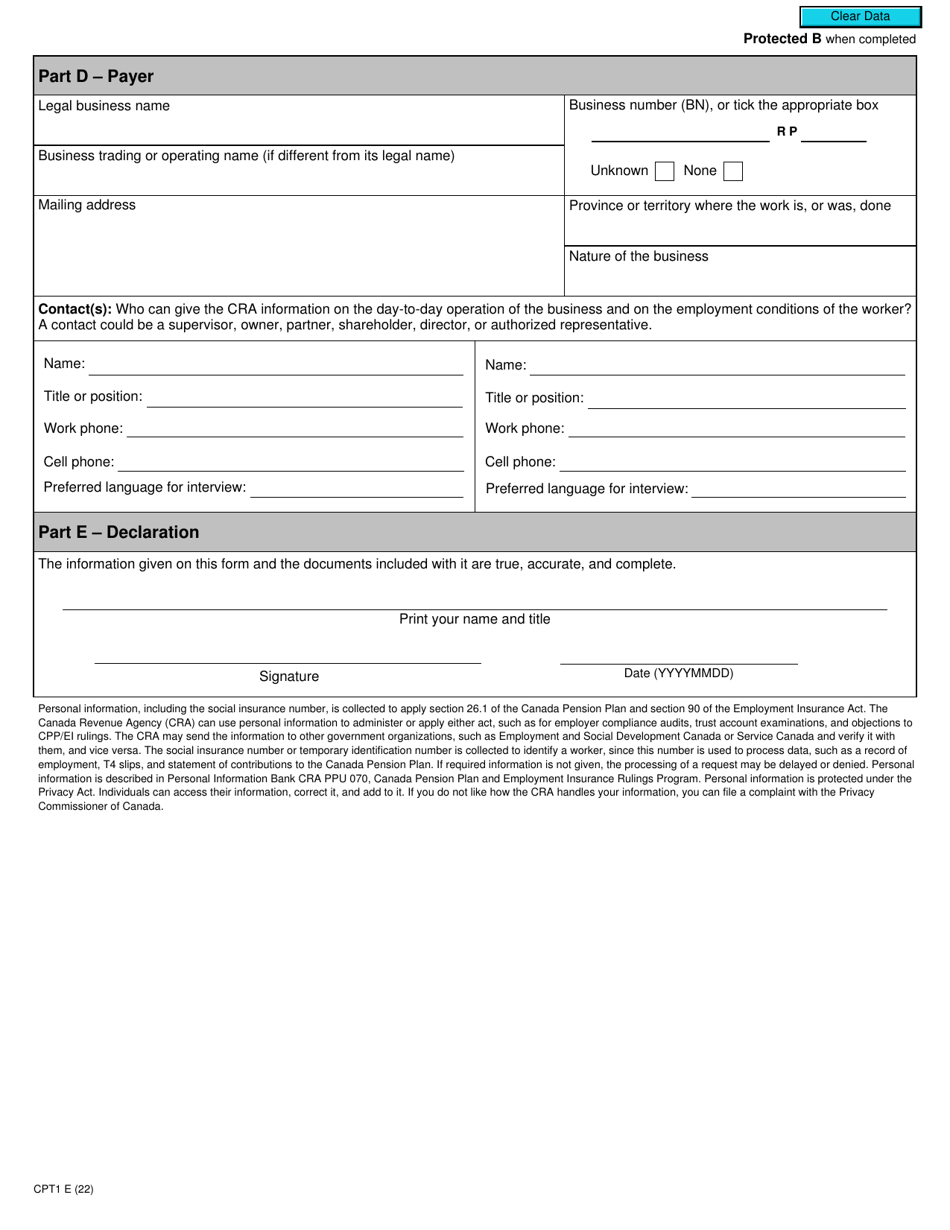

Form CPT1 Request for a Cpp / Ei Ruling - Employee or Self-employed - Canada

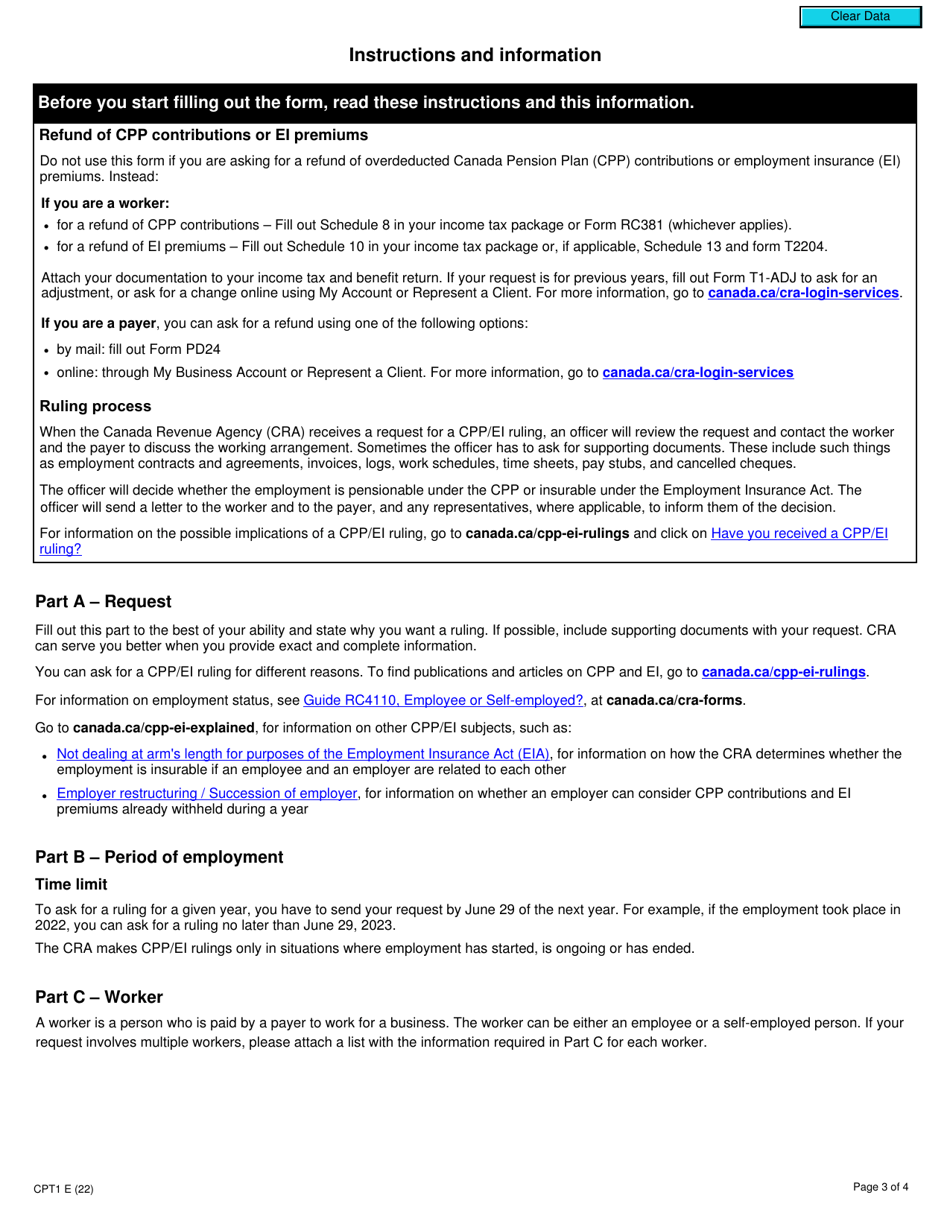

Form CPT1, Request for a CPP/EI Ruling - Employee or Self-employed, in Canada is used to request a ruling from the Canada Revenue Agency (CRA) to determine whether a worker is considered an employee or self-employed for the purposes of the Canada Pension Plan (CPP) and Employment Insurance (EI). This form helps individuals and businesses to clarify the proper classification of workers and the associated CPP and EI obligations.

The Form CPT1 request for a CPP/EI ruling is filed by self-employed individuals in Canada.

FAQ

Q: What is a CPT1 request?

A: A CPT1 request is a form used in Canada to request a ruling on whether an individual is considered an employee or self-employed for the purposes of the Canada Pension Plan (CPP) and Employment Insurance (EI).

Q: What is CPP?

A: CPP stands for Canada Pension Plan. It is a social insurance program that provides benefits to retired and disabled individuals, as well as their surviving dependents.

Q: What is EI?

A: EI stands for Employment Insurance. It is a program that provides temporary financial assistance to individuals who are out of work, looking for work, or unable to work due to specific circumstances.

Q: What is the purpose of the CPT1 request?

A: The CPT1 request is used to determine whether an individual should be classified as an employee or self-employed for CPP and EI purposes. This classification affects the individual's eligibility for benefits and the contributions they need to make.

Q: What is the difference between being an employee and being self-employed?

A: An employee works for an employer and is entitled to certain benefits, such as CPP and EI coverage, while a self-employed individual works for themselves and is responsible for their own contributions to CPP and EI.

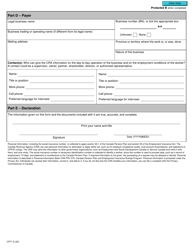

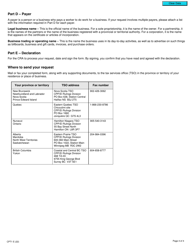

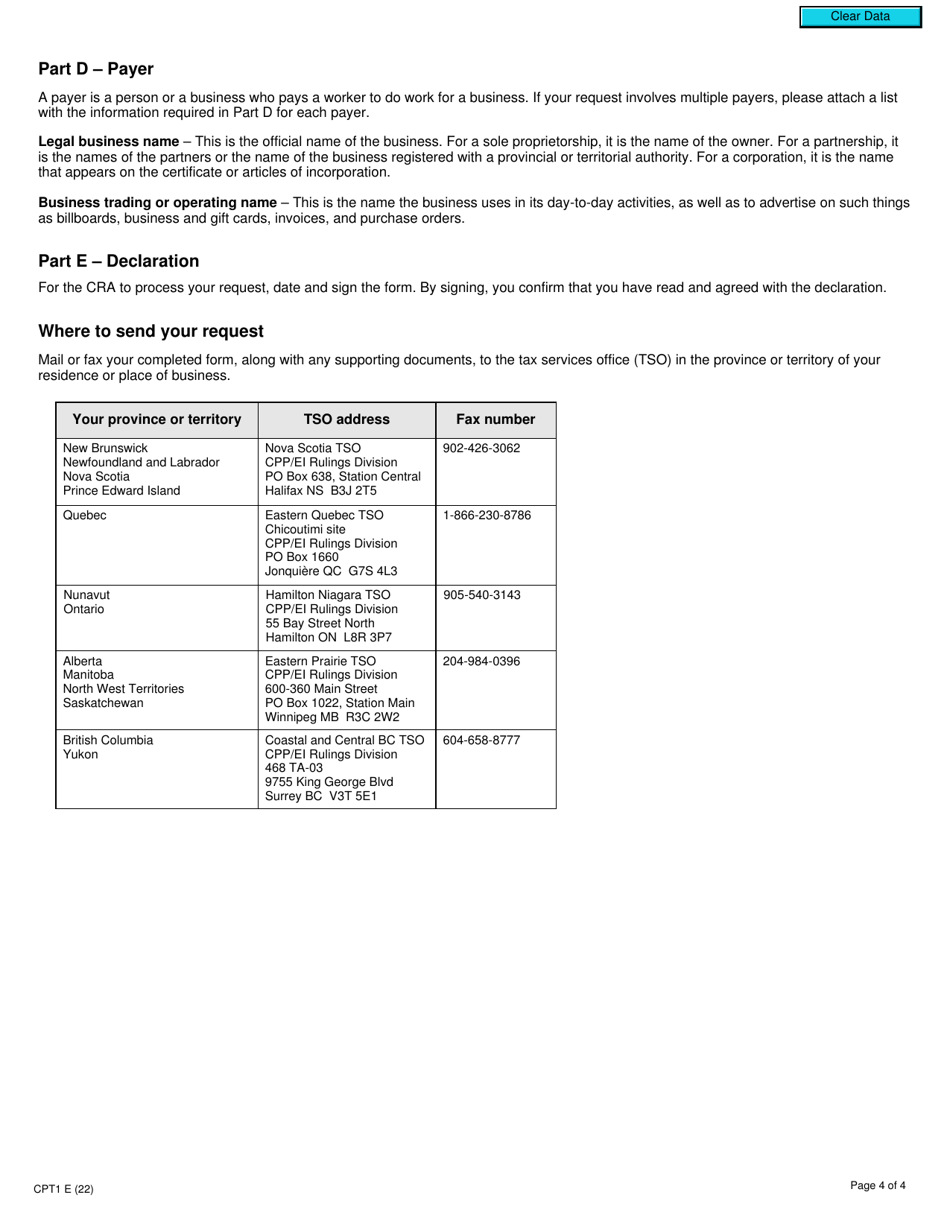

Q: How do I submit a CPT1 request?

A: To submit a CPT1 request, you need to complete the Form CPT1 and send it to the relevant tax office. The form must include detailed information about your employment arrangements and the factors that determine your status as an employee or self-employed.

Q: Why would I need to submit a CPT1 request?

A: You may need to submit a CPT1 request if your employment status is unclear and you want to ensure that you are classified correctly for CPP and EI purposes. It can also help determine your eligibility for benefits and the contributions you need to make.

Q: Can I change my employment status after submitting a CPT1 request?

A: Yes, you can change your employment status after submitting a CPT1 request. However, it is important to consult with the relevant tax office and follow the appropriate procedures to make any necessary updates.

Q: What happens after I submit a CPT1 request?

A: After you submit a CPT1 request, the tax office will review the information provided and make a ruling on your employment status. You will be notified of the decision and any subsequent actions you need to take.