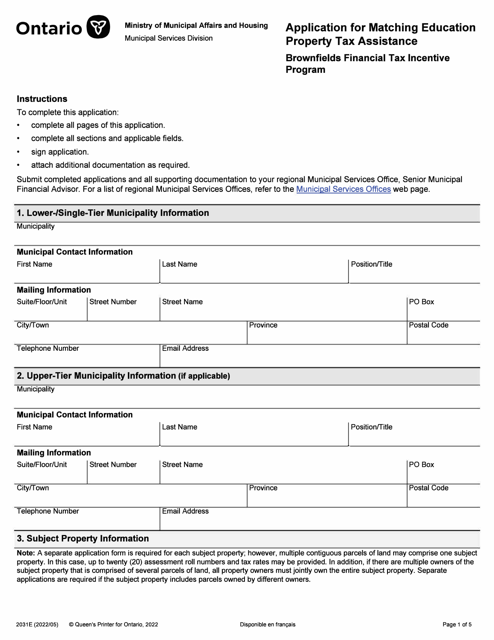

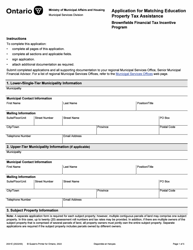

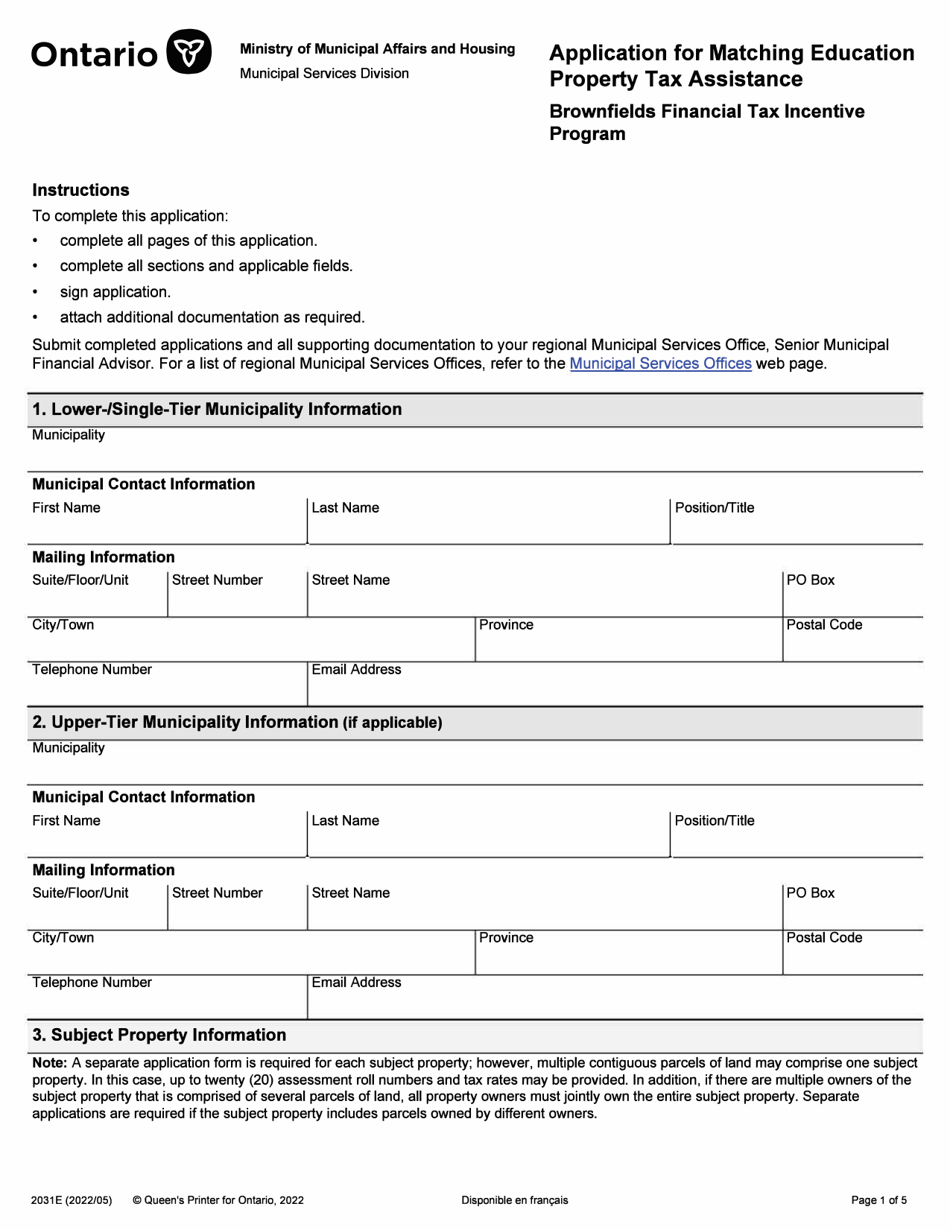

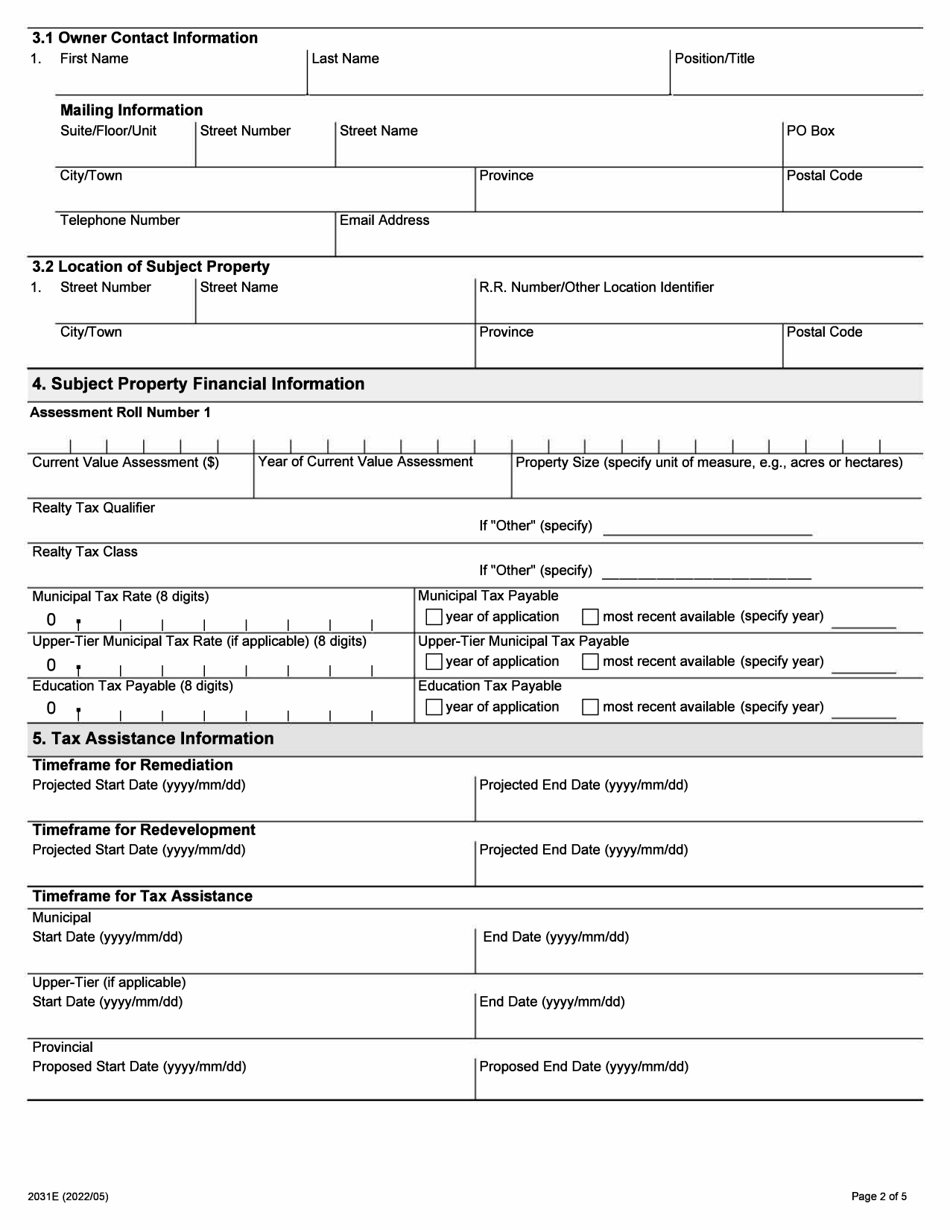

Form 2031E Application for Matching Education Property Tax Assistance - Brownfields Financial Tax Incentive Program - Ontario, Canada

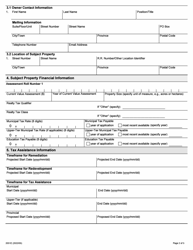

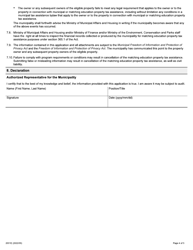

Form 2031E is an application form used for applying for property tax assistance under the Brownfields Financial Tax Incentive Program in Ontario, Canada. It is specifically designed for matching education property tax assistance.

The form 2031E application for matching education property tax assistance is filed by property owners in Ontario, Canada who are participating in the Brownfields Financial Tax Incentive Program.

FAQ

Q: What is Form 2031E?

A: Form 2031E is an application for matching education property tax assistance in Ontario, Canada.

Q: What is the purpose of Form 2031E?

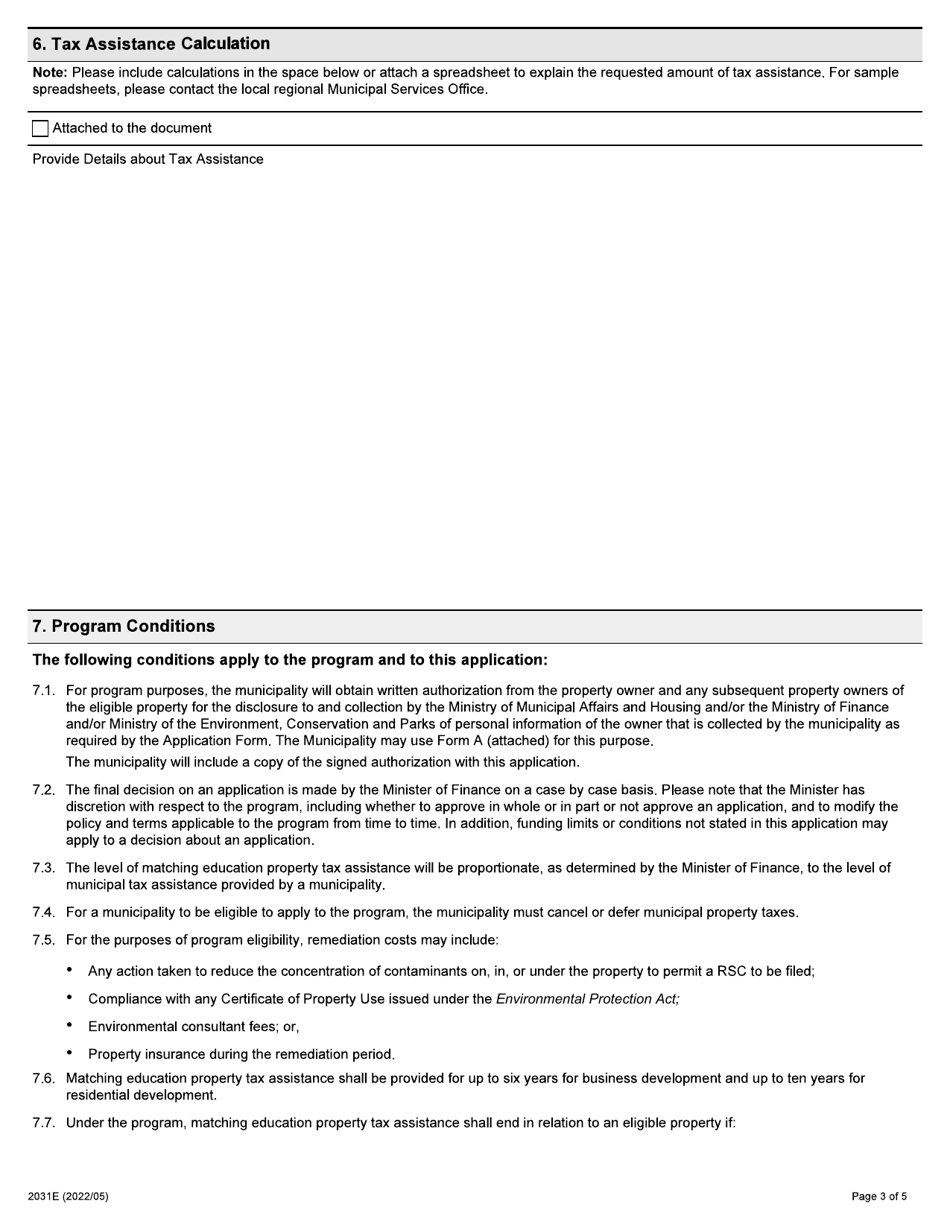

A: The purpose of Form 2031E is to apply for tax assistance under the Brownfields Financial Tax Incentive Program in Ontario, Canada.

Q: What does the Brownfields Financial Tax Incentive Program entail?

A: The Brownfields Financial Tax Incentive Program provides tax assistance for eligible brownfield properties in Ontario, Canada.

Q: Who is eligible for tax assistance under the Brownfields Financial Tax Incentive Program?

A: Eligible individuals and corporations who own brownfield properties in Ontario, Canada may apply for tax assistance under the program.

Q: How do I apply for tax assistance under the Brownfields Financial Tax Incentive Program?

A: To apply for tax assistance, complete and submit Form 2031E, the Application for Matching Education Property Tax Assistance, in Ontario, Canada.

Q: What is the purpose of the education property tax assistance mentioned in Form 2031E?

A: The education property tax assistance provided under the program is intended to match any tax exemptions or reductions already received by the property owner.

Q: Are there any specific deadlines for submitting Form 2031E?

A: Specific deadlines for submitting Form 2031E may vary, so it is important to check with the relevant government office or program guidelines for the most up-to-date information.

Q: Who can I contact for more information or assistance regarding Form 2031E and the Brownfields Financial Tax Incentive Program?

A: For more information or assistance, you can contact the government office responsible for the Brownfields Financial Tax Incentive Program in Ontario, Canada.