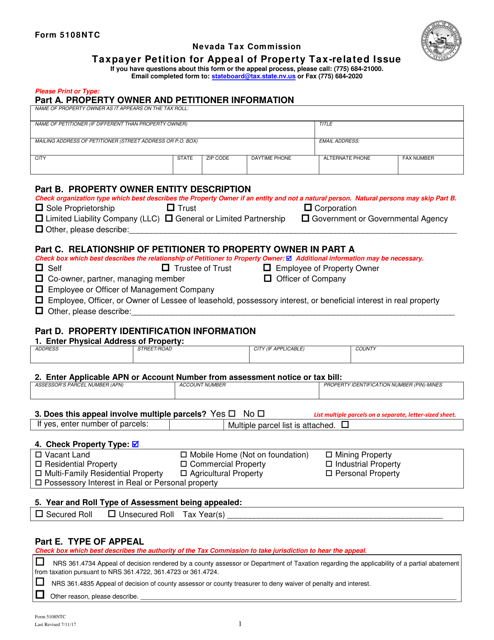

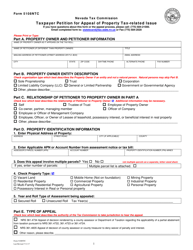

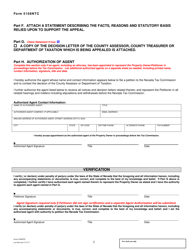

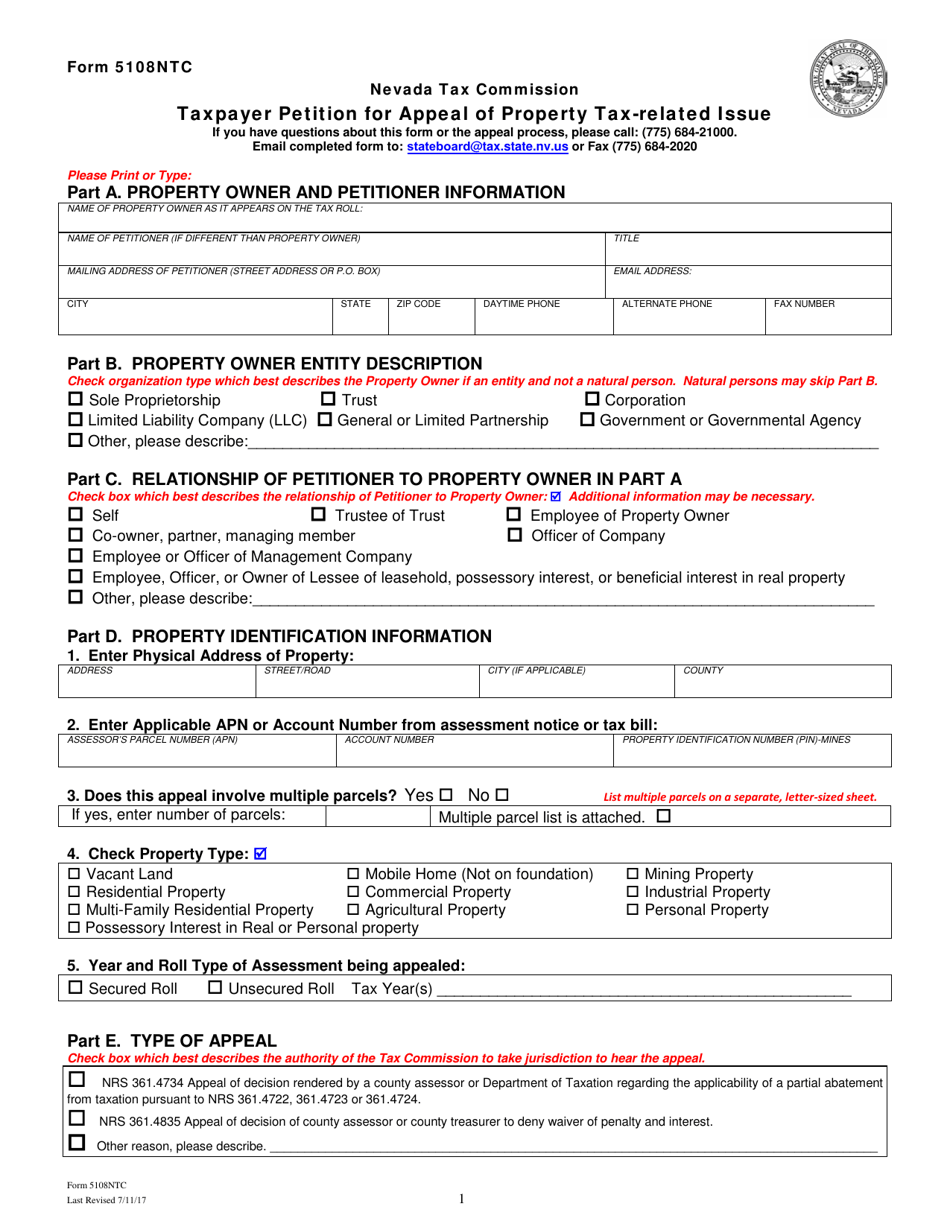

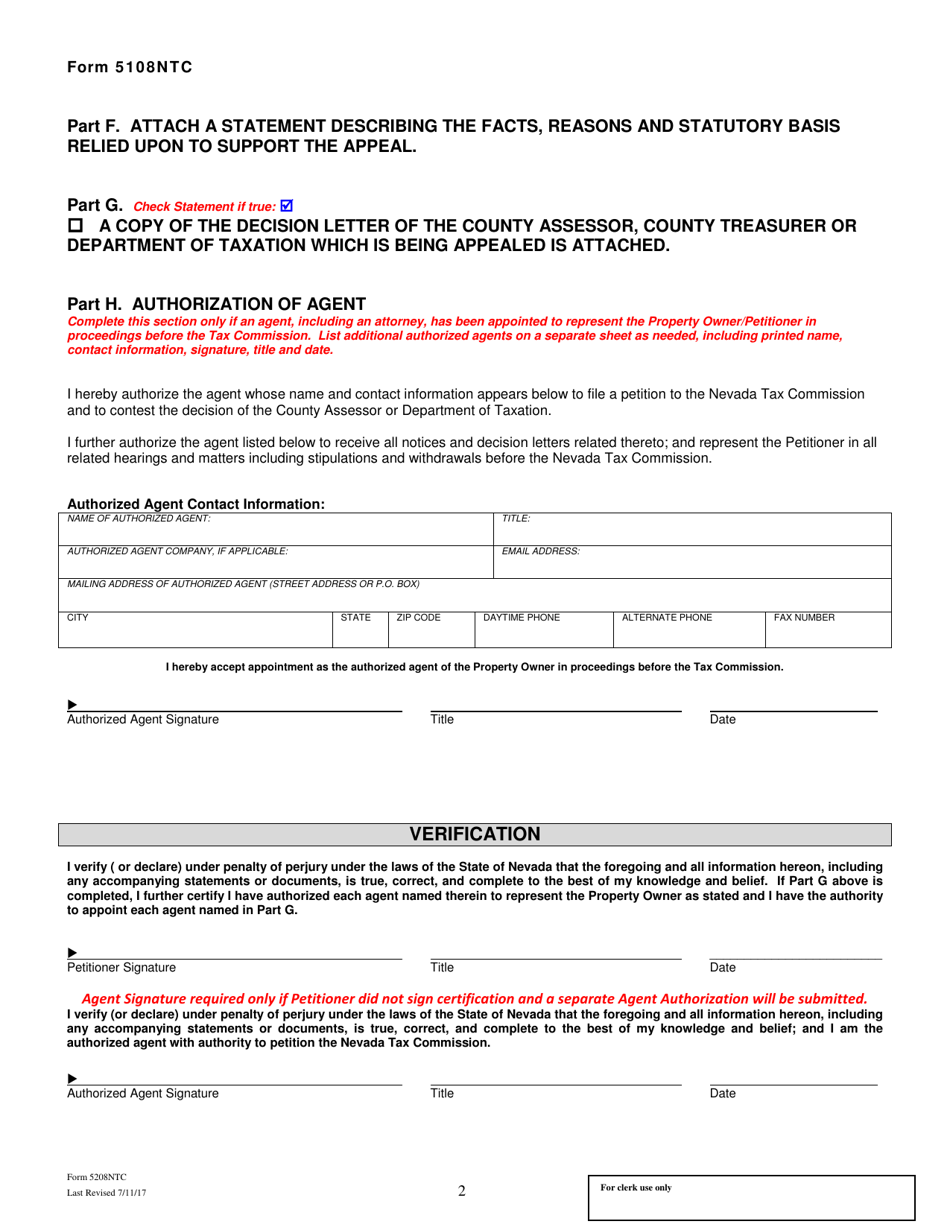

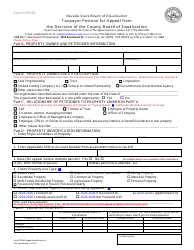

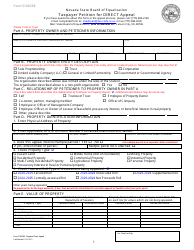

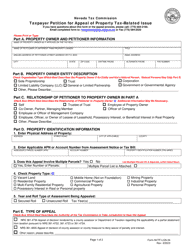

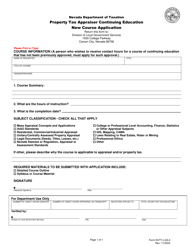

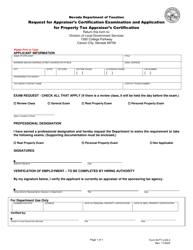

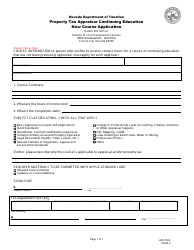

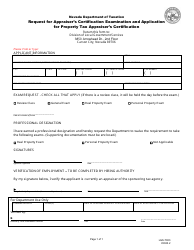

Form 5108NTC Taxpayer Petition for Appeal of Property Tax-Related Issue - Nevada

What Is Form 5108NTC?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5108NTC?

A: Form 5108NTC is a taxpayer petition for appeal of property tax-related issues in Nevada.

Q: Who can use Form 5108NTC?

A: Any taxpayer in Nevada who wants to appeal a property tax-related issue can use Form 5108NTC.

Q: What is the purpose of Form 5108NTC?

A: The purpose of Form 5108NTC is to allow taxpayers to formally appeal property tax-related issues in Nevada.

Q: Are there any fees associated with filing Form 5108NTC?

A: No, there are no fees associated with filing Form 5108NTC.

Q: What should I include with my Form 5108NTC?

A: You should include any supporting documentation or evidence that supports your appeal.

Q: What is the deadline for filing Form 5108NTC?

A: The deadline for filing Form 5108NTC is generally 60 days from the date of the assessment notice or tax bill, but it may vary depending on your county.

Q: What happens after I file Form 5108NTC?

A: After you file Form 5108NTC, the county board of equalization will review your appeal and make a decision.

Q: Can I appeal the decision of the county board of equalization?

A: Yes, if you disagree with the decision of the county board of equalization, you can further appeal to the Nevada Tax Commission.

Q: Is there a time limit for appealing to the Nevada Tax Commission?

A: Yes, you must appeal to the Nevada Tax Commission within 30 days of the decision by the county board of equalization.

Form Details:

- Released on July 11, 2017;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5108NTC by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.