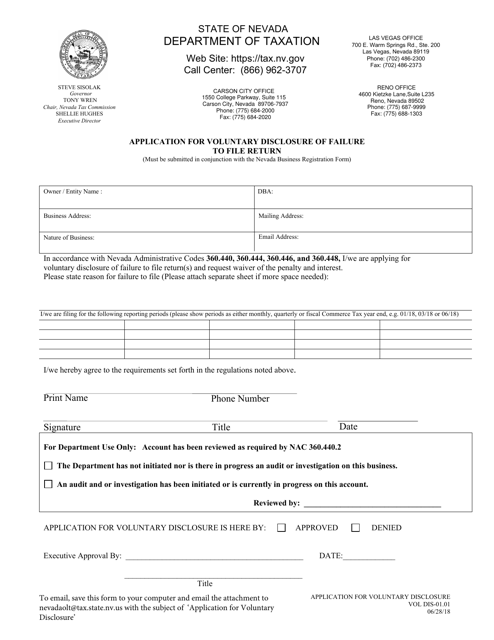

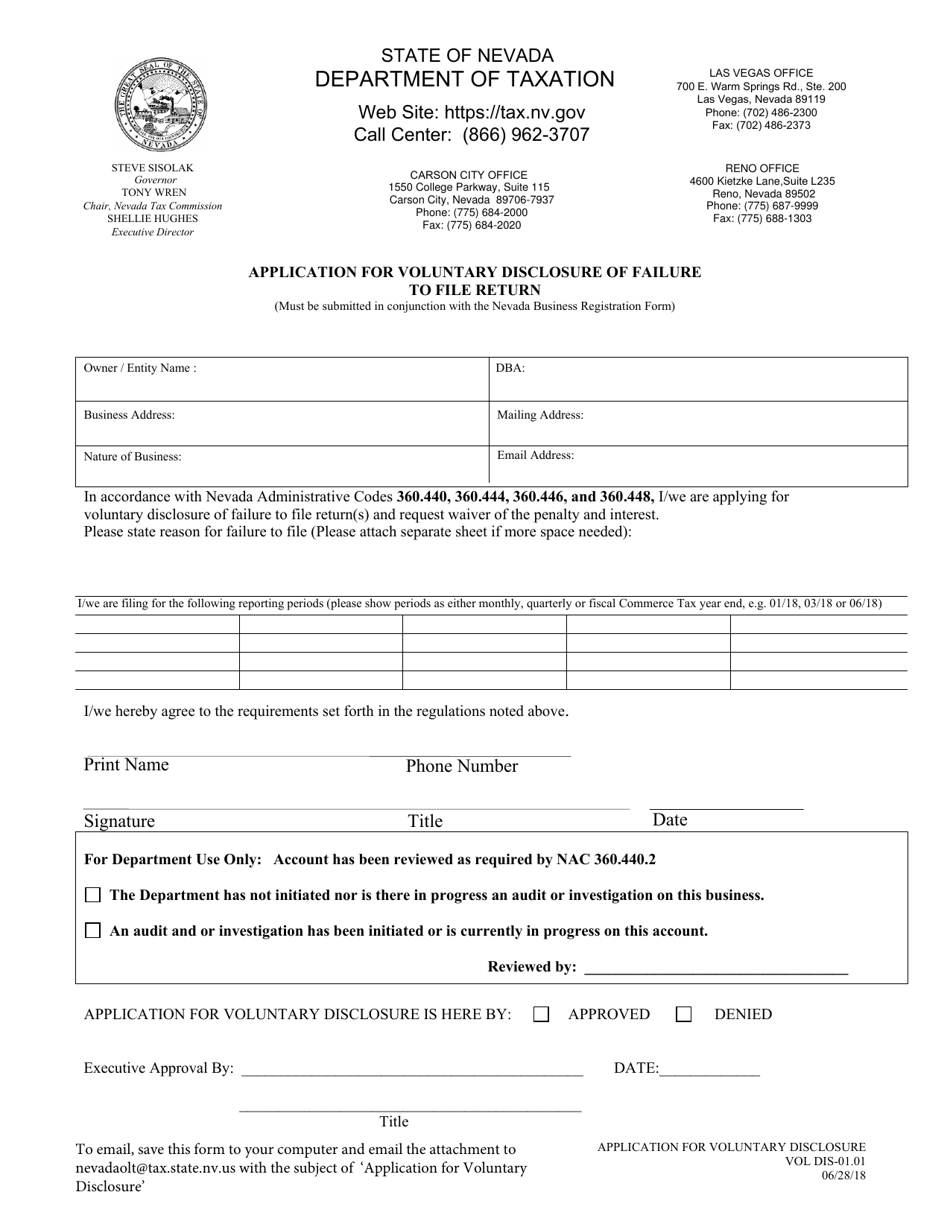

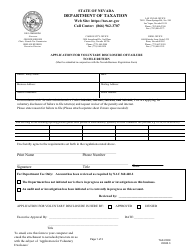

Form VOL DIS-01.01 Application for Voluntary Disclosure of Failure to File Return - Nevada

What Is Form VOL DIS-01.01?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VOL DIS-01.01?

A: Form VOL DIS-01.01 is the Application for Voluntary Disclosure of Failure to File Return in Nevada.

Q: Who should use Form VOL DIS-01.01?

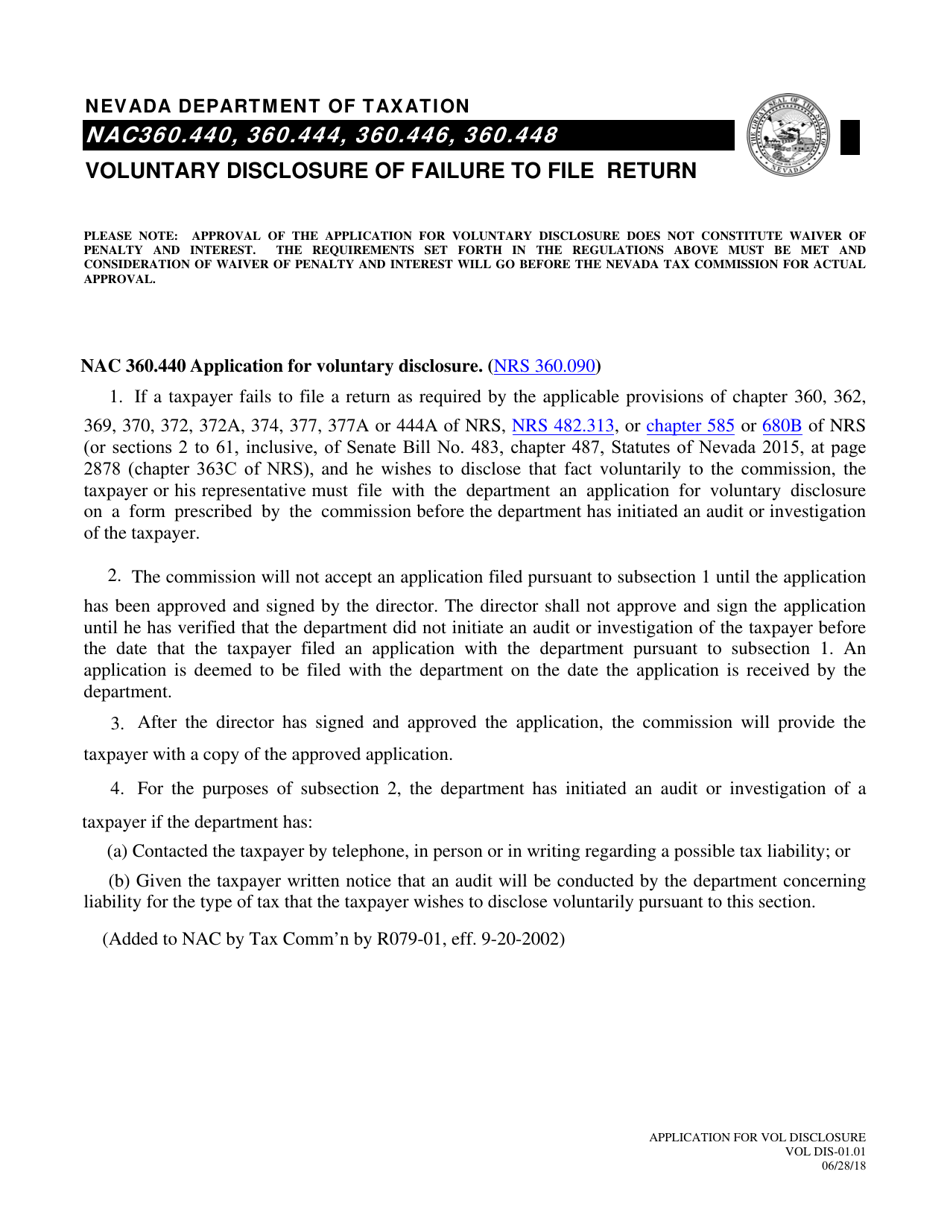

A: This form should be used by individuals or businesses who have failed to file a return in Nevada and want to voluntarily disclose and pay the taxes owed.

Q: What is the purpose of Form VOL DIS-01.01?

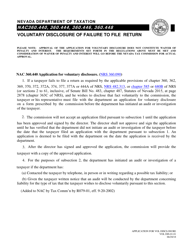

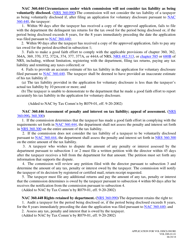

A: The purpose of this form is to allow individuals or businesses to come forward voluntarily and disclose their failure to file a return in Nevada and pay the taxes owed without being subject to penalties or criminal prosecution.

Q: What information is required on Form VOL DIS-01.01?

A: Form VOL DIS-01.01 requires the taxpayer to provide their personal information, the type of tax owed, the tax period(s) in question, and an explanation for the failure to file.

Q: Are there any fees associated with filing Form VOL DIS-01.01?

A: No, there are no fees associated with filing Form VOL DIS-01.01.

Q: Is Form VOL DIS-01.01 confidential?

A: Yes, the information provided on Form VOL DIS-01.01 is confidential and protected under Nevada law.

Q: What are the benefits of filing Form VOL DIS-01.01?

A: By voluntarily disclosing and paying the taxes owed using Form VOL DIS-01.01, individuals or businesses can avoid penalties, interest, and criminal prosecution.

Q: What should I do if I have questions about Form VOL DIS-01.01?

A: If you have questions about Form VOL DIS-01.01, you should contact the Nevada Department of Taxation for assistance.

Form Details:

- Released on June 28, 2018;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VOL DIS-01.01 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.