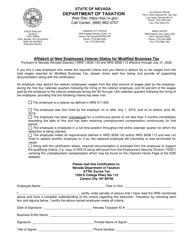

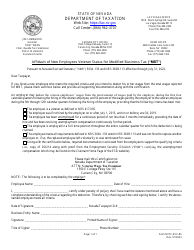

This version of the form is not currently in use and is provided for reference only. Download this version of

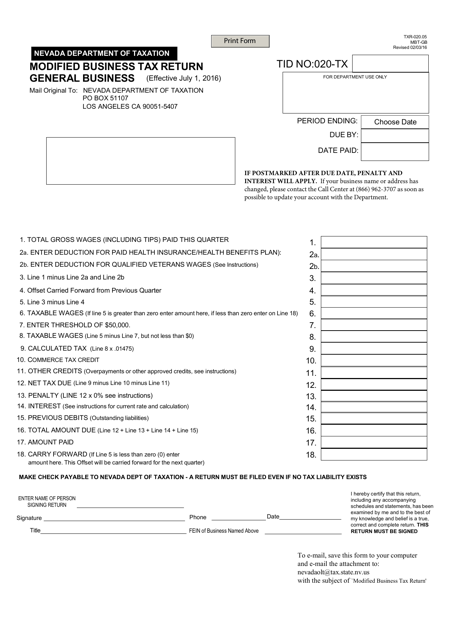

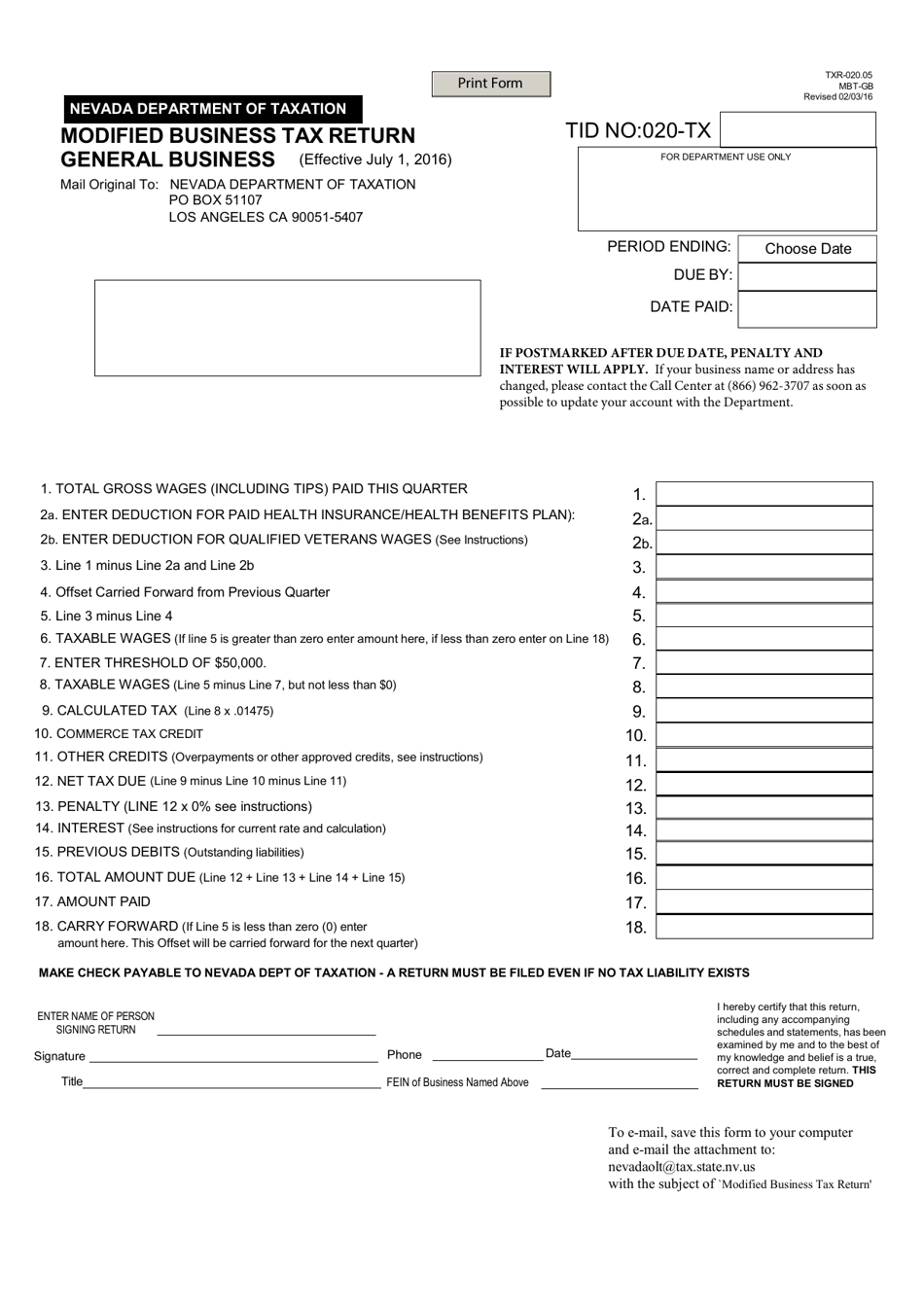

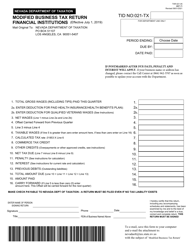

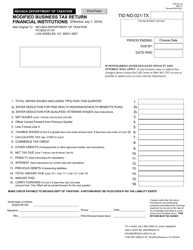

Form TXR-020.05

for the current year.

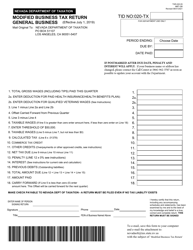

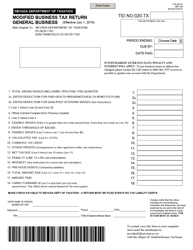

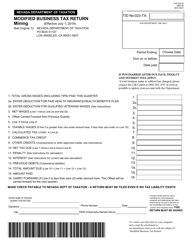

Form TXR-020.05 Modified Business Tax Return - General Business - Nevada

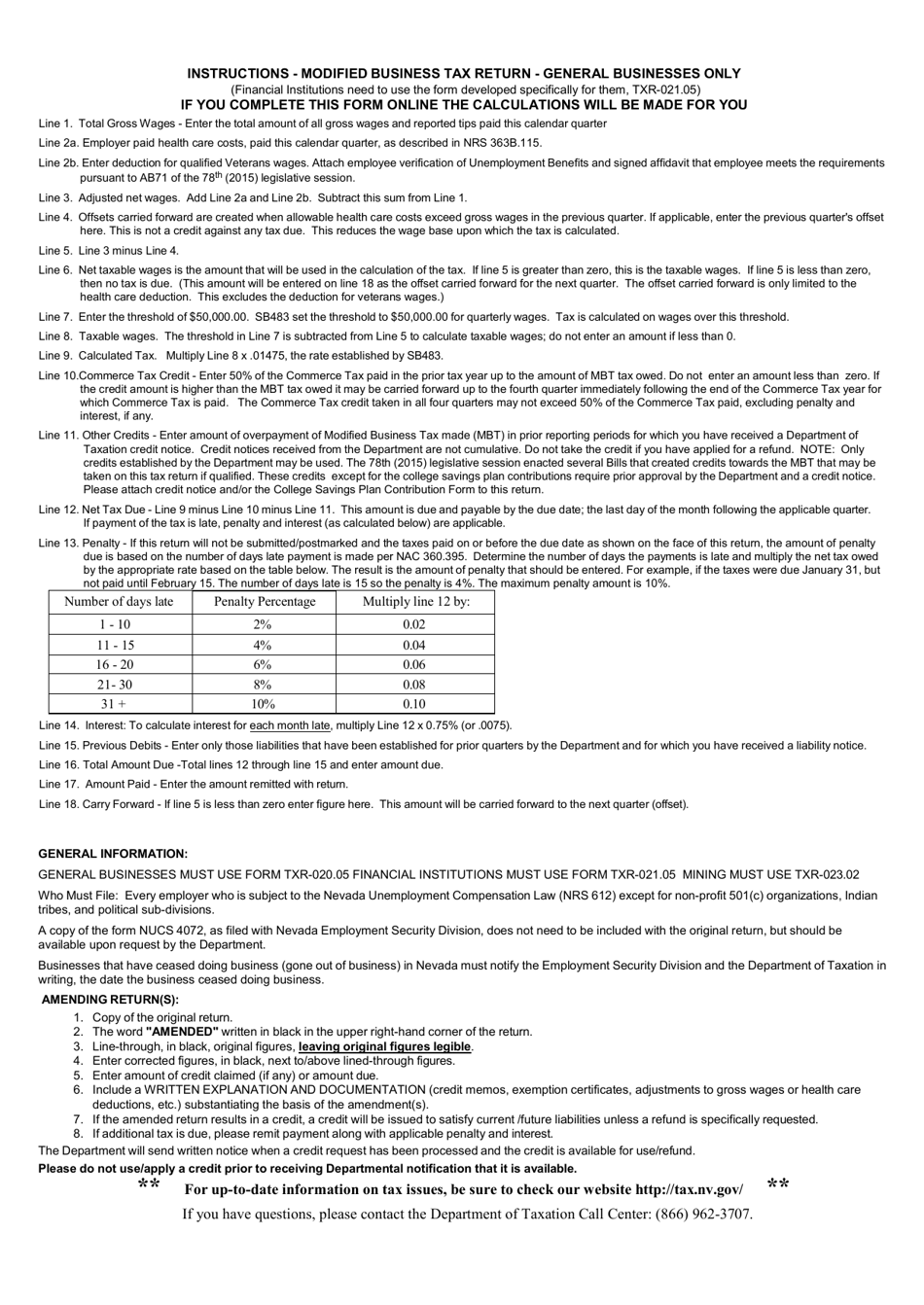

What Is Form TXR-020.05?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

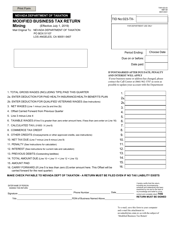

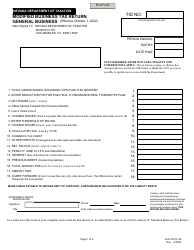

Q: What is Form TXR-020.05?

A: Form TXR-020.05 is the Modified Business Tax Return for General Business in Nevada.

Q: Who needs to file Form TXR-020.05?

A: Businesses in Nevada engaged in general business activities need to file Form TXR-020.05.

Q: What is the purpose of Form TXR-020.05?

A: Form TXR-020.05 is used to report and pay the Modified Business Tax in Nevada.

Q: When is Form TXR-020.05 due?

A: Form TXR-020.05 is due on the last day of the month following the end of the tax period.

Q: What information is required on Form TXR-020.05?

A: Form TXR-020.05 requires information about the business's gross wages and the tax due based on those wages.

Form Details:

- Released on February 3, 2016;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TXR-020.05 by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.