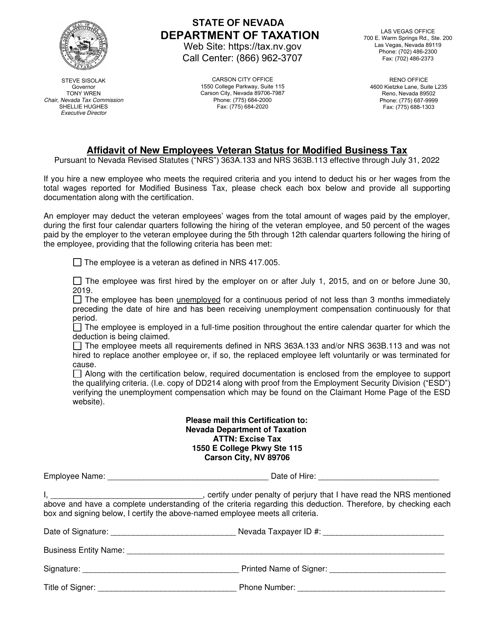

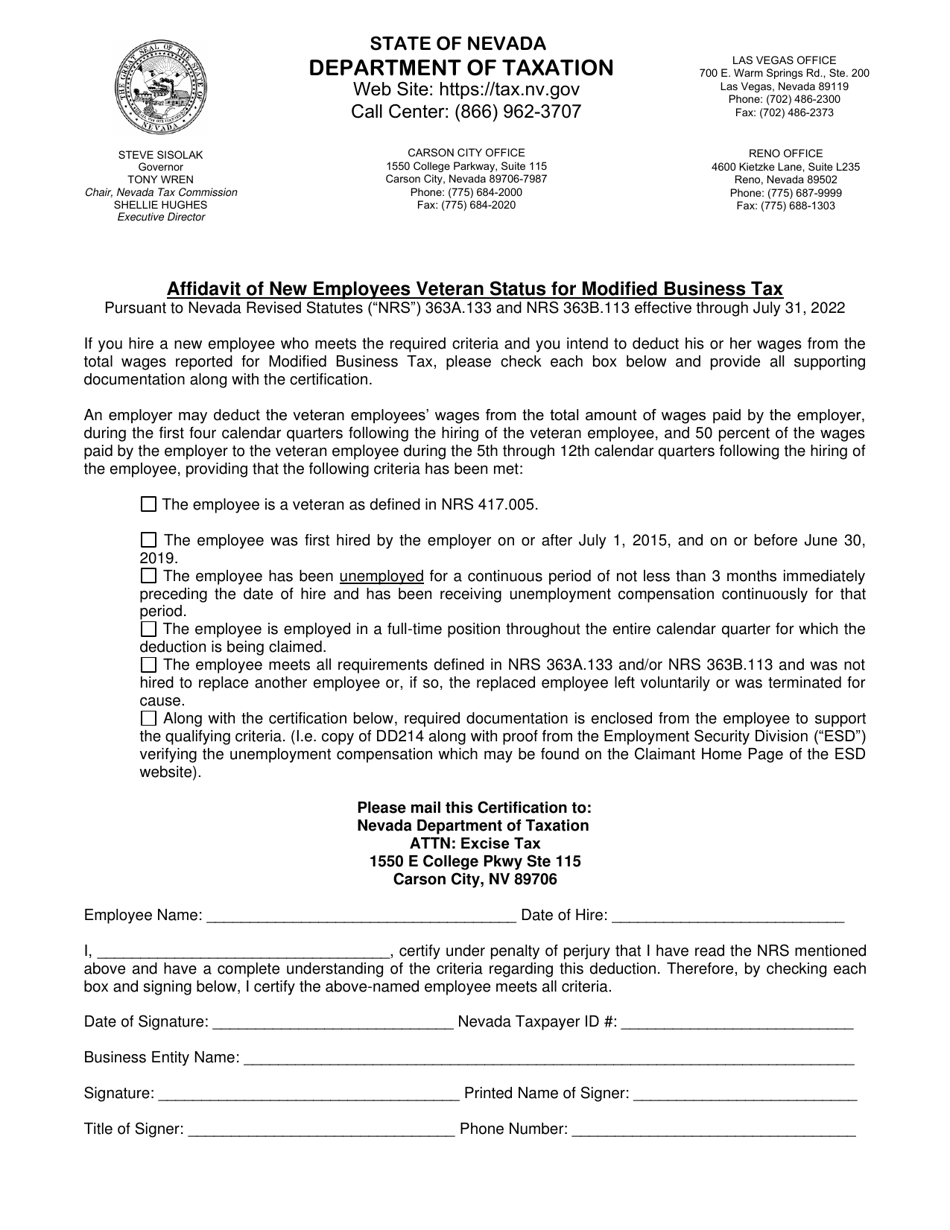

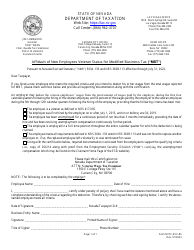

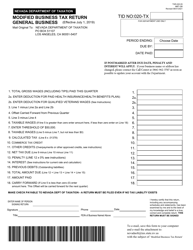

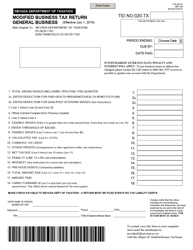

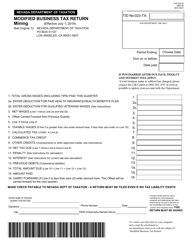

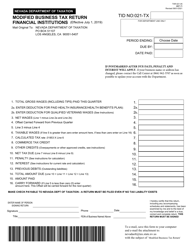

Affidavit of New Employees Veteran Status for Modified Business Tax - Nevada

Affidavit of New Employees Veteran Status for Modified Business Tax is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is an Affidavit of New Employees Veteran Status?

A: An Affidavit of New Employees Veteran Status is a document used in Nevada to determine the veteran status of new employees for the purpose of Modified Business Tax.

Q: Why is the veteran status of new employees important for Modified Business Tax in Nevada?

A: The veteran status of new employees can affect the Modified Business Tax rate that an employer needs to pay in Nevada.

Q: Who needs to submit an Affidavit of New Employees Veteran Status?

A: Employers in Nevada are required to submit an Affidavit of New Employees Veteran Status for each new employee.

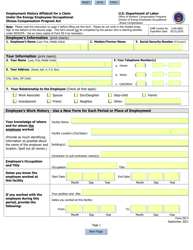

Q: What information is required in an Affidavit of New Employees Veteran Status?

A: The Affidavit requires the employer to provide the name, social security number, and veteran status of each new employee.

Q: Are there any exemptions or credits for employers based on veteran status?

A: No, the Affidavit of New Employees Veteran Status is used solely for determining the tax rate for Modified Business Tax in Nevada, and there are no specific exemptions or credits based on veteran status.

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.