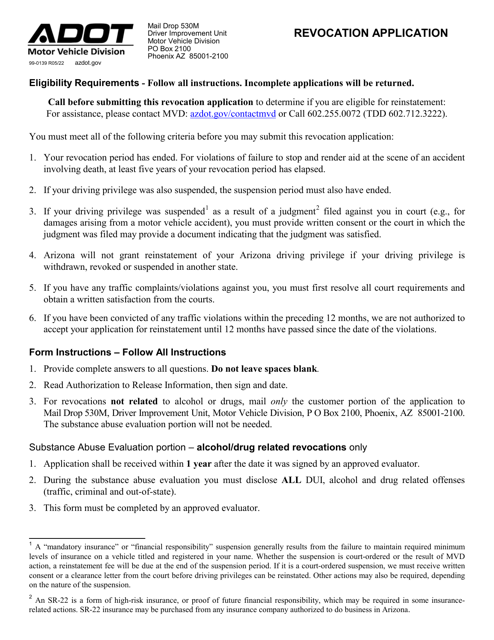

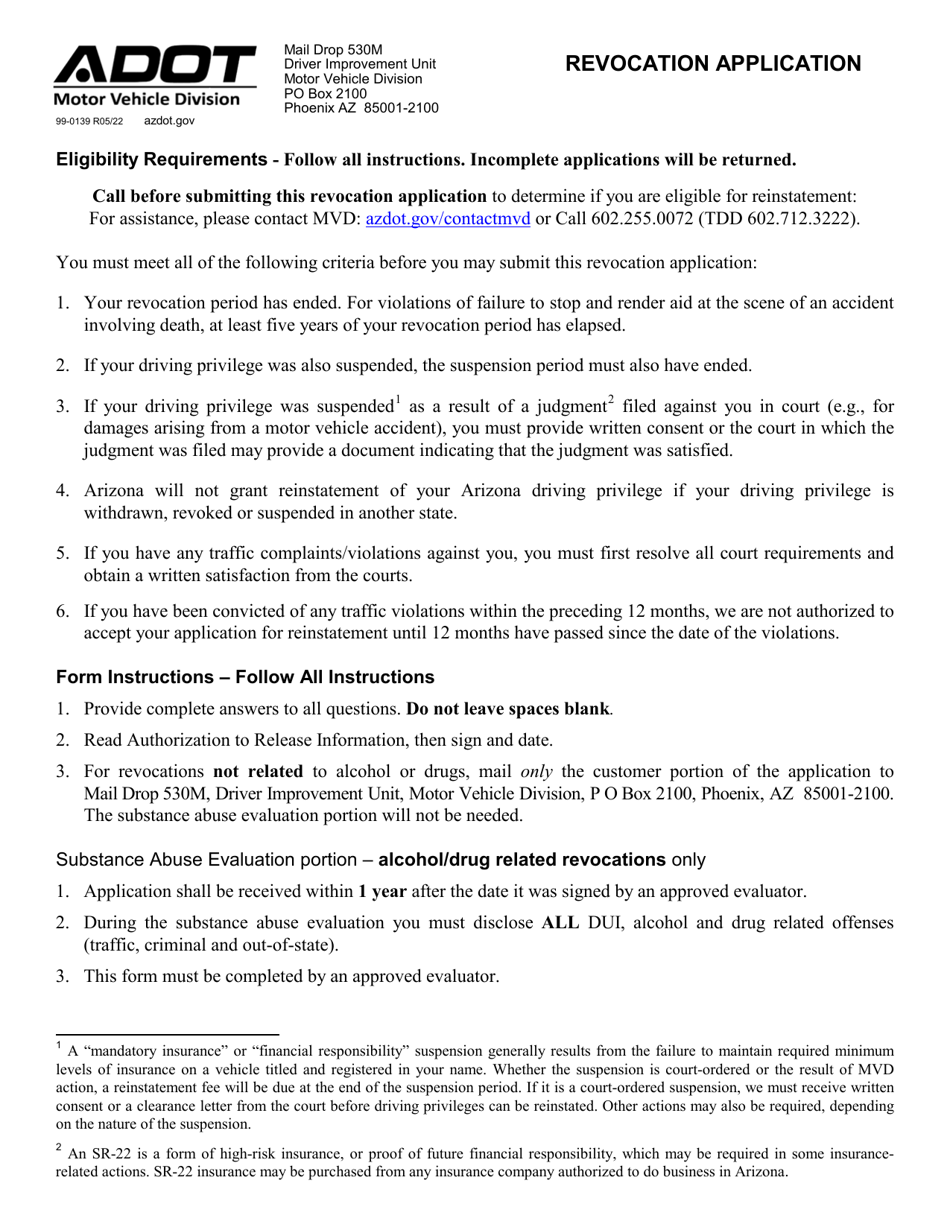

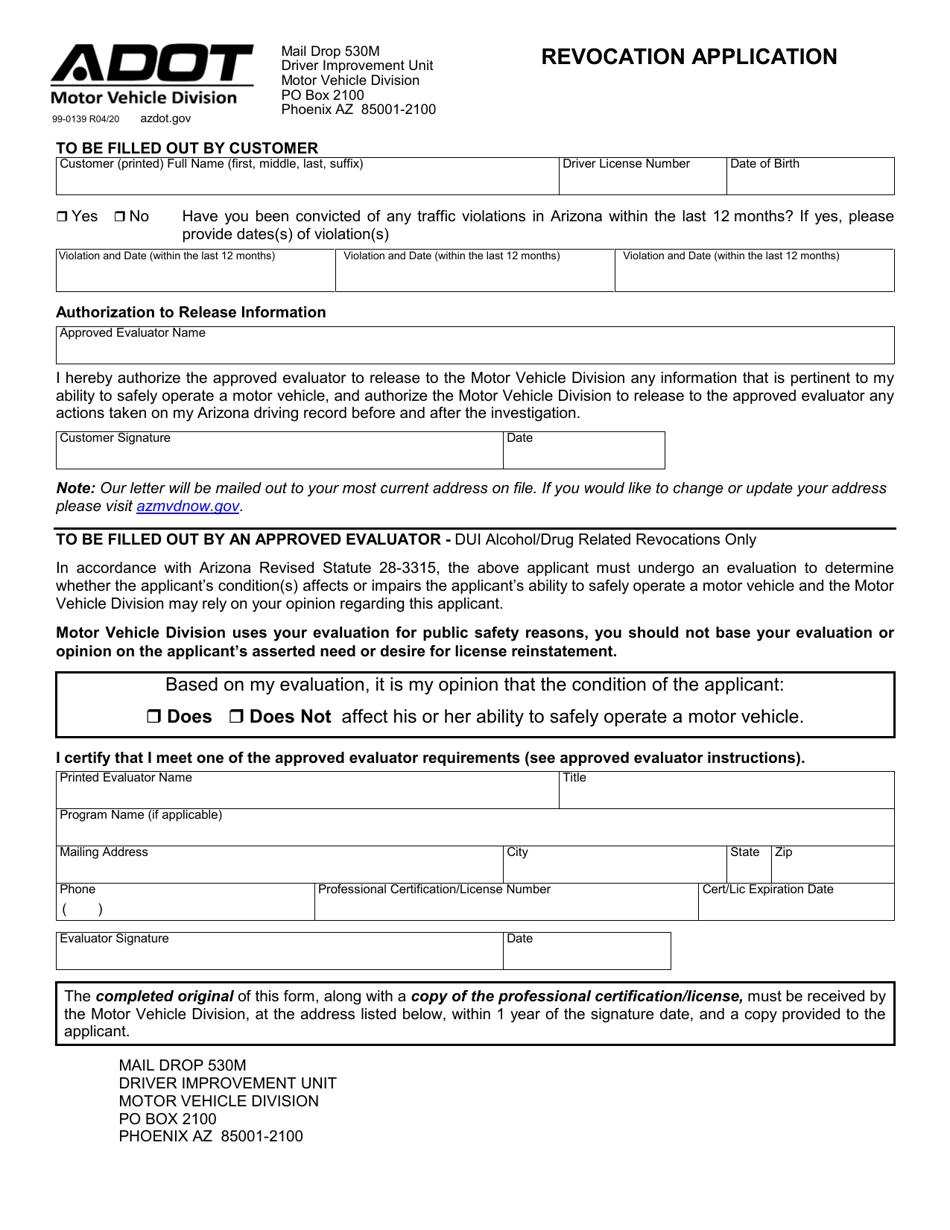

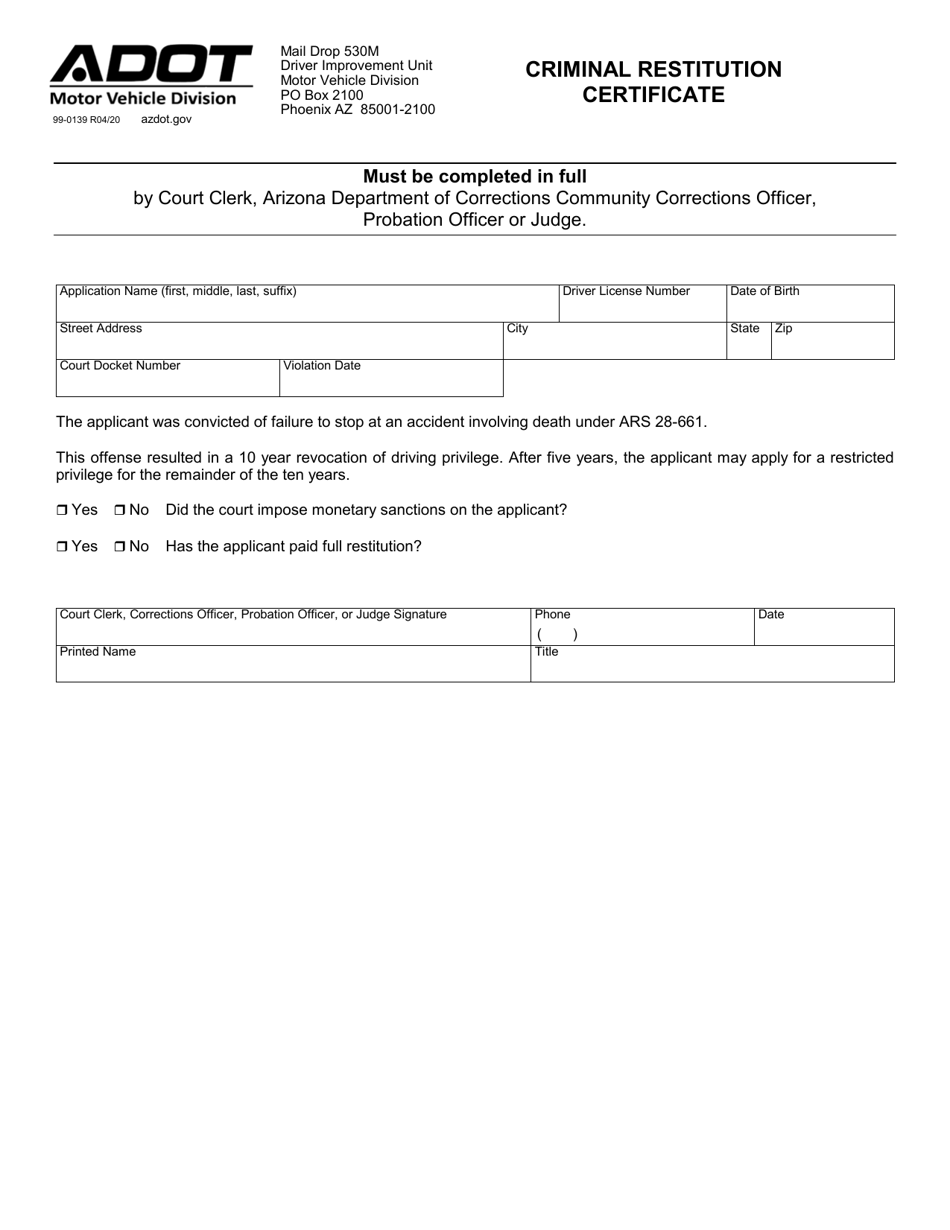

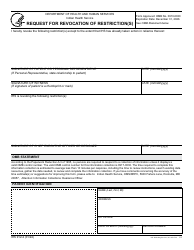

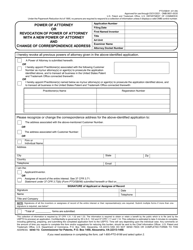

Form 99-0139 Revocation Application - Arizona

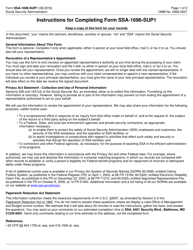

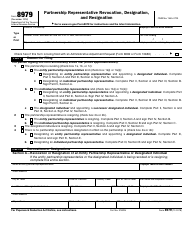

What Is Form 99-0139?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

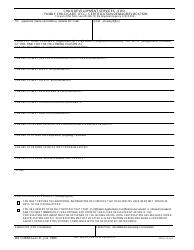

Q: What is Form 99-0139 Revocation Application?

A: Form 99-0139 Revocation Application is an application used in Arizona to request the revocation of a tax-exempt status.

Q: Who can use Form 99-0139 Revocation Application?

A: Nonprofit organizations that want to voluntarily revoke their tax-exempt status in Arizona can use Form 99-0139 Revocation Application.

Q: What is the purpose of revoking tax-exempt status?

A: Revoking tax-exempt status means that the nonprofit organization will no longer be exempt from paying state taxes in Arizona.

Q: Are there any fees associated with submitting Form 99-0139 Revocation Application?

A: There are no fees associated with submitting Form 99-0139 Revocation Application in Arizona.

Q: What information is required on Form 99-0139 Revocation Application?

A: Form 99-0139 Revocation Application requires information about the nonprofit organization, including its name, federal employer identification number, and reasons for revocation.

Q: What is the deadline for submitting Form 99-0139 Revocation Application?

A: There is no specific deadline for submitting Form 99-0139 Revocation Application in Arizona.

Q: What happens after submitting Form 99-0139 Revocation Application?

A: After submitting Form 99-0139 Revocation Application, the Arizona Department of Revenue will review the application and notify the organization of the revocation of its tax-exempt status.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 99-0139 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.