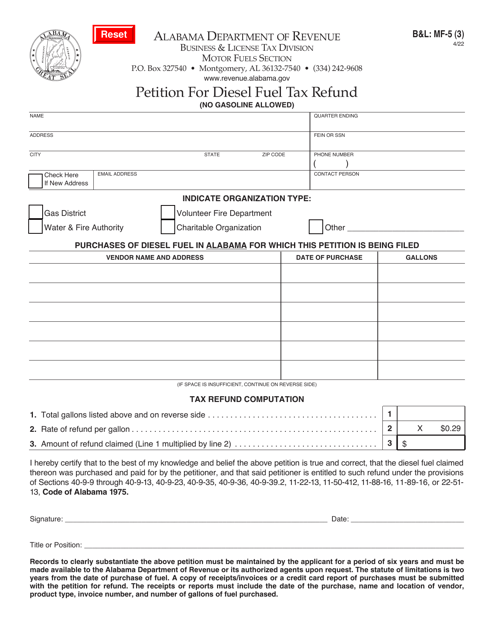

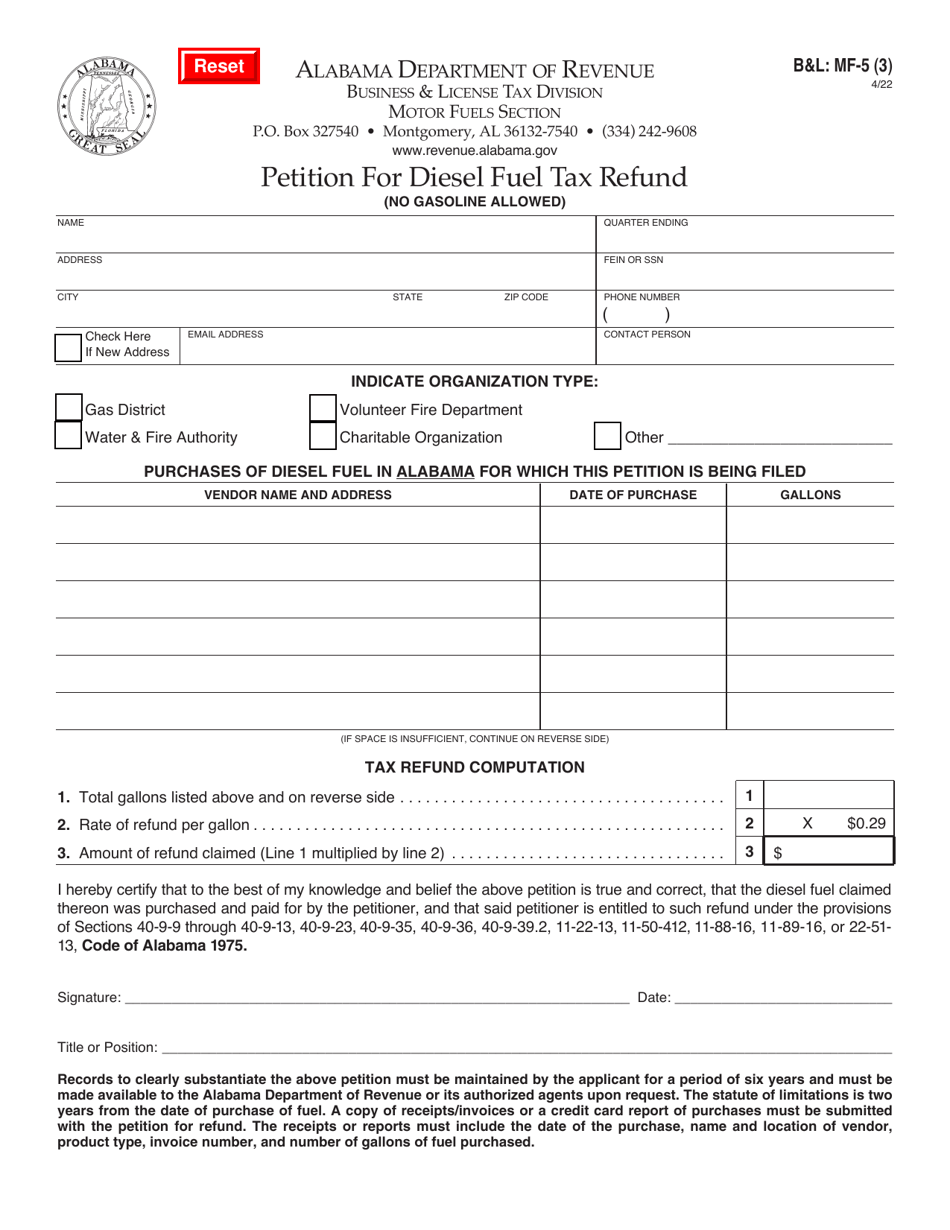

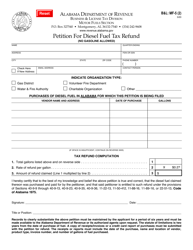

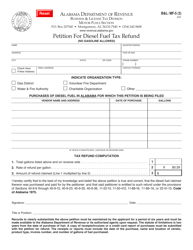

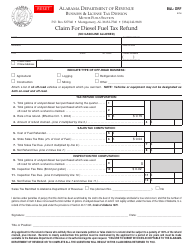

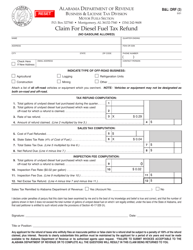

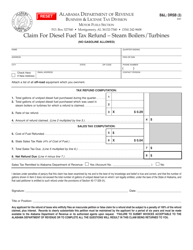

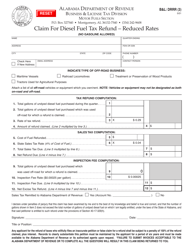

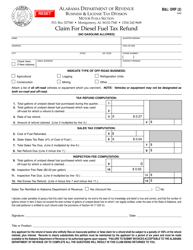

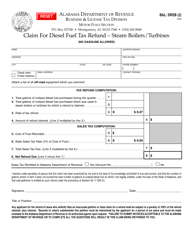

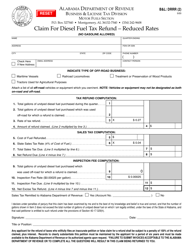

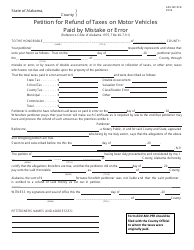

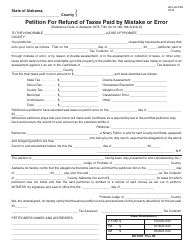

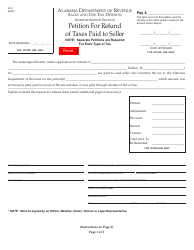

Form B&L: MF-5 (3) Petition for Diesel Fuel Tax Refund - Alabama

What Is Form B&L: MF-5 (3)?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L: MF-5 (3)?

A: It is the Petition for Diesel Fuel Tax Refund in Alabama.

Q: Who can use Form B&L: MF-5 (3)?

A: It can be used by individuals or businesses in Alabama who want to claim a refund on diesel fuel taxes.

Q: What is the purpose of this form?

A: The purpose is to request a refund of diesel fuel taxes paid in Alabama.

Q: Are there any specific eligibility requirements for the refund?

A: Yes, you must meet certain criteria, such as using the fuel for off-highway use or in certain agricultural activities.

Q: How do I fill out Form B&L: MF-5 (3)?

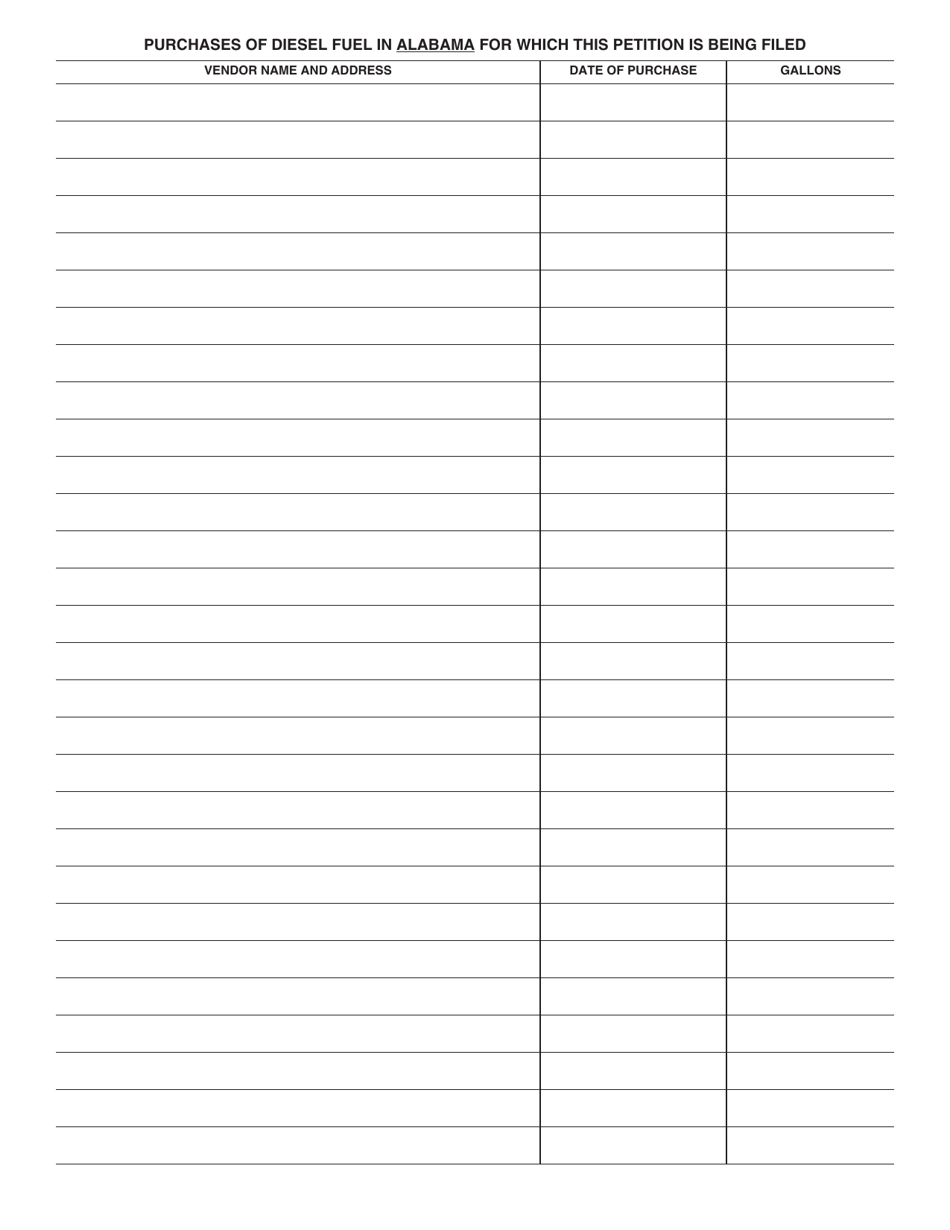

A: You need to provide information about your purchases of diesel fuel and calculate the refund amount.

Q: Is there a deadline for submitting the form?

A: Yes, the form must be filed within 6 months from the end of the calendar year in which the refund claim arises.

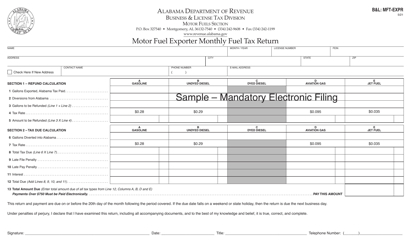

Q: Can I file the form electronically?

A: No, currently the form cannot be filed electronically and must be submitted in paper format.

Q: Is there any fee for filing this form?

A: No, there is no fee for filing the Petition for Diesel Fuel Tax Refund.

Q: What if my refund claim is denied?

A: You have the option to appeal the denial by following the instructions provided by the Alabama Department of Revenue.

Q: Can I claim refunds for previous years?

A: No, the form is only for claiming refunds for the current calendar year.

Q: Is there a limit on the amount of refund that can be claimed?

A: Yes, there is a maximum refund amount that varies depending on the type of fuel and its use.

Q: Who can I contact for more information?

A: You can contact the Alabama Department of Revenue for any additional questions or clarification regarding the form.

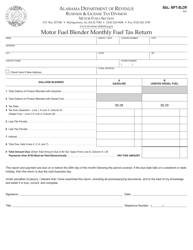

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MF-5 (3) by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.