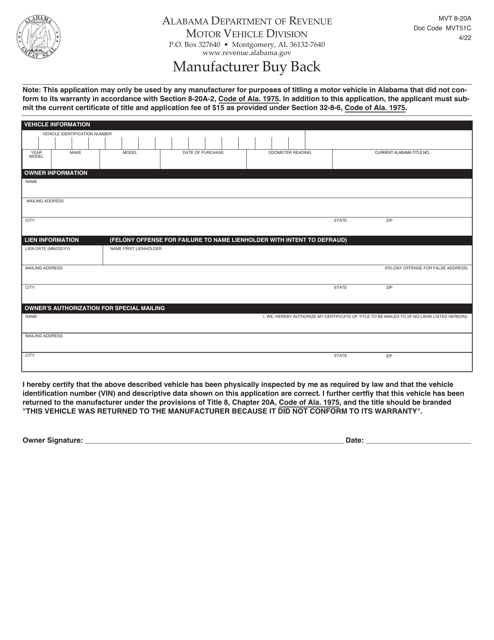

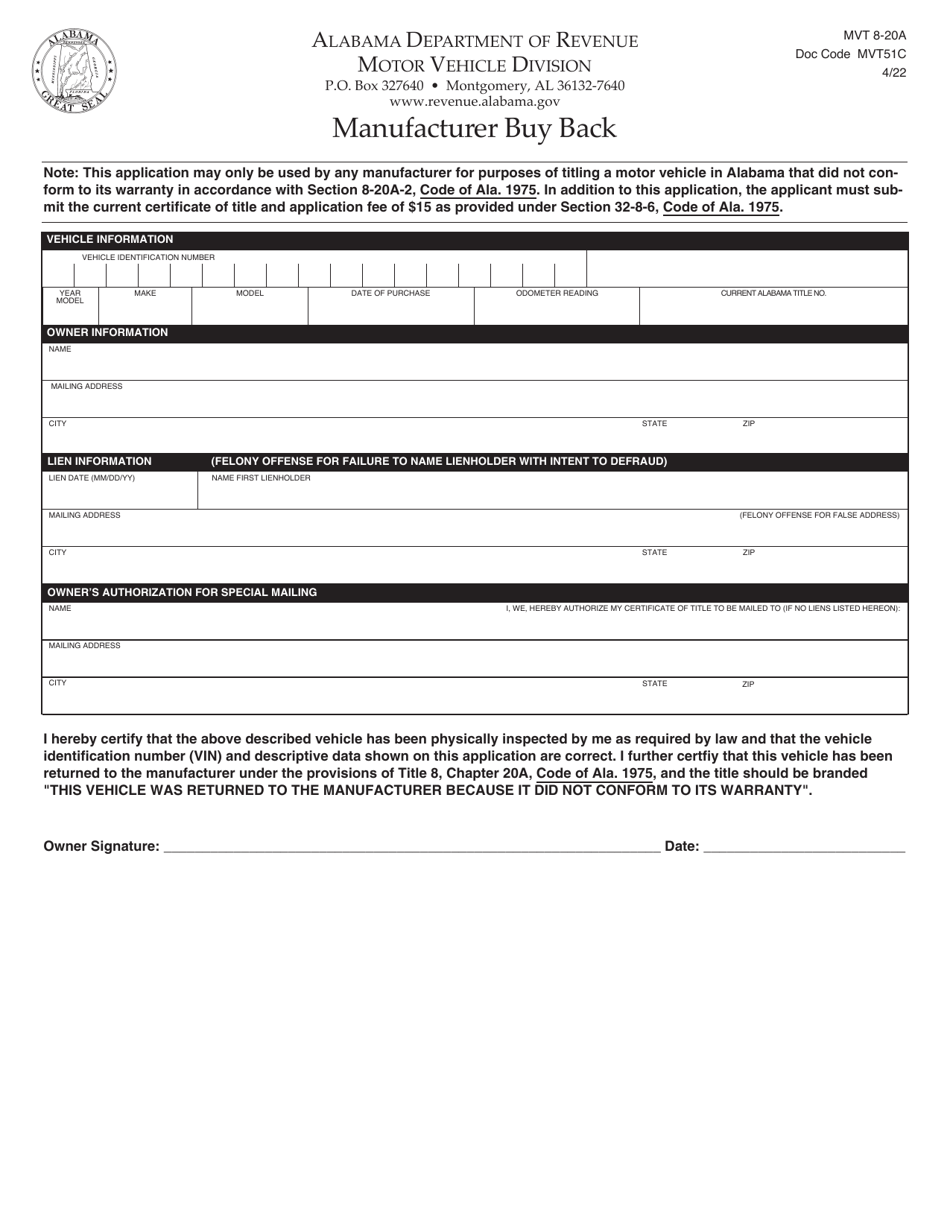

Form MVT8-20A Manufacturer Buy Back - Alabama

What Is Form MVT8-20A?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVT8-20A?

A: Form MVT8-20A is a form used for Manufacturer Buy Back transactions in Alabama.

Q: What is a Manufacturer Buy Back?

A: A Manufacturer Buy Back is when a vehicle manufacturer repurchases a vehicle from a consumer.

Q: Who uses Form MVT8-20A?

A: Form MVT8-20A is used by the vehicle manufacturer and the consumer involved in the buy back transaction.

Q: What information is required on Form MVT8-20A?

A: Form MVT8-20A requires information about the vehicle, including the vehicle identification number (VIN), make, model, and year.

Q: Is there a fee to submit Form MVT8-20A?

A: No, there is no fee to submit Form MVT8-20A.

Q: What happens after I submit Form MVT8-20A?

A: After submitting Form MVT8-20A, the vehicle manufacturer will process the buy back and may provide compensation to the consumer.

Q: Are there any eligibility requirements for a Manufacturer Buy Back?

A: Eligibility requirements for a Manufacturer Buy Back vary depending on the specific circumstances. It is best to contact the vehicle manufacturer or consult legal advice for specific eligibility requirements.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVT8-20A by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.