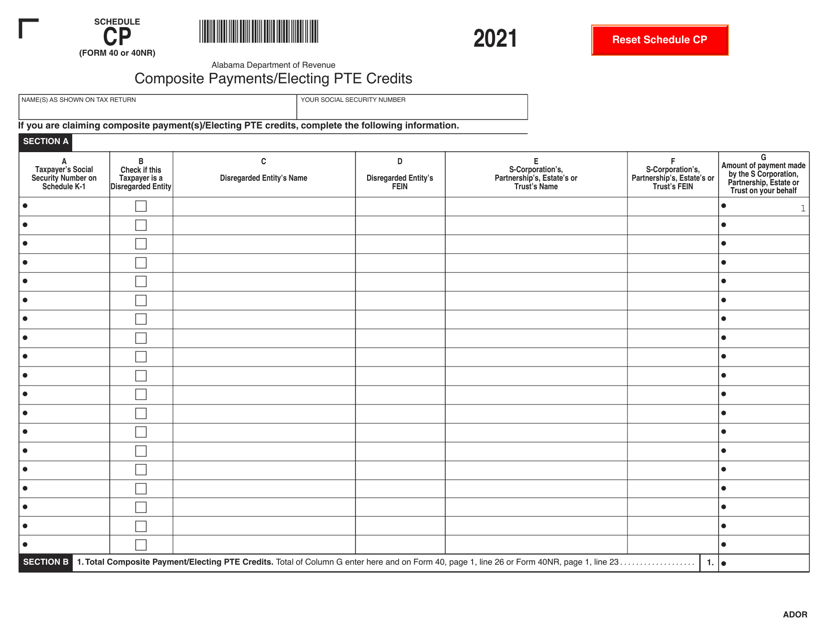

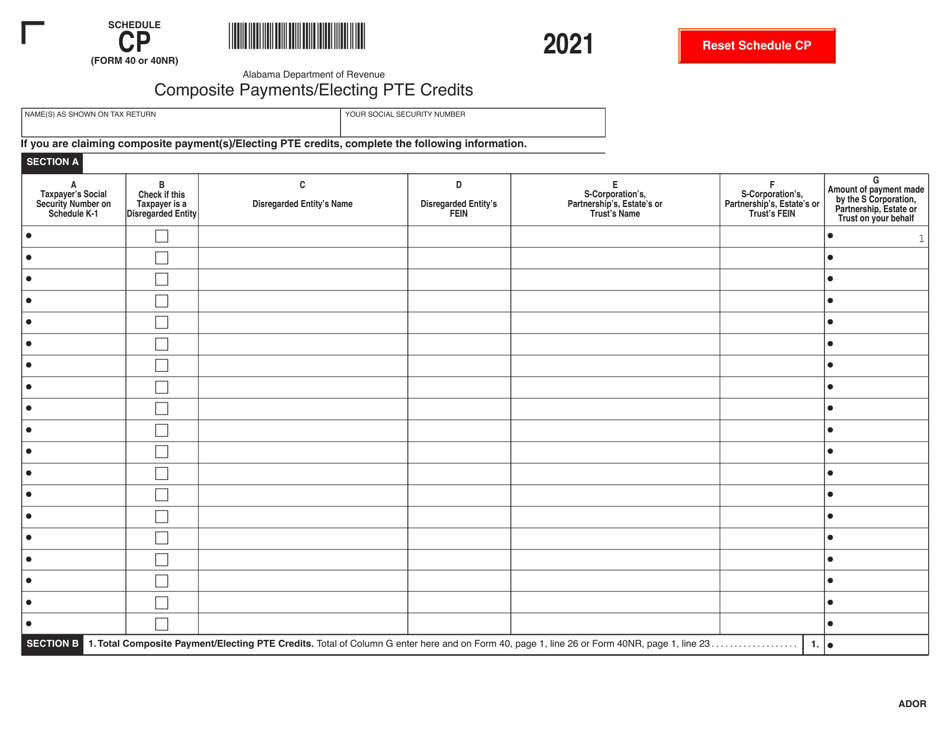

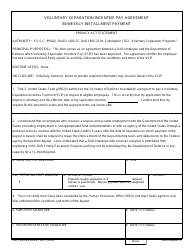

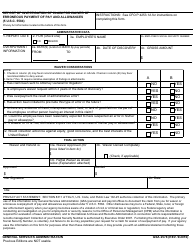

Form 40 (40NR) Schedule CP Composite Payments / Electing Pte Credits - Alabama

What Is Form 40 (40NR) Schedule CP?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40 (40NR) Schedule CP?

A: Form 40 (40NR) Schedule CP is a form used for reporting composite payments and electing private credits in the state of Alabama.

Q: What are composite payments?

A: Composite payments are income tax payments made by a pass-through entity on behalf of its nonresident individual members.

Q: What are electing private credits?

A: Electing private credits are certain tax credits that pass-through entities can allocate to their nonresident individual members.

Q: Who needs to use Form 40 (40NR) Schedule CP?

A: Pass-through entities in Alabama that make composite payments or want to allocate electing private credits need to use Form 40 (40NR) Schedule CP.

Q: What information is required on Form 40 (40NR) Schedule CP?

A: Form 40 (40NR) Schedule CP requires you to provide details of composite payment amounts and electing private credits allocated to nonresident individual members.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40 (40NR) Schedule CP by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.