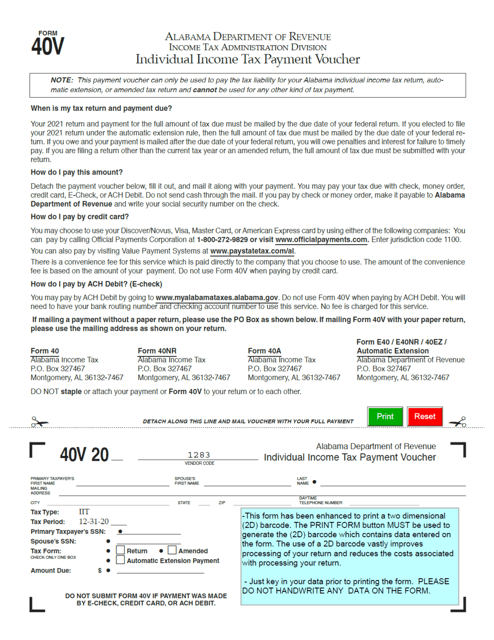

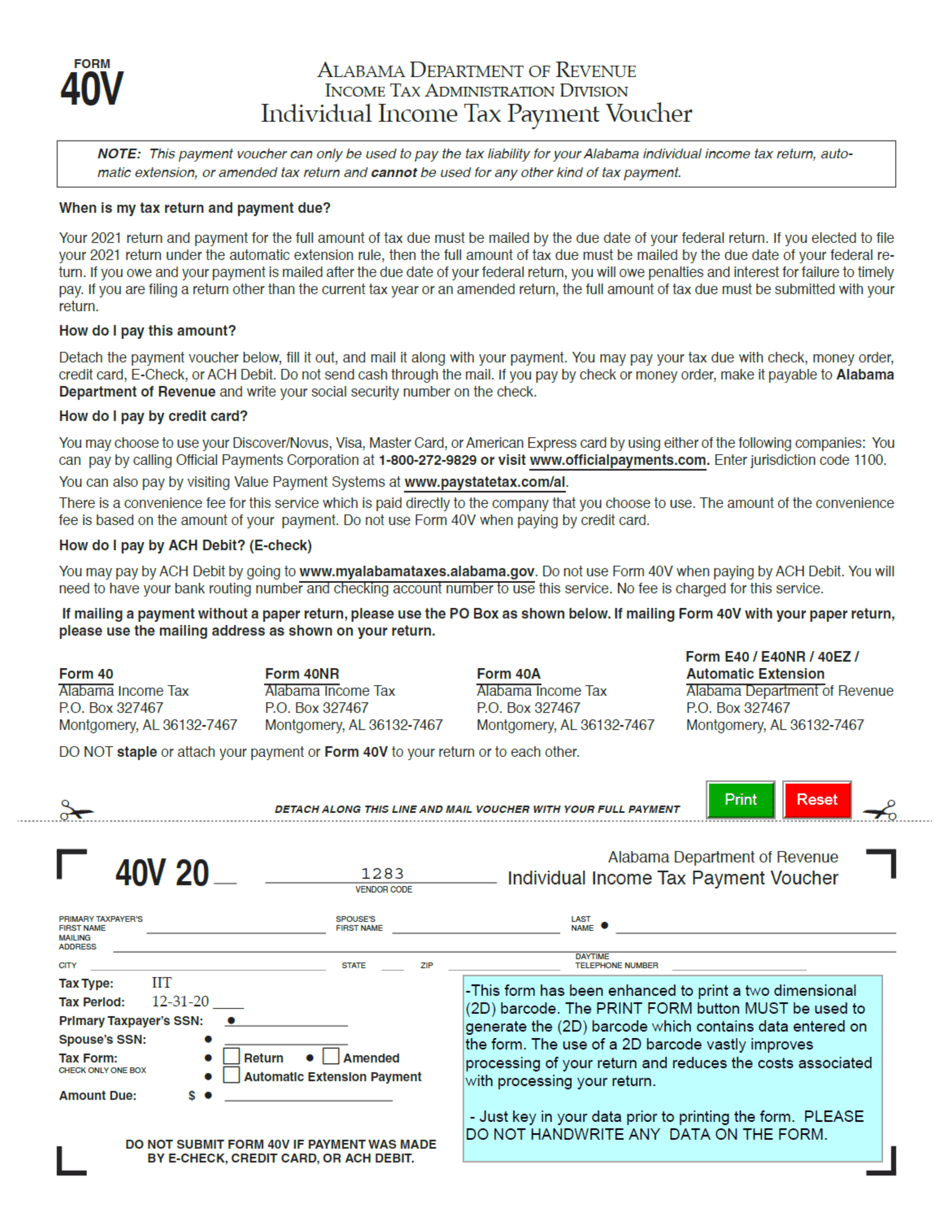

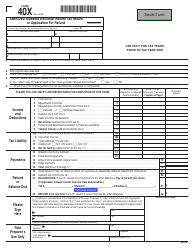

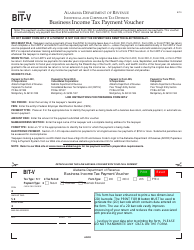

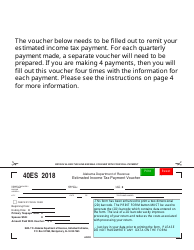

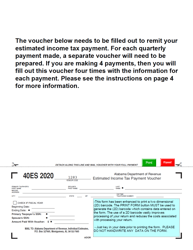

Form 40V Individual Tax Payment Voucher - Alabama

What Is Form 40V?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40V?

A: Form 40V is an Individual Tax Payment Voucher used for making tax payments in Alabama.

Q: Who uses Form 40V?

A: Individuals in Alabama who need to make tax payments use Form 40V.

Q: What is the purpose of Form 40V?

A: Form 40V is used to accompany tax payments made by individuals in Alabama.

Q: How do I use Form 40V?

A: Fill out the required information on Form 40V, attach your payment, and mail it to the designated address.

Q: When should I use Form 40V?

A: Use Form 40V when you need to make a tax payment to the Alabama Department of Revenue and want to include a payment voucher with your payment.

Q: Are there any other forms I need to include with Form 40V?

A: The specific requirements may vary depending on your tax situation, but generally you will need to include your payment along with Form 40V.

Q: Can I make my tax payment electronically instead of using Form 40V?

A: Yes, the Alabama Department of Revenue offers various electronic payment options.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40V by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.