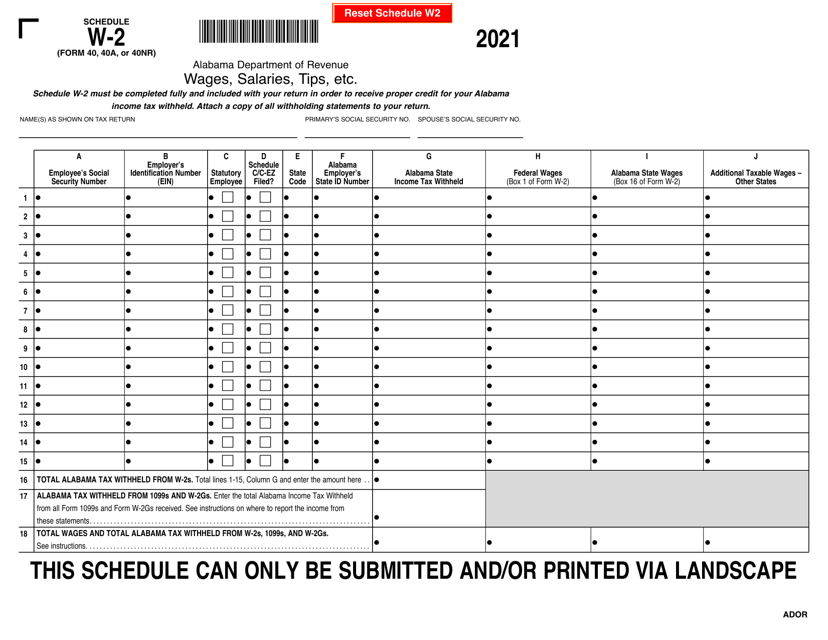

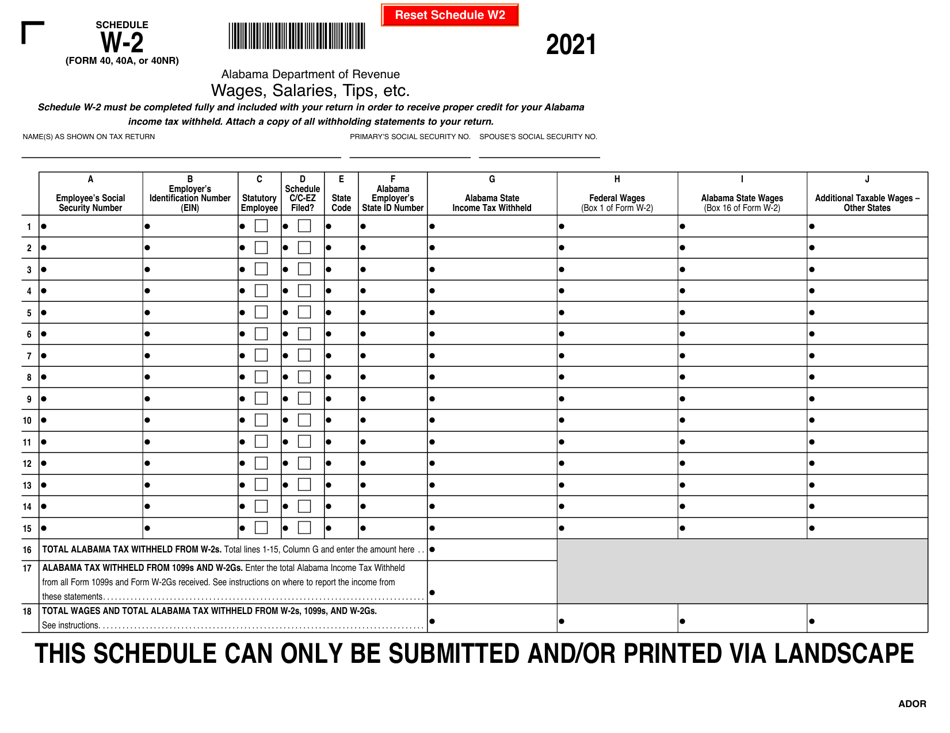

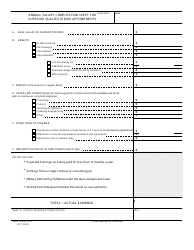

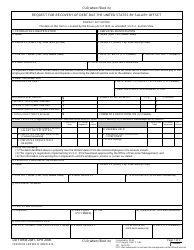

Form 40 (40A; 40NR) Schedule W-2 Wages, Salaries, Tips, Etc. - Alabama

What Is Form 40 (40A; 40NR) Schedule W-2?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40 (40A; 40NR) Schedule W-2?

A: Form 40 (40A; 40NR) Schedule W-2 is a tax form used for reporting wages, salaries, tips, and other income in the state of Alabama.

Q: What is the purpose of Form 40 (40A; 40NR) Schedule W-2?

A: The purpose of Form 40 (40A; 40NR) Schedule W-2 is to report income earned by individuals in Alabama, specifically the wages, salaries, and tips reported on their W-2 forms.

Q: Who needs to file Form 40 (40A; 40NR) Schedule W-2?

A: Individuals who are required to file an Alabama state tax return and have income from wages, salaries, or tips reported on a W-2 form need to file Form 40 (40A; 40NR) Schedule W-2.

Q: Is Form 40 (40A; 40NR) Schedule W-2 the same as a federal W-2 form?

A: No, Form 40 (40A; 40NR) Schedule W-2 is specific to the state of Alabama and is used to report income for state tax purposes. The federal W-2 form is used for reporting income for federal tax purposes.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40 (40A; 40NR) Schedule W-2 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.