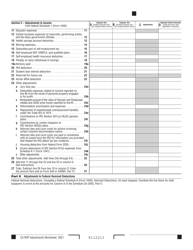

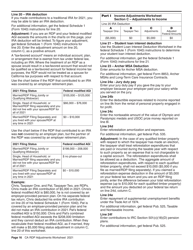

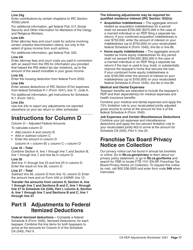

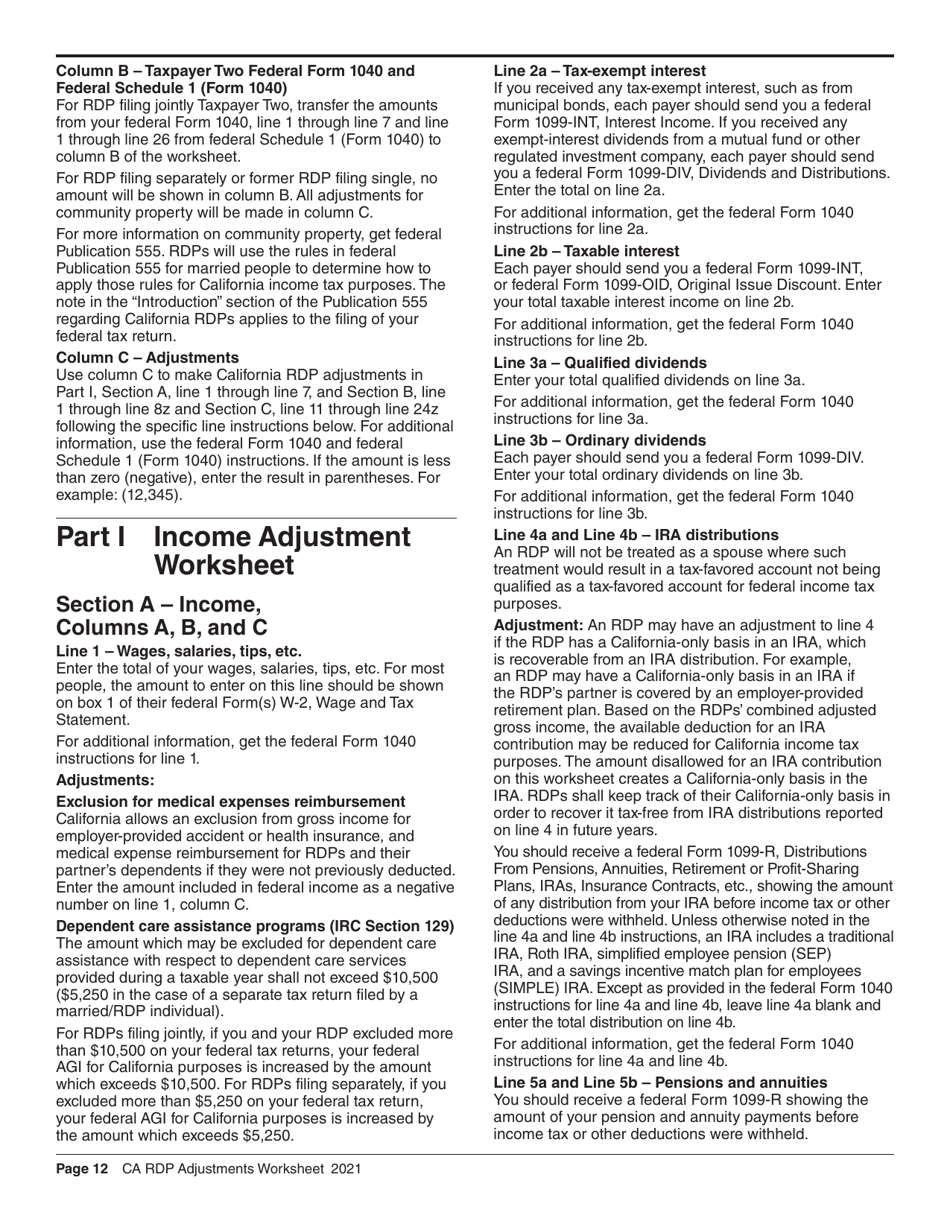

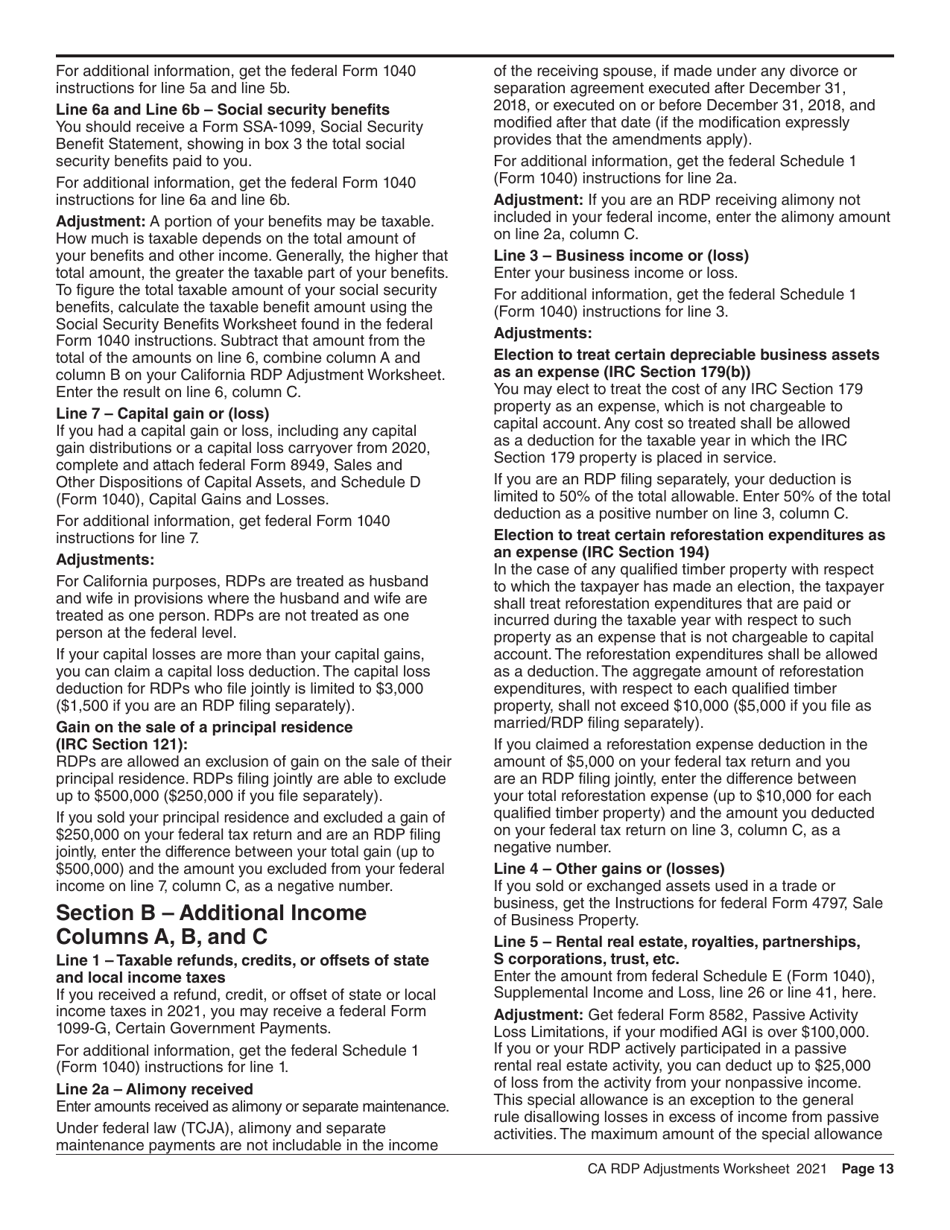

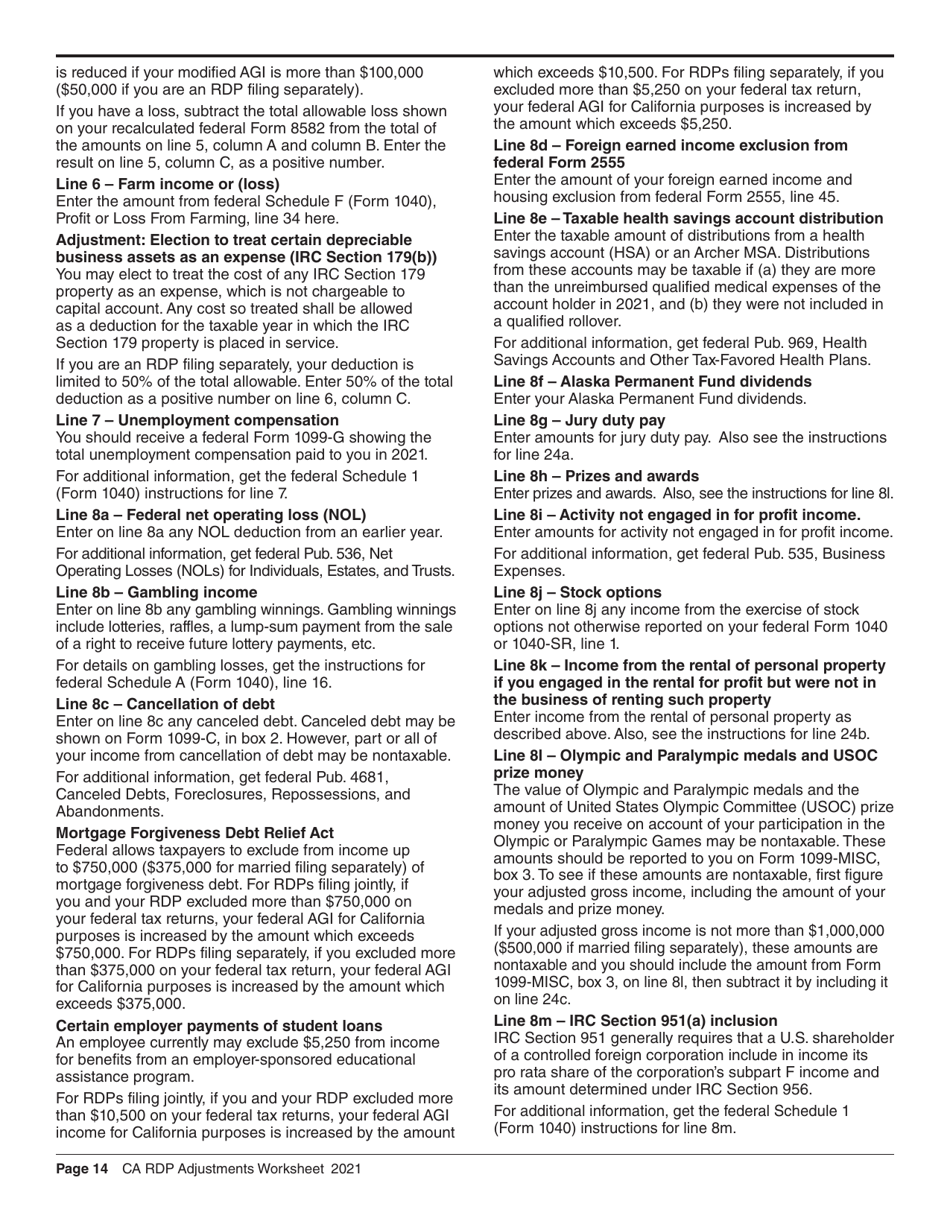

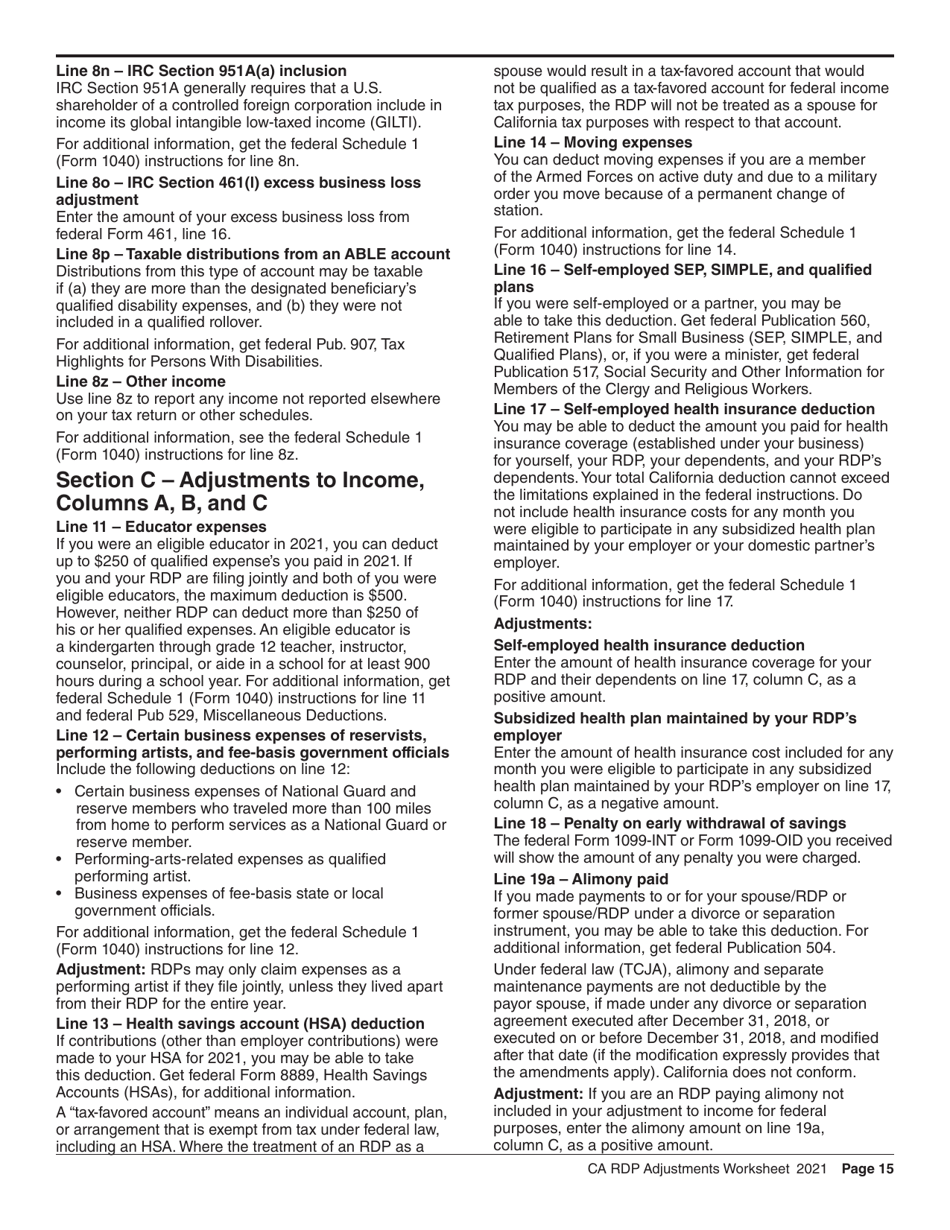

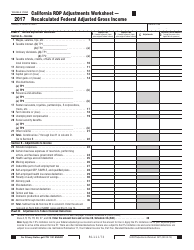

Form FTB737 California Rdp Adjustments Worksheet - Recalculated Federal Adjusted Gross Income - California

What Is Form FTB737?

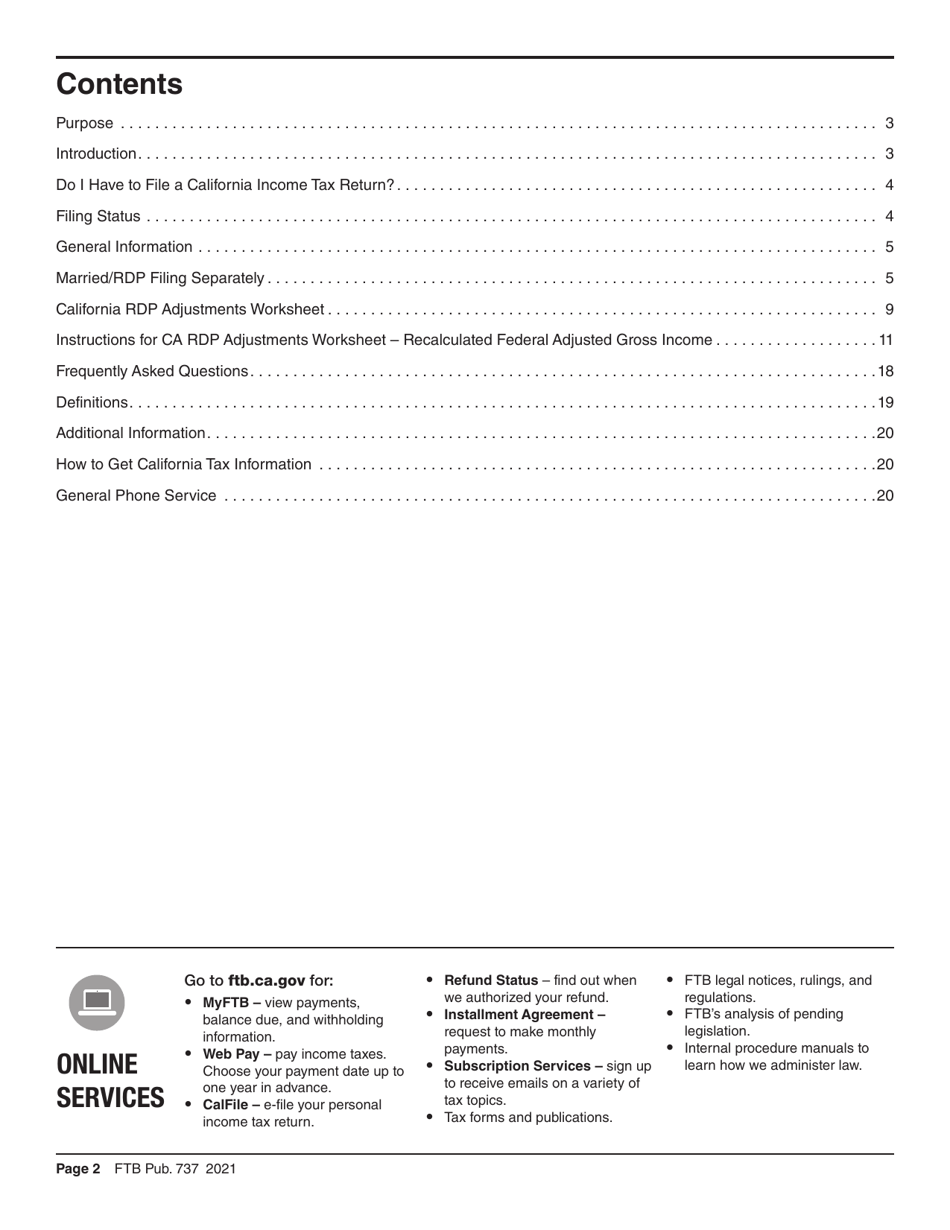

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB737?

A: Form FTB737 is the California Rdp Adjustments Worksheet.

Q: What does FTB stand for?

A: FTB stands for Franchise Tax Board.

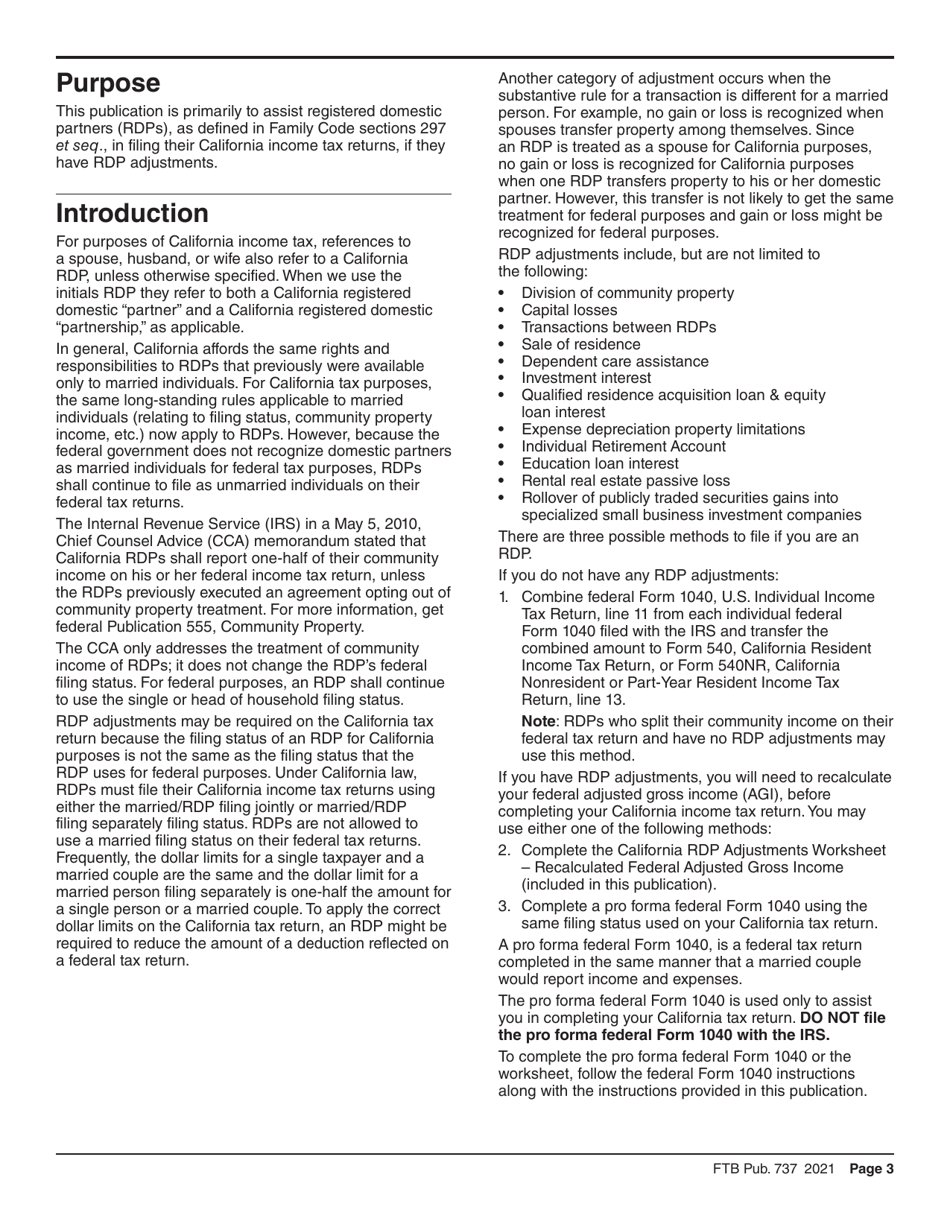

Q: What is the purpose of Form FTB737?

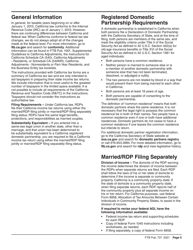

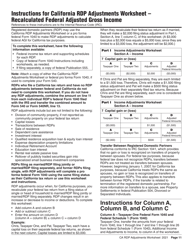

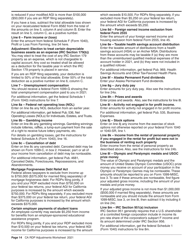

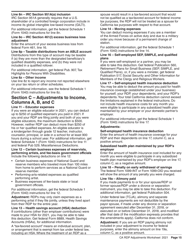

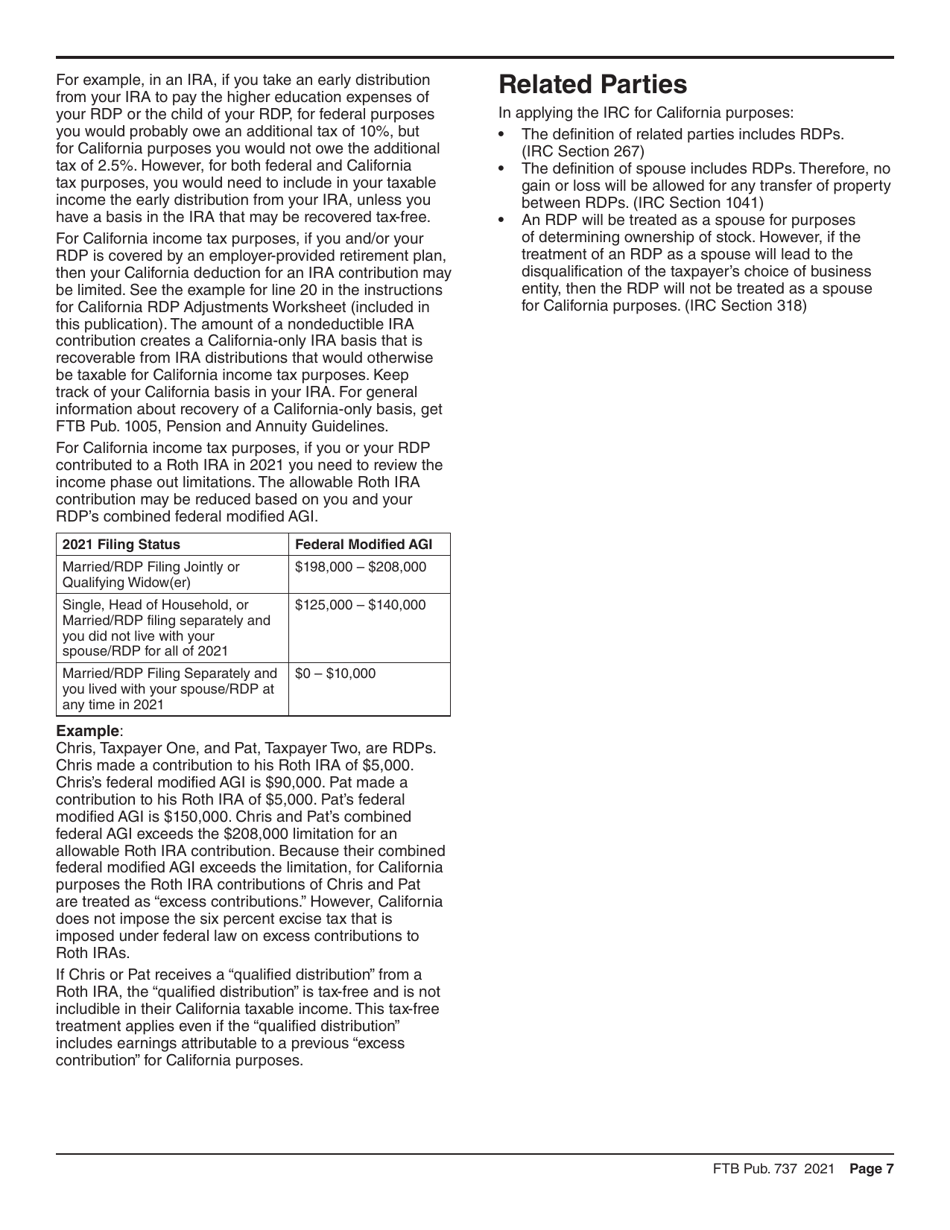

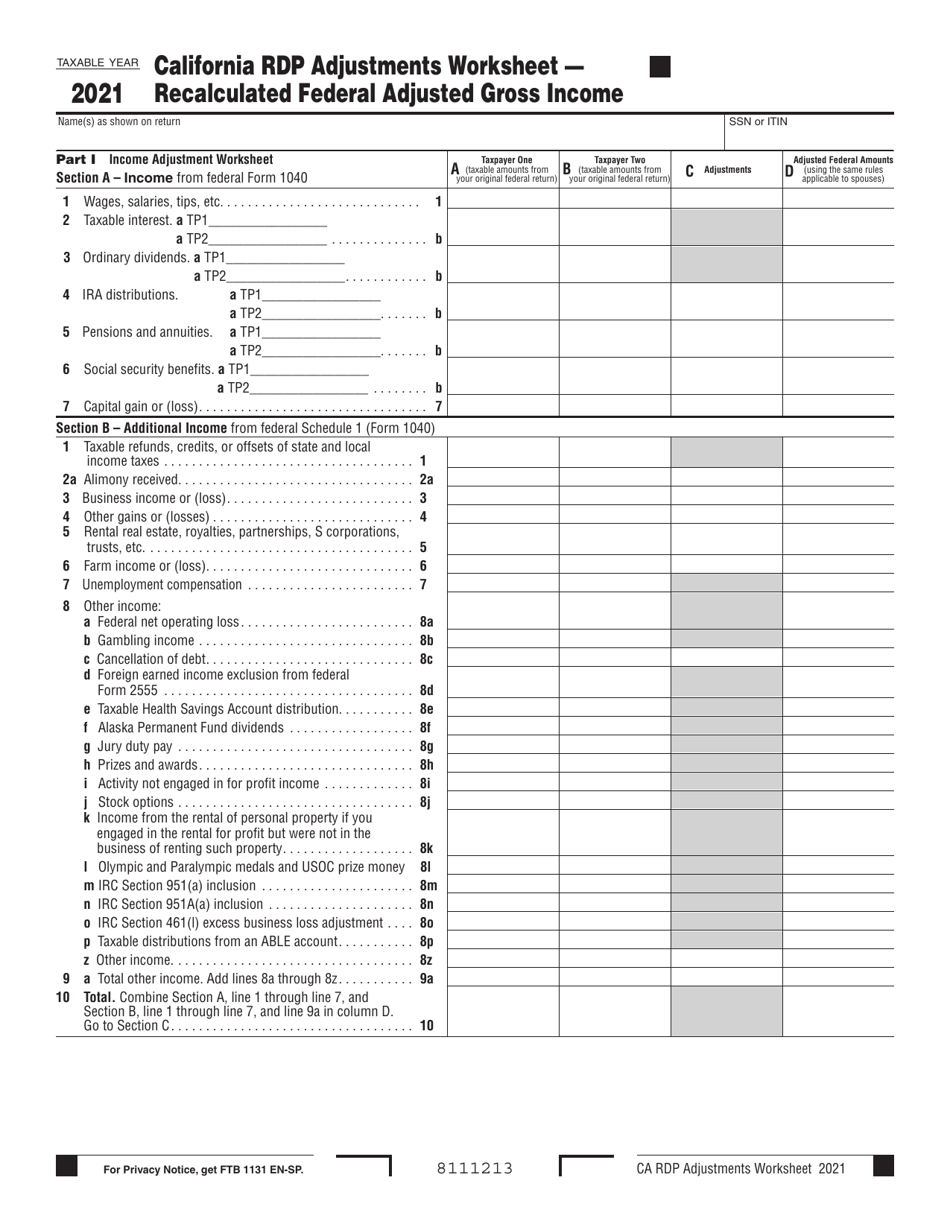

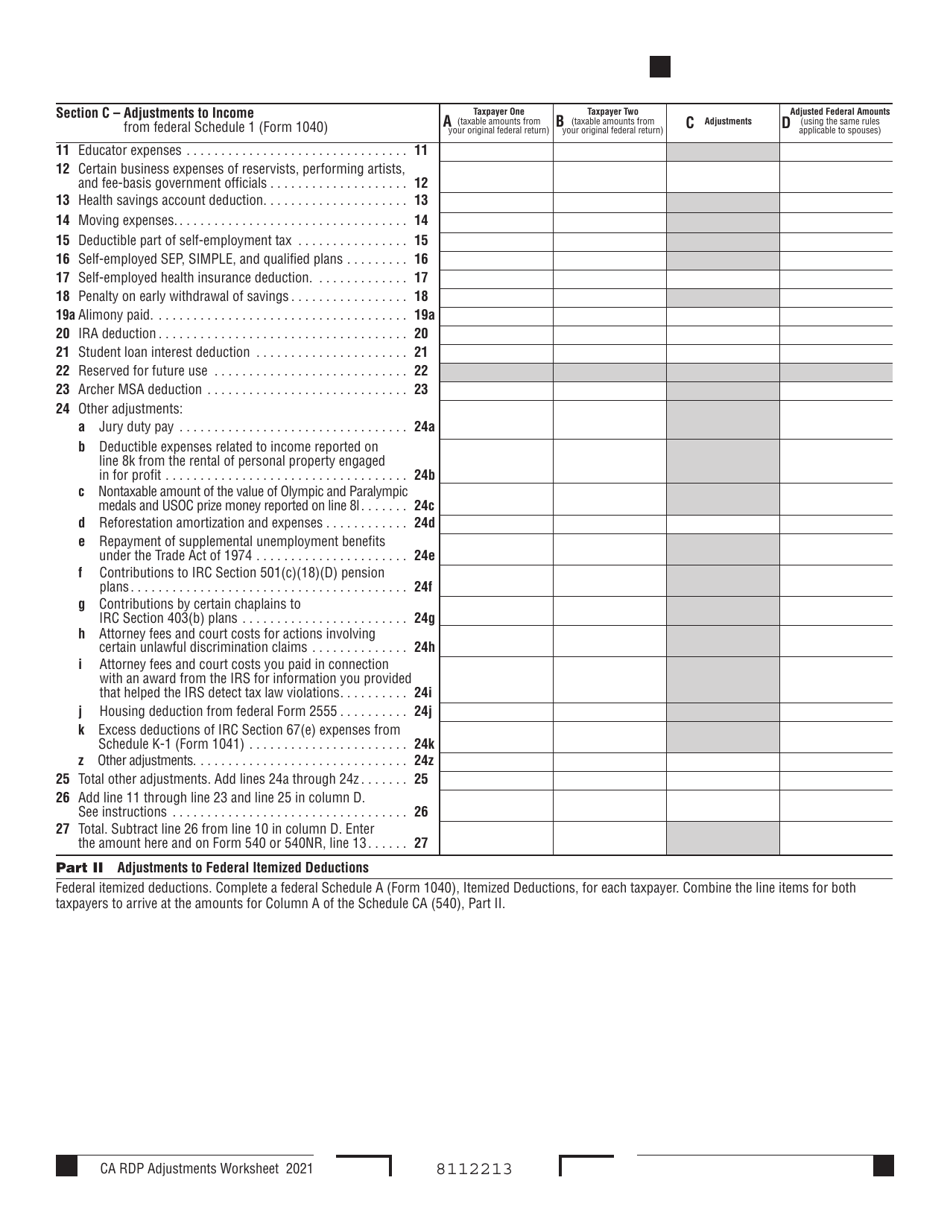

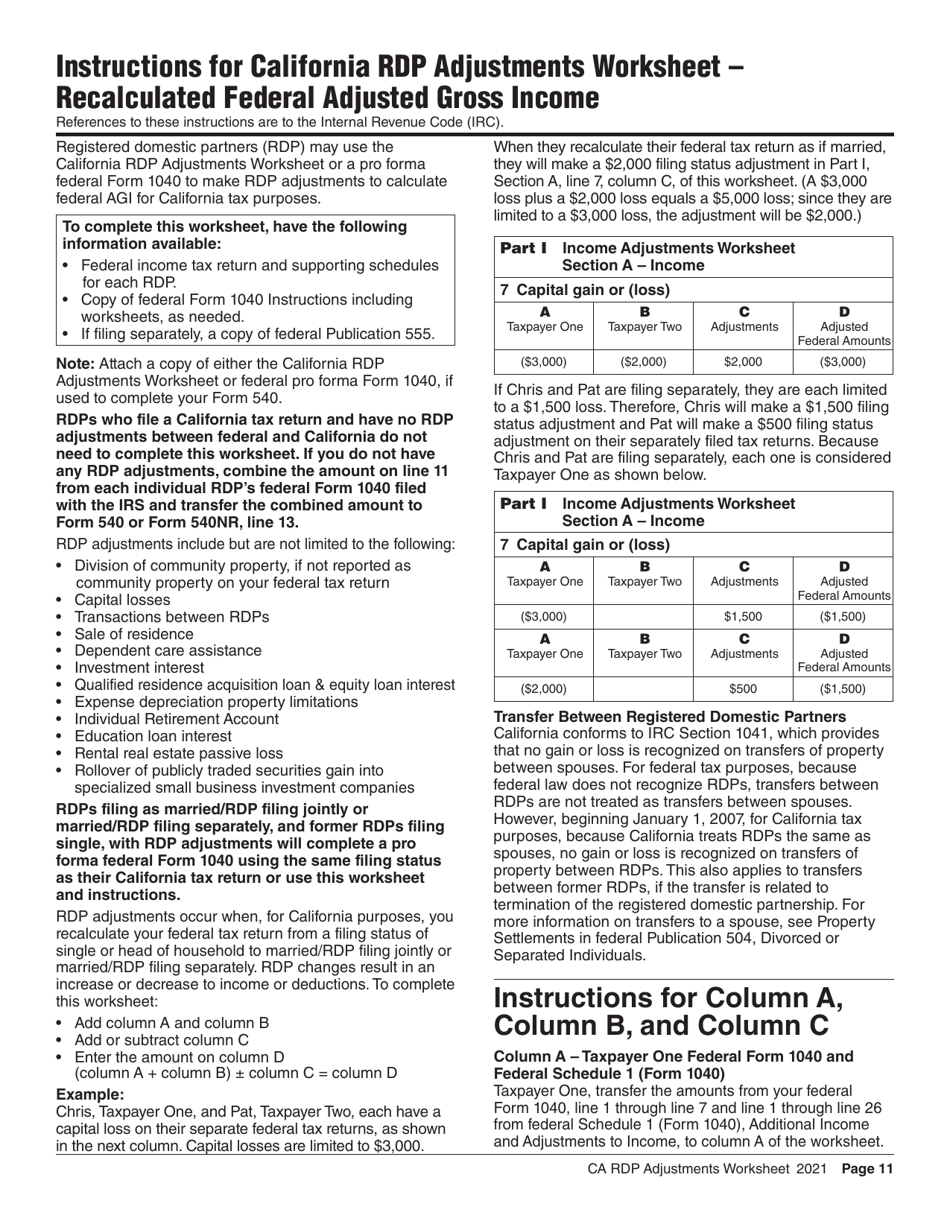

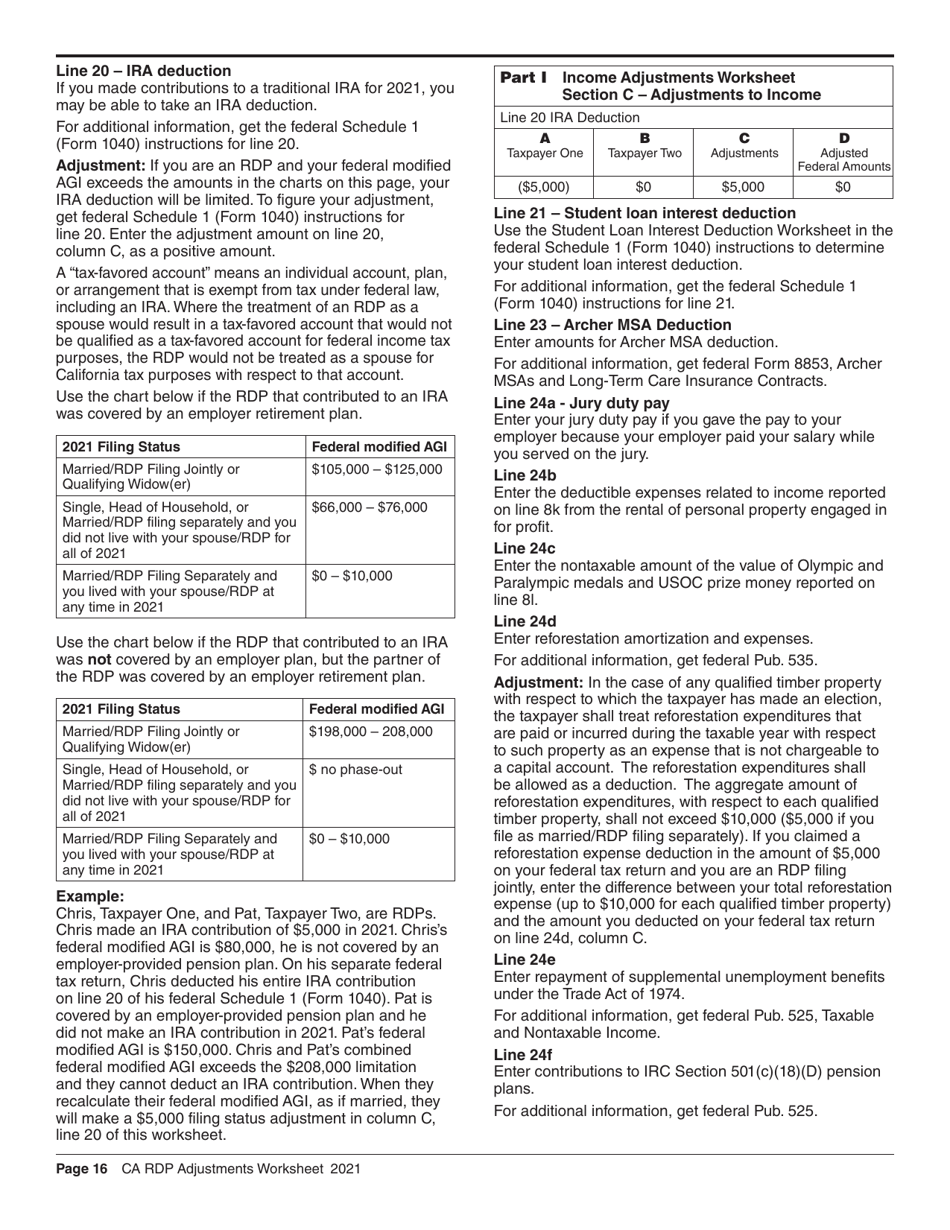

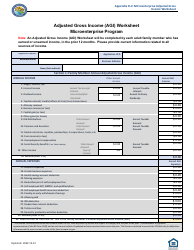

A: The purpose of Form FTB737 is to recalculate the Federal Adjusted Gross Income for California state tax purposes.

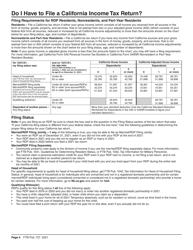

Q: Who needs to file Form FTB737?

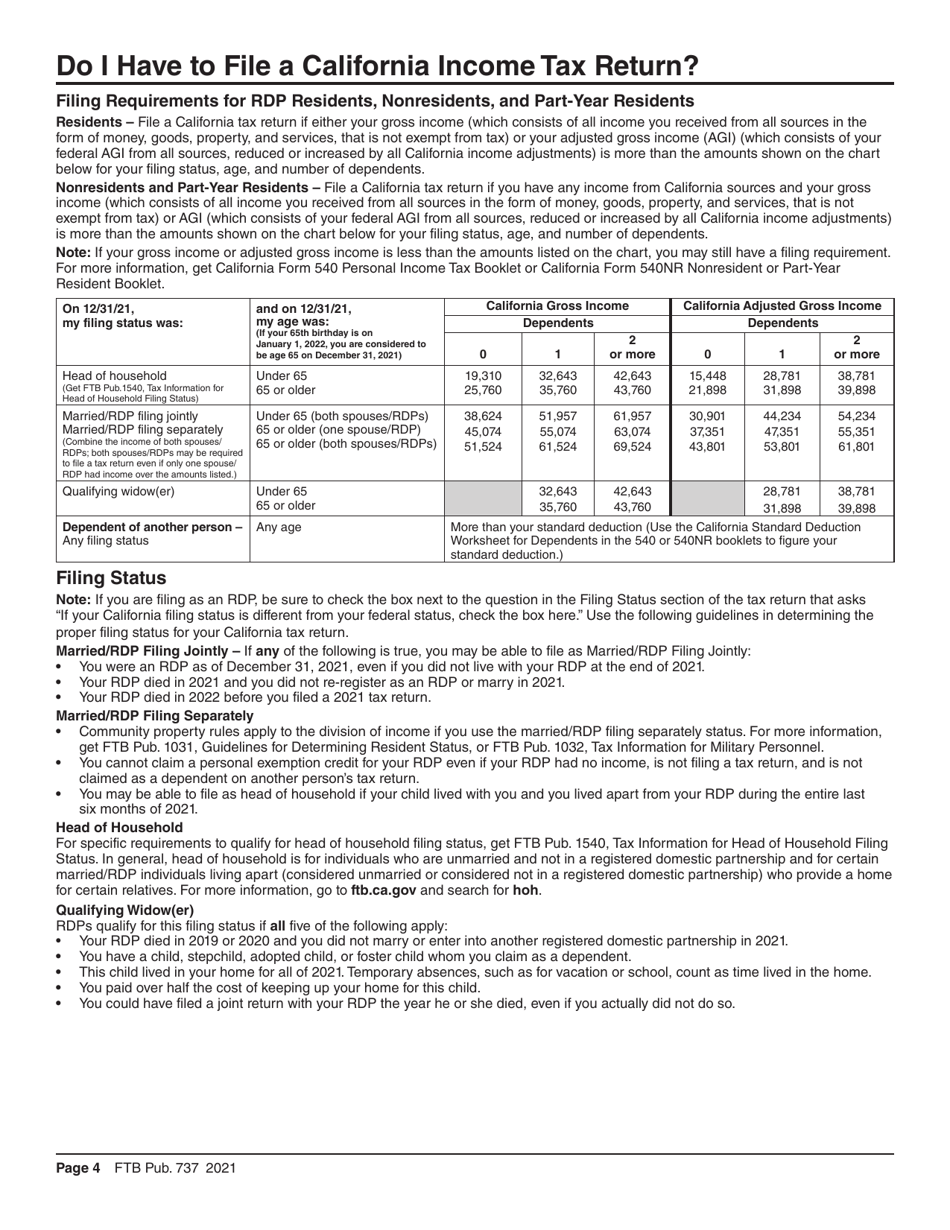

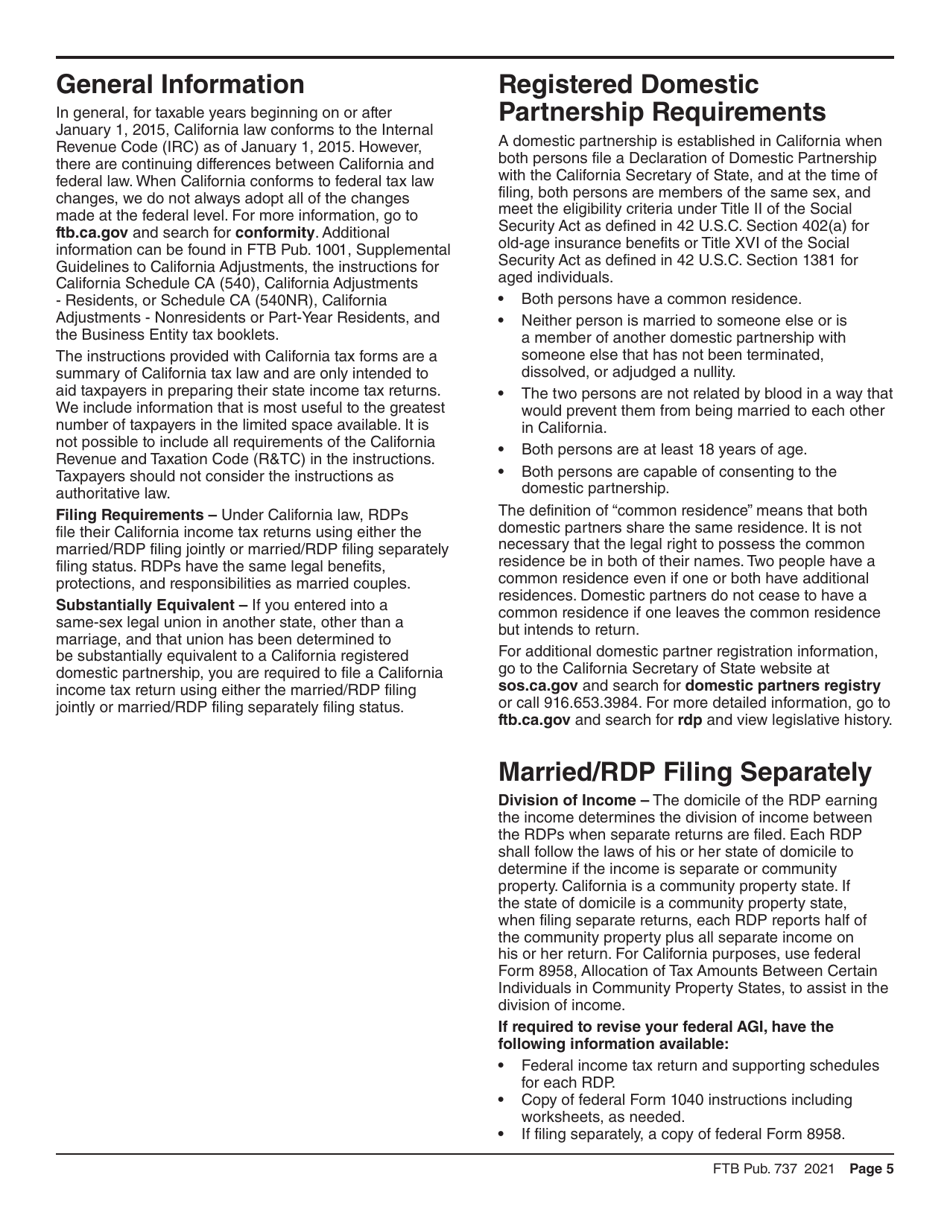

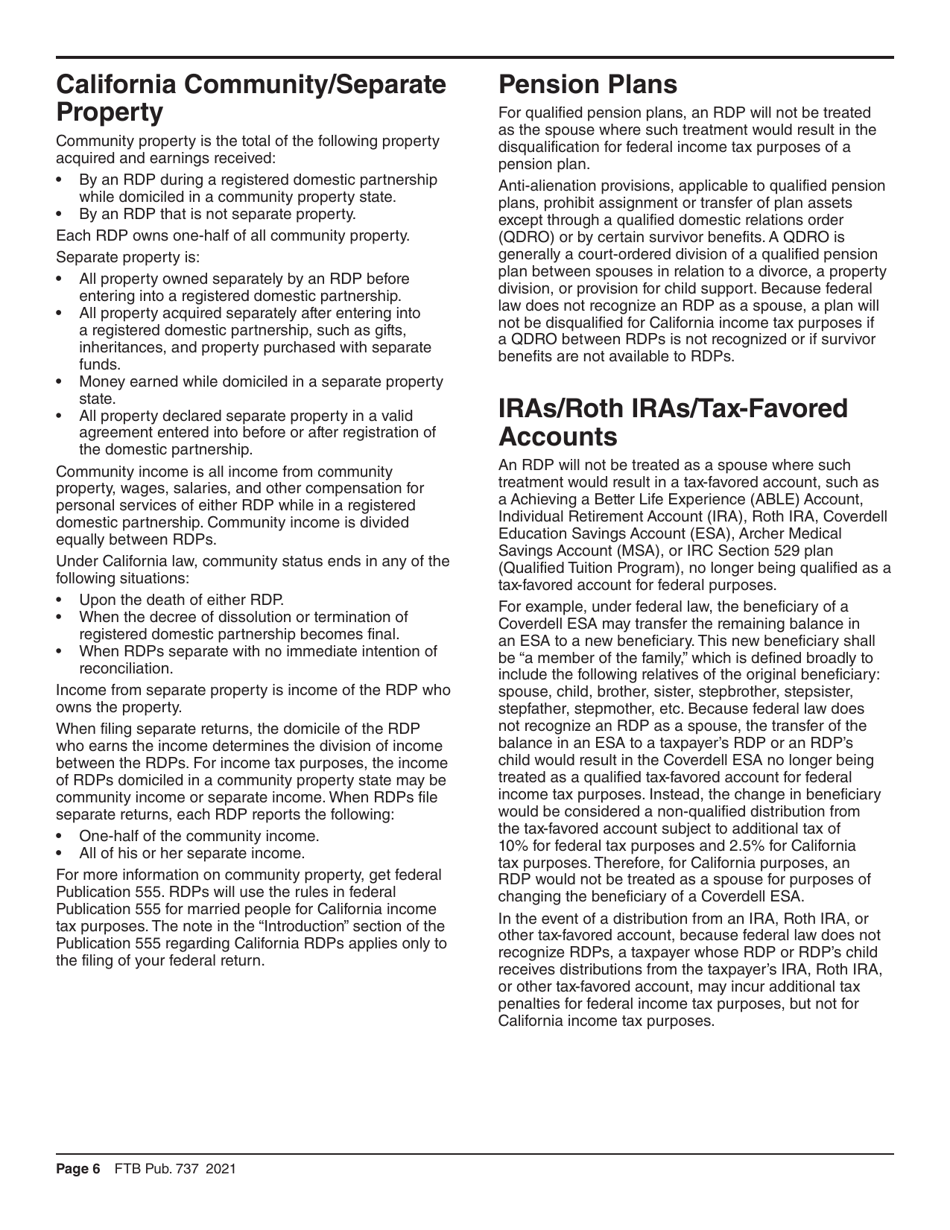

A: Taxpayers who are registered domestic partners (RDPs) and need to adjust their federal adjusted gross income for California tax purposes need to file Form FTB737.

Q: What is meant by recalculated federal adjusted gross income?

A: Recalculated federal adjusted gross income refers to the adjustment of the federal adjusted gross income amount to reflect any differences between federal and California tax laws.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB737 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.