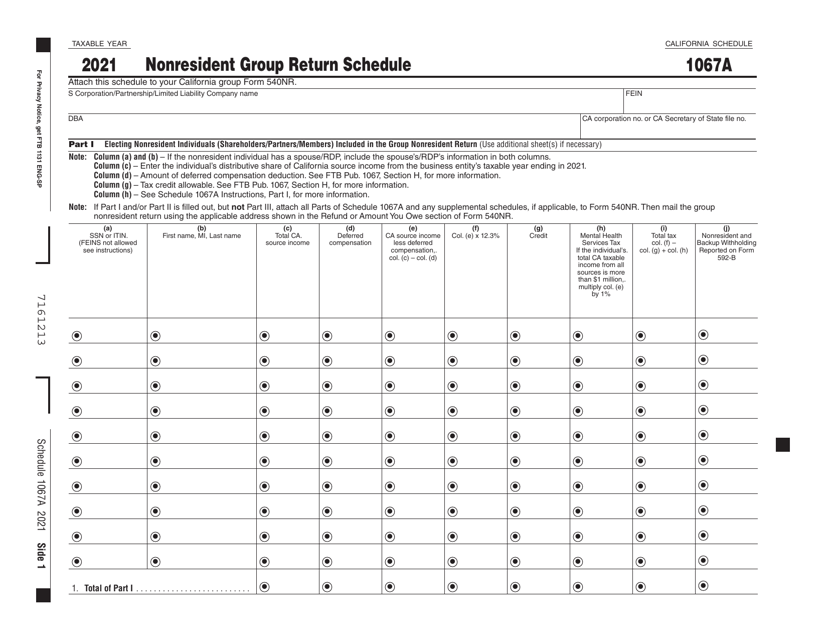

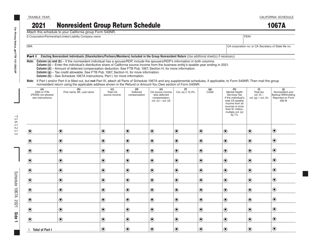

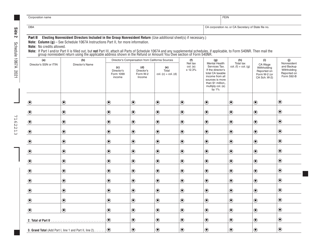

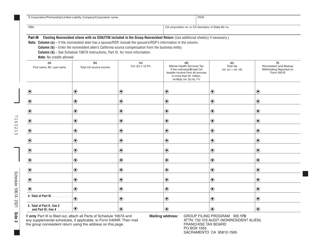

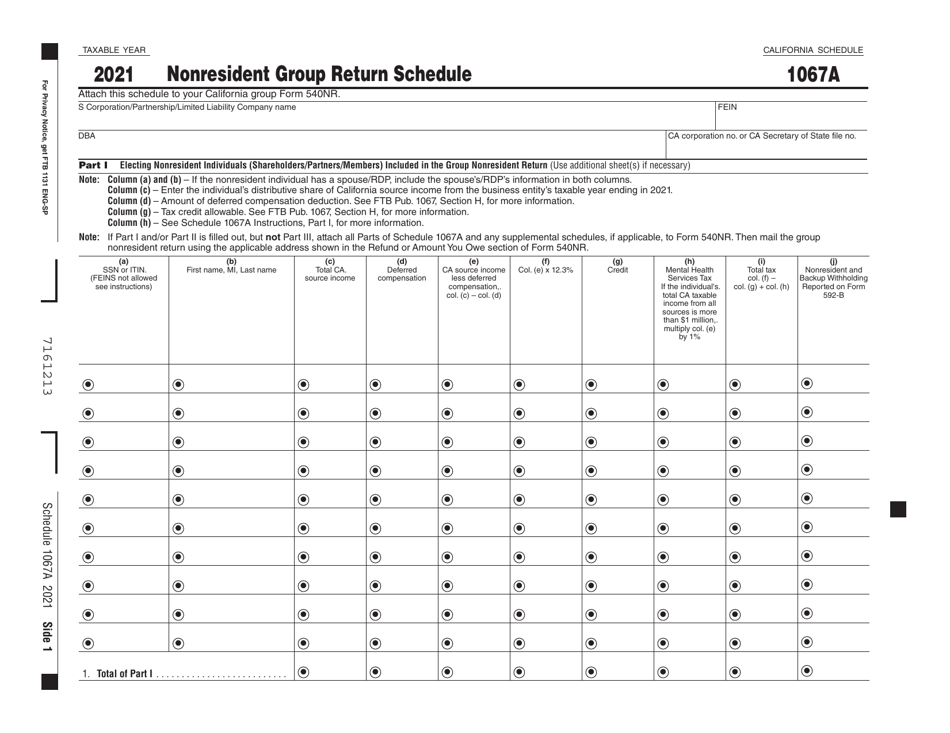

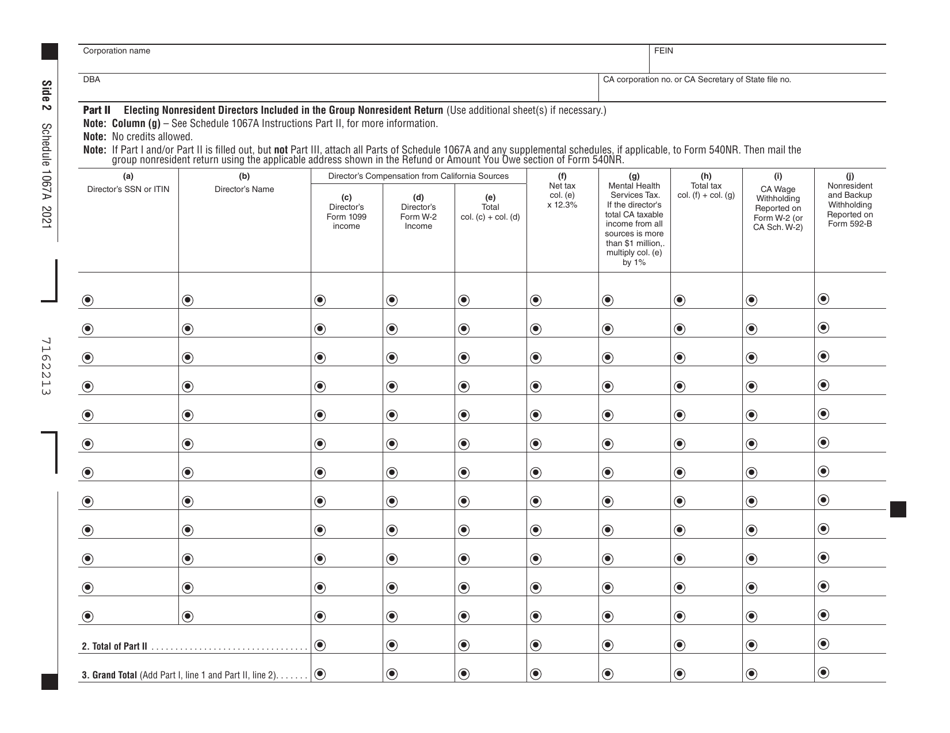

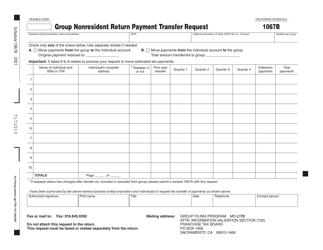

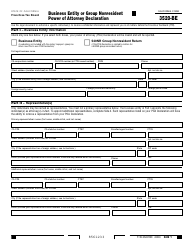

Schedule 1067A Nonresident Group Return Schedule - California

What Is Schedule 1067A?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1067A?

A: Schedule 1067A is a Nonresident Group Return Schedule for California.

Q: Who needs to file Schedule 1067A?

A: Nonresident groups who are required to file a group return in California need to file Schedule 1067A.

Q: What is a nonresident group?

A: A nonresident group is a group of nonresident shareholders, partners, or members who are not subject to California franchise or income tax.

Q: What information is required on Schedule 1067A?

A: Schedule 1067A requires information about the nonresident group, including the names and addresses of the members, their ownership percentages, and their net income or loss.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1067A by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.