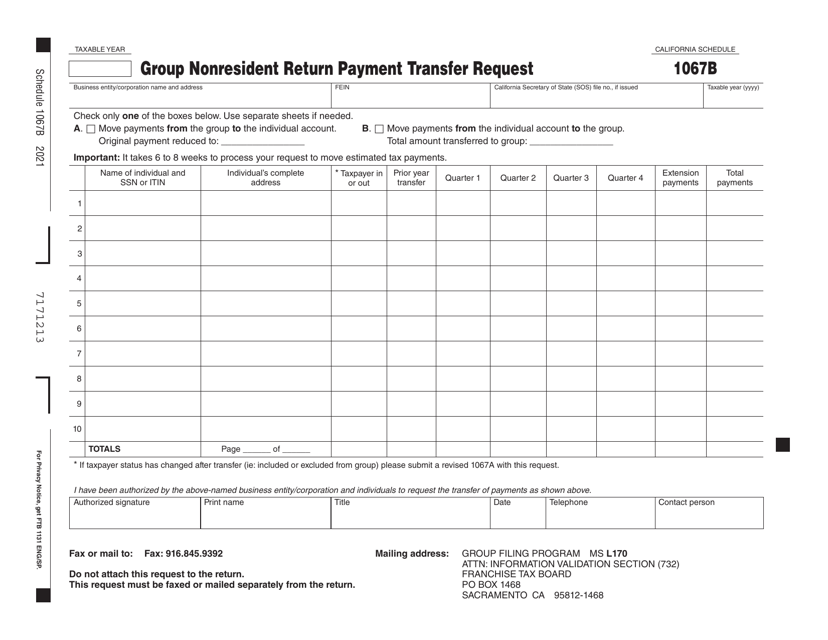

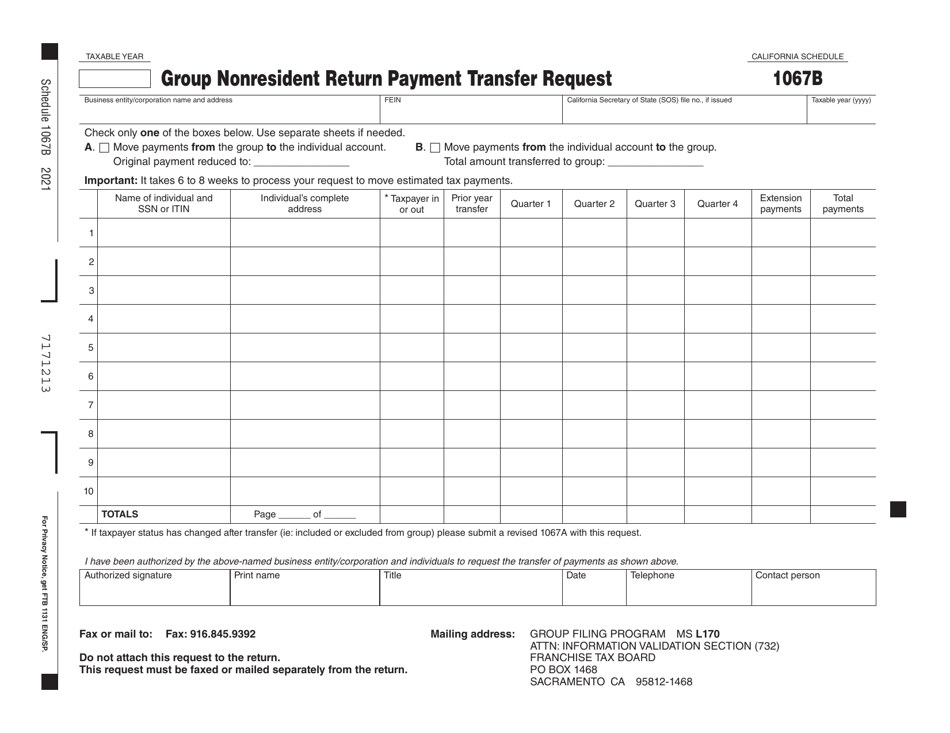

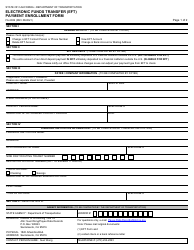

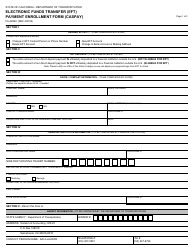

Schedule 1067B Group Nonresident Return Payment Transfer Request - California

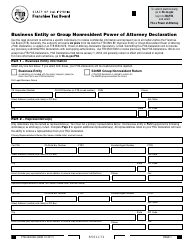

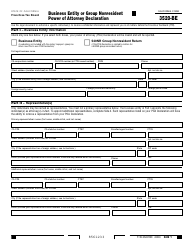

What Is Schedule 1067B?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

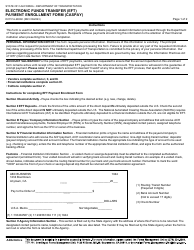

Q: What is Schedule 1067B?

A: Schedule 1067B is a form used for Group Nonresident Return Payment Transfer Request in California.

Q: Who needs to file Schedule 1067B?

A: The Group Nonresident Return Payment Transfer Request in California must be filed by nonresidents who are part of a group filing.

Q: What is the purpose of Schedule 1067B?

A: Schedule 1067B is used to transfer tax payments made by nonresidents to their group representative.

Q: When is Schedule 1067B due?

A: The due date for Schedule 1067B is the same as the due date for the nonresident tax return.

Q: Do I need to attach Schedule 1067B to my tax return?

A: Yes, you need to attach Schedule 1067B to your nonresident tax return.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1067B by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.