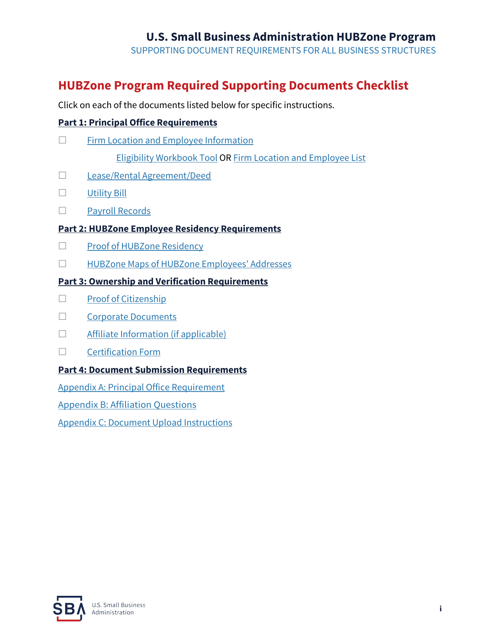

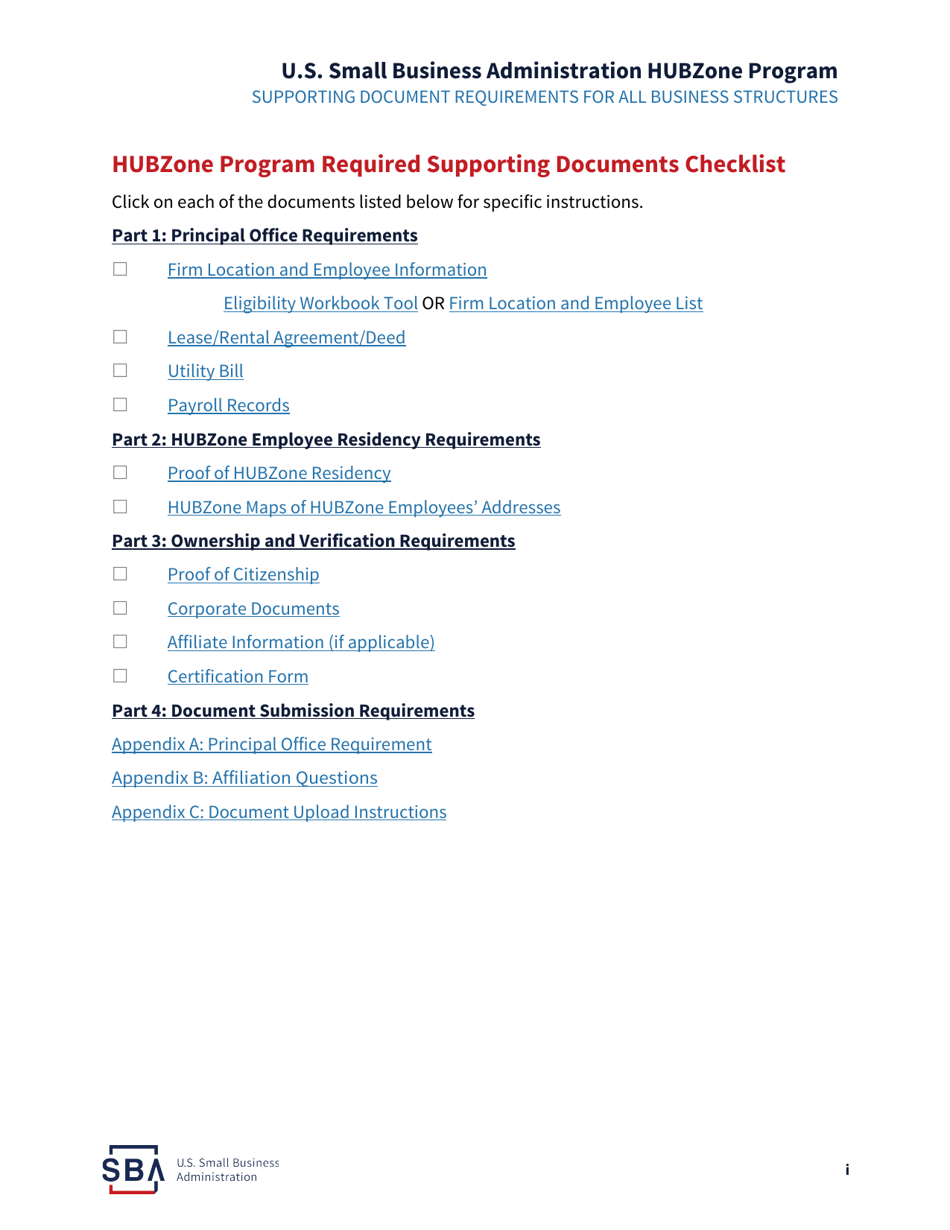

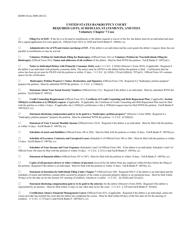

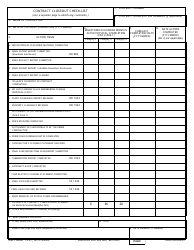

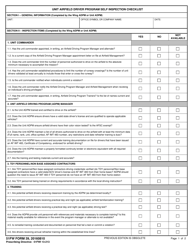

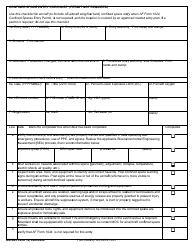

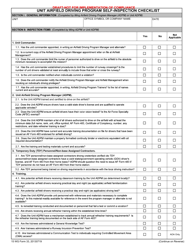

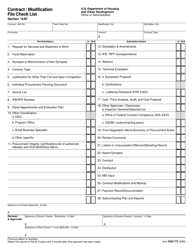

HUBZone Program Required Supporting Documents Checklist

HUBZone Program Required Supporting Documents Checklist is a 18-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is the HUBZone Program?

A: The HUBZone Program is a government initiative that helps small businesses in historically underutilized areas gain access to federal contracting opportunities.

Q: What are the required supporting documents for the HUBZone Program?

A: The required supporting documents for the HUBZone Program include proof of HUBZone certification, proof of principal office address, proof of employees' residential addresses, payroll records, and tax forms.

Q: What is proof of HUBZone certification?

A: Proof of HUBZone certification is a document provided by the Small Business Administration (SBA) that verifies a business's eligibility for the program.

Q: What is proof of principal office address?

A: Proof of principal office address is a document that confirms the address of the business's main office or headquarters.

Q: What is proof of employees' residential addresses?

A: Proof of employees' residential addresses is a document that shows the residential addresses of the employees working at the HUBZone certified business.

Q: What are payroll records?

A: Payroll records are documents that detail the wages, salaries, and other compensation paid to employees of the HUBZone certified business.

Q: What tax forms are required for the HUBZone Program?

A: The tax forms required for the HUBZone Program may include federal tax returns, state tax returns, and/or payroll tax records.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.