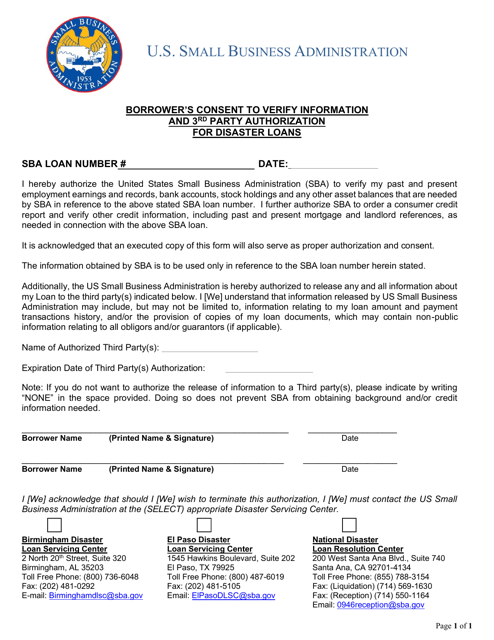

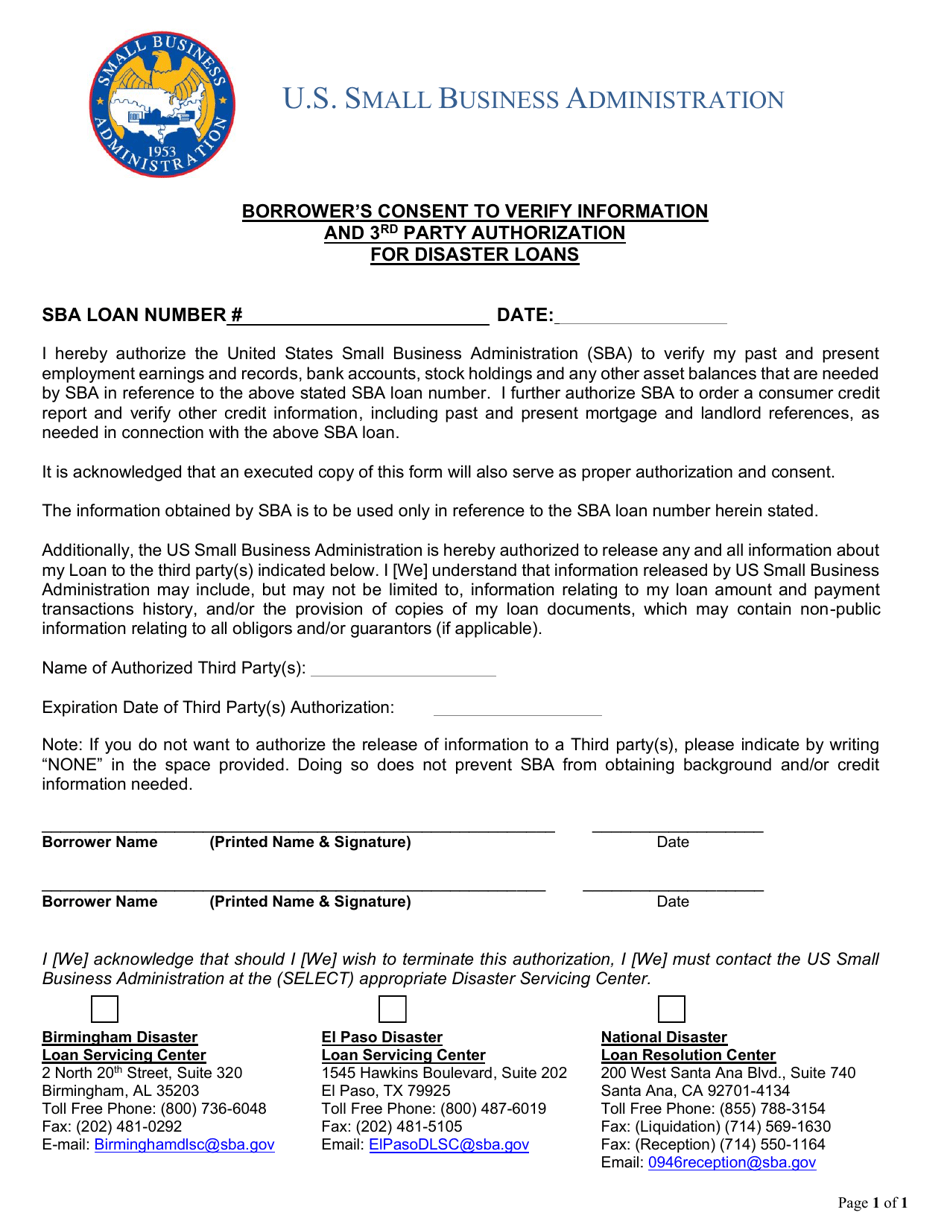

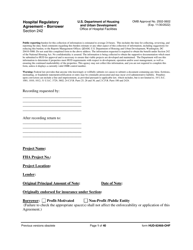

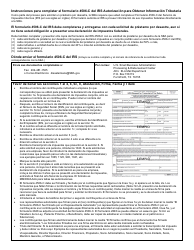

Borrower's Consent to Verify Information and 3rd Party Authorization for Disaster Loans

Borrower's Consent to Verify Information and 3rd Party Authorization for Disaster Loans is a 1-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is Borrower's Consent to Verify Information and 3rd Party Authorization for Disaster Loans?

A: It is a form that allows the lender to verify the information provided by the borrower and authorize the sharing of this information with third parties for the purpose of processing disaster loans.

Q: Why is Borrower's Consent to Verify Information and 3rd Party Authorization required for disaster loans?

A: It is required to ensure that the information provided by the borrower is accurate and to streamline the loan application and processing.

Q: What information can be verified through Borrower's Consent to Verify Information and 3rd Party Authorization?

A: The lender can verify the borrower's income, employment history, credit history, and any other relevant information needed to assess their eligibility for a disaster loan.

Q: Who are the third parties that can be authorized through Borrower's Consent to Verify Information and 3rd Party Authorization?

A: The third parties can include credit bureaus, financial institutions, government agencies, and any other entities involved in the loan application and processing.

Q: Is Borrower's Consent to Verify Information and 3rd Party Authorization mandatory for disaster loans?

A: Yes, it is mandatory for the borrower to provide consent for verification of information and authorization to share it with third parties as part of the loan application process.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.