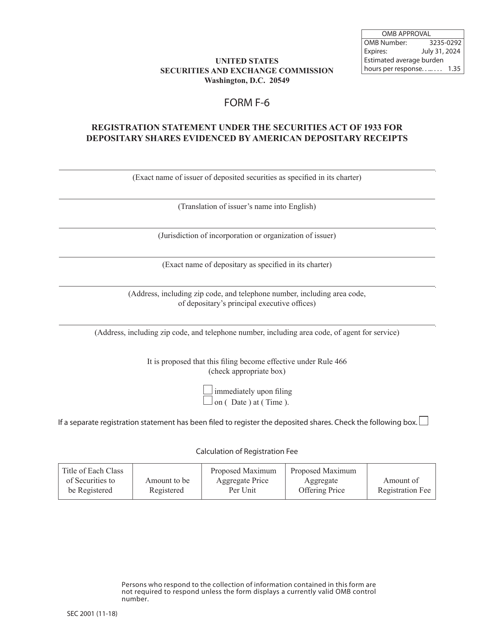

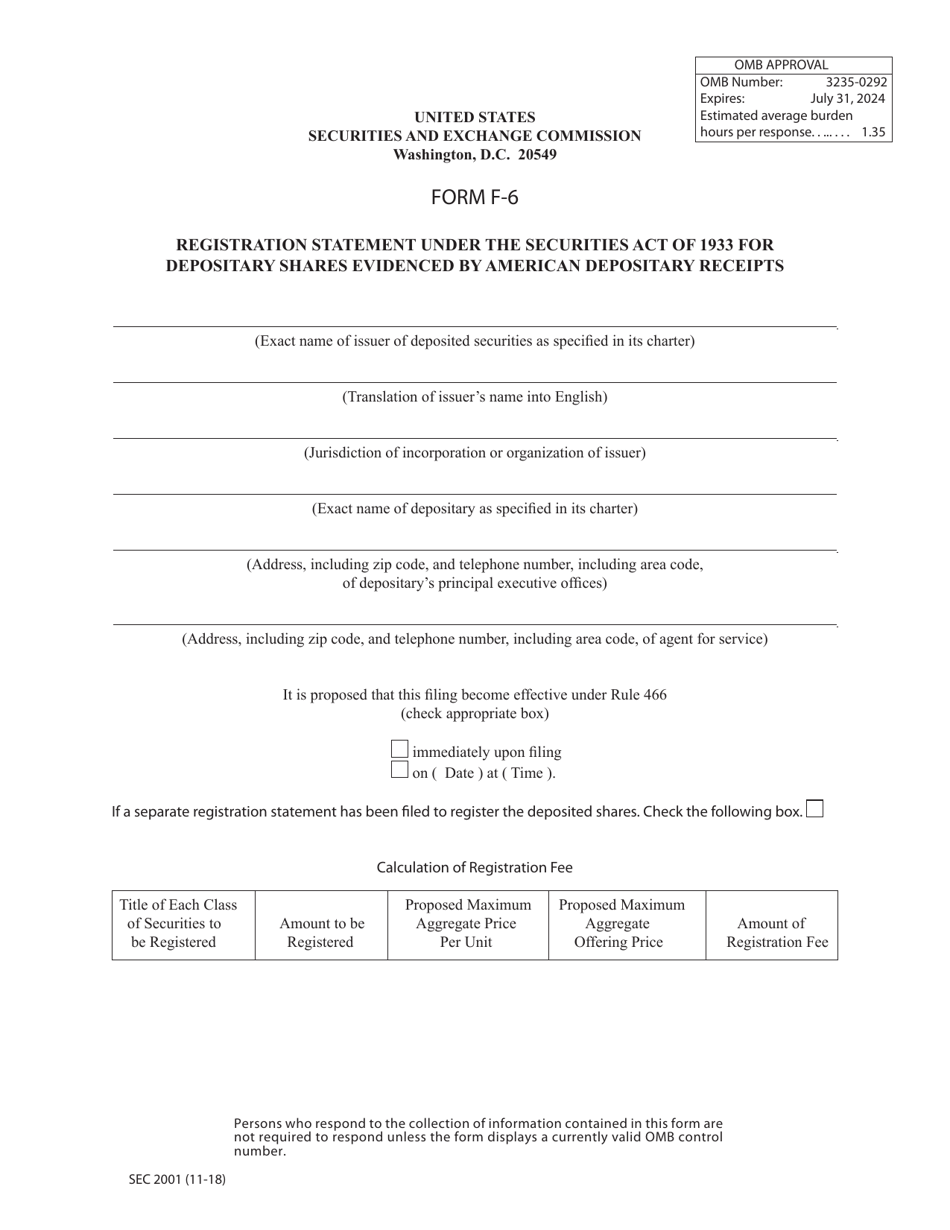

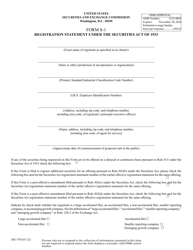

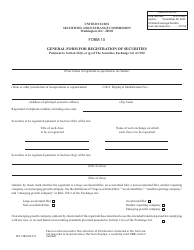

Form F-6 (SEC Form 2001) Registration Statement Under the Securities Act of 1933 for Depositary Shares Evidenced by American Depositary Receipts

What Is Form F-6 (SEC Form 2001)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on November 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-6?

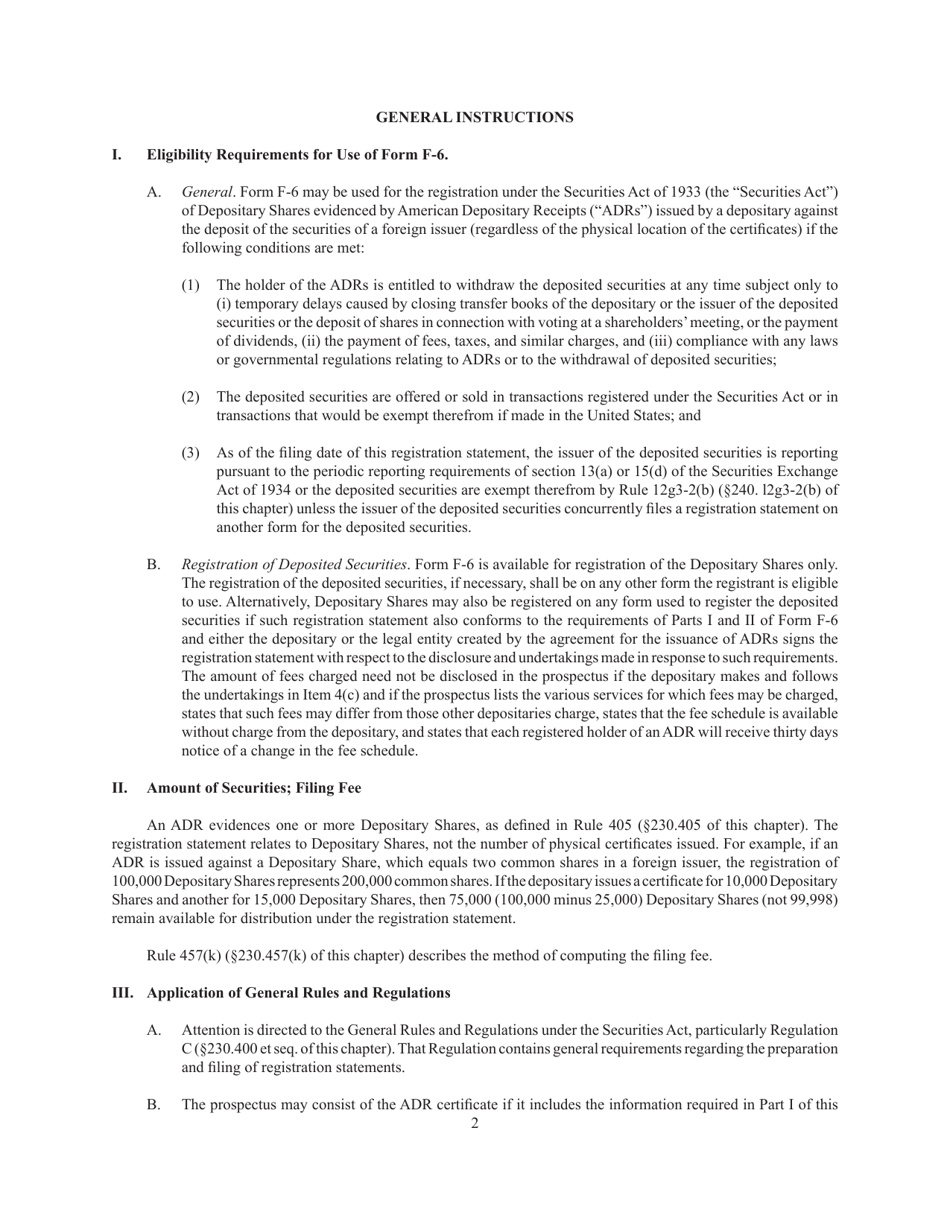

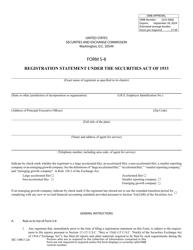

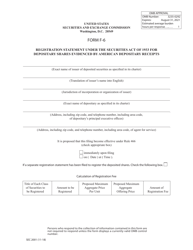

A: Form F-6 is a registration statement under the Securities Act of 1933 for depositary shares evidenced by American Depositary Receipts (ADRs).

Q: What does Form F-6 register?

A: Form F-6 registers the offering and sale of depositary shares represented by American Depositary Receipts (ADRs).

Q: What is the purpose of Form F-6?

A: The purpose of Form F-6 is to provide transparency and regulatory oversight for the offering and sale of depositary shares through American Depositary Receipts.

Q: What is a depositary share?

A: A depositary share is a unit of ownership in a foreign company that is represented by an American Depositary Receipt (ADR).

Q: What is an American Depositary Receipt (ADR)?

A: An American Depositary Receipt (ADR) is a negotiable security that represents ownership in shares of a foreign company held by a U.S. bank.

Q: What is the Securities Act of 1933?

A: The Securities Act of 1933 is a federal law that regulates the offering and sale of securities to protect investors from fraud and ensure transparency in the market.

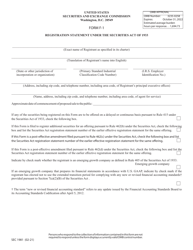

Q: Who is required to file Form F-6?

A: Any company seeking to offer and sell depositary shares through American Depositary Receipts (ADRs) in the United States is required to file Form F-6.

Q: Is Form F-6 specific to any particular country?

A: No, Form F-6 is specific to the United States and is used for the registration of depositary shares represented by American Depositary Receipts (ADRs) in the U.S. market.

Q: Are ADRs traded on U.S. stock exchanges?

A: Yes, ADRs are traded on U.S. stock exchanges just like regular stocks, providing U.S. investors with an opportunity to invest in foreign companies.

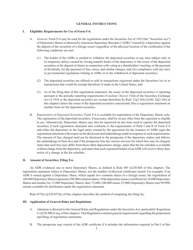

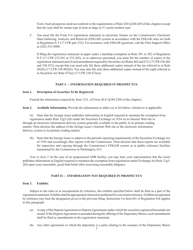

Q: What information is included in Form F-6?

A: Form F-6 includes information about the company offering the depositary shares, the terms of the offering, financial statements, and other relevant disclosures.

Q: Can individuals invest in depositary shares and ADRs?

A: Yes, individuals can invest in depositary shares and ADRs through brokerage accounts, allowing them to gain exposure to foreign companies without directly owning the foreign company's shares.

Q: Is filing Form F-6 a requirement for offering depositary shares in the U.S.?

A: Yes, filing Form F-6 is a requirement for companies offering depositary shares represented by American Depositary Receipts (ADRs) in the United States.

Form Details:

- Released on November 1, 2018;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-6 (SEC Form 2001) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.