This version of the form is not currently in use and is provided for reference only. Download this version of

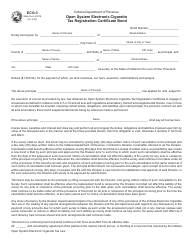

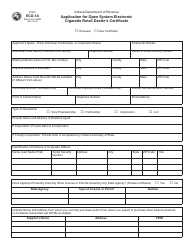

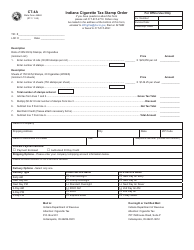

Form ECG-103 (State Form 53089)

for the current year.

Form ECG-103 (State Form 53089) Electronic Cigarette Tax Return for Retailers - Indiana

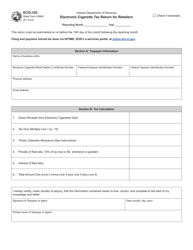

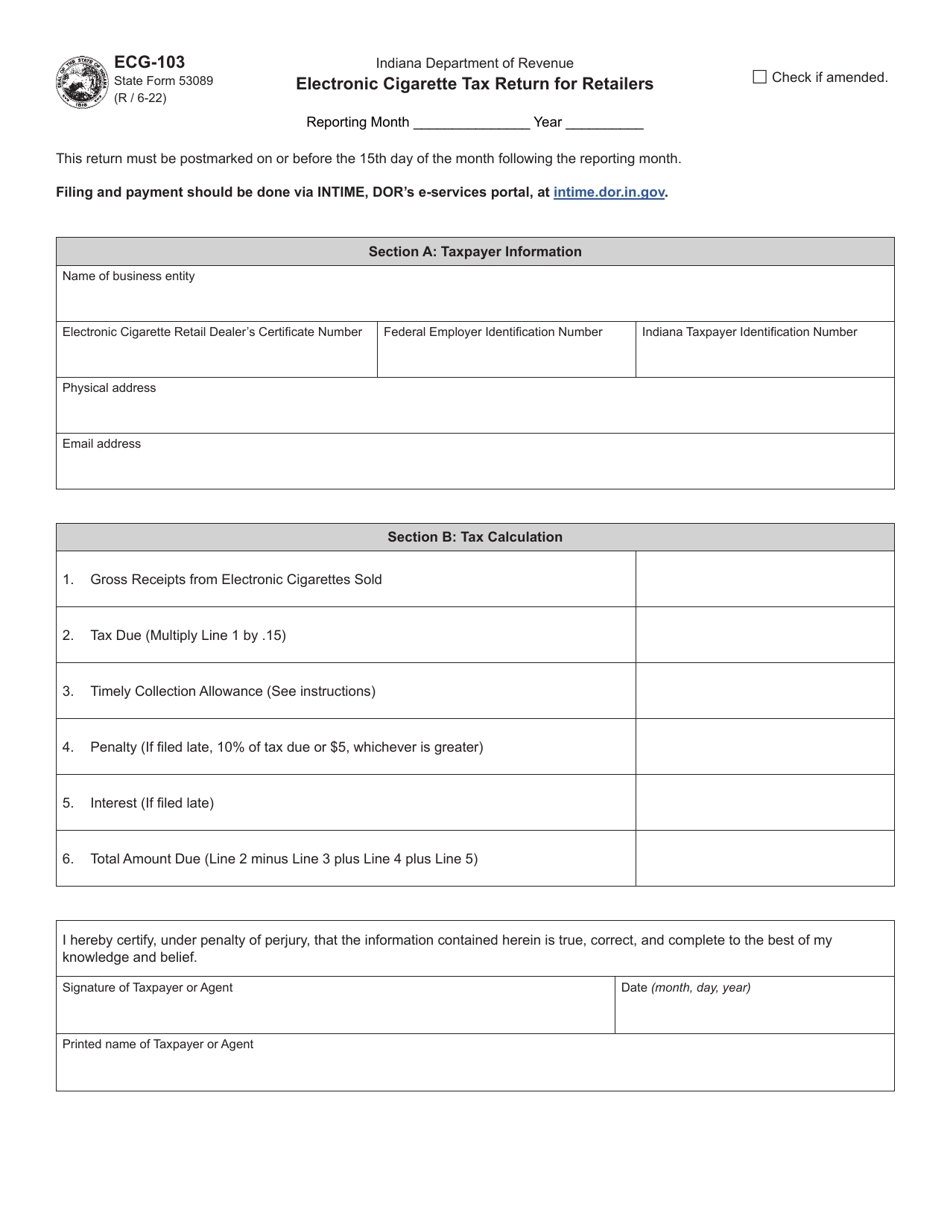

What Is Form ECG-103 (State Form 53089)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ECG-103?

A: Form ECG-103 is the Electronic Cigarette Tax Return for Retailers in Indiana.

Q: Who needs to file Form ECG-103?

A: Retailers who sell electronic cigarettes in Indiana need to file Form ECG-103.

Q: What is the purpose of Form ECG-103?

A: Form ECG-103 is used to report and pay the electronic cigarette tax owed by retailers in Indiana.

Q: When is the deadline to file Form ECG-103?

A: The deadline to file Form ECG-103 is on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late or incorrect filing of Form ECG-103?

A: Yes, there may be penalties for late or incorrect filing of Form ECG-103. It is important to file on time and accurately report the electronic cigarette tax.

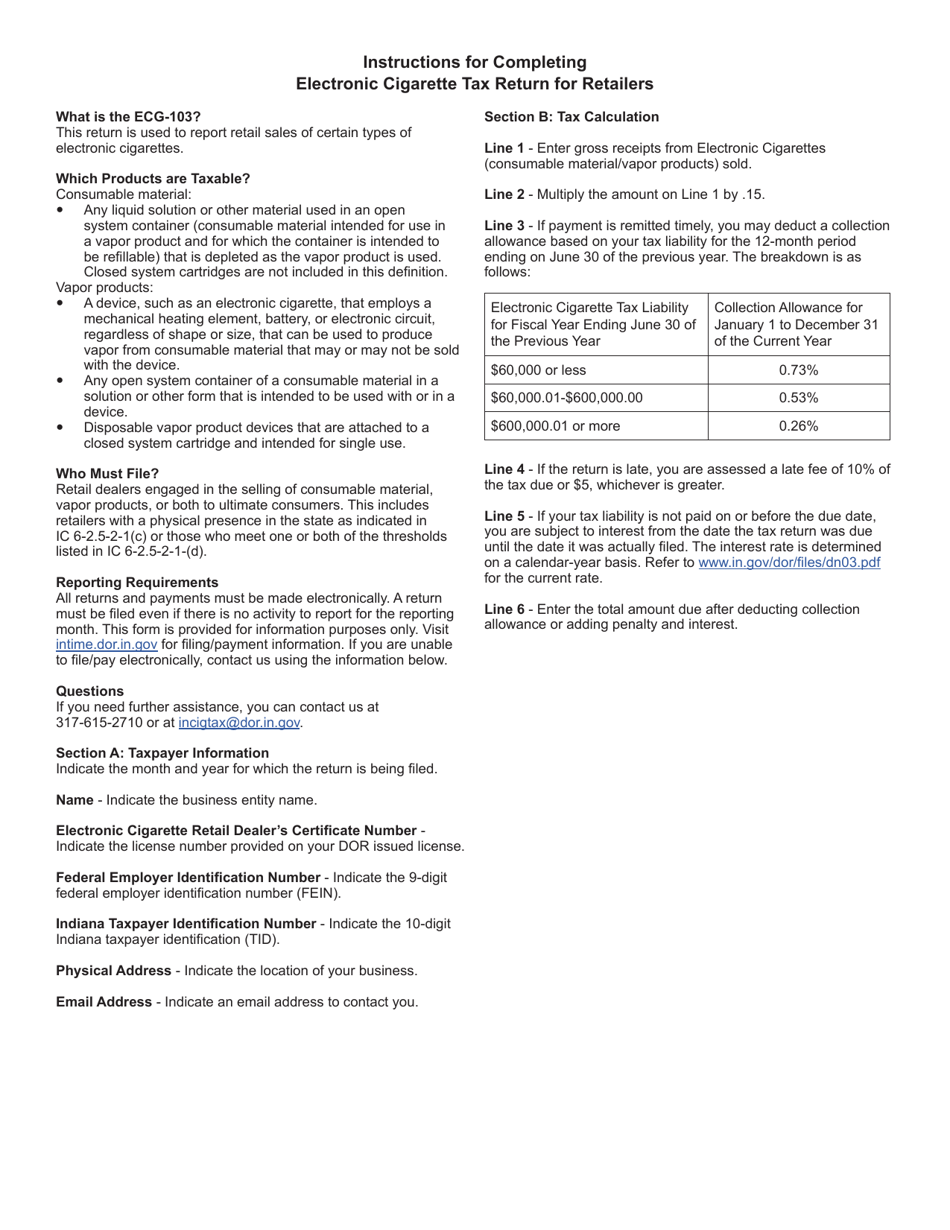

Q: Is there any guidance available for filling out Form ECG-103?

A: Yes, the Indiana Department of Revenue provides instructions and guidance for filling out Form ECG-103. It is recommended to review the instructions before filling out the form.

Q: Is there any payment required when filing Form ECG-103?

A: Yes, retailers are required to pay the electronic cigarette tax owed when filing Form ECG-103.

Q: What should I do if I have questions or need assistance with Form ECG-103?

A: If you have questions or need assistance with Form ECG-103, you can contact the Indiana Department of Revenue for support.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ECG-103 (State Form 53089) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.