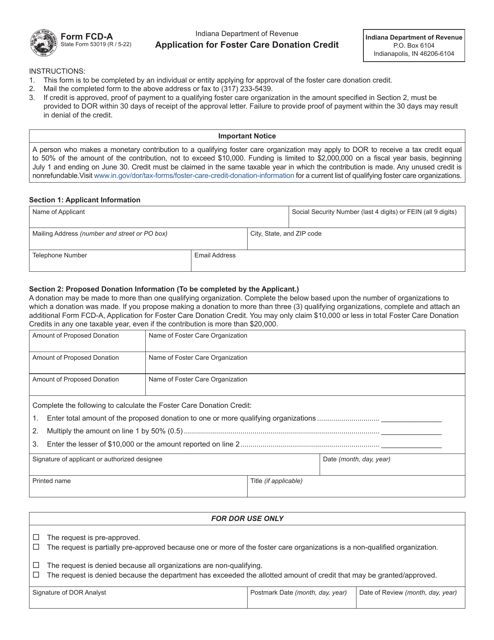

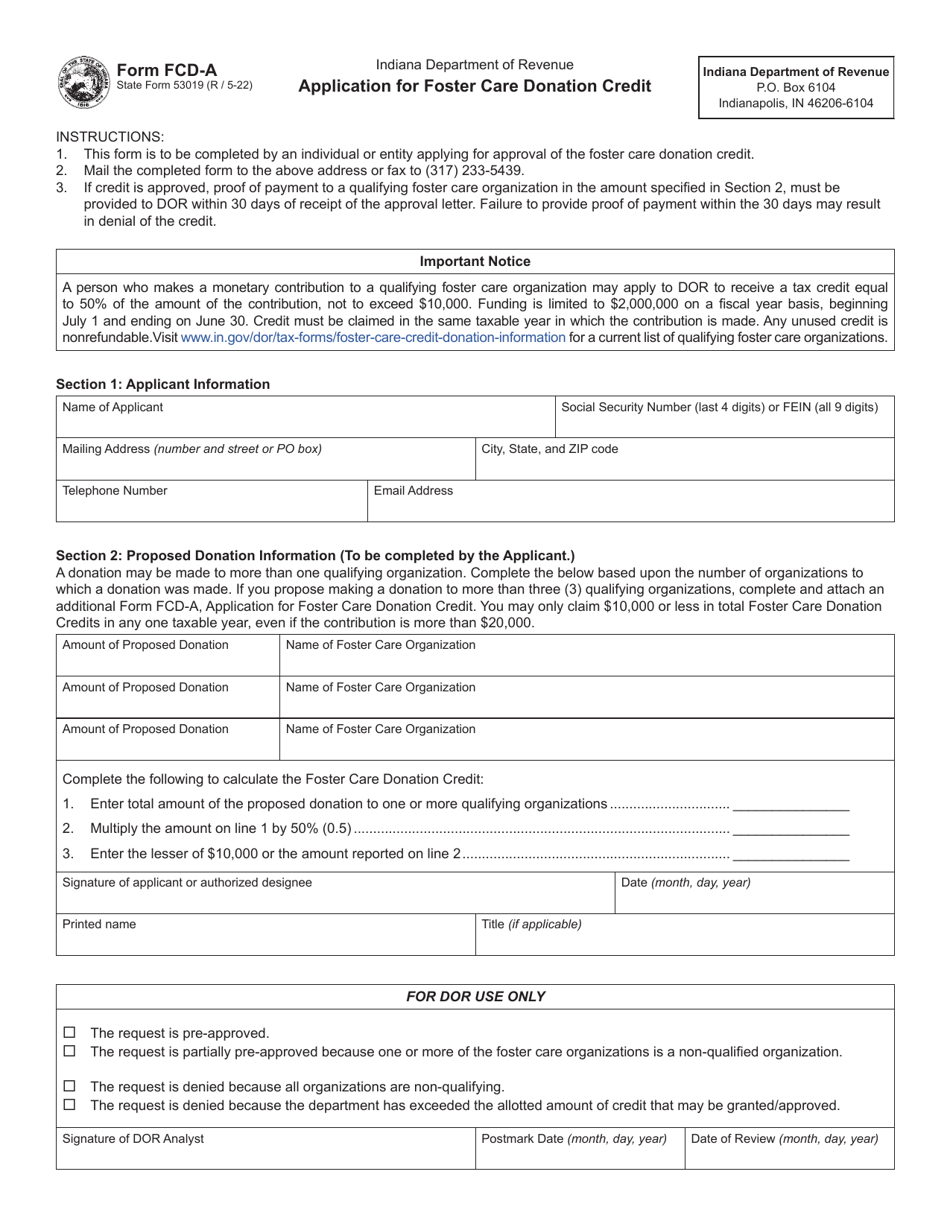

Form FCD-A (State Form 53019) Application for Foster Care Donation Credit - Indiana

What Is Form FCD-A (State Form 53019)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FCD-A?

A: Form FCD-A is an application for Foster Care Donation Credit.

Q: What is the purpose of Form FCD-A?

A: The purpose of Form FCD-A is to apply for the Foster Care Donation Credit in Indiana.

Q: What is the Foster Care Donation Credit?

A: The Foster Care Donation Credit is a tax credit available to individuals who make donations to qualified foster care programs in Indiana.

Q: Who is eligible to claim the Foster Care Donation Credit?

A: Individuals who make donations to qualified foster care programs in Indiana are eligible to claim the Foster Care Donation Credit.

Q: What is the deadline for filing Form FCD-A?

A: Form FCD-A must be filed with the Indiana Department of Revenue by the due date of your individual income tax return, which is typically April 15th.

Q: Are there any limitations on the Foster Care Donation Credit?

A: Yes, there are limitations on the amount of the credit that can be claimed. The maximum credit allowed is $1,000 for individuals or $2,500 for married couples filing jointly.

Q: Can the Foster Care Donation Credit be carried forward or refunded?

A: No, the Foster Care Donation Credit cannot be carried forward or refunded. It can only be used to offset your Indiana state tax liability.

Q: Are donations made to all foster care programs eligible for the credit?

A: No, donations must be made to qualified foster care programs in order to be eligible for the credit. It is important to check with the Indiana Department of Revenue for a list of eligible programs.

Q: Can I claim the Foster Care Donation Credit if I itemize deductions on my federal tax return?

A: No, the Foster Care Donation Credit is a nonrefundable credit and cannot be claimed if you itemize deductions on your federal tax return.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FCD-A (State Form 53019) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.