This version of the form is not currently in use and is provided for reference only. Download this version of

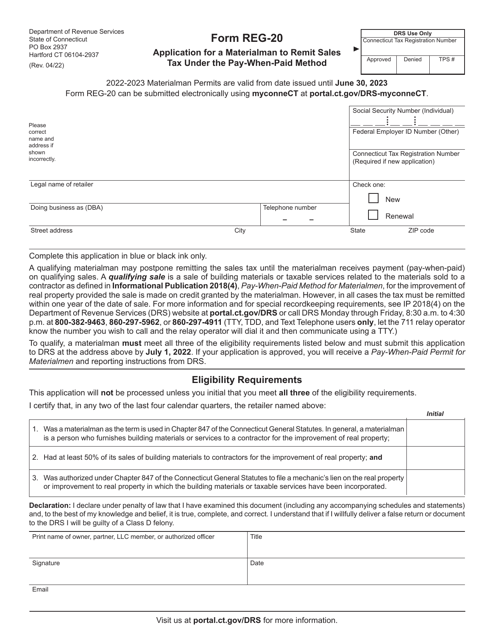

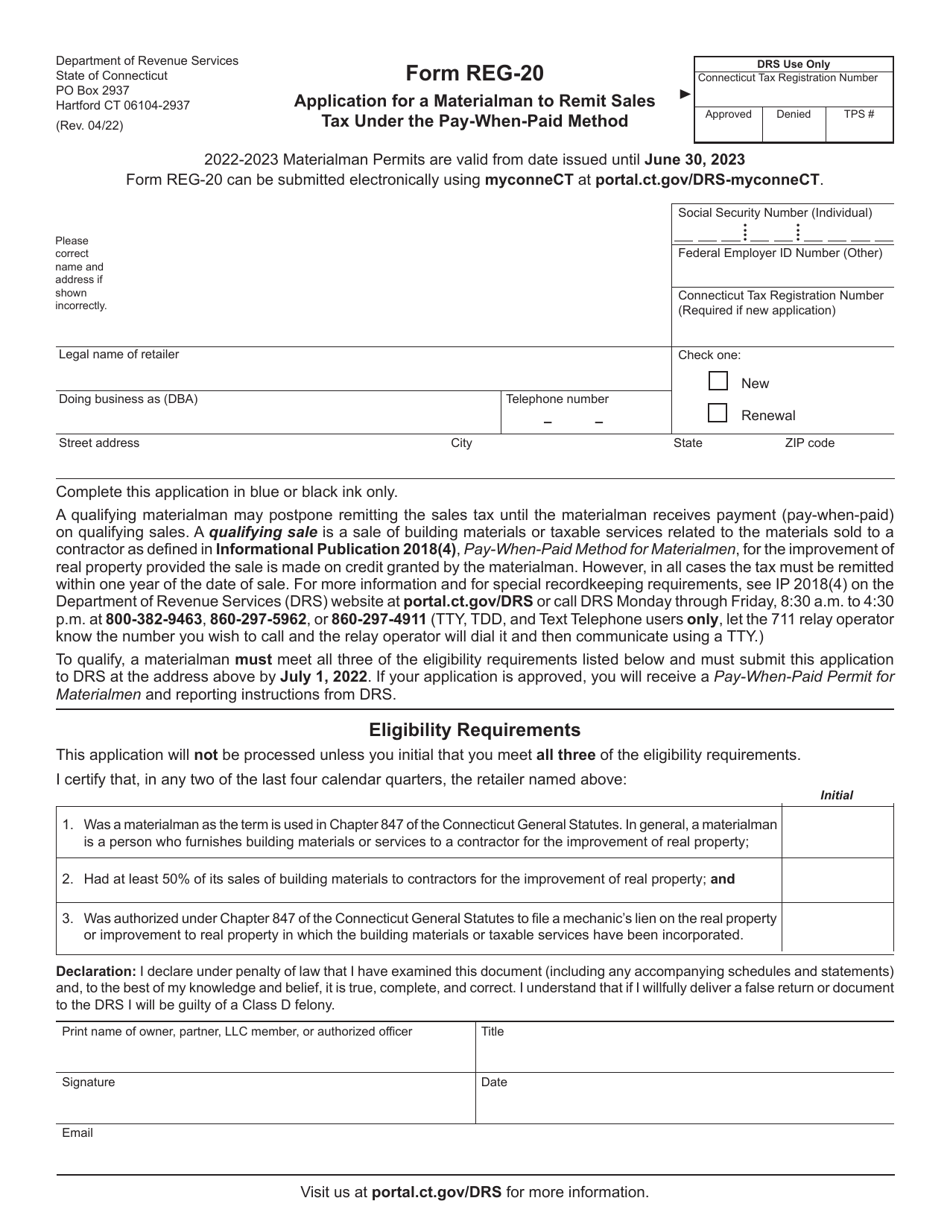

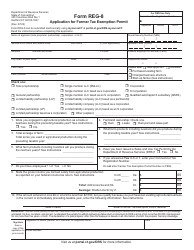

Form REG-20

for the current year.

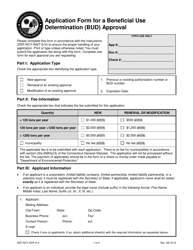

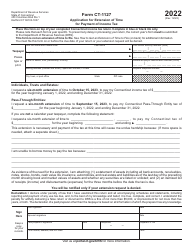

Form REG-20 Application for a Materialman to Remit Sales Tax Under the Pay-When-Paid Method - Connecticut

What Is Form REG-20?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-20?

A: Form REG-20 is an application for a materialman to remit sales tax in Connecticut.

Q: Who can use Form REG-20?

A: Form REG-20 is used by materialmen to remit sales tax under the pay-when-paid method in Connecticut.

Q: What is the pay-when-paid method?

A: The pay-when-paid method is a method of remitting sales tax in which the materialman pays the tax when they are paid for the materials they have supplied.

Q: How do I complete Form REG-20?

A: To complete Form REG-20, you will need to provide information about the materialman, the sales transactions, and the amounts being remitted.

Q: Are there any fees associated with Form REG-20?

A: No, there are no fees associated with submitting Form REG-20.

Q: When is Form REG-20 due?

A: Form REG-20 must be filed and remitted on or before the last day of the month following the end of the reporting period.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-20 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.