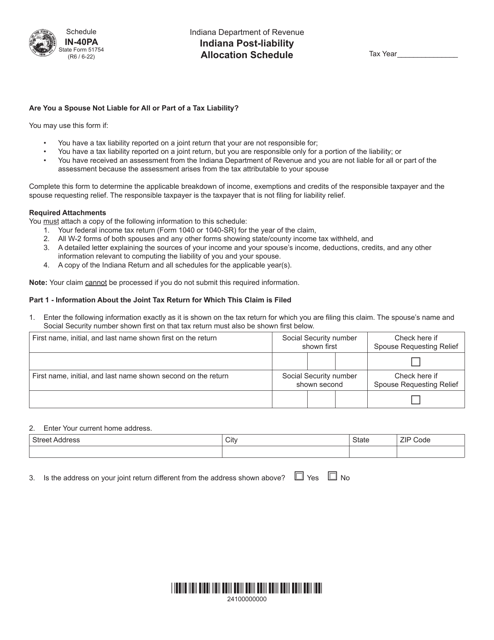

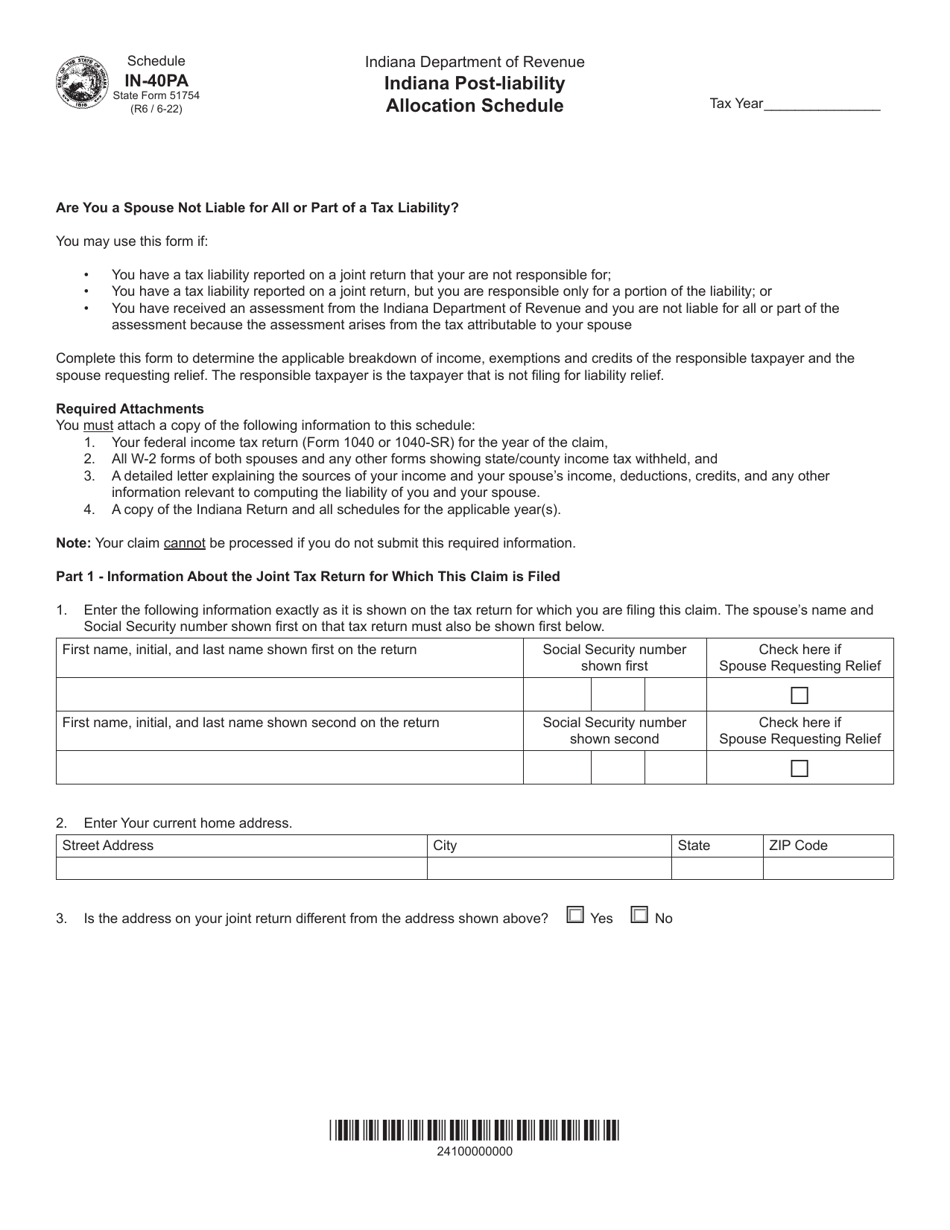

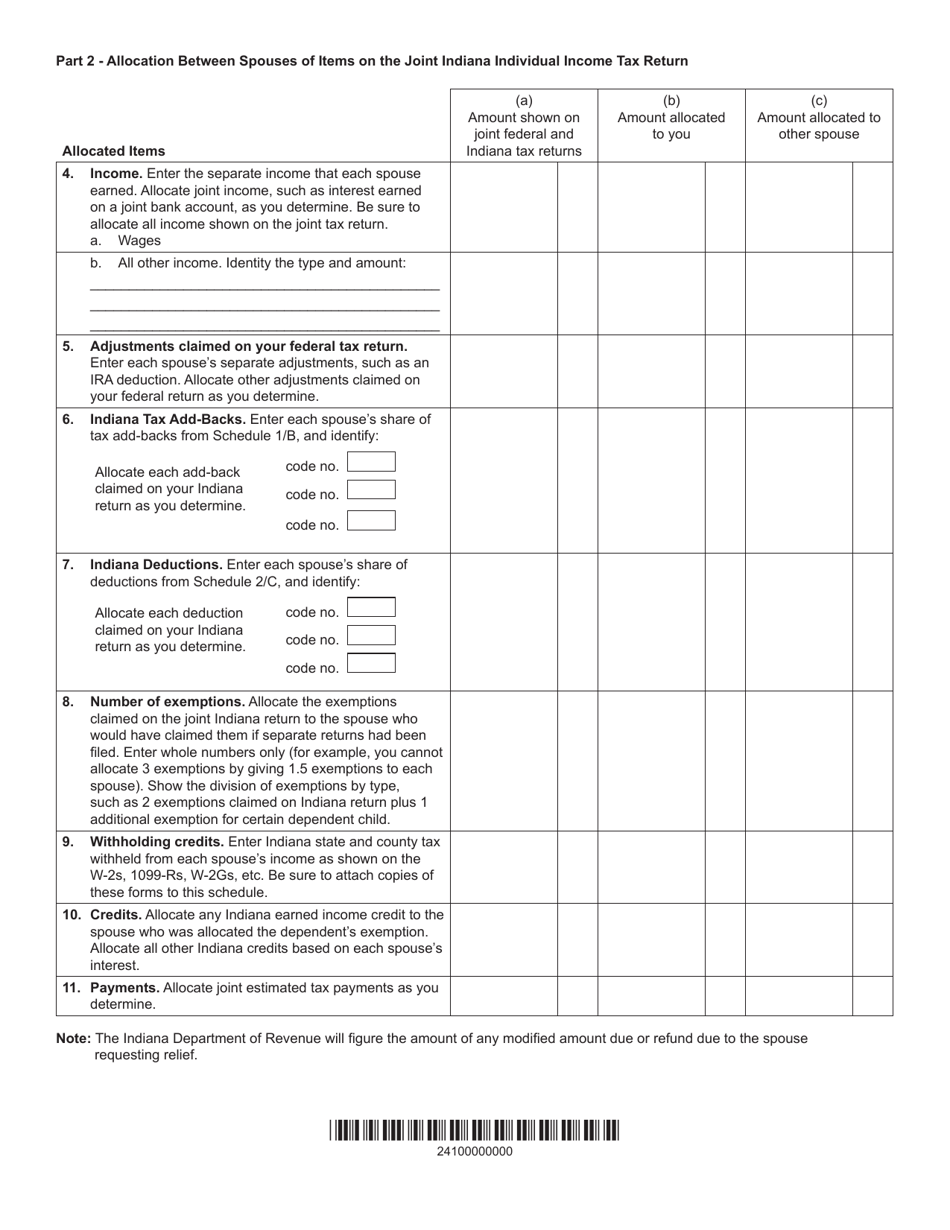

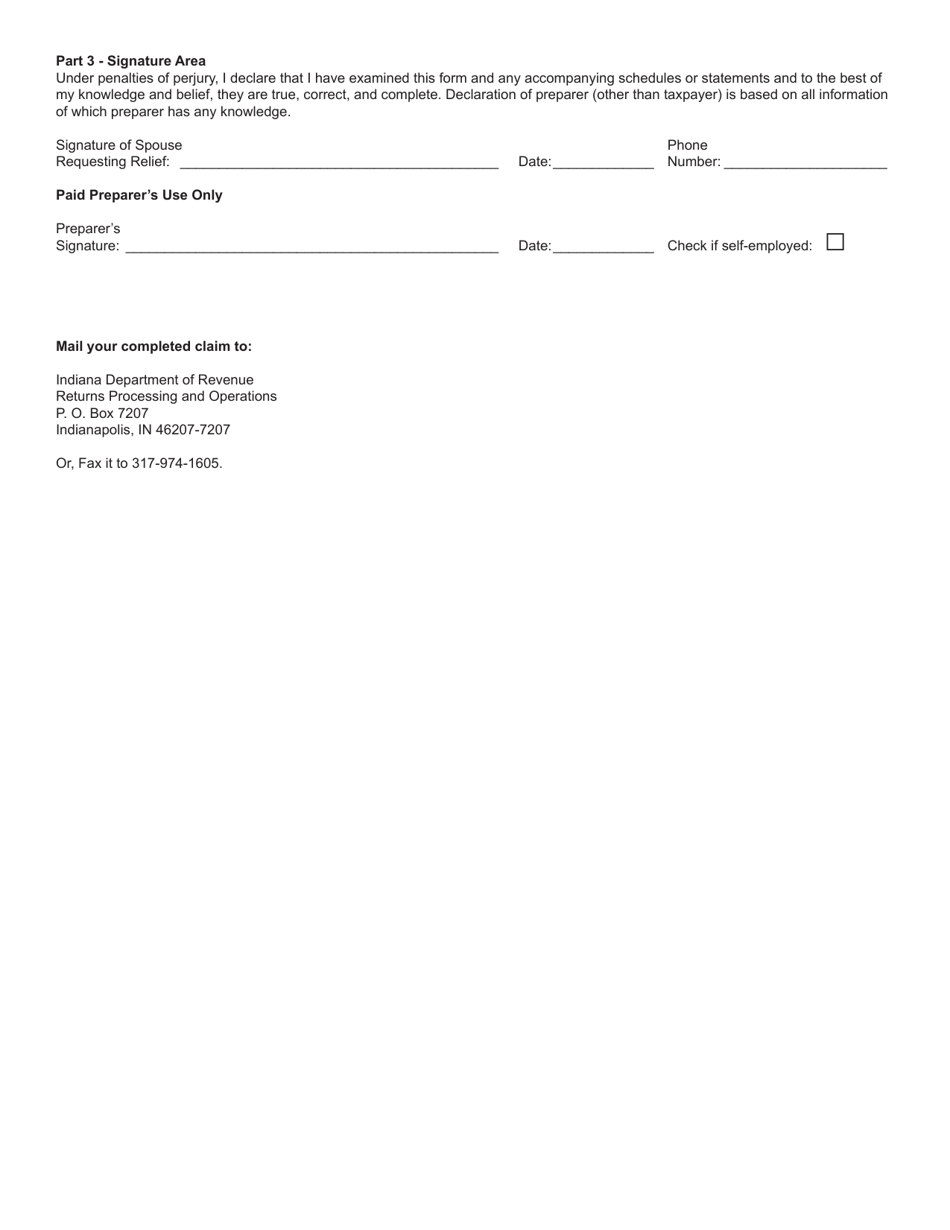

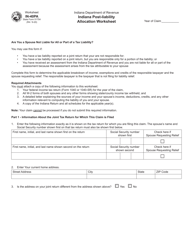

Form IN-40PA (State Form 51754) Indiana Post-liability Allocation Schedule - Indiana

What Is Form IN-40PA (State Form 51754)?

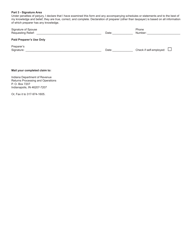

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IN-40PA?

A: Form IN-40PA is the Indiana Post-liability Allocation Schedule.

Q: What is the purpose of Form IN-40PA?

A: The purpose of Form IN-40PA is to allocate post-liability income among multiple taxpayers.

Q: Who needs to file Form IN-40PA?

A: Taxpayers in Indiana who have post-liability income and need to allocate it among multiple taxpayers must file Form IN-40PA.

Q: Is Form IN-40PA specific to Indiana state taxes?

A: Yes, Form IN-40PA is specifically for Indiana state taxes.

Q: What is the other name for Form IN-40PA?

A: Form IN-40PA is also known as State Form 51754.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IN-40PA (State Form 51754) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.