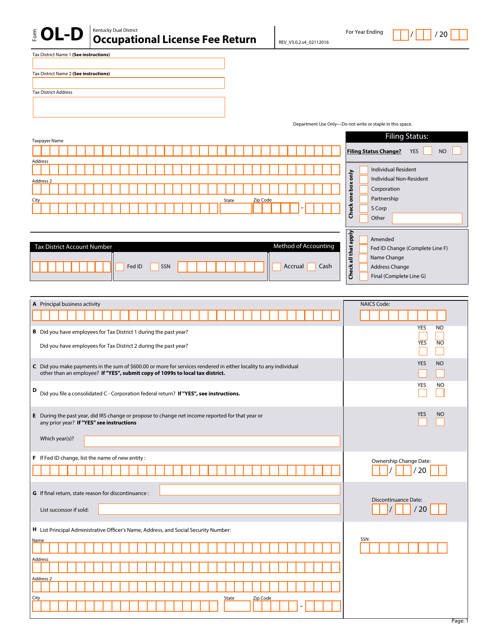

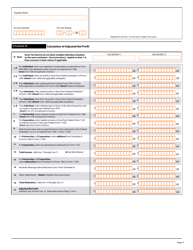

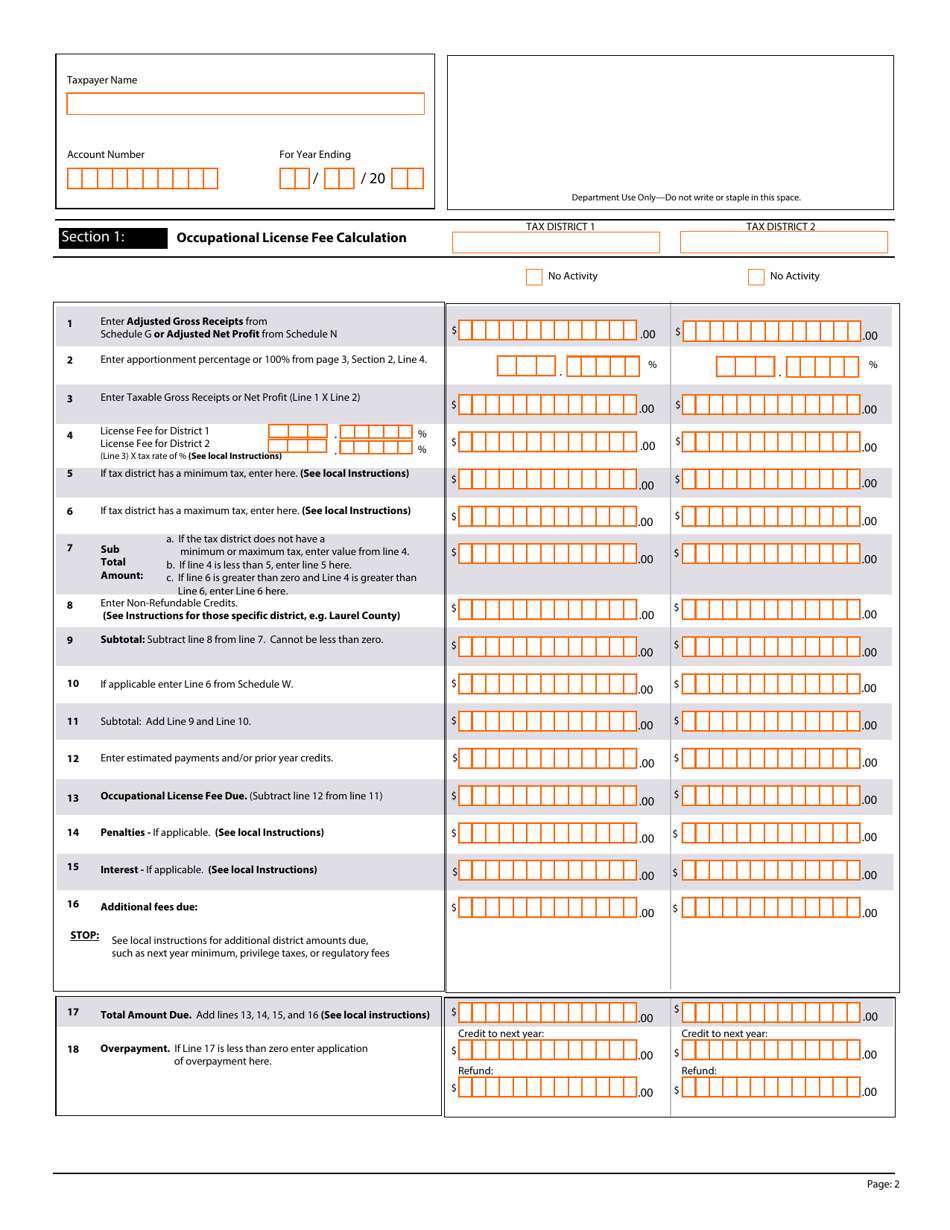

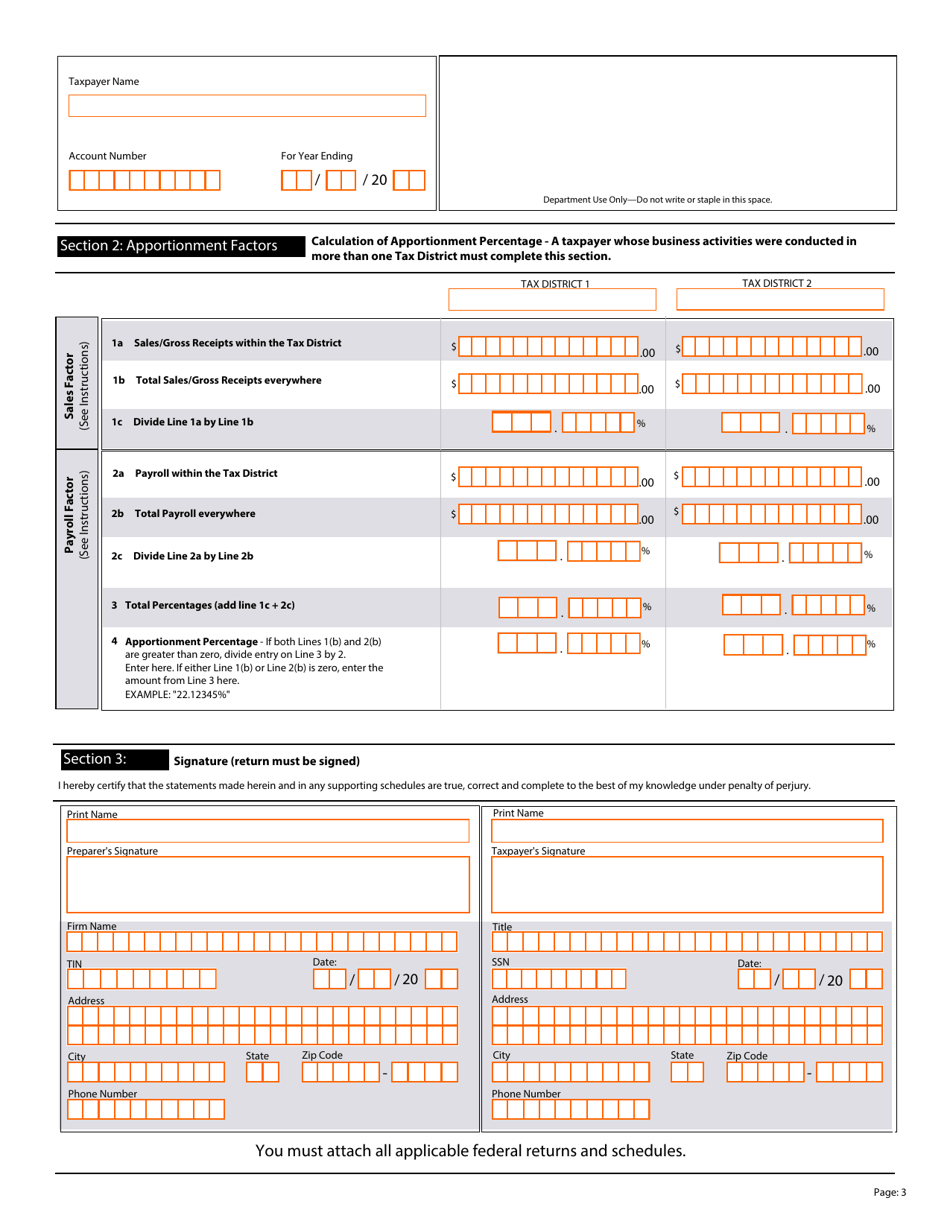

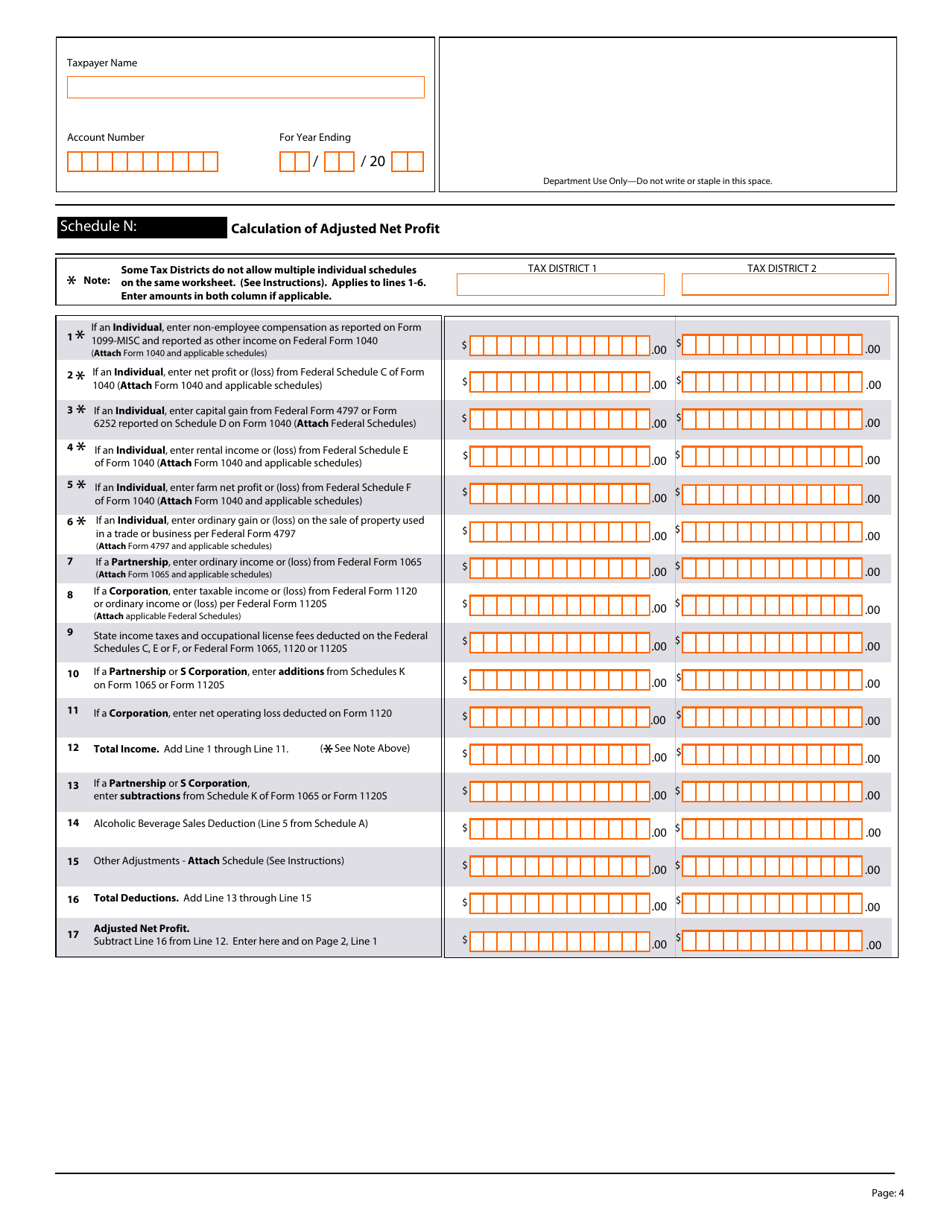

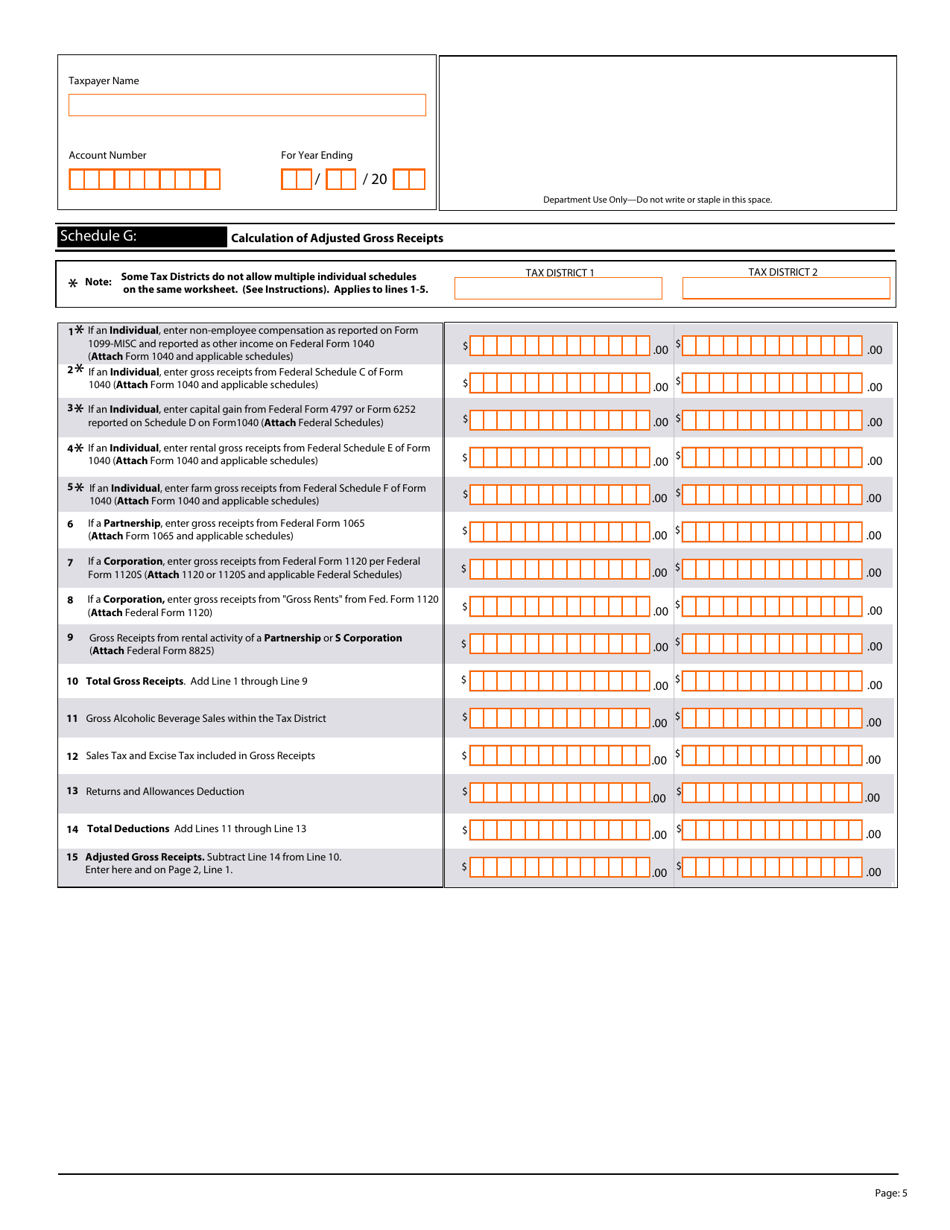

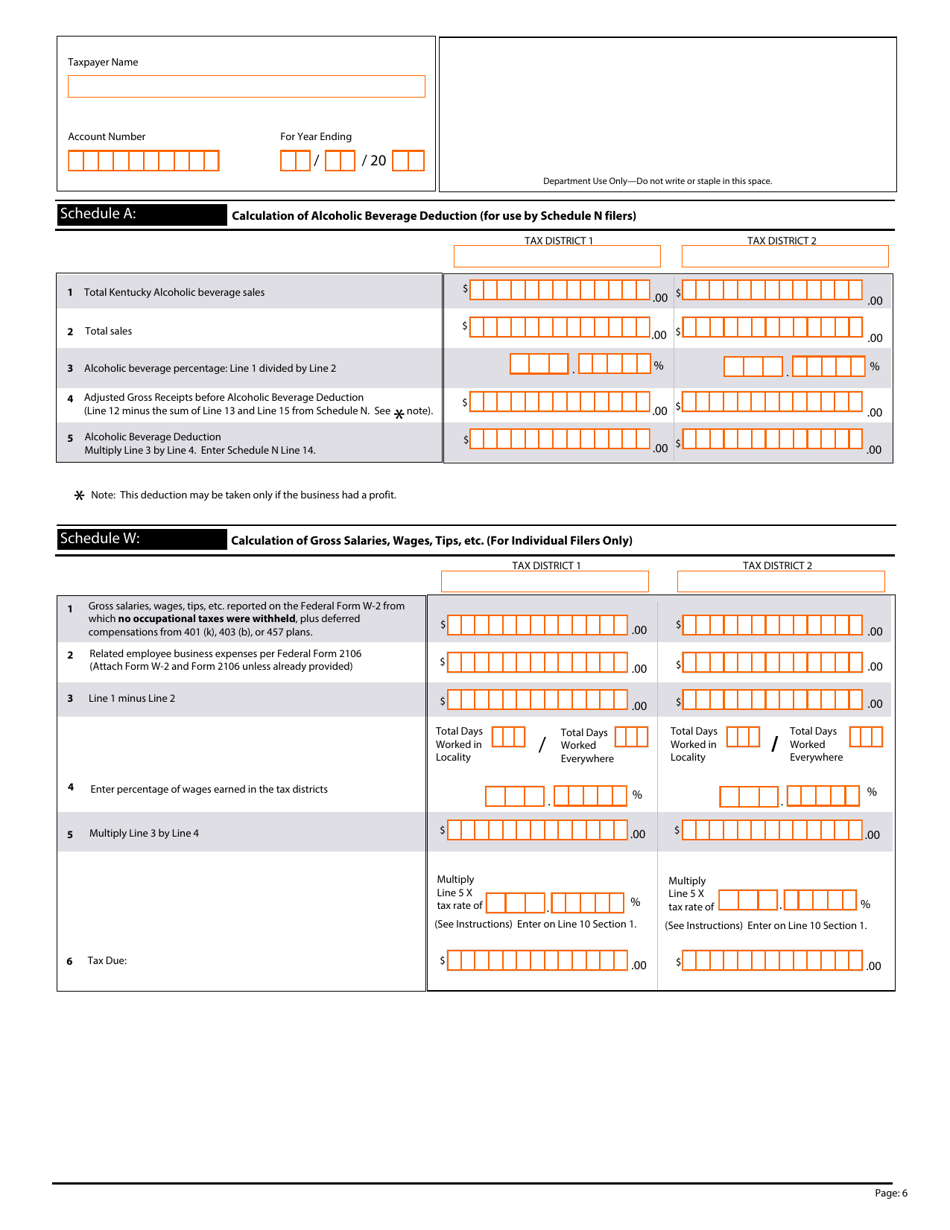

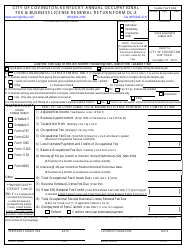

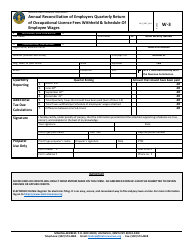

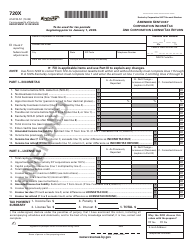

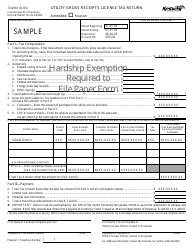

Form OL-D Dual Tax District Occupational License Fee Return - Kentucky

What Is Form OL-D?

This is a legal form that was released by the Kentucky Secretary of State - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OL-D?

A: Form OL-D is the Dual Tax District Occupational License Fee Return for Kentucky.

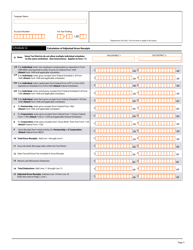

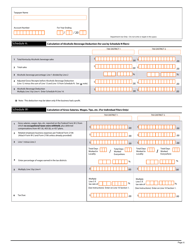

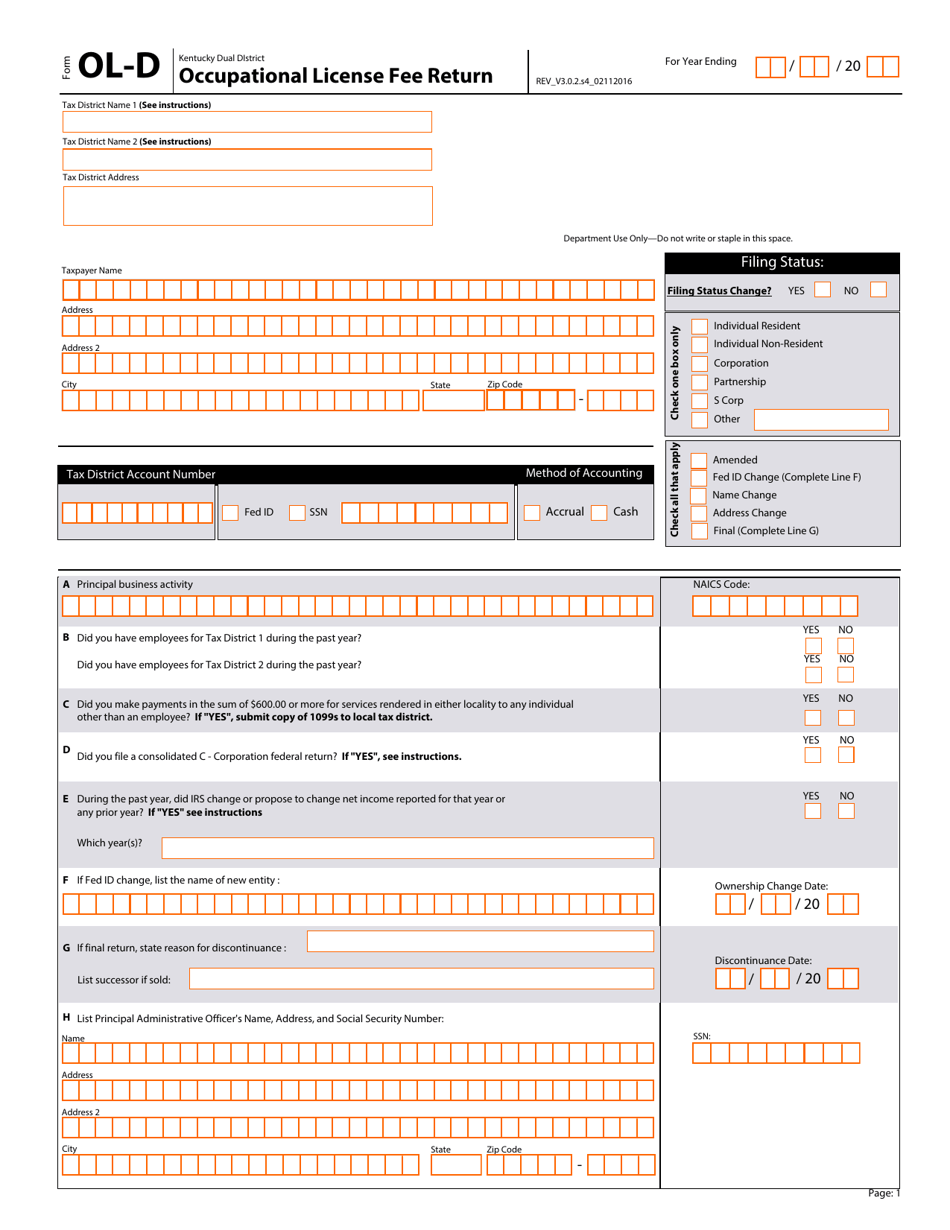

Q: What is the purpose of Form OL-D?

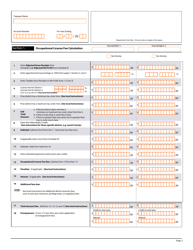

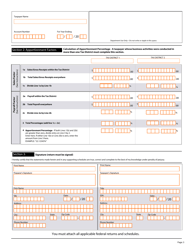

A: The purpose of Form OL-D is to report and pay the occupational license fee for dual tax districts in Kentucky.

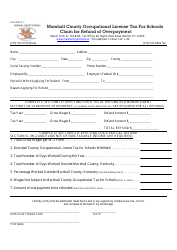

Q: Who should file Form OL-D?

A: Businesses operating in dual tax districts in Kentucky should file Form OL-D.

Q: What is a dual tax district?

A: A dual tax district is a district in Kentucky where both the city and county impose an occupational license fee on businesses.

Q: What information is required on Form OL-D?

A: Form OL-D requires information about the business, including gross receipts, employees, and the amount of the occupational license fee owed.

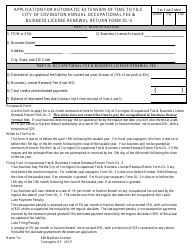

Q: When is Form OL-D due?

A: Form OL-D is due annually on April 15th.

Q: Are there any penalties for not filing Form OL-D?

A: Yes, failure to file Form OL-D or pay the occupational license fee can result in penalties and interest.

Q: Is Form OL-D only applicable to businesses in Kentucky?

A: Yes, Form OL-D is specifically for businesses operating in dual tax districts in Kentucky.

Form Details:

- Released on February 11, 2016;

- The latest edition provided by the Kentucky Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OL-D by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.