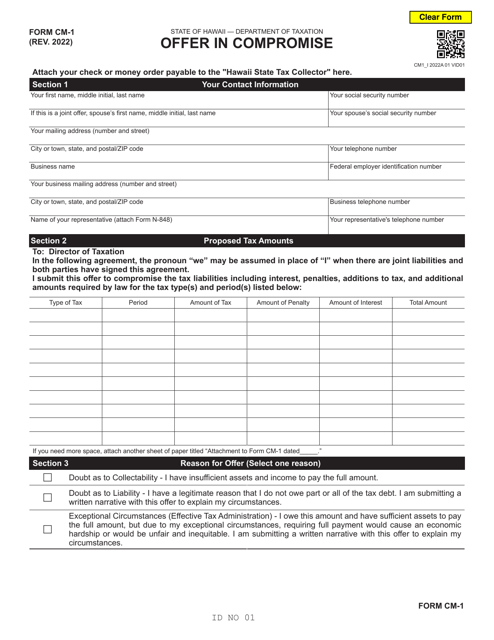

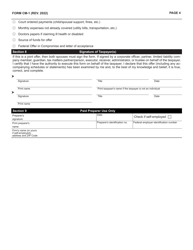

Form CM-1 Offer in Compromise - Hawaii

What Is Form CM-1?

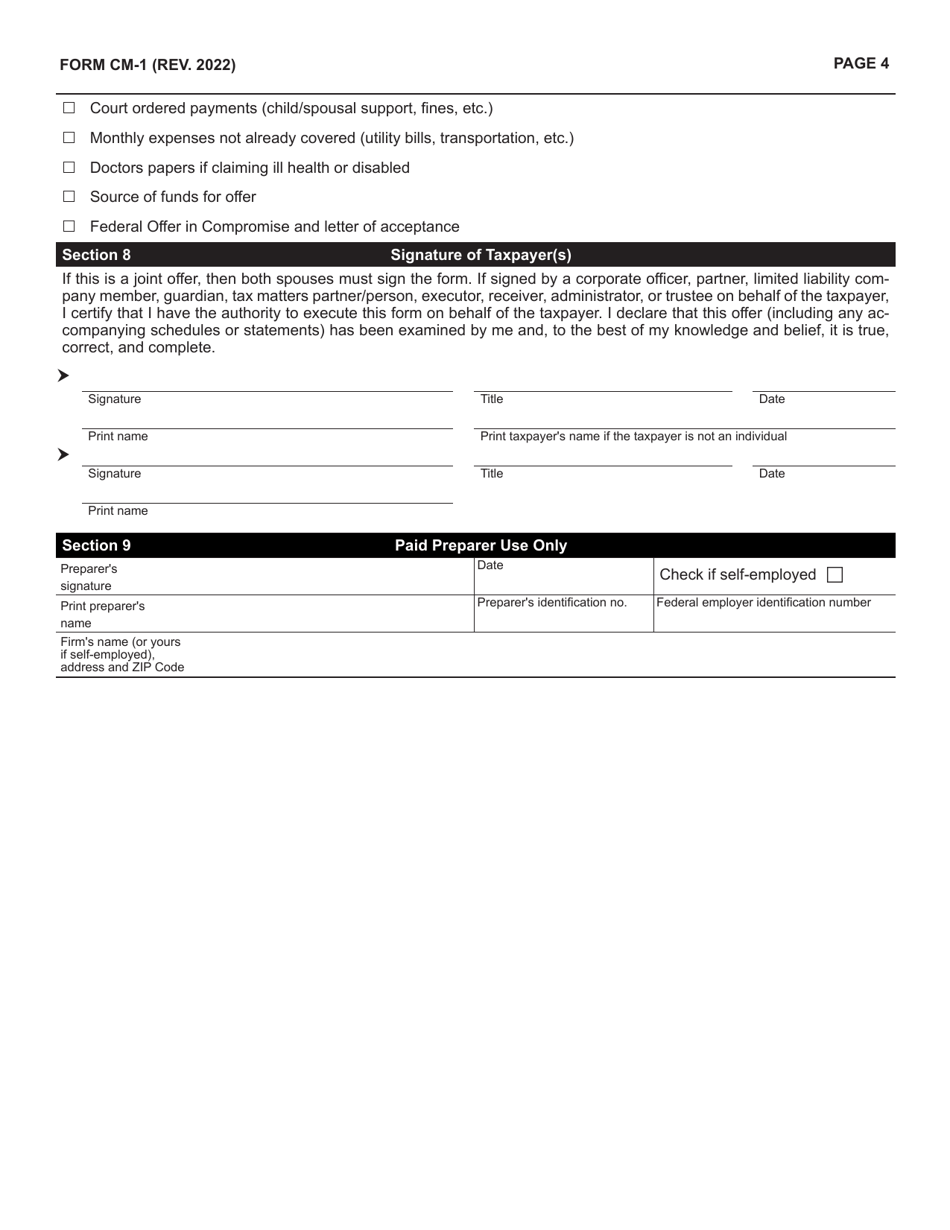

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CM-1?

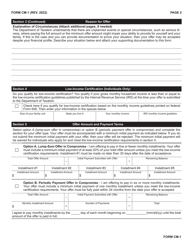

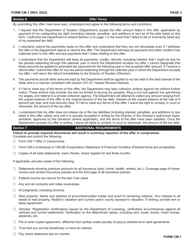

A: Form CM-1 is used to submit an Offer in Compromise to the State of Hawaii.

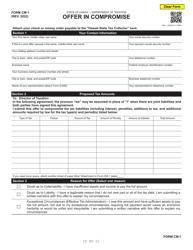

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a request to settle a tax debt for less than the full amount owed.

Q: Who can use Form CM-1?

A: Form CM-1 is for individuals and businesses who want to submit an Offer in Compromise to the State of Hawaii.

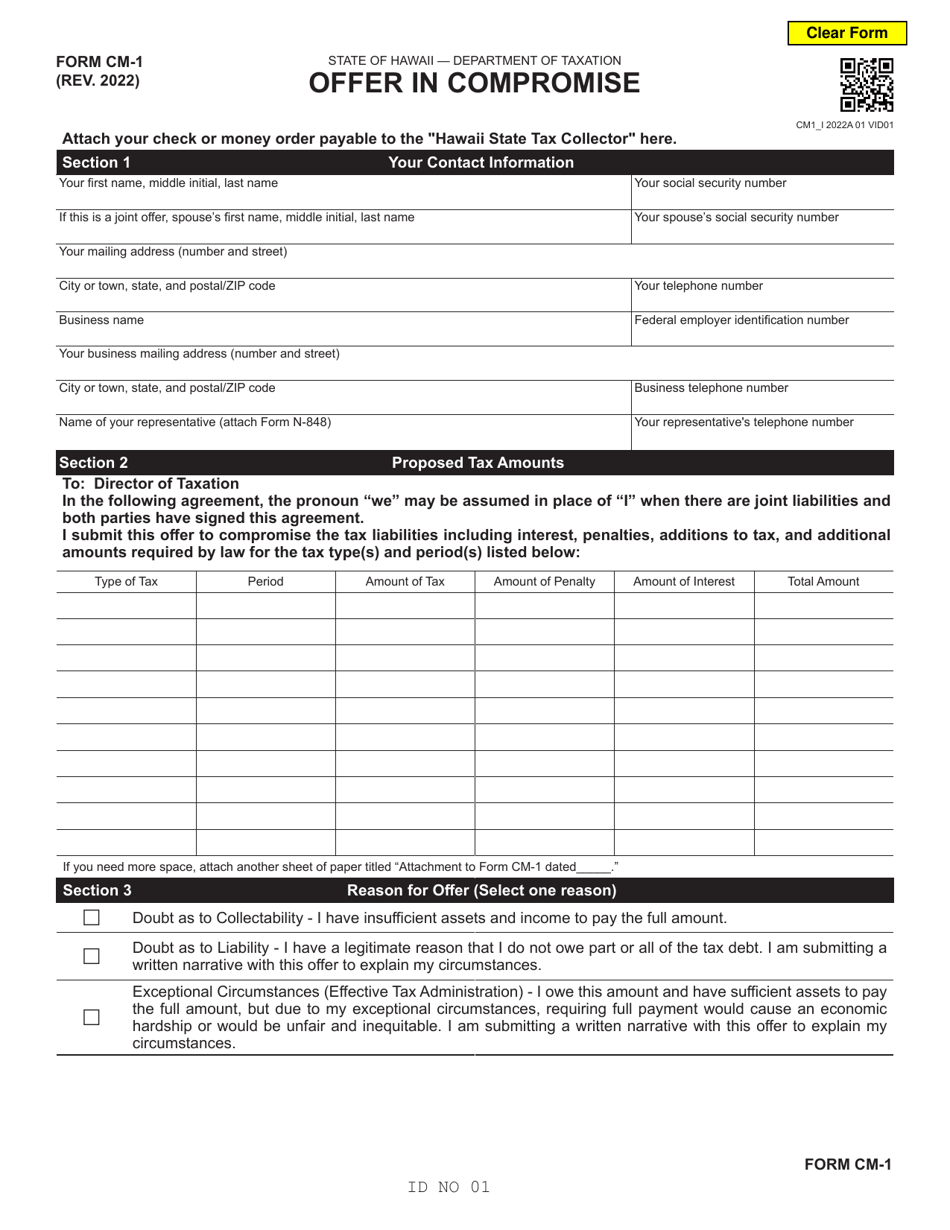

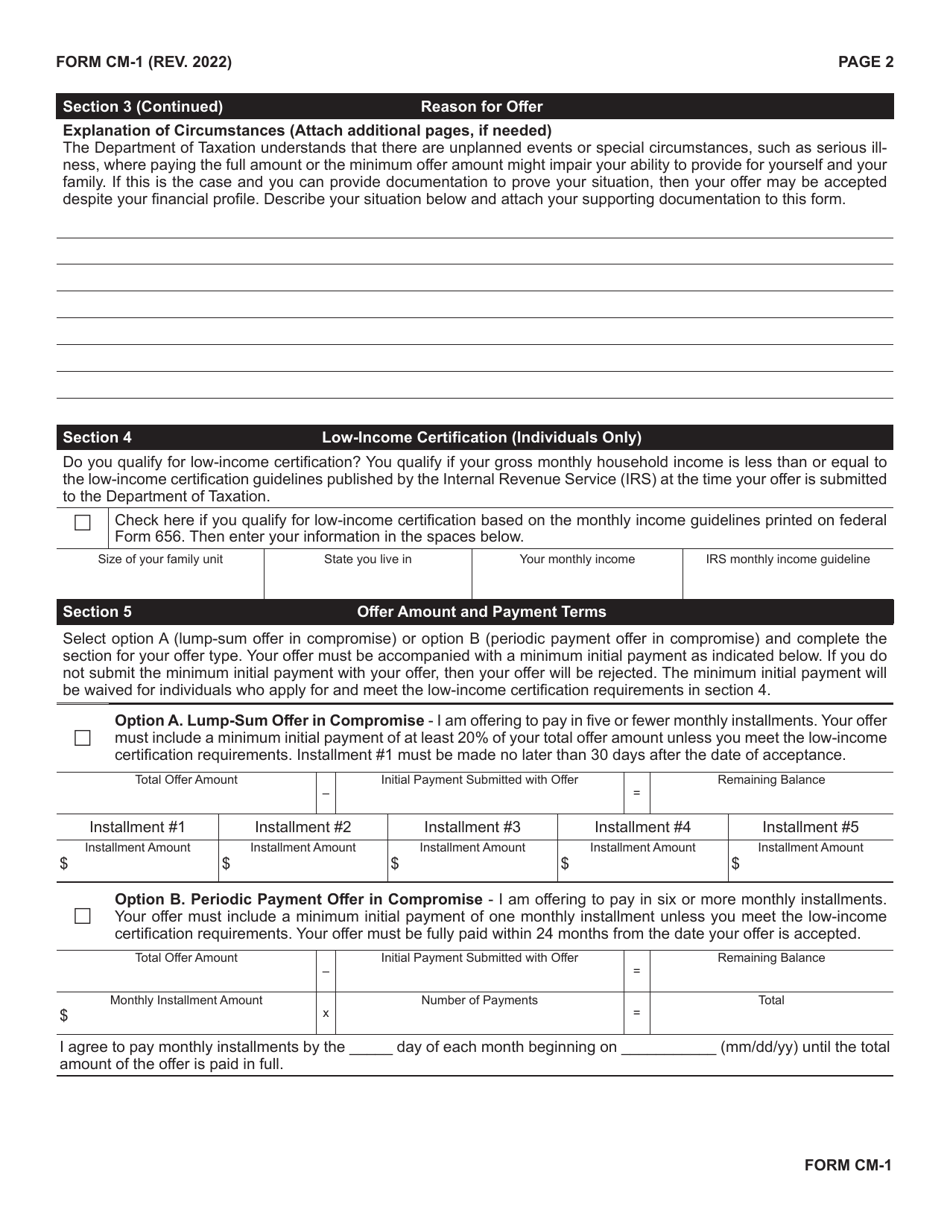

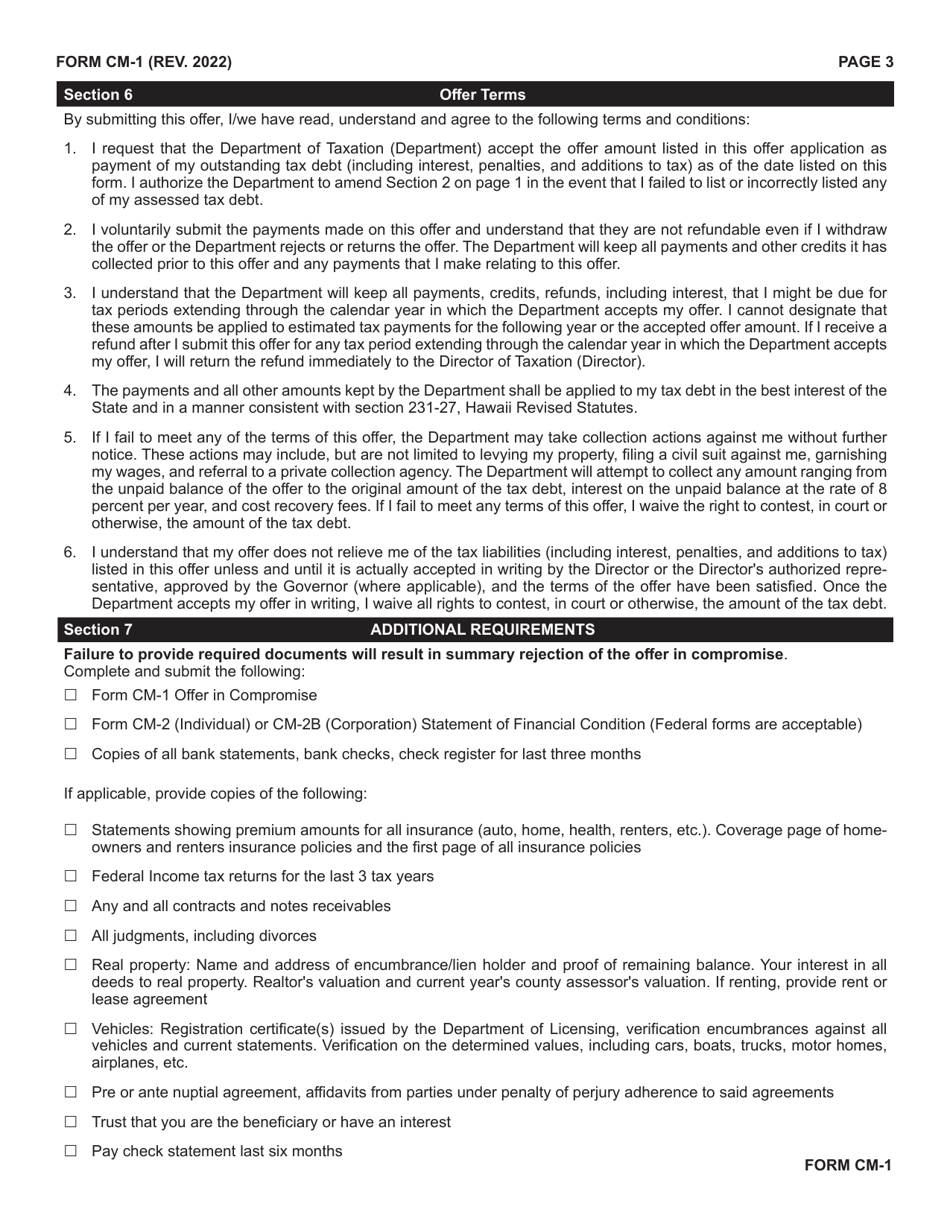

Q: What information is required on Form CM-1?

A: Form CM-1 requires information about your financial situation, tax debts, and reasons for requesting an Offer in Compromise.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CM-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.