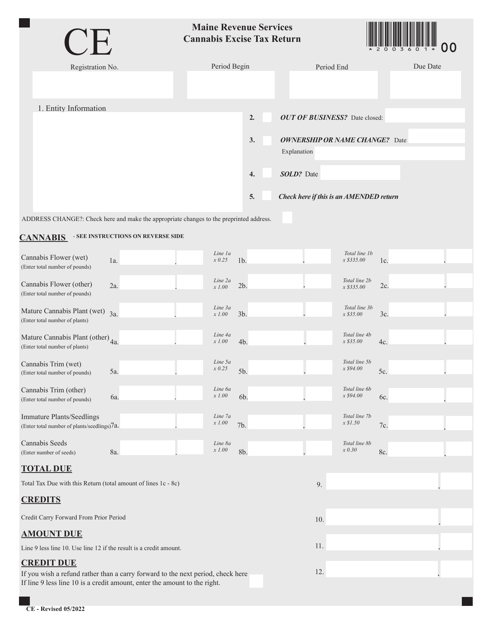

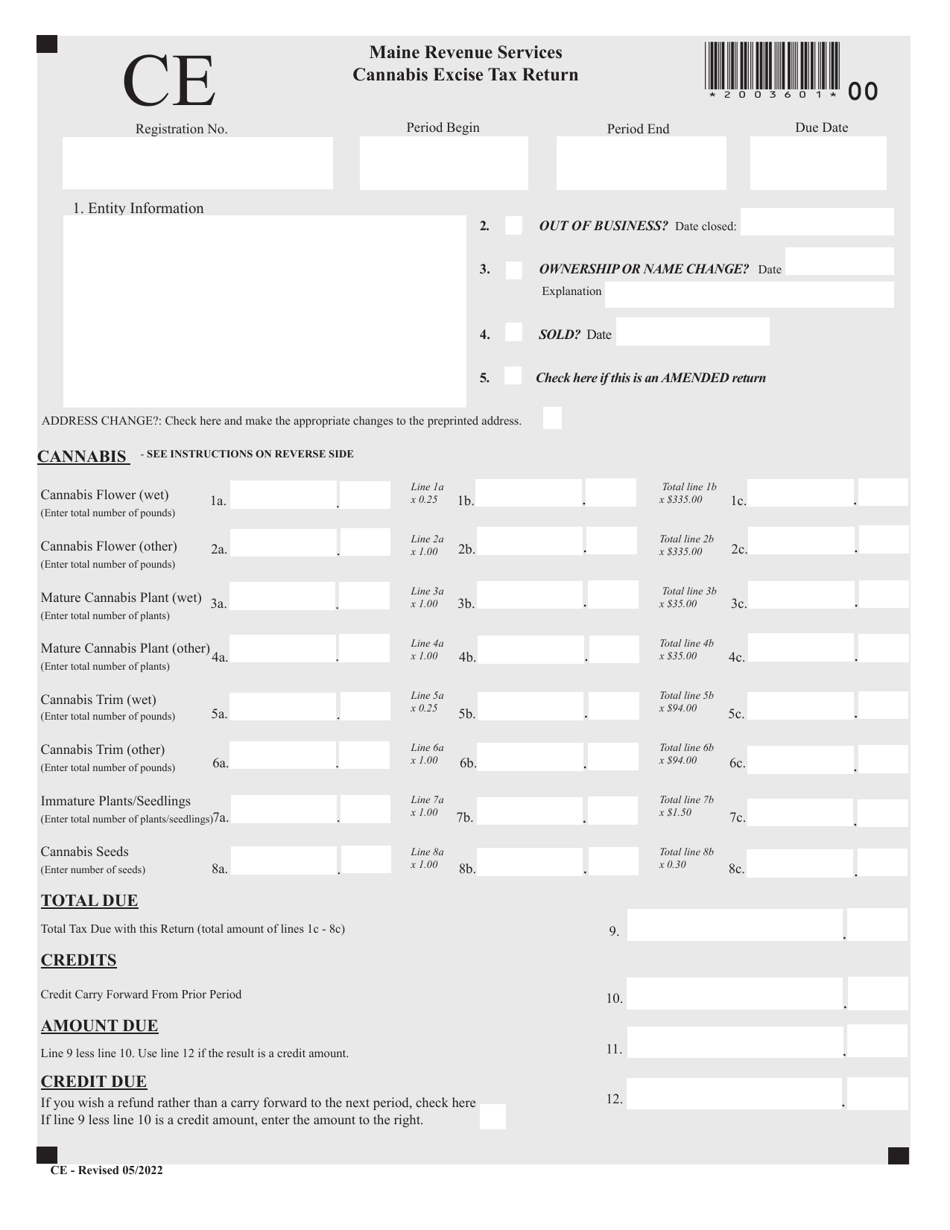

Form CE Cannabis Excise Tax Return - Maine

What Is Form CE?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

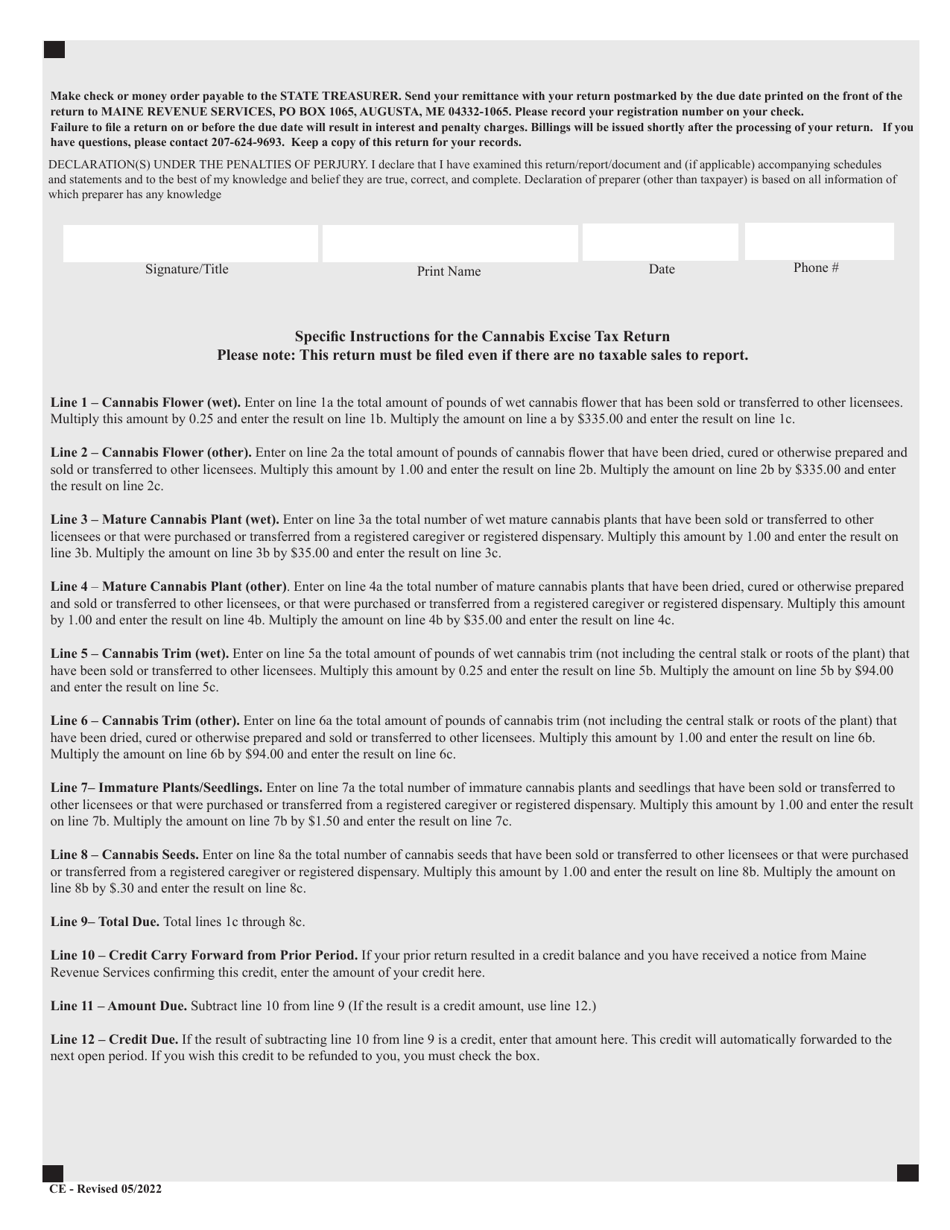

Q: What is the Form CE Cannabis Excise Tax Return?

A: The Form CE Cannabis Excise Tax Return is a tax return form used in the state of Maine to report and pay the excise tax on cannabis sales.

Q: Who needs to file the Form CE Cannabis Excise Tax Return?

A: Any business or individual engaged in the sale of cannabis in Maine is required to file the Form CE Cannabis Excise Tax Return.

Q: How often do I need to file the Form CE Cannabis Excise Tax Return?

A: The Form CE Cannabis Excise Tax Return must be filed on a quarterly basis, with due dates of April 15, July 15, October 15, and January 15.

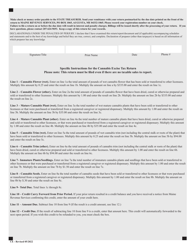

Q: What information do I need to provide on the Form CE Cannabis Excise Tax Return?

A: The Form CE Cannabis Excise Tax Return requires you to provide information about your cannabis sales, including the total ounces of cannabis sold and the amount of excise tax owed.

Q: Are there any penalties for not filing the Form CE Cannabis Excise Tax Return?

A: Yes, failure to file the Form CE Cannabis Excise Tax Return or pay the required tax can result in penalties and interest charges.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CE by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.